The Yen Carry Trade – What is it and why is it Rocking the Markets?

Insights

|

Posted 07/08/2024

|

2257

The Monday ‘Black market crash’ in the Nikkei 225 led to a 12% drop, but was followed by Tuesday’s 12% gain on opening. The volatility in the stock markets worldwide is following the rapid appreciation of the Yen relative to the USD leading to a lot of speculation that this is the beginning of the Japanese Carry Trade Unwind. So what just made your next Japan holiday 20% more expensive and what does the Carry Trade Reversal mean of the future of world markets and currencies?

What is the Yen Carry trade and why did it cause such market panic on Monday?

The Yen Carry trade was the ability to borrow in Japanese Yen, and then buy overseas assets, with the devaluation of the Yen relative to the USD, this had a double win for anyone who bought U.S. stocks, or Brazilian coffee, providing returns both from the asset appreciation, and from the currency exchange rates relative to the Yen. This has happened as the Bank of Japan has been buying huge amounts of their own debt, now sitting around 125% of GDP whilst keeping interest rates at record lows. With the Bank of Japan (BOJ) lifting interest rates above 0 this year and the Federal Reserve looking at dropping rates, the Yen is becoming more attractive, meaning money is beginning to come back to Japan.

It is believed Mondays 12% drop in the Nikkei 225, followed by worldwide stock market drops, may have been the result of light Monday markets, and margin calls on some of these Yen borrowings. But this appears to be just the beginning of the Yen Carry trade.

Why did the BOJ hike

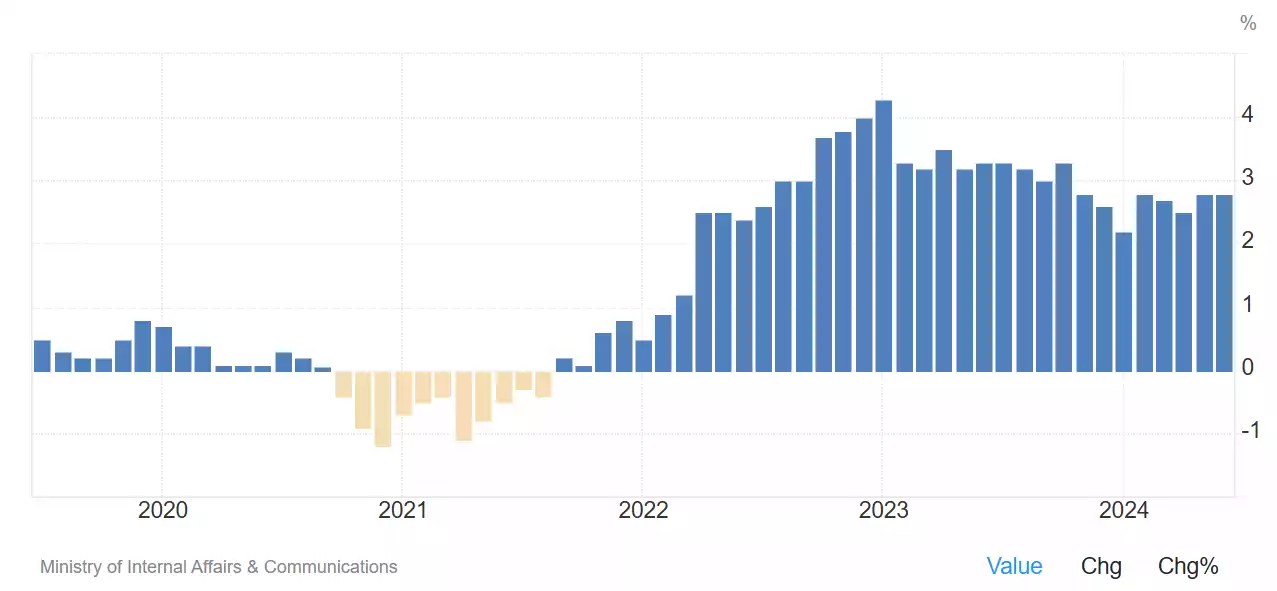

In May annual inflation in Japan lifted by 0.5% month on month, annualised, this rate of inflation would be 6%, this appears to have put the BOJ in notice, and they followed with a 0.15% raise. Looking at Japan’s inflation graph, you can see inflation has been sitting well above the 2% comfort zone since early 2022.

Japan’s 5-year Inflation Graph; Japan Inflation Rate (tradingeconomics.com)

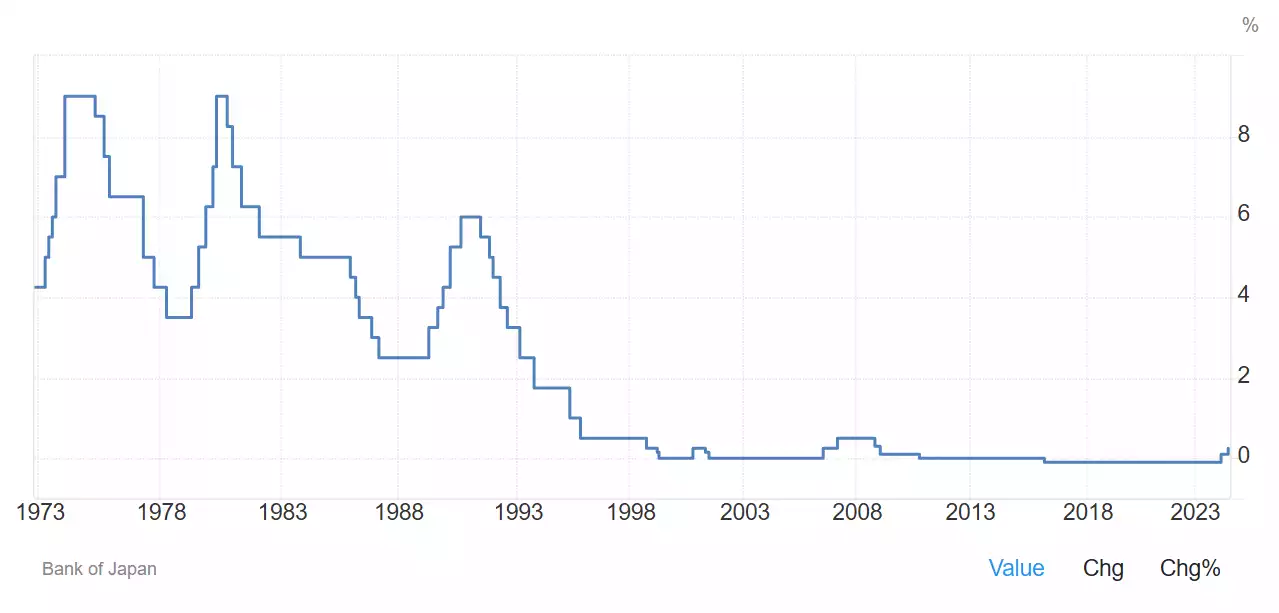

Now being in Australia with current rates at an annoying 4.35% (so much easier to follow when they were full 0.25%), this seems like a small thing, but in Japan where interest rates have been 0 or negative since 2016 this was a huge raise. In fact, Japan’s interest rates have sat at 0% since 1998, with only a couple of notable periods of lifts 2000 and 2008. Now if anyone wants to recall history on the last economic recessions… 2000 and 2008.

Japan’s interest rates all time; Japan Interest Rate (tradingeconomics.com)

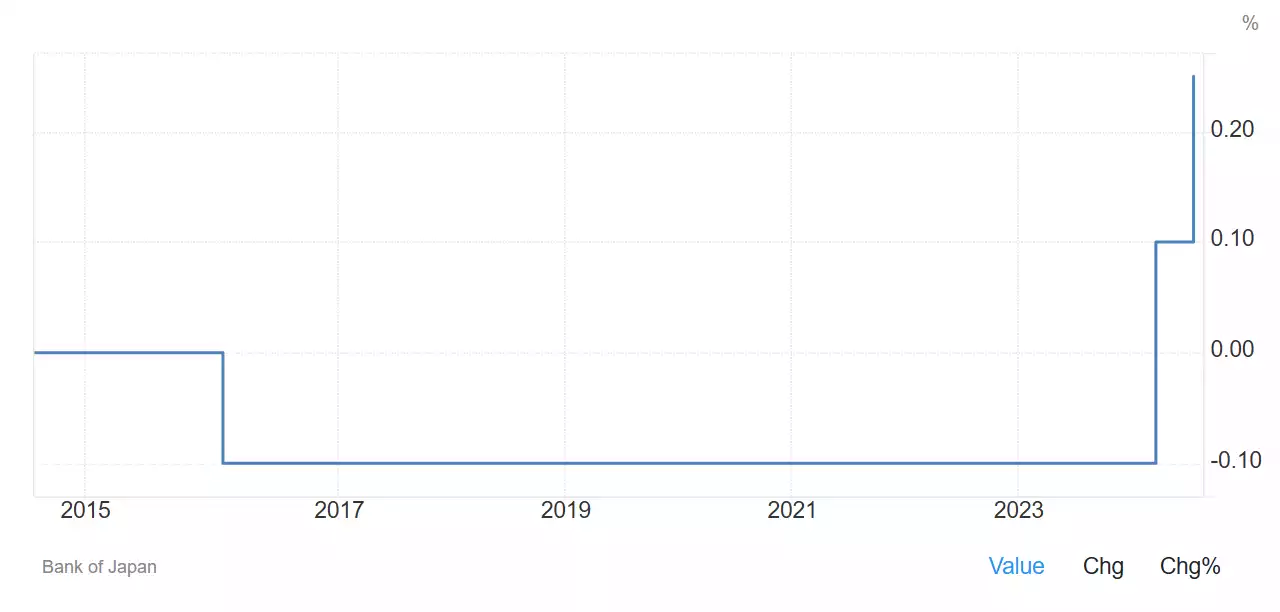

This is Japan’s second time lifting this year, in March it lifted rates from -0.1% to 0.1% and now it has lifted rates to 0.25%. The size of the lift is more apparent on the 10-year graph, which shows interest rates in Japan are now the highest they have been since December 2008.

Japan’s interest 10 year; Japan Interest Rate (tradingeconomics.com)

With the rise in interest rates and the unwind of the Carry Trade, the Yen has appreciated nearly 20% against the Australian dollar and dropped from 160 to 142 against the USD in a similar amount of time.

USDJPY 2-year graph; TradingView

To understand how much further can go, in 1998 when Japan first dropped rates the USDJPY sat at around 100, it wasn’t until 2022, with inflation hitting the world and Central Banks raising did it start to dramatically increase.

USDJPY 20-year graph; TradingView

So, if the stock market turmoil has seen an unwind of 25% of the rise, there’s still 75% left to unwind based purely on the exchange rate.

Devaluation of the USD and inflation

As the Yen Carry trade unwinds one of the outcomes should be the devaluation of USD relative to both the Yen and other currencies. Some other currencies including the Brazilian Peso may also devalue relative to other currencies, basically the main recipients of the Carry Trade should be the main currencies to devalue relative to both the Yen and other currencies. As the USD devalues, purchasing power decreases as higher prices are implemented, which could stoke U.S. inflation.

There was speculation on Monday with the massive worldwide stock market drops that the Federal reserve would step in and intervene, with markets pricing a 60% chance of a drop in interest rates this week. As interest rates drop, currencies drop further, which has the potential to drive inflation even higher in the U.S. as the USD will be able to buy less.

We have spoken before about the lift in interest rates in the U.S. paired with uncontrollable government spending, forcing inflation to move throughout the world. If the USD devalues with the Carry Trade and the U.S. continues to see poor job numbers and inflation numbers, sub 0 inflation should move back to the U.S., with initial deflationary pressures in the rest of the world.

We’ve previously spoken about government spending in the U.S. (and worldwide) causing demand-pull inflation which interest rate hikes are unlikely to tame, next time, inflation will be likely caused by cost-push inflation, occurring where wages and raw material costs become higher, decreasing aggregate economic supply. Interest rates do tame this type of inflation, but at this point, as the economy is most likely depressed from pushing interest rates at the wrong time, Central banks are likely to get this wrong and not raise interest rates in this cycle.

Inflation coming home to roost

If the Federal Reserve drops from here, or the Bank of Japan lifts the interest rate differential is likely to get closer, if this is the case inflation is likely to be unleashed (again), but under this scenario, though happening over months and years into the future, it will finally come home to roost in the U.S. where it was started, just in time for the next U.S. President…