Inflation in two different worlds

News

|

Posted 13/03/2024

|

2930

Inflation in two different worlds

The U.S. inflation numbers came in last night – higher than expected with actual at 3.2% vs 3.1% expected. Australia reported their CPI a week ago with inflation at 3.4% vs 3.5% expected. So what is the future of CPIs in the U.S. and why is Australia different and likely to need to drop rates sooner??

Demand Pull/ Supply Push Inflation

Demand Pull Inflation is when demand for goods or services rise faster than the supply. This can happen as an economy strengthens and employment rises and more consumers want more goods and services. Cost Push Inflation on the other hand is when supply shortages occur leading to higher input costs and higher prices.

During Covid both these types of inflationary pressures happened, supply shocks such as the chip shortages making computer and automobiles more scarce, driving a supply shortage, as well as demand pull instruments being the huge stimulus employed by the governments to create a huge amount of keyboard consumers doing their bit by not going to work and therefore not producing, but buying up goods that couldn’t be produced. This, as all consumers know, has now washed through the world with the covid delays gone, with the initial shocks of initial labour shortages and transportation hikes back to pre-covid moderation.

Remember the term ‘transitory inflation’ – this term was used as all central banks believed covid was only a supply shock – forgetting the effect the huge government stimulus had on the economy creating demand pull inflation which eventually led central banks to raise interest rates at the fastest rate in history.

As you can understand, monetary policy targets the economic strength and employment of an economy to temper demand. If there is a supply shock, monetary policy is unlikely to have any impact. According to the theory, supply push inflation, as it is a shock, will eventually moderate therefore using traditional monetary controls of interest rates can in fact make inflation higher (more on this later), but demand push inflation can be controlled by monetary policy. Demand push inflation is still apparent in the U.S., with the government spending still outstripping pre-covid spending. In fact President Biden has just announced his 2025 budget proposal, a $7.3 trillion spend amounting to a $1.7 trillion deficit – this is an expenditure of around $45,000 per taxpayer in the U.S. and assumes no shock spending such as covid or the Ukraine war so is likely to be higher.

$1.7 trillion in excess expenditure is a huge demand push, its approximately $5000 in excess spending per person in the U.S.. With the average U.S. earnings $50k per person this is an additional 10% of debt demand. It is therefore no wonder that in the U.S. the last two CPI numbers have come in as ‘shocks’ as they thought the monetary policy was doing more…. But in fact its not doing enough and rates will need to go higher under the current scenario.

Australia Supply Pull Misstep

Now let’s look at how traditional monetary policy has failed the Australian mortgage holder. The RBA has 1 lever – interest rates up or interest rates down. After covid with inflation soaring the RBA pulled on the lever and our inflation started to drop. However unlike the U.S. who is energy sufficient (so should we be but unfortunately our resources have been sold to the lowest bidder) Australia relies on the International energy market. With the Ukraine war 2 years after covid another supply pull shock was unleashed in Australia, that was not seen as dramatically in the U.S.. So as the RBA lifted interest rates to temper this new supply push inflation they created more inflation. How?

Well if you look at our current inflation numbers – the drivers of current inflation are financial (Insurance, financial services and housing). The items sustaining inflation are insurance and housing – these cost increases have been driven through increased financing costs from higher interest rates.

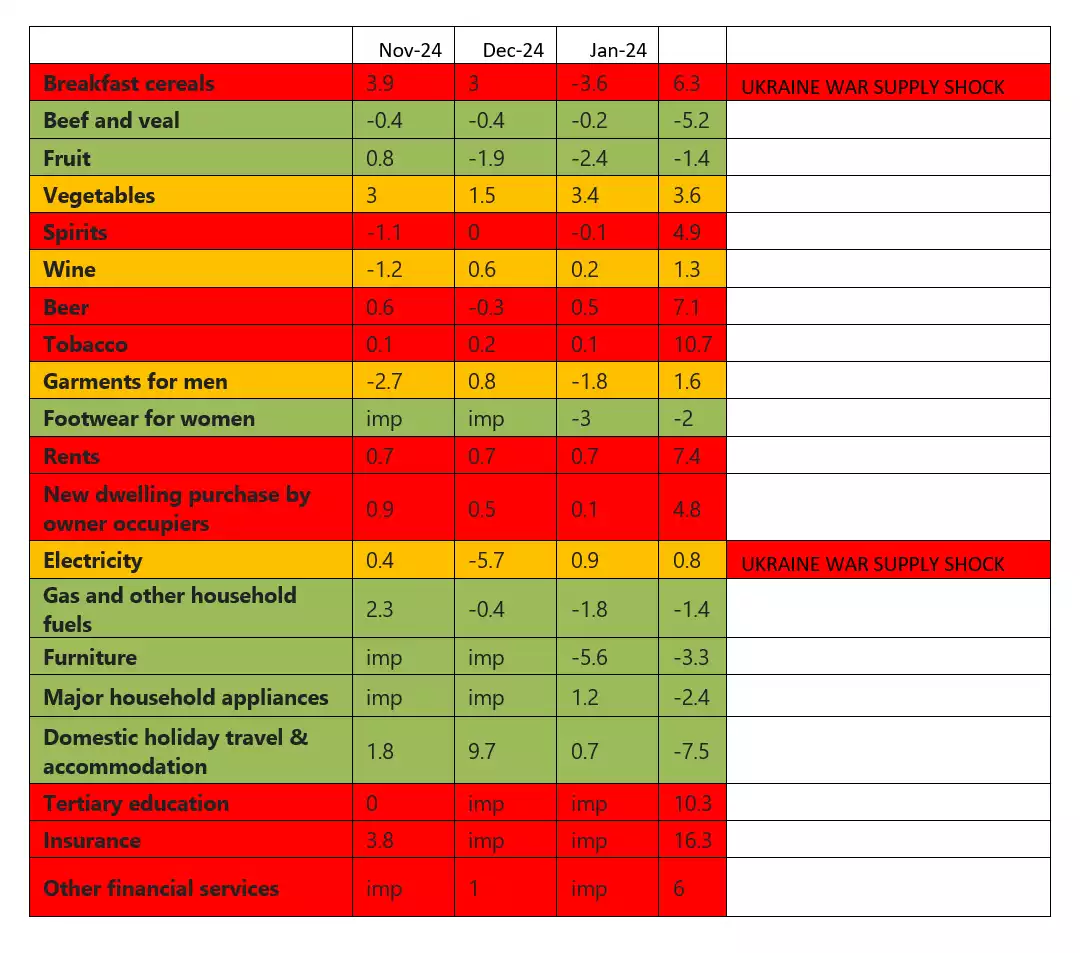

But now have a look at some of the other items – breakfast cereals and energy – they are dropping as the theory goes as they were supply push inflation (cereal and energy from the Ukraine war). And look at the Demand pull items from covid – for example garments, footwear and travel 1.6%, -2% and -7.5% running below current CPI – monetary policy has worked, but continuing to use it to control supply push inflation is now driving inflation into financial expenditure.

Where does this leave the world?

As the Reserve Currency of the world the U.S. has some responsibility and accountability, but due to the political environment they seemed to have forgotten their position. As the likes of Australia, Europe and the UK hold their interest rates too long into Supply shocks they will continue to anchor their economies – they will need to drop rates soon. But as the fiscally irresponsible U.S. continues to outspend, they will continue to create demand push inflation that will either need higher for longer or higher interest rates. Traditionally this would create a stronger USD – but with deficits running at $1.7 trillion more than expenditure of $7.3 triliion or 23% who will keep buying this debt?