Shocking U.S. Jobs Report & Immigration Ponzi Scheme (Australia same!)

News

|

Posted 11/03/2024

|

2184

Welcome to U.S. election year where all will not be what it seems in the headlines as the Biden administration will pull out all stops to make the economy look better than it is. However the similarities on many fronts to Australia cannot be missed and cannot be ignored. Last week we wrote “‘Do as they do, not as they say’ – Why Central Banks Are Buying Gold” and equally today, “Look beyond the headlines – why immigration is hiding the real economic reality”…

The all important U.S. non farm payrolls (NFP) job report came out on Friday night our time and it was notable for being more ridiculous than January’s huge ‘beat’. It was notable for a few reasons. First it beat expectations again, second it saw a massive 35% reduction back adjustment to January (long after the high fiving initial headline number), and third, a look behind the headline reveals a structural issue with the U.S. economy that MUST be a warning to Australia too.

At 275,000 new jobs added it blew away most market expectations which had a median of 200K. And so, the headline print is ‘U.S. economy doing fine, nothing to see here…’.

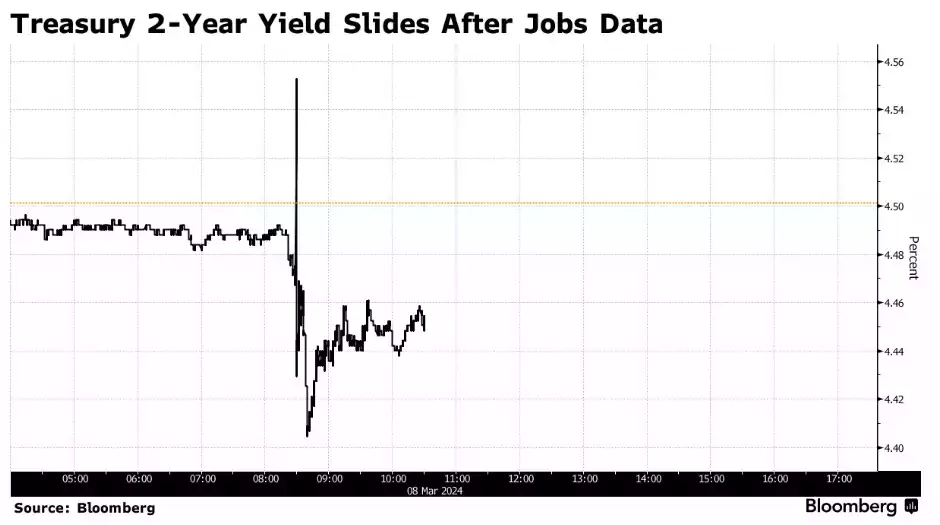

And then we see that the huge, outlying 353,000 print in January was ever so quietly revised down to just 229K, ‘just’ a 35% reduction long after the headline so convenient for Biden in an election year. But the bond market did not miss it and in our world of ‘bad news is good news because they will ease monetary policy’ the January revision, along with a surprise jump in unemployment rate to 2 year high 3.9% was celebrated with a quick drop in bond yields, particularly at the short end and now the market is back to 100bps cuts this year and a cut in June now fully priced in. Gold jumped even higher.

This quote from Bloomberg says it all…

““Bond investors were bracing for another experience like last month,” when job creation exceeded even the highest of nearly 80 economist estimates in Bloomberg’s survey, said Bryce Doty, senior portfolio manager at Sit Investment Advisors. “To see the massive revision downward was a huge relief.””

Yep, a “huge relief” that new jobs are weaker and unemployment higher because it will take pressure off the Fed and they can drop rates. Welcome to our hyper-financialised, Global Liquidity fixated world.

However, when you look behind the headlines of that 275K February print you start to see a much deeper issue and one that Aussies, in particular one Mr Albanese, need to look carefully at.

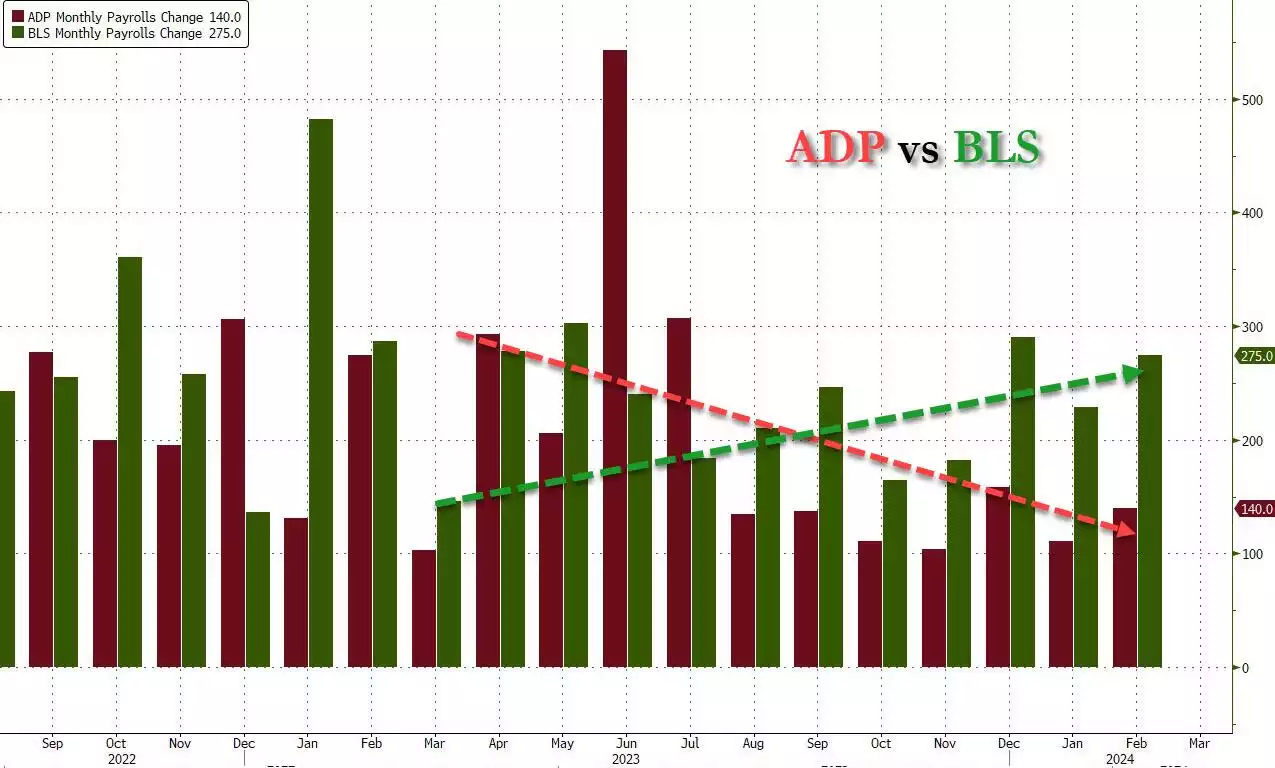

First, average hourly earnings plummeted 80% to its lowest in 2 years (whilst supposedly in a ‘tight’ employment market…). Whilst Biden’s administration (BLS) may be responsible for the NFP numbers, the ADP payrolls report which is based on real employment at the company level is showing a very different picture. ADP payrolls are in a downward trend, whilst even adjusted BLS NFP numbers are clearly painting a better picture.

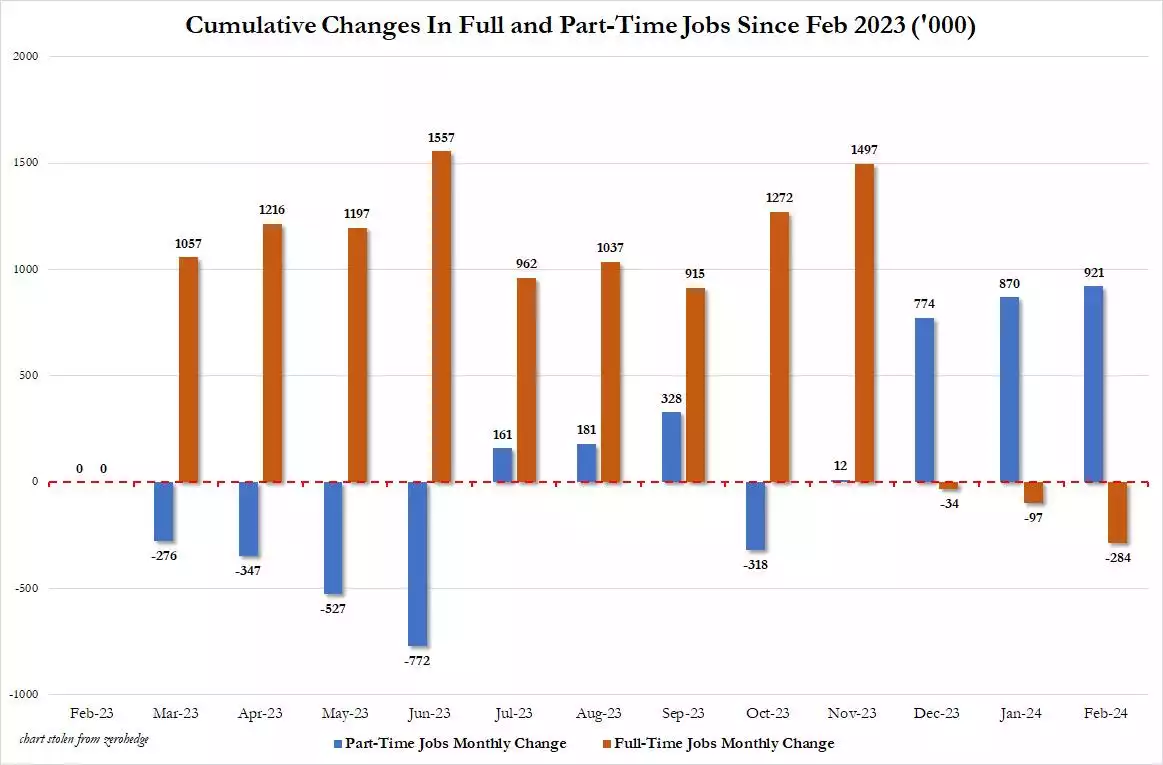

And then we look at the make up of the employment and in another sign of economic stress, the last year has seen a loss of 284K full time jobs against a gain of 921K part time jobs. This is a trend since the end of last year. That is not a sign of a healthy market.

We have spoken repeatedly about how the Albanese government imported over 600,000 migrants last year putting massive pressure on housing affordability and inflation but conveniently masking 4 straight quarters of per capita recession.

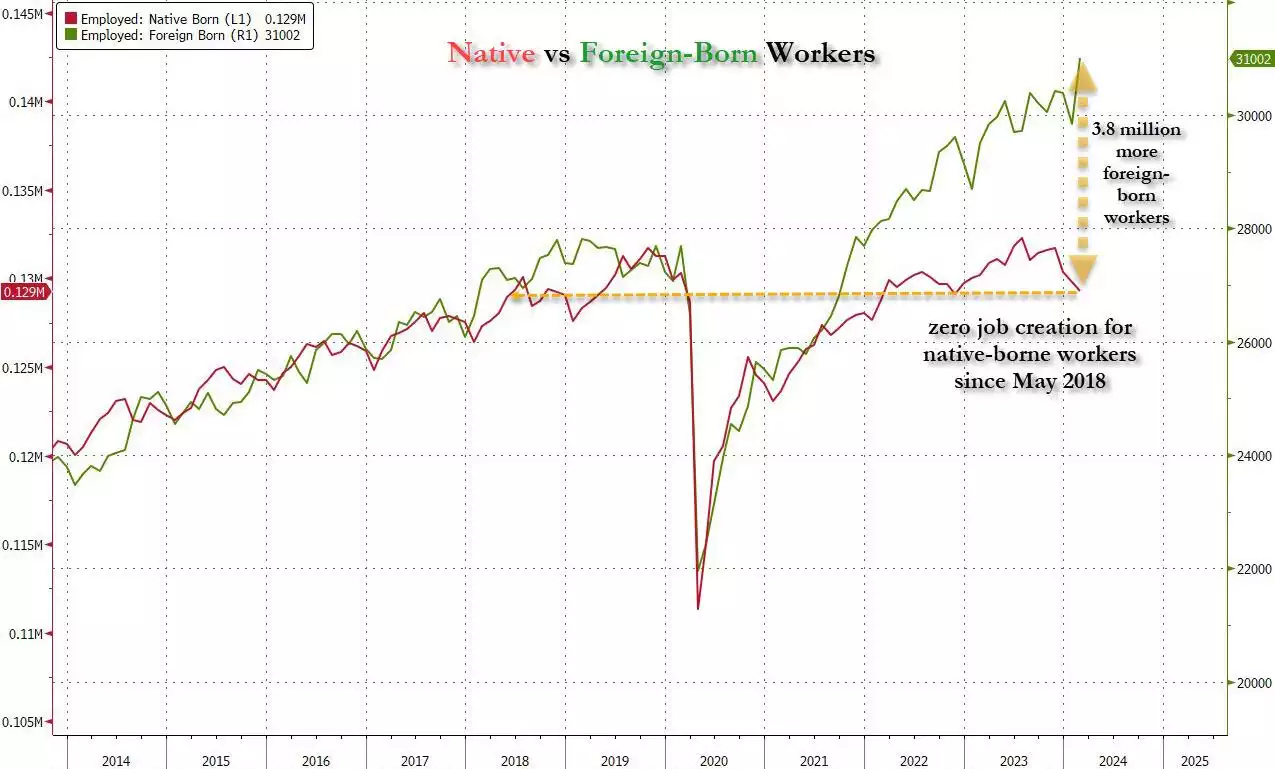

In the U.S., migrant workers, even illegal who get 5 years of work whilst ‘processing’, have taken ALL net jobs since the middle of 2018.

Ponzi schemes, by definition, see ‘growth’ purely by virtue of conning new participants into the pyramid nature of the scheme. Both the U.S. and Australia are using immigration to hide the biggest Ponzi scheme of all. Cold comfort if you are trying to buy or now even rent a home or feeling the pinch of inflation against wages that won’t rise enough because… you guessed it… all the new migrant workers (as we see in clear numbers above in the U.S. as well). Trump is looking like a shoe in now and he will stop that immigration. What then?

The only certainty in the above is the Fed (and RBA) will need to cut rates and print more money to stop the house of cards collapsing. Wait too long and this hyper-financialised economy pops. Never has gold and silver seen such an amazing each way bet on the outcome.

When the immigration tide recedes all will see the economy is swimming naked...