Why US Treasuries May Break the Market

News

|

Posted 14/08/2023

|

3219

There is an eery sense in nearly all markets at the moment as narrative meets reality and no one seems to know where this goes. The elephant in the room is US Treasuries and no one seems to ‘get it’ as one normally doesn’t find this elephant in one’s room…

Friday night saw more market turmoil as US PPI (inflation at the factory door) ran hotter than expected in another sign that inflation may be a little stickier than thought / hoped and that maybe the mythical ‘soft landing’ everyone is hoping for won’t happen. The S&P500 and NASDAQ had their 2nd week in a row of closing lower week-on-week and Treasuries again finished lower (meaning yields higher). Precious metals and bitcoin continue to chop up and down within a ‘boring’ range as they fight the higher rates & USD v safety & inflation hedge battle for love.

So let’s strip this bare and simple and do some math around debt, because quite frankly, its ALL about debt and that there is too much of it.

Too much debt is why the Fed and central banks around the world cranked up the money printing presses and suppressed rates since the GFC. Debt was about to collapse the world during the GFC and it had to be ‘fixed’ before the CDS’s (credit default swaps) exploded and, what looked like what was already a bad situation, got a whole lot worse.

Since then, because ironically printing money creates a whole lot more debt in the form of Government Bonds (including US Treasuries), debt has exploded much much higher than before the GFC. Much more debt means more interest payments…

The pain in US Treasuries in particular is that the US government has a double whammy of a whole lot of bonds maturing and needing to be ‘resold’ AND a government that is spending hand over fist and filling up its TGA (bank account) that was emptied prior to the debt ceiling debacle. So…. there is a mountain of US government bonds flooding the market at the exact same time that the world is buying less of them because of the exact reason there are so many… it’s a giant Ponzi scheme and participants are opting out for either financial or political reasons.

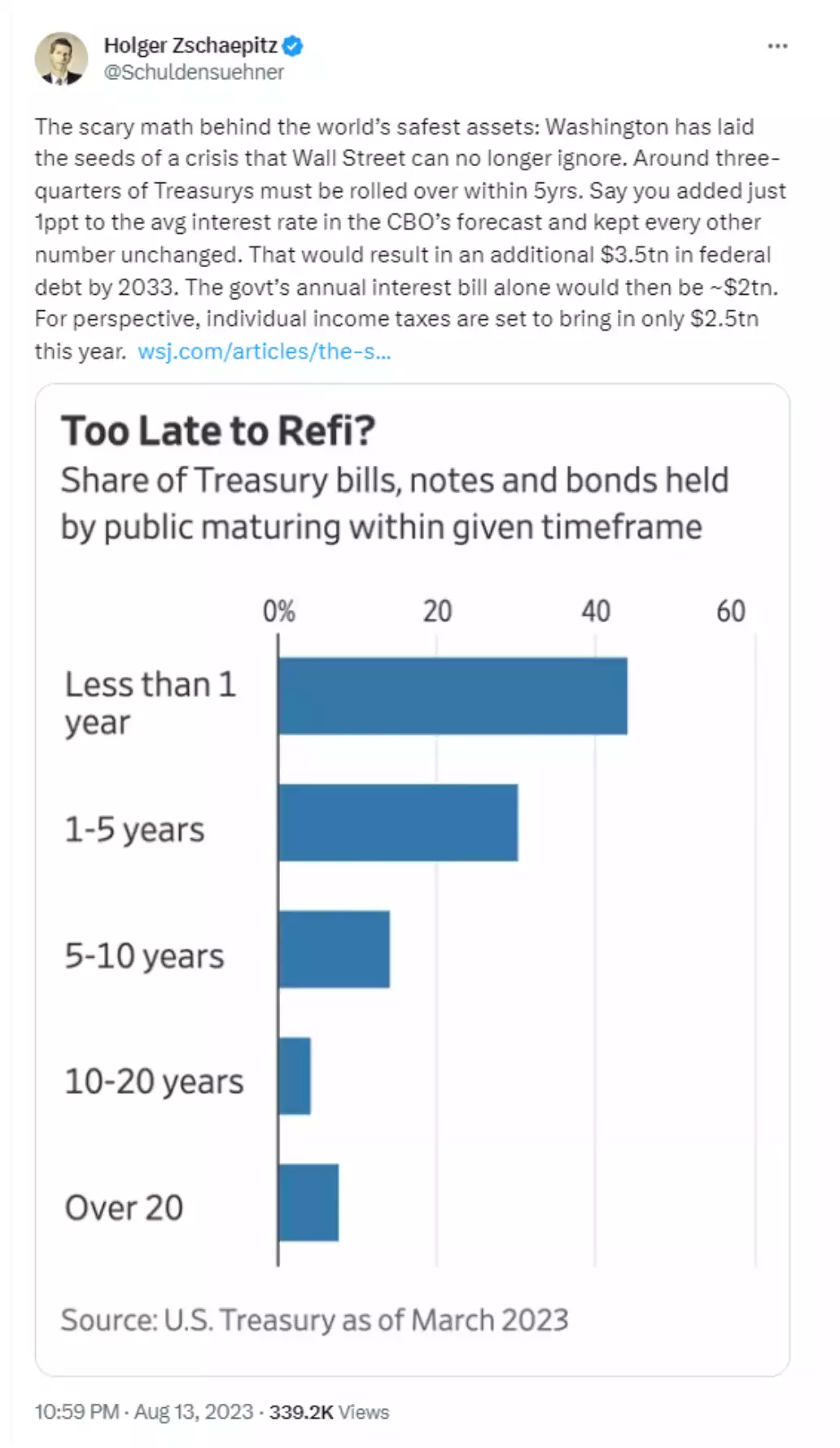

The following tweet puts this into perspective:

Yes you read right. Nearly ALL tax receipts (the government’s only income) would be required to just pay the interest… But the Fed sets the interest rate right?

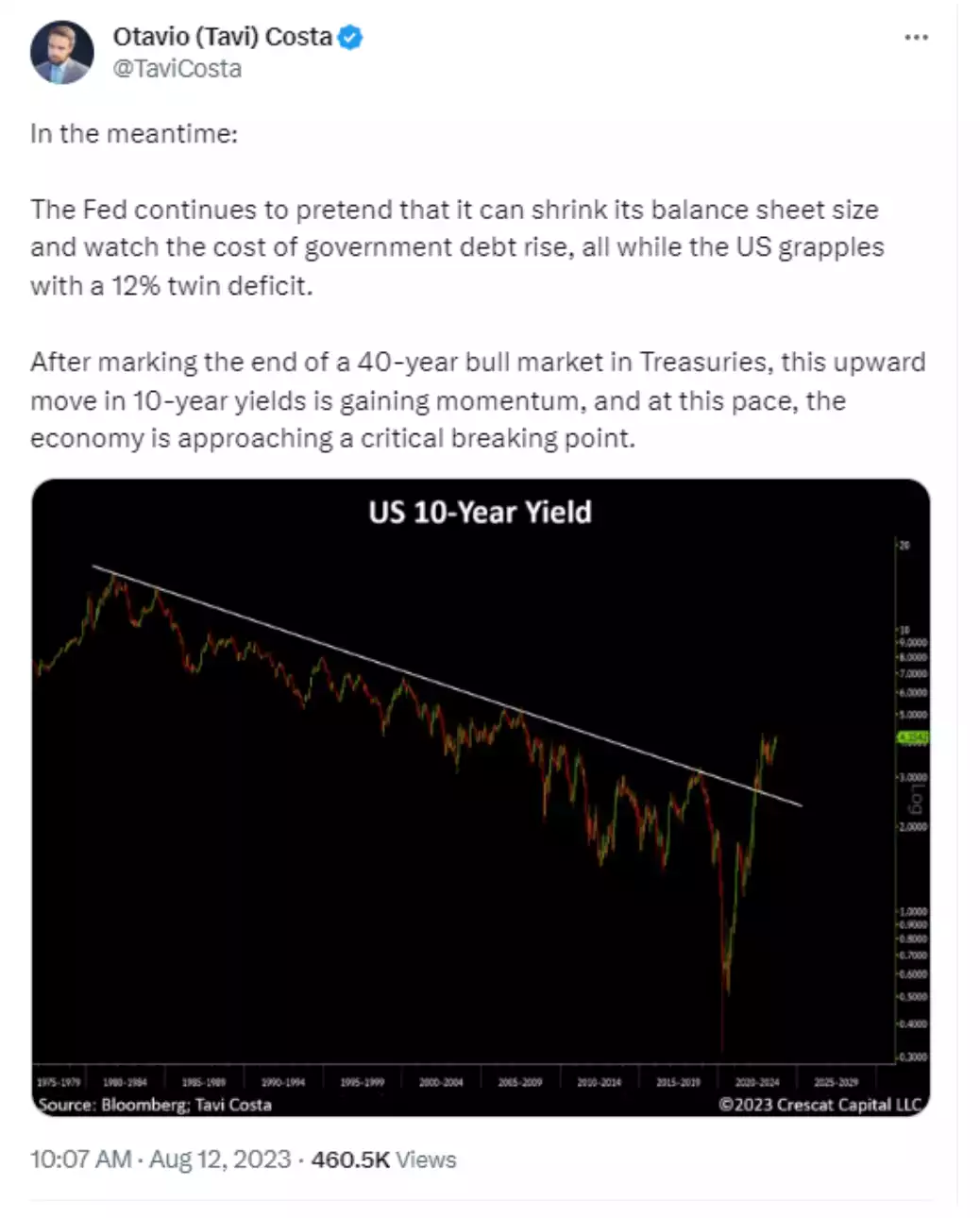

As the broader market doesn’t buy US Treasuries at the rate required and starts to think inflation may indeed be sticky, supply/demand/price fundamentals dictate that the price of these bonds drops, further raising the world’s ‘risk free return’ or defacto interest rates. For a very long time now these have been predictably falling in a defined channel. Until now….

The key words there are ‘breaking point’ as that is ultimately what people don’t understand fully yet. The world’s biggest ever debt pile quite simply cannot handle interest rates higher than the GDP that pays the interest on them. The central banks are trapped in a Ponzi scheme of their own making where they need to monetise debt to pay the interest on the debt, creating more debt. That is, by definition, unsustainable. Meanwhile, everyone is looking and wondering what might be the pin that bursts this ‘everything bubble’. Few would have predicted the ‘worlds safest asset’ as the cause, and may well not be.

The Fed are possibly playing a confidence game here, deliberately letting it get to the point where it justifies what promises to be an eye watering QE (money printing) response. Global Macro Insider’s Raoul Pal put it well in an update earlier:

“How things play out in Q4 is extremely important.

I think the Fed knows they have to get interest rates down to the long-term trend of GDP or lower or everything breaks…

I think we have to assume they are hiking this late in the cycle on purpose — that they want inflation to undershoot and unemployment to rise somewhat…

The undershoot would give them the cover to monetise the debt and get rates lower. Basically, the current hawkishness is a narrative ruse.

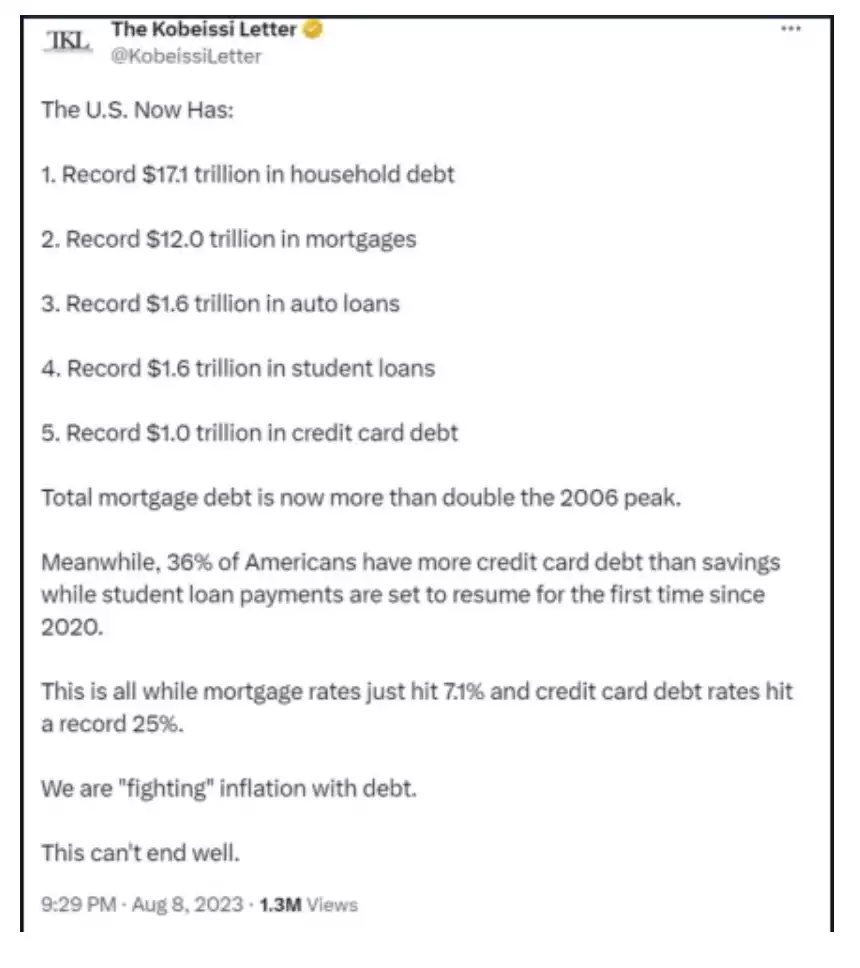

All of this is happening with this as the consumer picture…”

There are 2 assets in the world considered the most ‘risk free’. The US Treasuries/USD combo and gold. We mentioned earlier gold’s competing forces currently. Should the Fed push this all the way to market breakage of some sort, gold’s safe haven, volatility and inflation protection properties should shine. (Oh, and the Fed have a near perfect record of hiking into a recession of their making). Should, or more accurately, once the Fed turn on the printers again, all that debt based liquidity should be very supportive of higher gold prices as bonds and the USD tank. Gold is trapped between both narratives right now and hence chopping sideways. Math and economics mean that simply can’t stay that way.

The old saying, better a year too early than a day too late may be quite relevant right now…