Gold Hits All-Time High Amid Market Reactions to Fed’s Powell Rate Outlook

News

|

Posted 17/07/2024

|

2480

Gold has reached an all-time high in USD, as precious metals experience a significant surge. Over the past 24 hours, both gold and silver have gained over 2%. The rise in gold prices is driven by growing expectations of Federal Reserve rate cuts and increased speculation on a potential second term for Donald Trump.

Gold's breakout to a new record high follows a bullish crossover of the 20-Day Moving Average above the 50-Day Moving Average observed yesterday. The previous record of US$2,450, set on May 20, has been surpassed. As of today, Tuesday, gold has reached a new peak of US$2,468 and continues to trade near this high. In the local currency, gold is currently trading at a spot price of AU$3,666.

Higher gold prices are supported by recent market movements. A monthly bullish signal was triggered earlier this month when gold rose above June’s high of US$2,388. With July now halfway complete, gold has a strong chance of ending the month in the upper third of its price range. Additionally, a weekly bullish continuation signal was triggered this week, putting gold on track to end the week strong, also in the upper third of its trading range. If this trend continues, gold could experience significant upward momentum heading into next week.

Gold is now nearly 20% higher for the year, driven by expectations of Federal Reserve easing and substantial buying by central banks. Geopolitical tensions have further bolstered gold's appeal as a traditional safe-haven asset.

Overnight, U.S. Federal Reserve Chair Jerome Powell stated that recent data has increased policymakers' confidence that inflation is moving towards the central bank’s 2% target.

“I would say we didn't gain any additional confidence in the first quarter, but the three readings in the second quarter, including the one from last week, do add somewhat to confidence,” he said. “We're a dual mandate bank; for a long time since inflation arrived, it's been appropriate to

focus mainly on inflation, but now that inflation has come down and the labour market has indeed cooled off, we're going to be looking at both mandates. They're in much better balance, and that means that if we were to see an unexpected weakening in the labour market then that might also be a reason for reaction by us.”

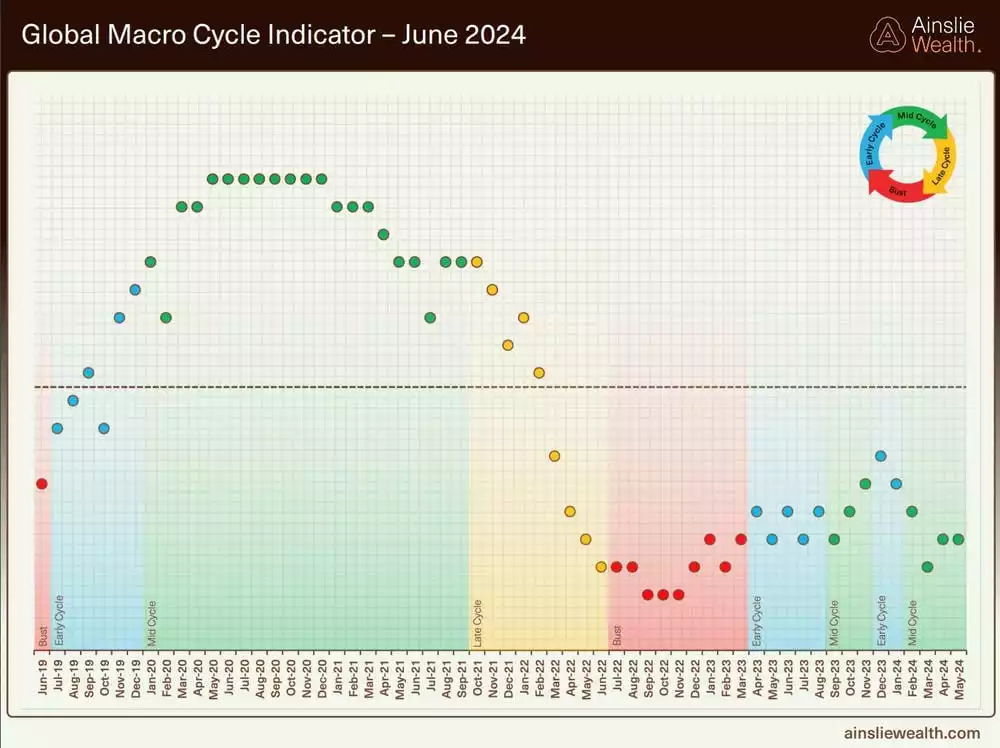

Ainslie Research has long argued that the recent gains in precious metals were inevitable, thanks to global liquidity trends.

According to the latest data, global liquidity has increased by 2.9% on both a 3-month annualised basis and year-over-year, amounting to a nominal rise of US$920 billion, bringing the total to US$170.7 trillion. Despite this recent increase, liquidity levels remain below the start-of-year mark but are still above the year's lows. The liquidity recovery, which began in October 2022, has been notably sluggish, especially during the first half of 2024, due to central banks' tightening policies.

The recent uptick in global liquidity, the rise in risk assets, and statements from Jerome Powell indicate that the sluggish market trend has reversed. As the saying goes, a picture is worth a thousand words. Looking at the charts below, consider whether you believe the momentum in precious metals prices will continue…