The Great U.S. Rates vs Market ‘Alligator Jaws’ About to Slam Shut?

News

|

Posted 15/03/2024

|

1722

Last night saw a divergence from the bad news is good news behaviour from markets as fears of resurgent inflation saw expectations of rate cuts by the Fed this year fall further. The night saw the combination of weaker than expected retail sales (2nd month in a row) and rising jobless claims indicating economic weakness but the clincher that spooked markets was an unexpected surge in PPI (producer price index, or inflation at the factory gate – ala future retail inflation). Hello stagflation. That saw expectations of a Fed rate cut fall further and the markets asking ‘but, but, when’s my cheap money coming back?’.

Recall that rate cuts were already under pressure after the hotter than expected CPI numbers this week. The hope was that was just an outlier and PPI would show slowing CPI coming. But it did the opposite, rising 0.6% month on month, making it the highest print since mid 2022 and seeing the year on year number rise to 1.6%, a 6 month high.

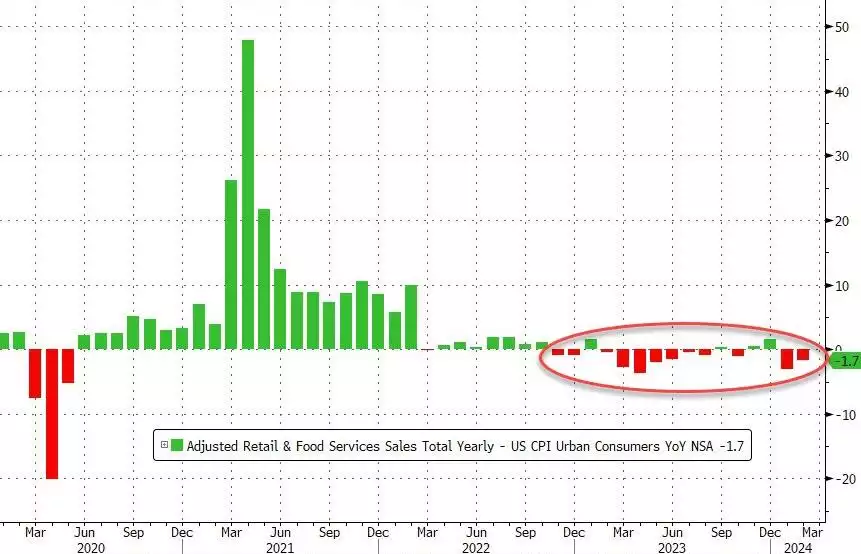

Countering this is retail sales, under again (0.6% vs 0.8%) and indicating cooling demand on the supply / demand equation for CPI. However, as we wrote this week, the U.S. is staring down the barrel of more demand push inflation coming to counter this. Just as we pointed out this week, they also quietly but hugely downgraded the already bad January number too (-0.7% to -1.1%). Looking at it in real (inflation adjusted) terms, it is worse again:

And so with increasing inflation but weakening economy, are heading toward stagflation and no chance of the mythical ‘soft landing’?

The market is increasingly thinking the Fed will hold fire on cuts for longer to ensure they get inflation under control with expectations dropping from 6 cuts this year to now just 3 in less than 2 months…

We have spoken about the ‘alligator jaws’ scenario in regard to the unsustainable disconnect between that Fed Fund Rate everyone is fixated on the Fed dropping, and the bond market yields which ordinarily must be below the FFR to make sustainable sense. So how’s that looking now?

Bond yields rose strongly again last night as ‘higher for longer’ won out. The reality is though, that you can’t have FFR above bond yields and the yield curve inverted before something breaks. And so, let us look at the other ‘alligator jaws’ elephant in the room right now..

Something has to give but gold has an each-way bet. Cut rates and the Fed joins the global liquidity party that gold so dearly loves. Hold strong and bond yields rise further, money leaves equities (possibly in a disorderly – alligator jaws slam shut – manner), interest costs on that record debt pile explode, and ensuing economic crisis sees the big gold safe haven play. As we discussed this week too, the AUD will likely fall against this, adding further fire to the AUD priced gold price.