Best Asset in a Stagflation Recession – “Real Money Beyond the Reset”

News

|

Posted 01/09/2023

|

8391

Last night saw a reminder that the ‘soft landing’ narrative may still have some sticky inflation resistance. The Fed’s preferred inflation metric, Core PCE Deflator (Personal Consumption Expenditures) rose to 4.2%. They also focus on the services component excluding ‘shelter’ and it is staying persistently high at 4.69%. It caps off a raft of economic metrics this week that point to stagflation risks dead ahead – high inflation + low growth. Durable goods dropped the most since 2017, GDP growth was quietly revised lower, and as we discussed earlier this week, the labour market is worsening quickly too.

The inevitable comparisons to the 1970’s ensue. Crescat Capital’s Otavio Costa just spoke to a nuance of difference that few are talking about.

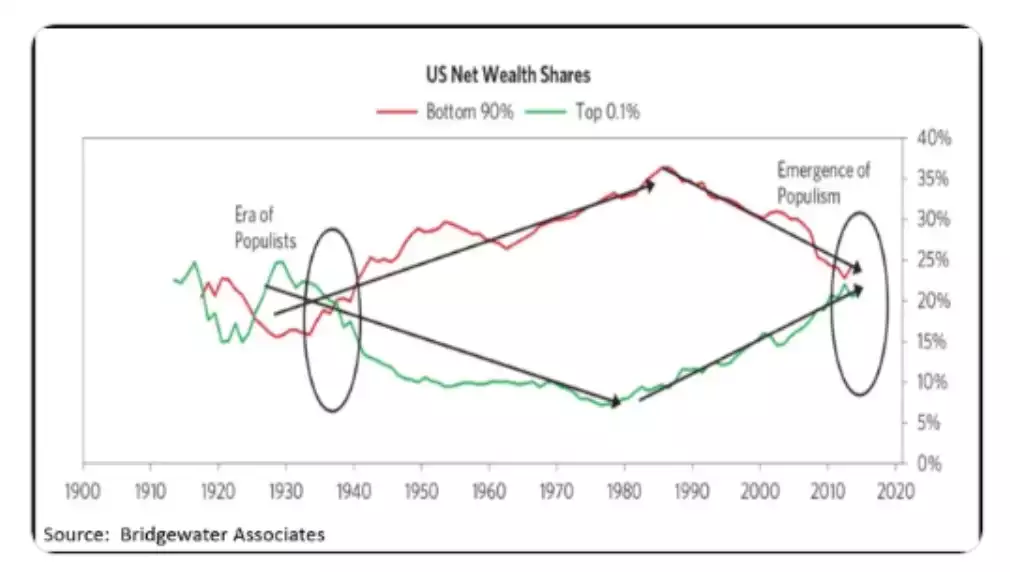

“A notable contrast to the inflationary period of the 1970s is the prominence of today's inequality problem.

Different from the broad wage-price spiral experienced back then, the convergence of the current wealth gap disparity and a substantially elevated cost of living is set to concentrate the growing wage pressure predominantly among the lower classes.

This mirrors what is often witnessed in emerging markets.

To confront these challenges, these economies tend to prioritize extensive fiscal stimulus measures aimed directly at addressing social welfare issues, thereby contributing to the exacerbation of the inflationary problem.

Developed economies are starting to adopt similar policies, although these trends are still in their early phases.”

Costa references the following chart put together by Ray Dalio’s Bridgewater:

And so, the government needs to spend more but has less income, so bigger and bigger deficits which need to be funded with more and more bonds issued into a market with less and less appetite for them. We discussed this week how the term premium for bonds is less than the Fed’s fund rates so why on earth would ANYONE buy bonds in this scenario?

Enter the US Federal Reserve and its magical money printers as the only solution unless they can somehow lower rates which can only happen if inflation comes down.

The least path of resistance to reduce debt is to have inflation higher than rates, raising the value of assets (faster) against that massive debt pile, whilst the Fed continues to monetise the new issuance of debt to fund the stimulatory fiscal spending we already see and Costa predicts even more of (and paying interest on all that debt). At the risk of repetition it is a classic Ponzi scheme. Schemes are great if you are on the right side of the trade and have the assets that survive the inevitable reckoning and reset. So what is that asset?

Whilst everyone is talking recession, not enough are drawing the distinction between the types of recessions. This coming recession is looking increasingly like a higher inflation recession or stagflationary setup. Bloomberg macro strategist Simon White yesterday discussed this trap:

“The next US downturn is primed to wrong-foot investors as stocks, bonds and commodities trade markedly differently than in a regular, non-inflationary recession.

Stocks and commodities lower, bonds higher.

That’s probably what most people would expect to happen in a slump.

But historically in inflationary recessions, nominal returns of stocks mask the true damage done to equity portfolios; bonds rise in nominal terms, but in real terms they start selling off long before the recession begins; and commodities don’t fall in price, they rally.”

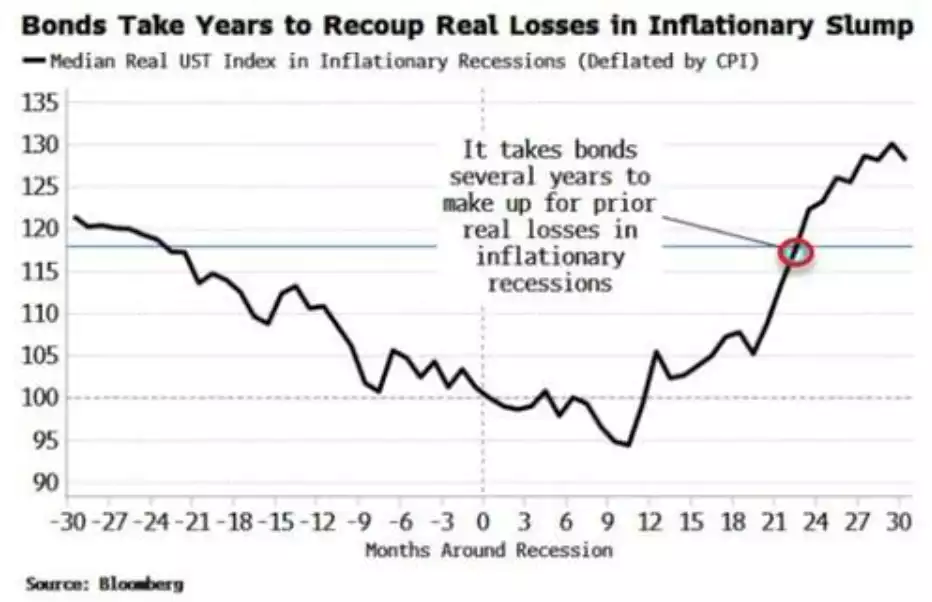

Too few people understand the different dynamics and the real returns as opposed to nominal returns. A 6% return is zero if inflation is 6%. Gold’s biggest “competitor” for the safe haven play during the sorts of turbulent times we appear to be entering are US bonds. However, when those turbulent times are in an inflationary period, they look decidedly poor. Again, from White:

“Nonetheless, money illusion once again makes returns look better than they really are. In real terms, bonds typically sell off before the inflationary recession begins, and continue to sell off after it. It takes several years before an investor recovers their real losses, even though nominally they have had made money.”

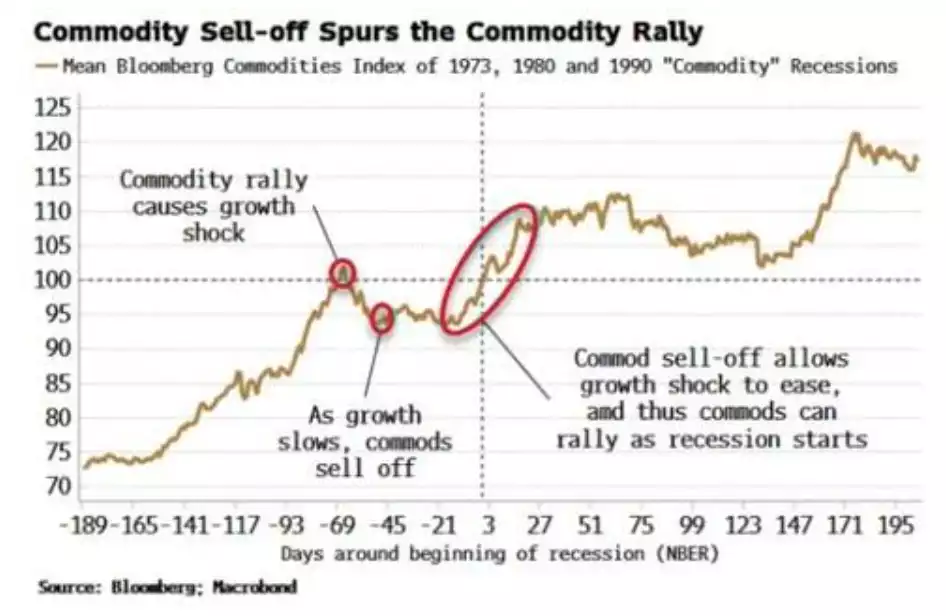

As opposed to commodities:

“The commodity shock in 2020-22 will be the ultimate cause of the next downturn. We may have already experienced the pre-recessionary selloff in the 23% fall in commodity prices we have seen since last summer.

Either way, commodities have been rallying, boosted by supportive conditions in excess liquidity. A recession – if the past is a guide – won’t be enough to stop them from continuing to do so.

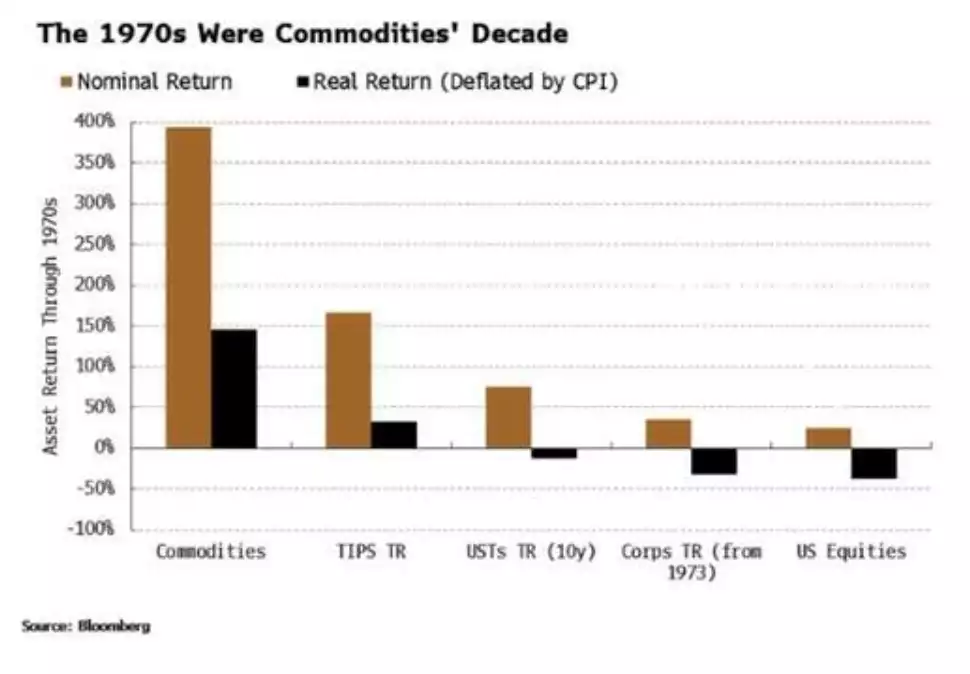

This is not just a nominal phenomenon; commodities typically are the best-performing asset class in real terms when inflation is elevated. Through the 1970s – a decade pock-marked with high inflation, stagnant growth and a deep recession – commodities were the only major asset class to deliver a significantly positive real return.”

“As someone once quipped, the past is a foreign country, they do things differently there. One of which is not treating real and nominal returns as synonymous.

If present-day investors wish to preserve the (real value) of their wealth, they need to do likewise, and jettison heuristics that will likely prove to be outmoded in the next recession.”

And so looping back to our ‘what do I own in a Ponzi scheme’ question, consider the following for gold, silver and platinum:

- Tightly correlated with commodities

- Monetary assets that have tight correlation with global liquidity just as the money printers are about to go brrrr

- Safe haven assets that are not the very same ‘safe haven’ debt instruments (ala bonds) at the very centre of said Ponzi scheme

- Historic, proven, inflation hedges

- The one asset over literally thousands of years that prevail as each (and there have been many) major credit cycle, and the Fiat currency standing behind it, fails. Each failure has been marked by civil unrest and uprising. The first chart above is often the classic indicator of that getting close.

Yes the rich will get richer as this peaks – but they will do so off owning the very assets that inflate in the scheme, commodities being core. Money makes money for sure, but ANYONE can own the assets set to not only enjoy the ride up, but importantly survive, indeed thrive on the ‘other side’.

Topically the cheapest bullion item we sell is our very own ‘real money beyond the reset’ silver 1/2oz Ainslie Round for around $27 at time of writing… Anyone…

You can click on the image below to buy online…