‘Higher Longer’ – The New ‘Transitory Inflation’

News

|

Posted 22/08/2023

|

1786

As the world enters the 28th month of ‘transitory inflation’, it seems timely the new catch phrase from worldwide central banks is introduced - ‘Higher Longer’ – the new Central Bank Rhetoric. So as transitory is now referred to as sticky (ironically – their dictionary meanings are opposite), lets translate Higher Longer to what may end up being the exact opposite as Central Banks models continue to fail in their economic predictions with reactions creating more chaos.

In November 2021 Fed Chair Powel ditched the transitory inflation rhetoric (first seen in Central Bank notes in April 2021) ditching this tagline and opening the Fed to faster bond buying taper (QT) and 12 rate increases…. Here we are today with higher interest rates, higher house prices, higher government debt and a precarious world economy – where inflation in the US is being called sticky, disinflation in China is a recession and no one knows what the hell is going on in Japan because after 30 years of disinflation they now have 6% inflation and a Central Bank continuing yield curve control.

So lets investigate why Higher Longer doesn’t make sense

Will oil prices continue to rise?

Oil is being touted as the reason inflation will continue to rise – and it certainly seems that way with current bowser prices in Australia becoming a current dinner table topic. Looking back with the beginning of the Ukraine War energy prices spiked as the US sanctioned Russia, spiking oil and gas prices in Europe, with the world energy companies gouging and paralyzing the rest of the world including energy producer countries like Australia creating a huge inflationary shock. The US responded by pumping the US economy with cheap oil from its Strategic Petroleum Reserve, and lifting their internal production, Australia responded by sending (cheaper than Australian) gas overseas and 6 months later the world energy market was back in some sort of lower priced equilibrium that has only recently started to cause ructions of possible price inflation with continuous OPEC cuts. So why inflation in oil after a period of disinflation? Well, the SPR is emptying and OPEC just keeps cutting, in fact so low that current oil output is around that of 2009.

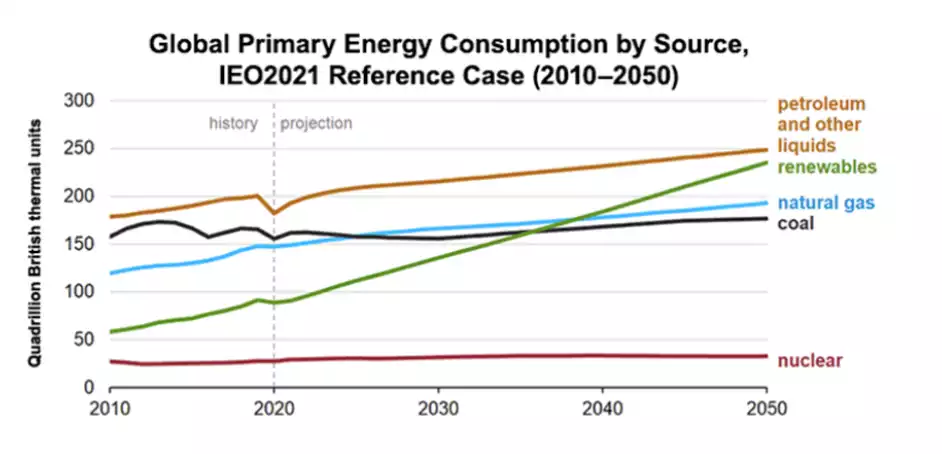

But the US is now producing record amounts of crude at 12 million barrels a day, China’s disinflation is putting downward pressure on oil demand, greater usage of public transport (as covid fear dissipates and oil pushes people back onto public transport), the potential for the end of the Ukraine war and finally renewables and nuclear maybe getting some ‘time in the sun’. So is it reasonable to see these prices rising much past the possible current fear of rising?

Higher Longer – US Debt

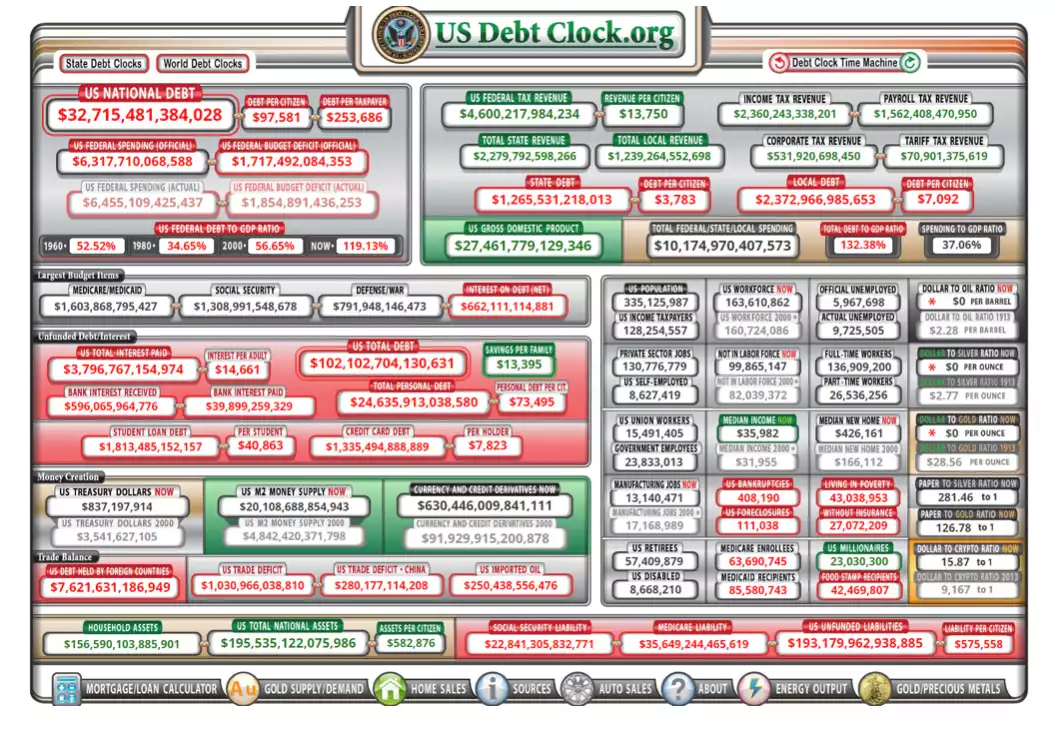

The debt clock – one of the most amazing websites to recheck on every couple of months hit a US National Debt of $32.7 trillion last night.

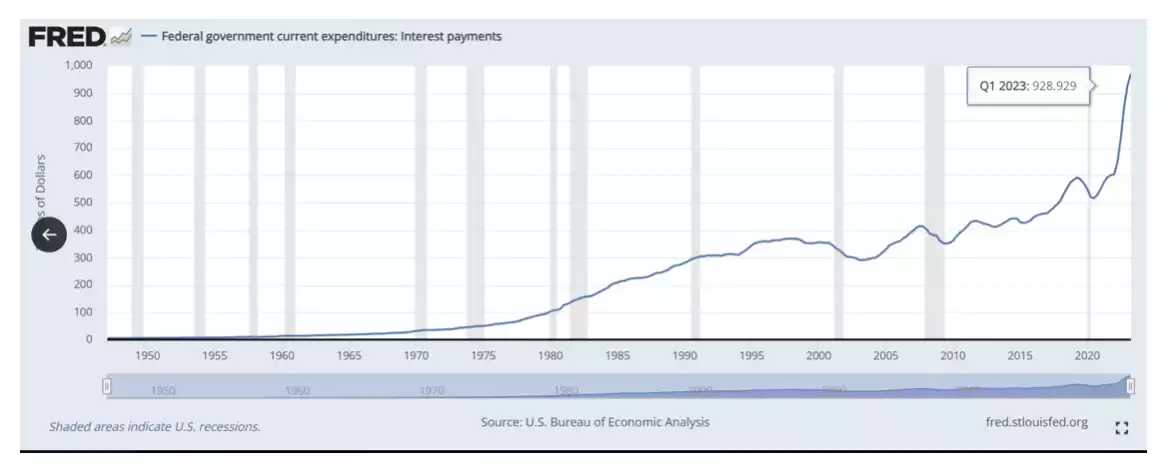

The shear scale and demand for US bonds and ever diminishing prices and ever greater returns, means the US who was previously paying $500billion in interest is now paying ever so close to $1 trillion. What you need to remember here though is the increase in interest is on new or replaced bonds which during the covid $6 trillion spend was at near 0%, new issuance on the current deficit is at 4.3% (a new overnight record as bonds continue to fall).

There’s much conjecture as to who’s buying these bonds – as China and Japan appear to be selling, the Federal Reserve is running off their balance sheet, leaving the rest of the world to do the heavy lifting on bigger and greater issuance. At some point this lack of demand stops dropping bond prices which in turn raises the interest rate the US government needs to pay for new bonds, but when? The US simply cannot afford greater and higher interest payments so something will have to give.

Labour Market Massaging

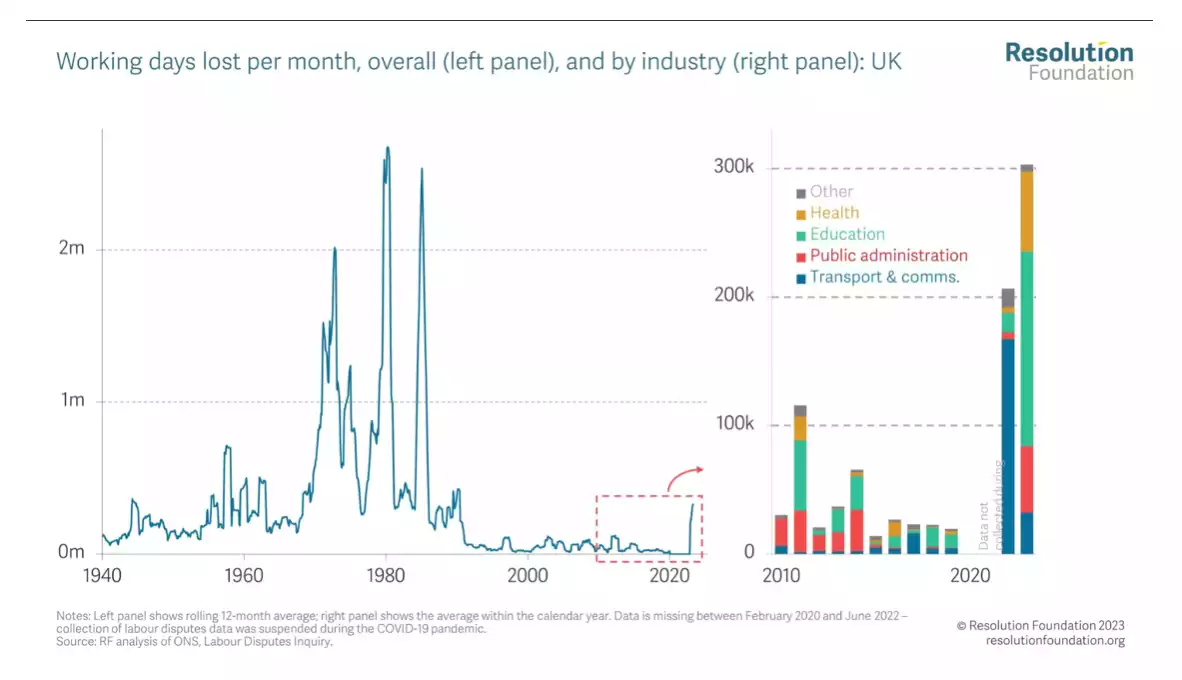

We have written recently about the current labour market and why unemployment is not what it is cracked up to be and is higher than what is being reported or structurally flawed. Whether it be hours worked, disability schemes hiding long term unemployed, dropping participation rates or record strike days in the UK labour is hard to fine – sure – but people are working less. If interest rates stay higher longer and savings continue to fall people will be forced back into the workforce fundamentally shifting unemployment.

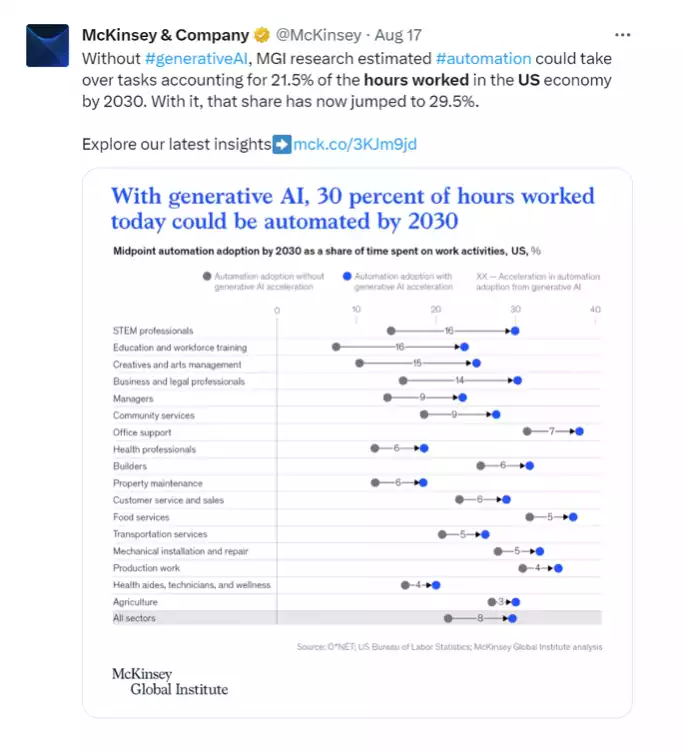

And if the labour market is as strong as everyone says into the future – why are the price of AI stocks such as Nvidia so high on PE multiples – if its not going to help automate office jobs, reduce labour and create unemployment? A recent McKinsey and Company estimate of the AI transition for the accounting automation for the US economy suggest 30% of hours worked could be reduced by AI by 2030 – so what will the unemployment rate do then and shouldn’t it have already started?

The Savings party is over

In Argentina we’ve been told everyone is going out like it’s the end of the world. Why? Because their inflation has hit 103% and they know their savings will be wiped out by inflation so they may as well go out and spend and have a good time. So now look at the US, in yesterdays Ainslie article And….its gone. US Consumer Nearly Broke | Ainslie Bullion we spoke about the $2.2 trillion in covid savings that is now -$91 billion. It’s gone – it appears the US knows how to party like the Argentinians – knowing their money is going to be worth less under greater inflation, they have spent and spent, there is nothing left to buy and no money to pay for it. This does not sound inflationary to me, it sounds a lot more in line with what both China and Germany are currently starting to report with PPI for both countries recently dropping to -4.4% for China and -6% for Germany – the party is over and people are not buying…..

Forget increased mortgages – what about decreased construction because of interest rates

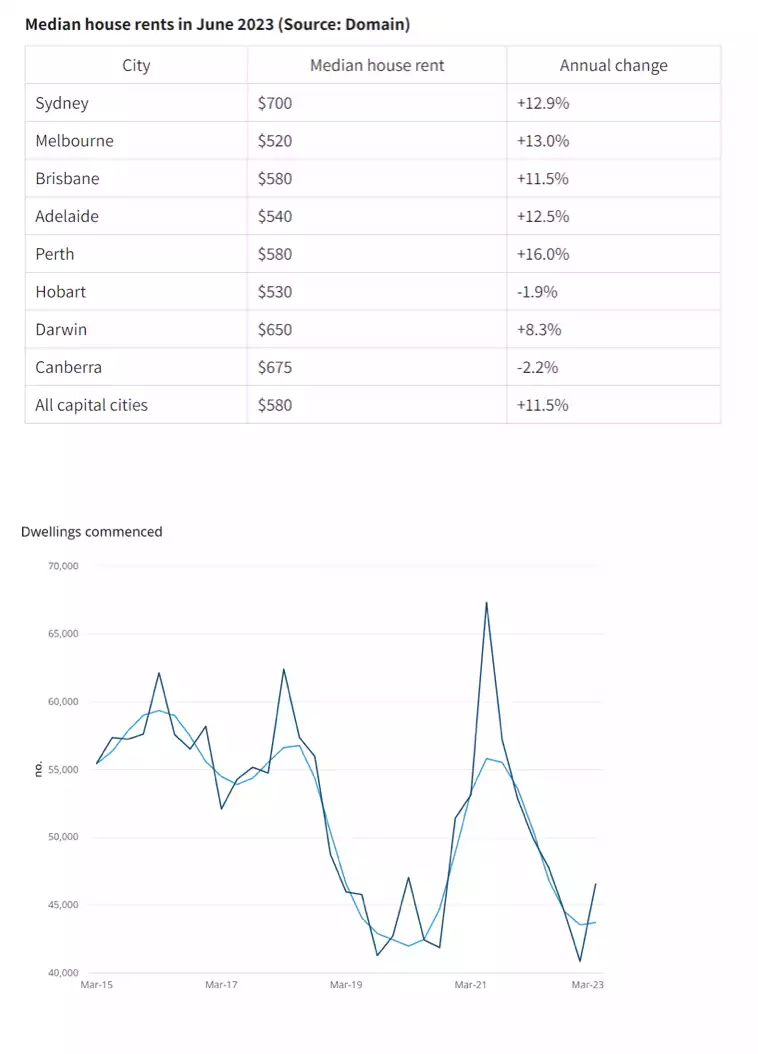

Despite multiple interest rate rises in both Australia and the US right now house shortages, increased mortgages and rental increases are biting consumers, and have been a major cause of inflation. But what do higher longer rates do to this market, and is higher longer the answer? Well higher longer is stalling housing approvals – look at Australia, despite rental increases of 12.9%, housing supply and construction continue to stall. Why? Because of the uncertainty in prices going forward and the cost to build. So as for the example in Australia, rents have gone up 11.5% in all capital cities in the last 12 months, dwellings commenced building continue to decline reaching a 10 year low in March despite record immigration. Higher returns with higher interest rates combined with higher uncertainty is not stimulating the housing market like Central Banks thought it should. Looking at the graph dwelling peak was in April 21 – right when that pesky ‘transitory’ word kept popping up.

HOW Higher Longer?

So when the central banks tell you higher longer or transitory - dig a little deeper – the transitory term was used against a backdrop of some of the largest Monetary (Trump) and Fiscal (Biden) stimulation the world economy had ever seen…. It was NEVER going to be transitory, throw a shock over the top (Ukraine war) and the world had an inflation timebomb that is still being unraveled. So now think about Higher Longer – unemployment is going up, housing prices are going up but because of interest rate hikes, oil may not be inflationary, the savings party is over and the US cannot afford higher longer interest rates – just one shock away from tipping the scale like when transitory became sticky.