Is There a Subprime Credit Card Crisis on the Horizon?

News

|

Posted 06/09/2023

|

2601

Last month, Macy's, in its second-quarter results, highlighted significant credit card delinquencies that greatly impacted its profit margins, sparking concerns about the state of credit. A deeper dive into the data shows that analysts have every reason to be worried.

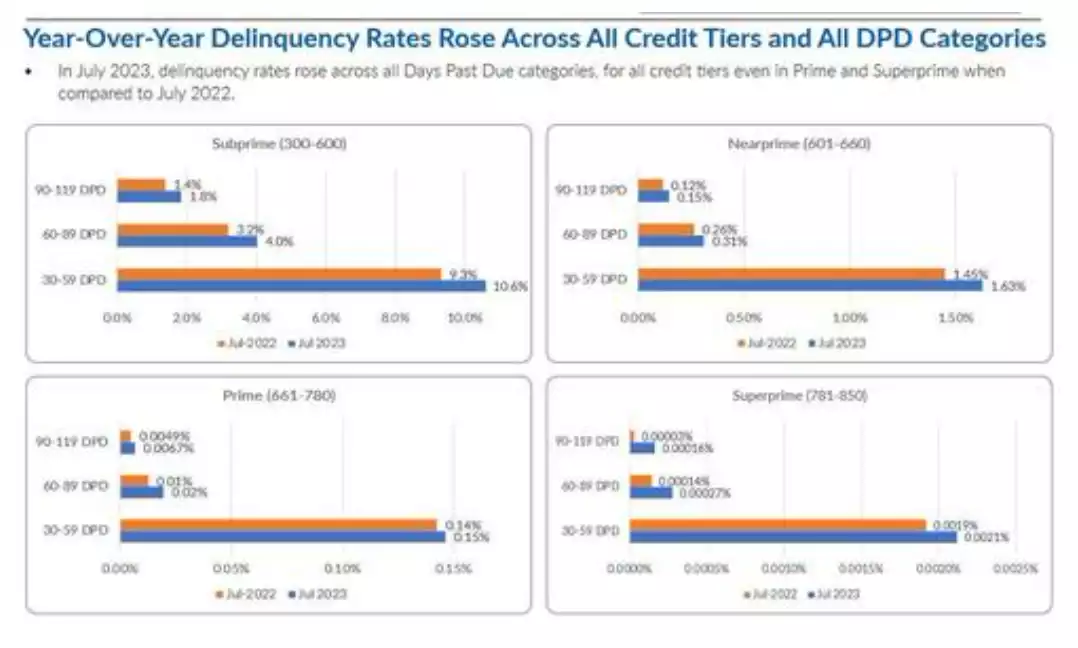

According to the latest data from VantageScore, individuals with credit scores ranging from 300 to 600 (considered subprime) saw a delinquency rate of 10.6% in July, for payments overdue by 30 to 59 days. This is an increase from 9.3% compared to the previous year. In contrast, prime borrowers experienced a minimal increase, with a delinquency rate of just 0.15% in July, up from 0.14% in the same month in 2022.

The delinquency rate refers to the amount of debt that is passed due, expressed as a percentage.

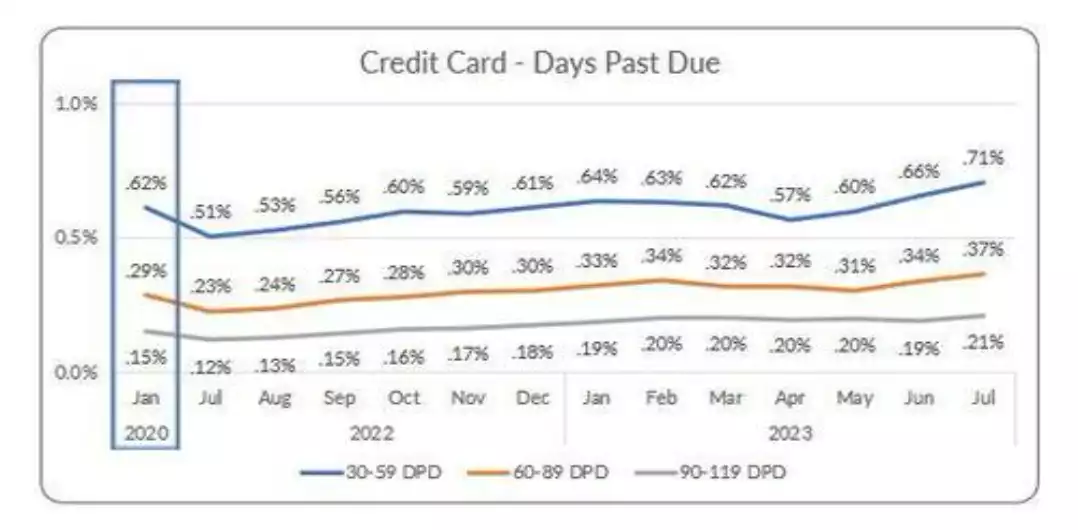

Furthermore, a broader look at 13 months of delinquency rate data reveals that delinquencies, both short-term and long-term, are on an upward trend.

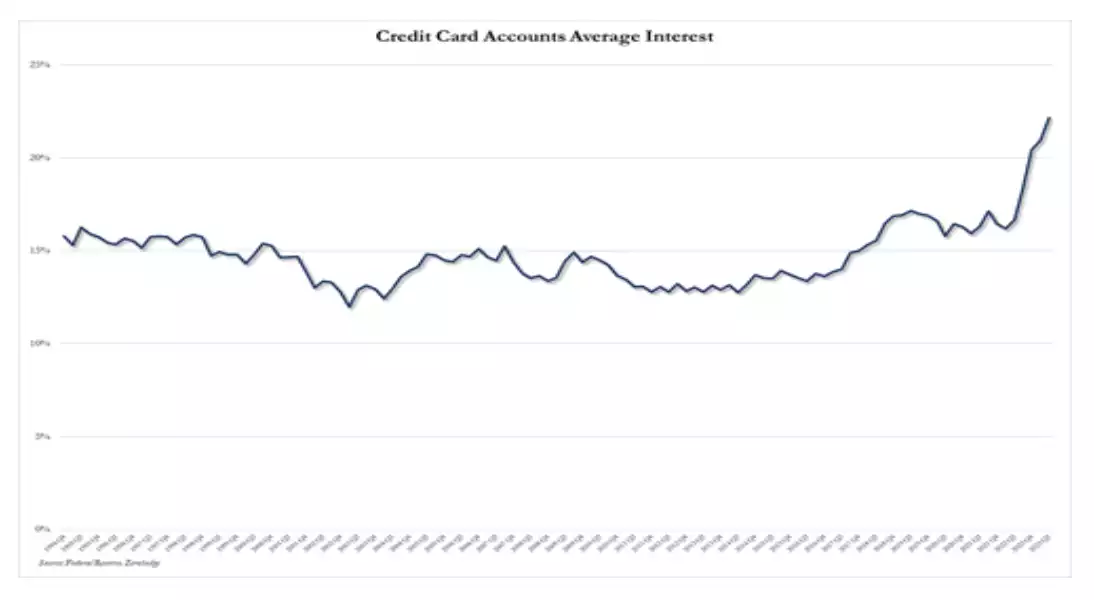

Concurrently, the interest paid on credit card debt is soaring to alarming level we have never seen before.

The situation becomes even more concerning when examining delinquency rates among small banks. Among the top 100 banks, the delinquency rate reached 2.63% in the second quarter, compared to 1.71% the previous year. Of course, as we have discussed in the past, these smaller regional banks are barely solvent as is, and any capital stressors such as lack of debt repayments may very well prove to be fatal.

One theory suggests that some smaller banks relaxed credit requirements following the 2008 recession to attract customers and increase deposits. In 2018, Congress further eased credit-requirement rules for smaller banks by rolling back parts of the Dodd-Frank Act, designed to strengthen the banking system.

Balbinder Singh Gill, an assistant professor of finance at the Stevens Institute of Technology's School of Business, expressed his concern, stating, "We've seen a huge increase in credit-card delinquencies," noting that such delinquencies are particularly affecting low-wage households.

Balbinder Singh Gill highlighted the growing disparity, saying, "Wages are not increasing at the same rate as inflation. People want to have the same standard of living. They want to buy the same food, but it’s impossible as their wages are still low, so they’re using credit cards. That’s OK for the short term, but at the end of the day, you have to pay off the debt.”

With credit card APRs averaging at 24%, falling behind on payments could push lower-income workers into bankruptcy. Additionally, defaulting consumers may face significant late-payment fees as well as APRs of up to 30%, according to reporting by LendingTree.

These concerning developments come at a challenging time for consumers, especially those with lower incomes. Student loan repayments are set to resume after a pandemic-era moratorium, and interest rates are at a 22-year high. While the Federal Reserve has indicated no immediate plans to raise rates, inflation remains above the Fed's 2% target rate.

While this vicious debt cycle may continue in the short term, clearly the current level of credit card debt is unsustainable and some degree of consequences must ensue. The growing signals of significant financial system dead ahead continue to mount.