And….its gone. US Consumer Nearly Broke

News

|

Posted 21/08/2023

|

2527

As the warning signs mount of a nasty recession dead ahead, a major revision by JP Morgan reveals all the free money dished out to Americans during COVID is all gone and the sugar hit of ‘Bidenomics’ fiscal stimulus wearing off. And so, we may see yet another catalyst for a recession as the (until now strong) consumer spending support is removed.

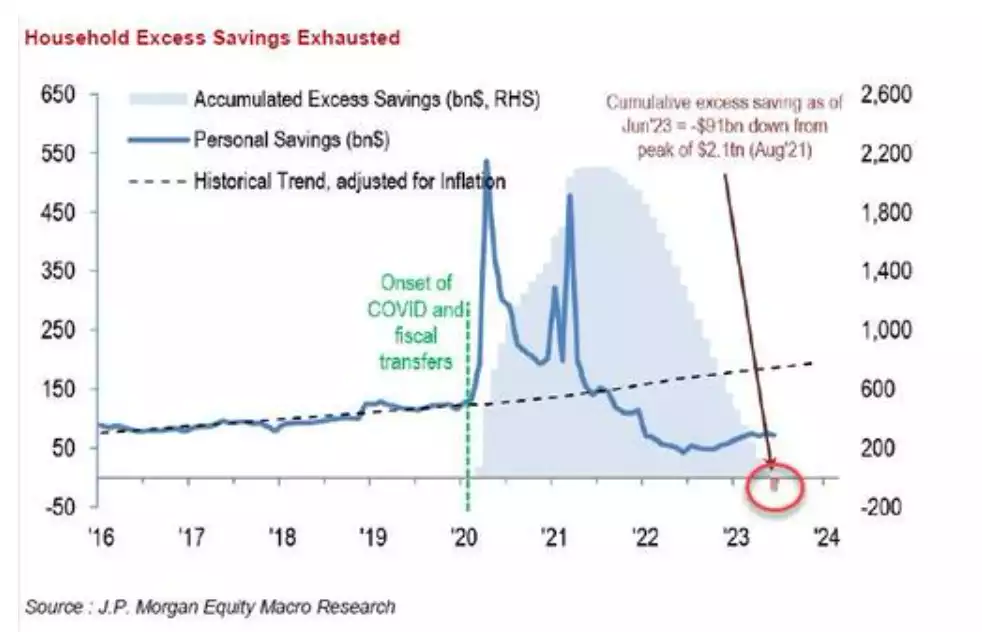

Consumer spending has been a massive support to US GDP despite the fastest rate hiking cycle ever but perversely helped by rampant inflation requiring even more expenditure. Helping this along however, the US consumer had the leftovers from the unprecedented US Government’s $2 trillion COVID handout.

The chart below clearly shows how not only has that money all been spent, but they are now well below pre COVID levels. Not surprisingly when one continues to spend as cost of living surges, the money soon runs out. The speed with which this is happening caught analysts off guard. JP Morgan just a month ago warned that Americans would exhaust their savings by the end of this year. On Friday however, they revised this to… now.

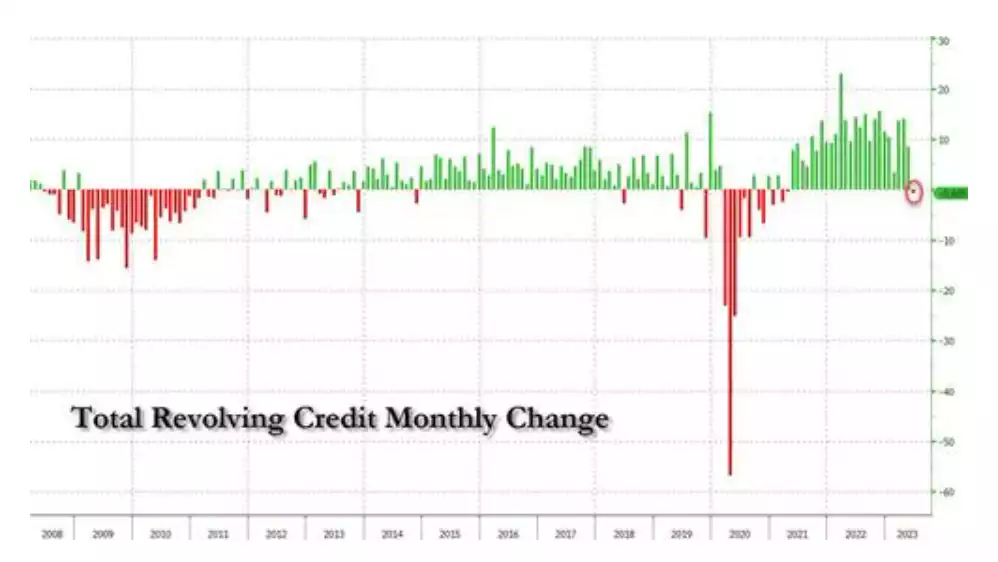

The reality hit to the YOLO crowd has seen even credit card usage turn negative for the first time since COVID and off the back of a VERY high usage as you can see below. That creates a double hit to consumer spending both in terms of actual expenditure but also the psyche of the average American clearly indicating a big step back from the excesses seen in the last few years.

This comes just ahead of the end of the 3 year student loan repayment COVID holiday which happens next month. Barclay Bank recently estimated that alone could see $15.8b per MONTH decrease in spending ($190b/yr).

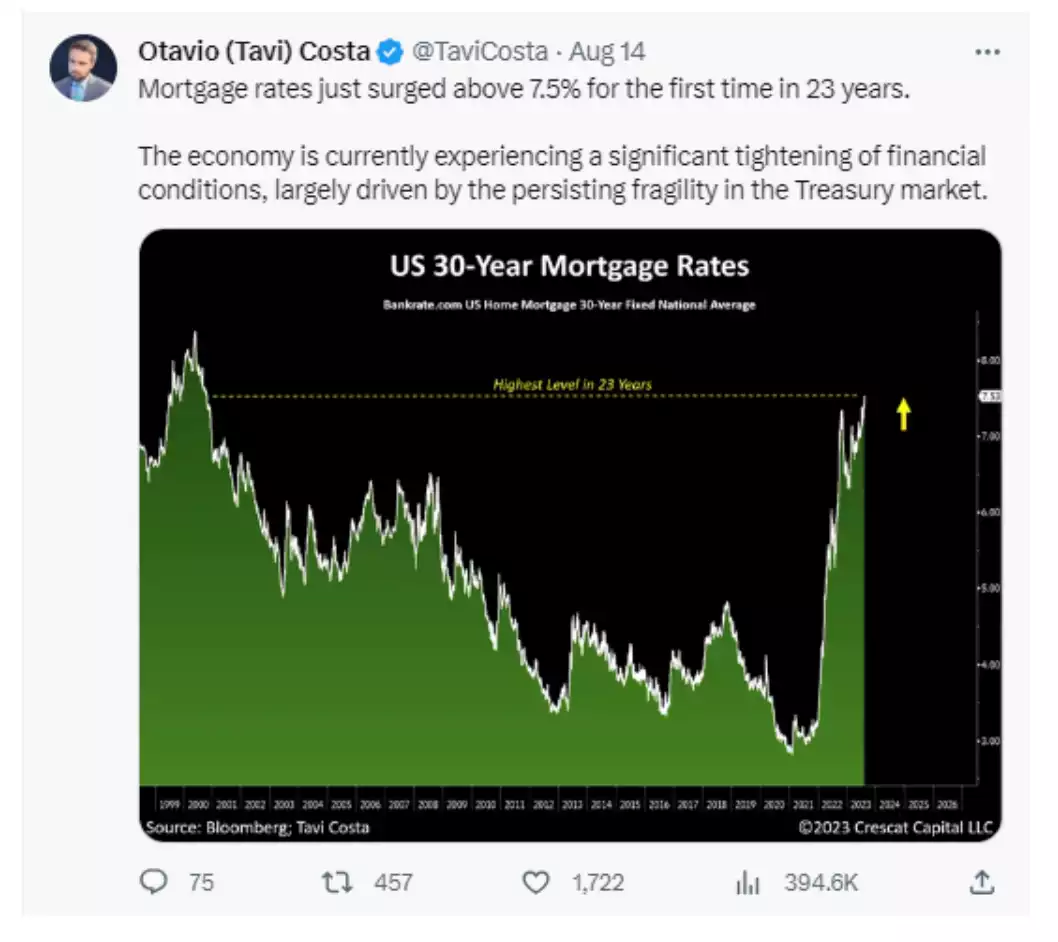

The ‘hope strategy’ of the soft landing for the US looks to be quickly disappearing. The bond market looks incredibly precarious and threatening higher rates for longer despite the falling inflation figures. That means as more and more Americans refinance their loans they are looking at the following reality – a 23 year high interest rate:

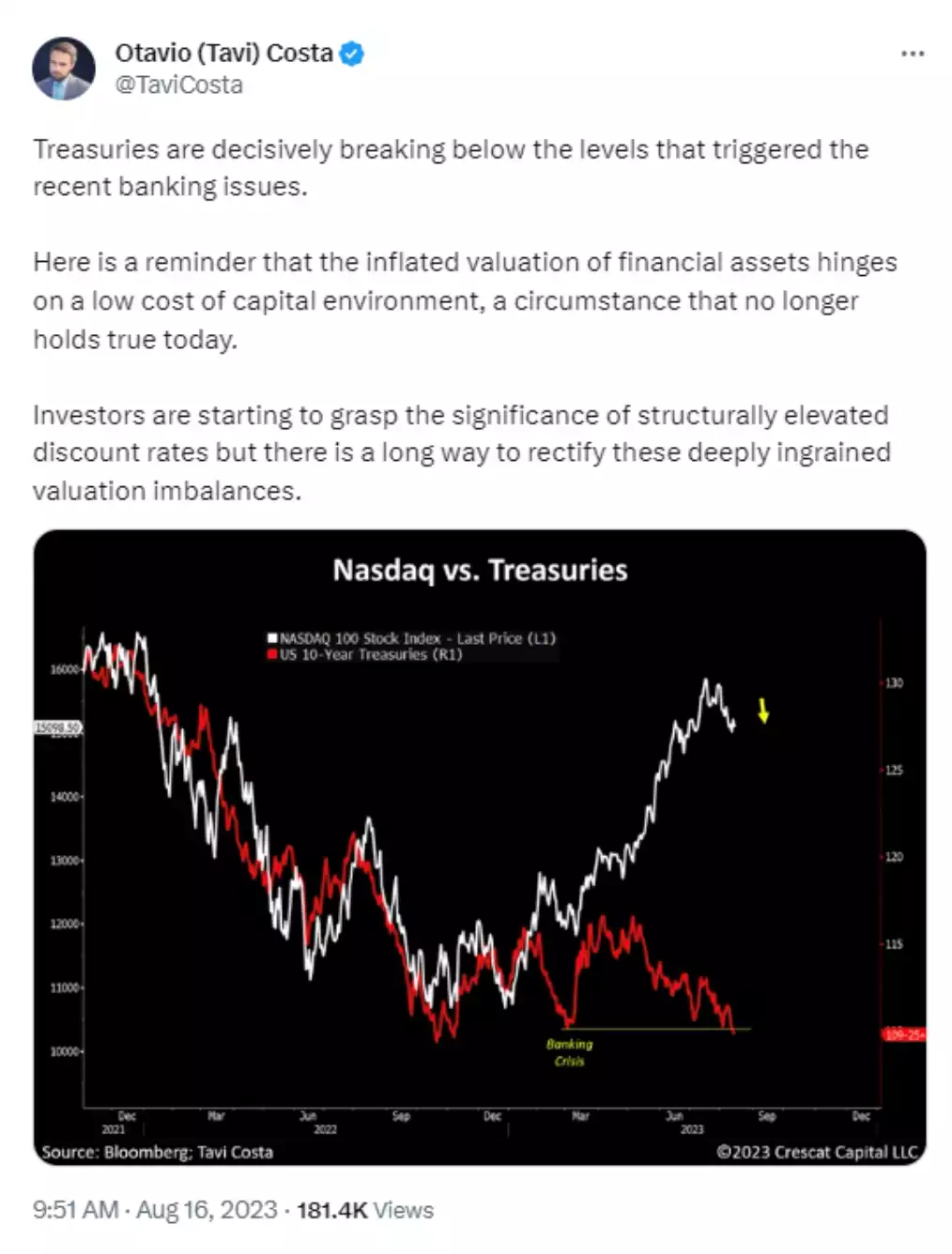

It looks like the US sharemarket is starting to do the math, closing the week last week with its biggest weekly loss since the banking crisis and its 3rd week in a row down. The NASDAQ in particular is getting hammered. Investors often call the US Treasury market the ‘market of truth’. If that is the case, things are looking very ominous for the US sharemarket…

The US Consumer and Bidenomics has keep the game going. That game looks to be near full time. It may be time to prepare.