U.S.’s own CBO Forecasts Fatal Debt Burden Ahead

News

|

Posted 25/06/2024

|

2233

New estimates coming from the United States Congressional Budget Office (CBO) paint a bleak picture for the next decade and beyond, a picture that precious metals investors know all too well.

Economic growth and tax revenue is estimated to lift government revenues to US$4.9 trillion in 2024, representing 17.2% of GDP and increasing to 18% by 2027 and staying at that level until 2034. At this point, one could be forgiven for over-indulging on hopium in these challenging times. As we know, however, the devil is often in the detail. Along with the estimate of growth comes growth in another department – the budget deficit – which is forecasted to grow from US$1.9 trillion this year to US$2.8 trillion by 2034.

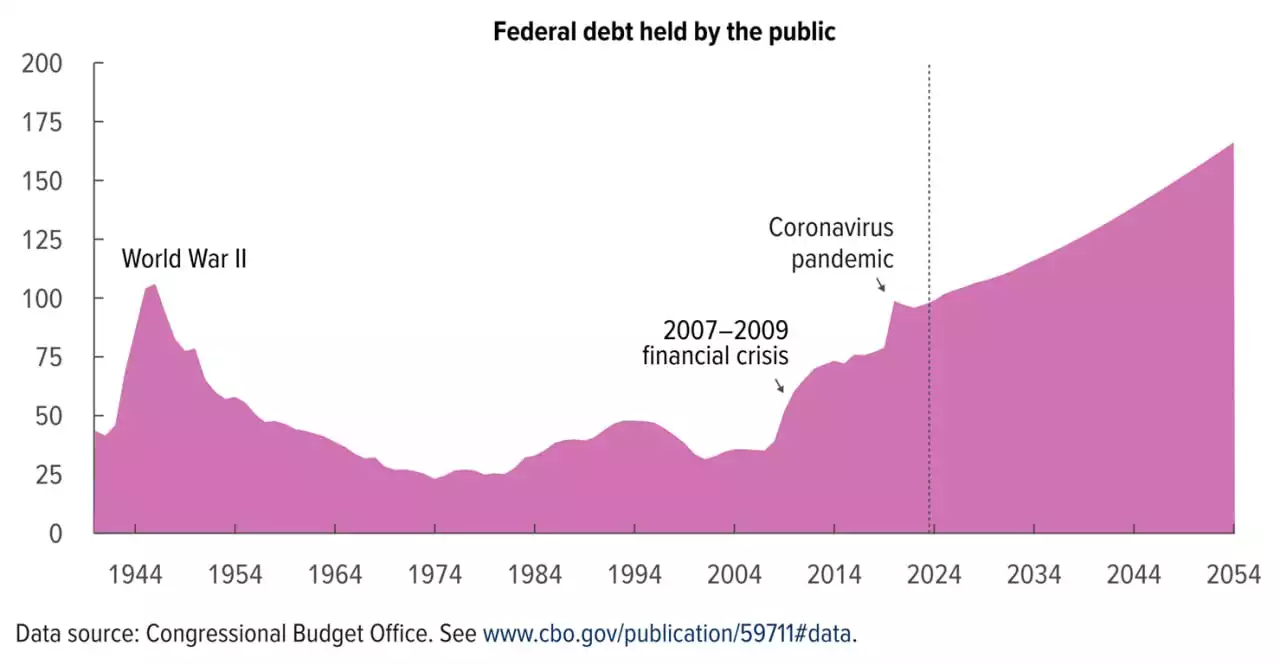

Excessive spending is at the heart of this mess as by 2034, government expenditure is expected to skyrocket from US$6.8 trillion to US$10.3 trillion (around 24.9% of GDP). A sizeable chunk of this increase comes from the rising cost of debt. Over the next decade, public debt is predicted to grow from 100% of GDP in 2024 to 122% in 2034, increasing by US$22 trillion to US$50.6 trillion. (And, that figure excludes the debt held by other entities like the Federal Reserve and does not account for unfunded liabilities currently sitting at US$216 trillion (see below from U.S. Debt Clock).

Looking out even further the government themselves see (and seem to accept) Debt:GDP at over 150%!

The reality is that balancing the budget just by boosting revenue is a pipe dream because no combination of tax hikes or other revenue measures can drum up an extra US$2 trillion a year. If they raise taxes, investment and growth will likely slow down, making the fiscal mess even worse. And let's not forget, many believe that there's a good chance we'll experience a global recession in the next decade. If that happens, government spending will likely skyrocket even more, pushing deficits higher, no matter how much revenue is taken in. Running an annual deficit of 6% of GDP just to get 2% growth is a risky game.

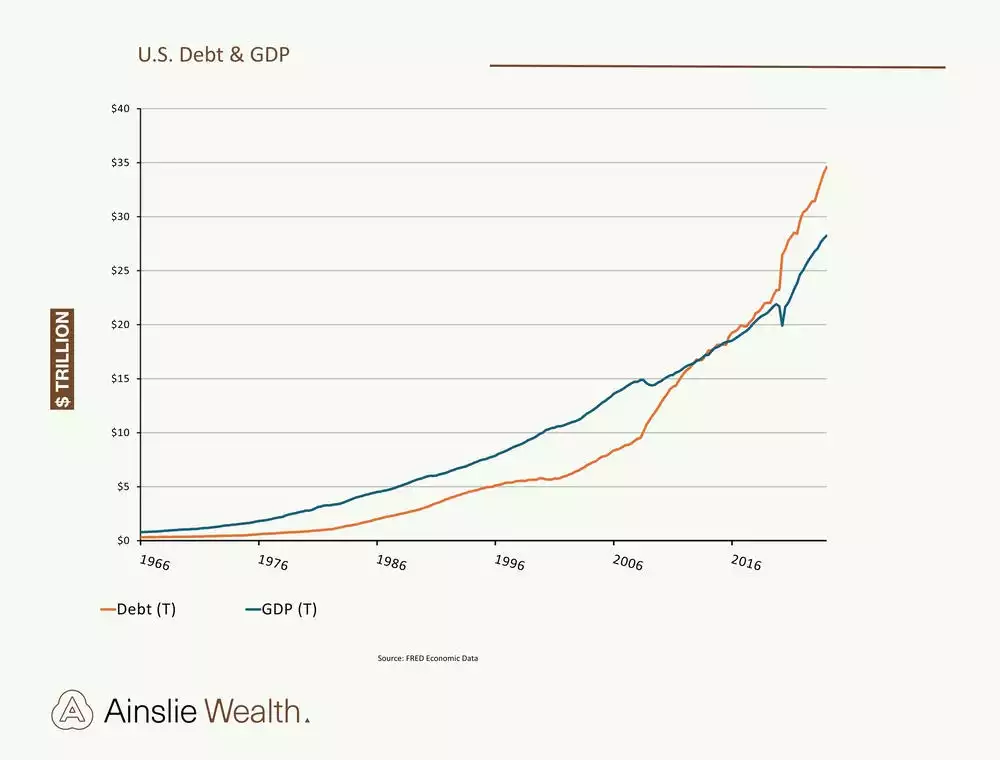

You can see below we crossed the Rubicon where debt exceeded GDP in 2015 and then the eyes really rolled back as debt went exponential.

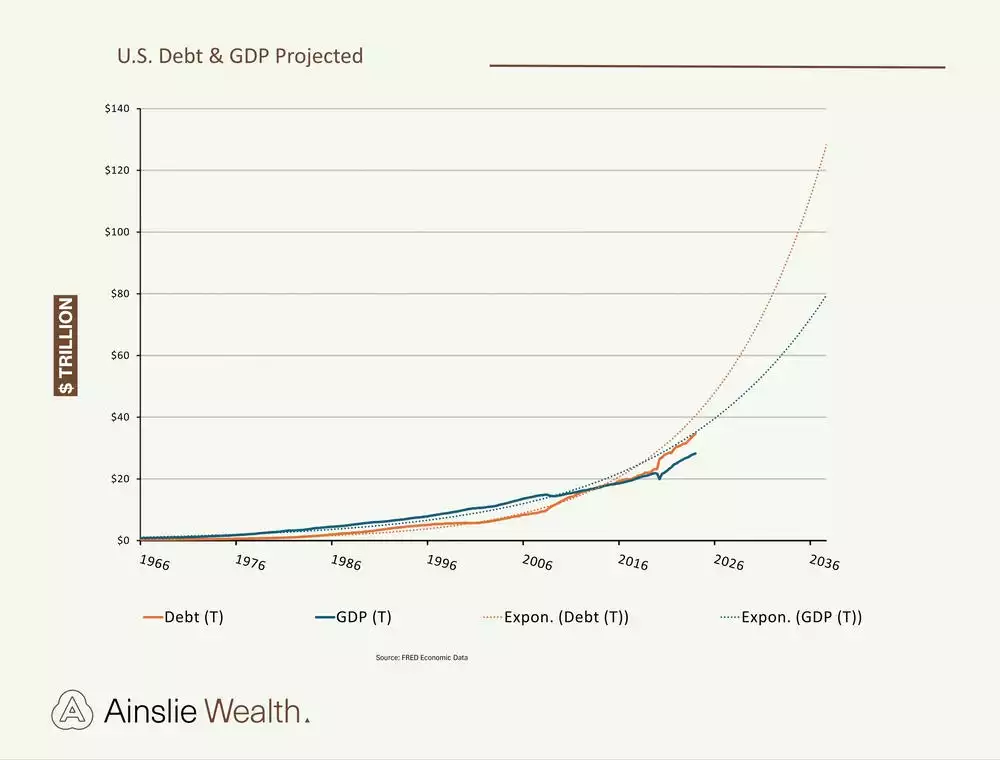

And so, projecting that exponential growth you can see we have a high correlation with the CBO’s own numbers.

Reckless government borrowing results in higher taxes, slower growth, and less purchasing power for regular Americans, and it puts a burden on future generations, making them poorer before they’re even born. The glimmer of hope? The winds of change that may blow through Washington before long. The next administration needs to focus on pro-growth policies that boost productivity and encourage business growth. Combining solid monetary policy with growth-focused fiscal strategies will be crucial to keeping the U.S. a global economic leader. Have I enjoyed some hopium? Is this all too much to ask for? Almost certainly. Both Biden and Trump love fiscal spending. Thankfully, in this uncertain economic landscape, we have the timeless value of gold and silver which we expect to continue to provide growth as a reliable safe haven and benefactor of currency debasement for investor wealth.