SPR and Inflation – Strategic Petroleum Reserve Hits Historic Low

News

|

Posted 08/08/2023

|

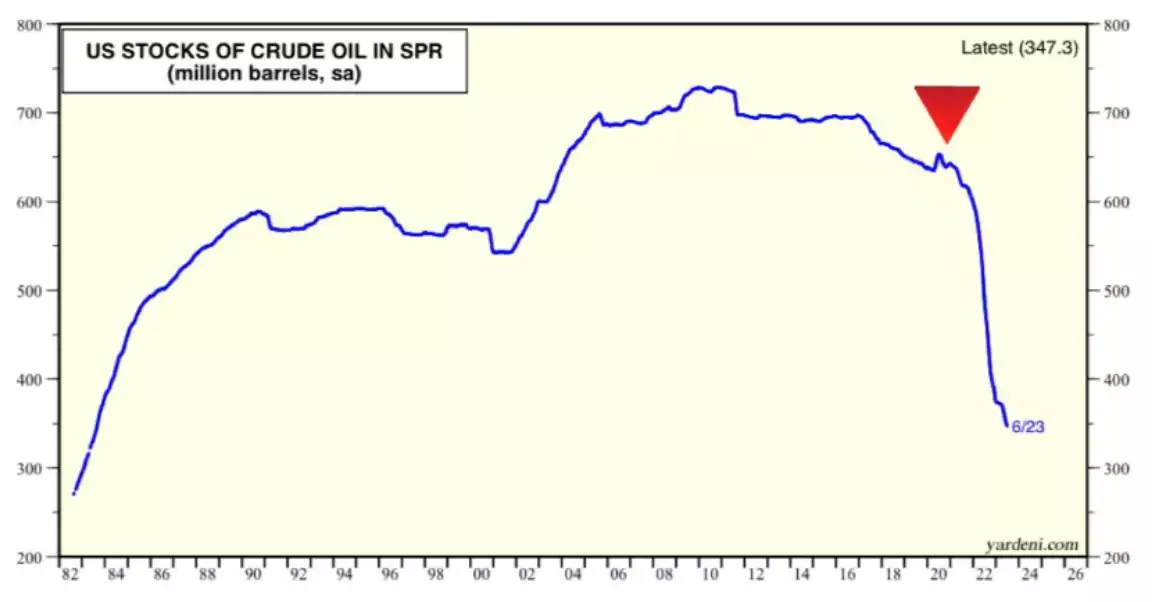

2270

Since 1975 the Strategic Petroleum Reserve has given the US self assurance on the ability to be able to respond to Emergencies and economic oil warfare. Since the Ukraine war the US government has used the SPR not as an emergency measure, but rather to fight inflation created from the Russian oil sanctions due to their invasion of Ukraine. As stocks now dwindle to the lowest level since 1983, and every attempt the US government makes to refill it is thwarted by OPEC will the inflation detractor now add to the world energy inflation again?

Strategic Petroleum Reserve

In 1973 OAPEC (Organisation of Arab Petroleum Exporting Countries) proclaimed an oil embargo on the US after the American support for the Yom Kippur War, raising oil prices by 300%. In response, the SPR or the Strategic Petroleum Reserve was introduced in 1975 to mitigate the risk of future oil embargos. It is the largest publicly known emergency supply of oil, housed in underground tanks in abandoned salt mines in Louisianna and Texas. In July 2023 the SPR is 346.8million barrels which is about 17 days of oil. This is the lowest level since 1983.

Ukraine War and Inflation fight

On March 22 in response to the Ukraine war Joe Biden announced his administration would release 180 million barrels (at a price of $96 vs price paid of ~ $28) to help with US oil prices during the Ukraine war oil shock. This helped lower gasoline prices an estimated 17c-43c per gallon in the US obviously helping to moderately lower inflation.

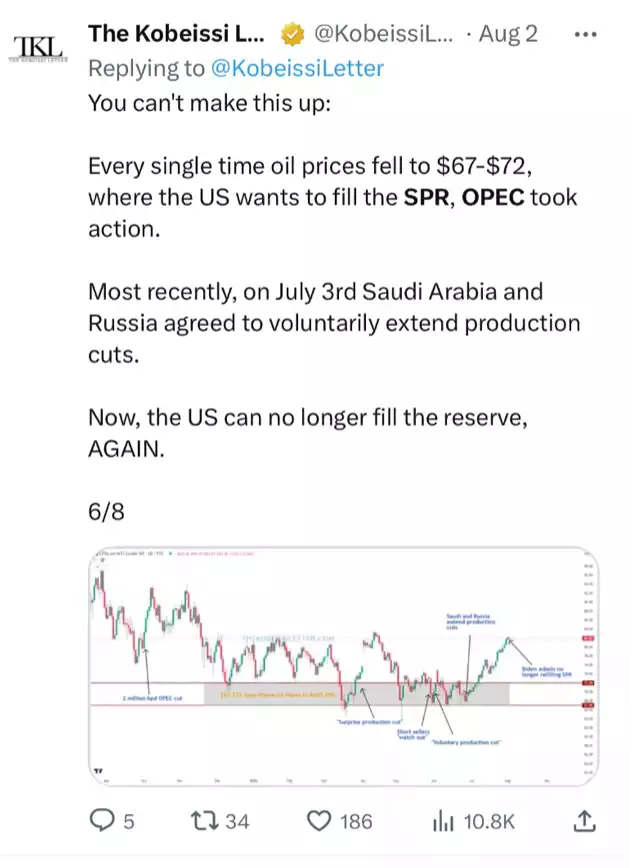

After selling the oil at $96/barrel the Biden administration in December last year announced they planned to refill the SPR at around $67-$72/ barrel but appear to be thwarted every time they announce a purchase and the SPR level continues to dwindle.

The problem the Biden administration now has is every time they go to start replenishing the SPR OPEC keeps responding with cuts in production – rising the oil price again. An Analysis done by the Kobeissi Letter on Twitter has tracked each announcement and each response from OPEC and charted it.

Pulled Offer

On August 1st, the Biden administration pulled an offer to buy 6 million barrels of oil for the SPR, with market conditions, AKA price and tight oil supply, hindering the plan. Unfortunately for the US they appear to have missed the current window of $67-$72/barrel as oil prices again climb above $80/barrel, currently sitting at $82. Crude prices are in fact now expected to rise futher with OPEC+ cutting output, 3.66million barrels since November last year. This now means that if the Biden adminsitration wants to refill the reserves they will in fact be adding further to oil inflation by increasing demand. So they are being left with the option of Emergency energy security or adding to the current precarious inflation situation, as oil prices once again beign to spike.

Trump 2020 and the SPR

In 2020, under Trump’s term, the Department of Energy (who runs the SPR) proposed filling the SPR to its maximum capacity adding an additional 77 million barrels ,however the bill was scuttled at $24/ barrel (the current SPR reserve is an average price of $29.7) claiming it was an oil industry bail out. The $24/ barrel price seems relatively inexpensive compared to the current $82/barrel Biden may be forced to refill at.

Oil Price Rebound

With OPEC fighting to keep the price high, the Ukraine war continuing and the dwindling SPR in the US, inflationary pressures in energy prices may resume again. Oil is a huge contributor to broader inflation at a time when most economic indicators are plummeting. That spells stagflation…