Ever Higher Debt, High Rates, Low Growth – Hello Stagflation

News

|

Posted 11/09/2023

|

2142

We have written at length about the unprecedented debt levels at the public or government level, particularly in the US, the issuer of the world’s reserve currency. Today let’s look at debt at the private level and what that means.

At nearly $33 trillion of public debt, the US is running at a debt to GDP ratio of 130% and nearing a $1 trillion annual interest bill which would exceed defence and health budgets.

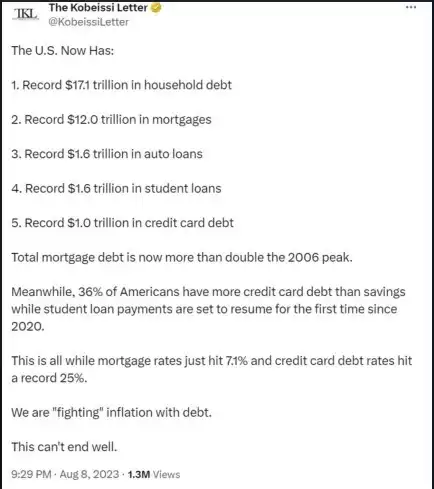

At the private level we reported recently that Americans have spent nearly all the free money dished out during the pandemic. So, the cash is gone but the debt creating it remains on the government’s books. With no savings and persistently higher inflation than wage growth, Americans have turned to credit cards… in a big way. How big? Try over $1 trillion for the first time in history.

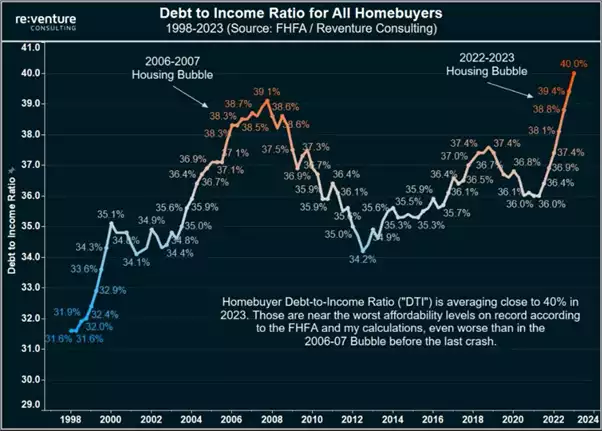

So how about at the home ‘owner’ level? Well that too just hit an all time (in all history) level, per the chart below, at 40%.

In dollar terms, that is $17.1 trillion…

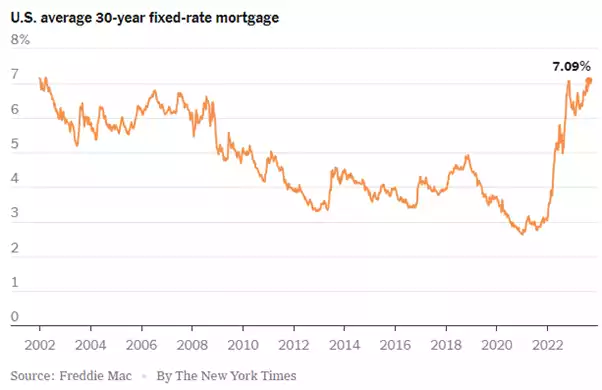

At the moment the US home owner is saved by the predominance of 30 year fixed term loans, many of which pre-date the fastest rise in mortgage rates in history. But these continue to mature plus any new entry or moving house triggers the new 21 year high rate of over 7%. That prospect of course has seen sales of existing homes fall nearly 19% however prices remain sticky because no one wants to sell as then they’d have to refinance at over 7%. That adds to the inflation picture in addition to other core and persistently high elements like oil.

Recently we posted the following dire summary in an article:

At the public and private level the biggest Ponzi scheme in history is hurtling toward the inevitable outcome of any Ponzi scheme, collapse. You can’t continue to print new money with debt, to pay the interest on the existing (and now larger) debt indefinitely.

The drag of all this debt on the global economy amid sticky inflation and high interest rates means stagflation – low growth and high inflation. Add in a sharemarket absolutely dominated by a handful of highly over valued ‘growth stocks’ whilst US bonds continue to weaken (raising yields) and it has all the hallmarks of a nasty correction. As we wrote recently, that stagflation induced ‘correction’ could well resemble something more akin to a ‘reset’. As that article outlines, history says gold and silver are the perfect asset to hold in that environment.