Why THIS could be the start of the next gold bull run

News

|

Posted 30/10/2023

|

2903

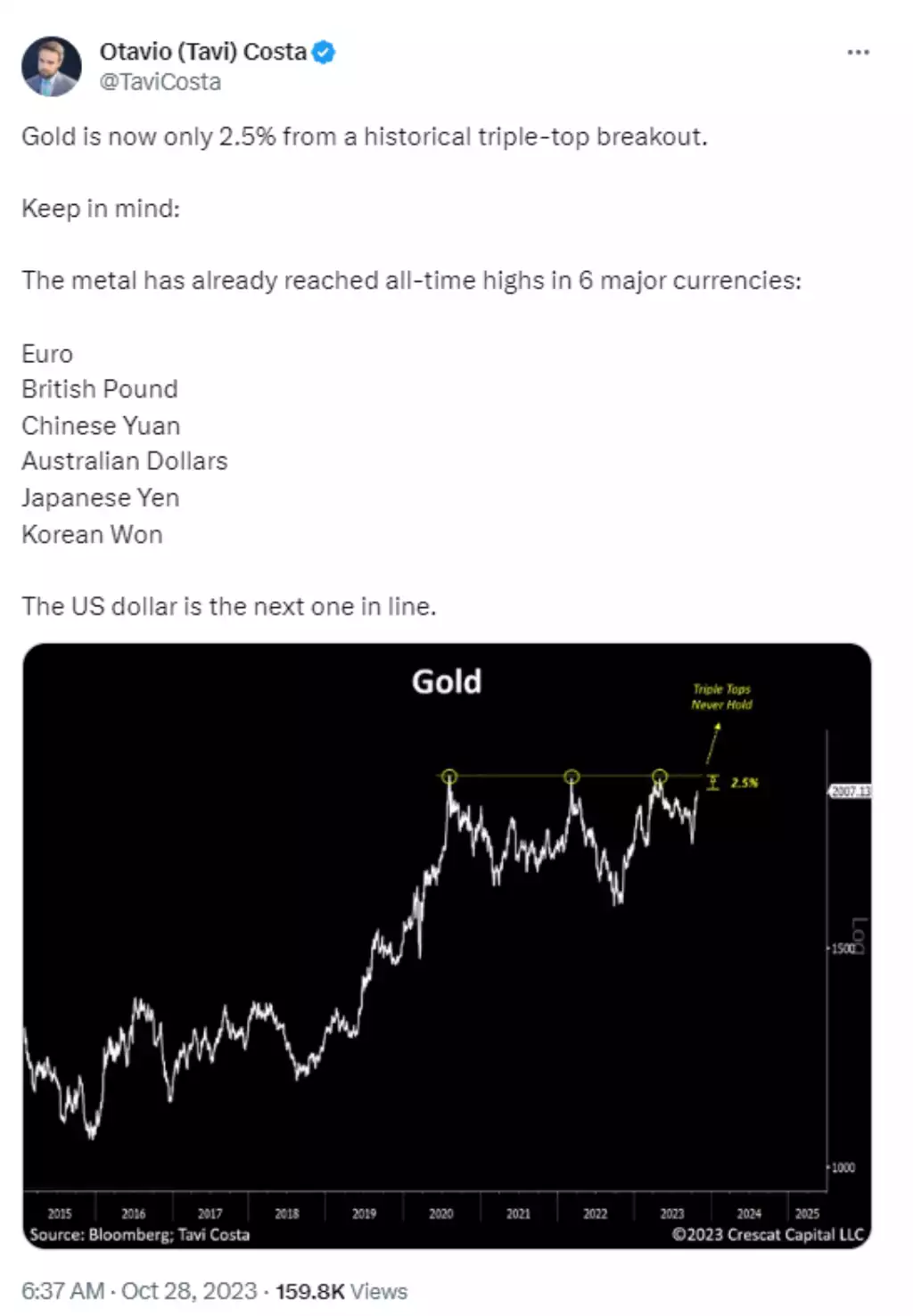

Gold burst through USD2000 again on Friday night and is now firmly in play to break through that ‘triple top’ resistance line that ‘never fails’…

It would be historically VERY rare if gold were not to break through that line convincingly after a triple top and start its next bull run. So lets look at why…

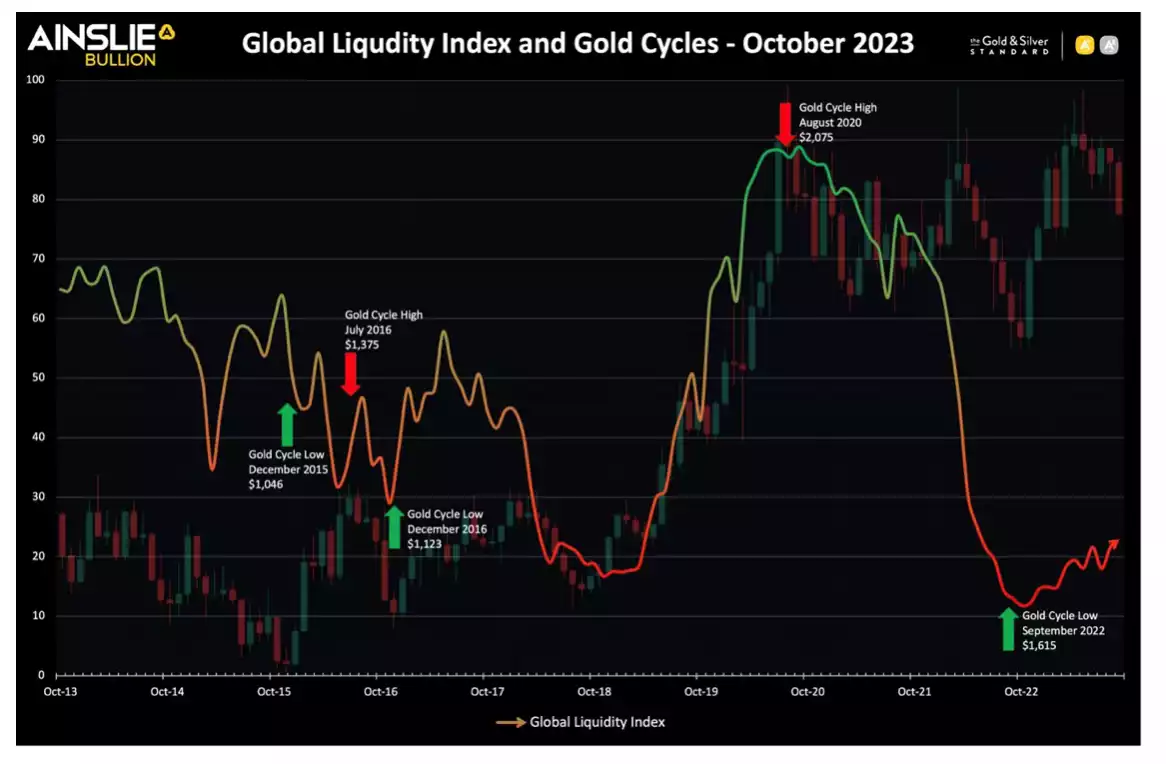

This aligns almost perfectly with our Global Liquidity Index (GLI) indictor. Our Chief Economist, Chris Tipper, explained this last week here and it’s a must watch if you missed it. Chris has overlaid the buy and sell signals this model (combined with technical chart signals and macro economic inputs) puts out. You can see we are still in play for the last buy signal when gold bottomed back in October last year. You can see the first ‘top’ above aligned perfectly with the top of the GLI in 2020 (below), then we had the unforeseen Ukraine/Inflation ‘top’ (above) against trend (below) in 2022, resumption of the decline to the bottom of the GLI, then the 3rd top earlier this year. The 3rd was just a blip in the clear resumption of expanded global liquidity and as we reported last week here, here and here.

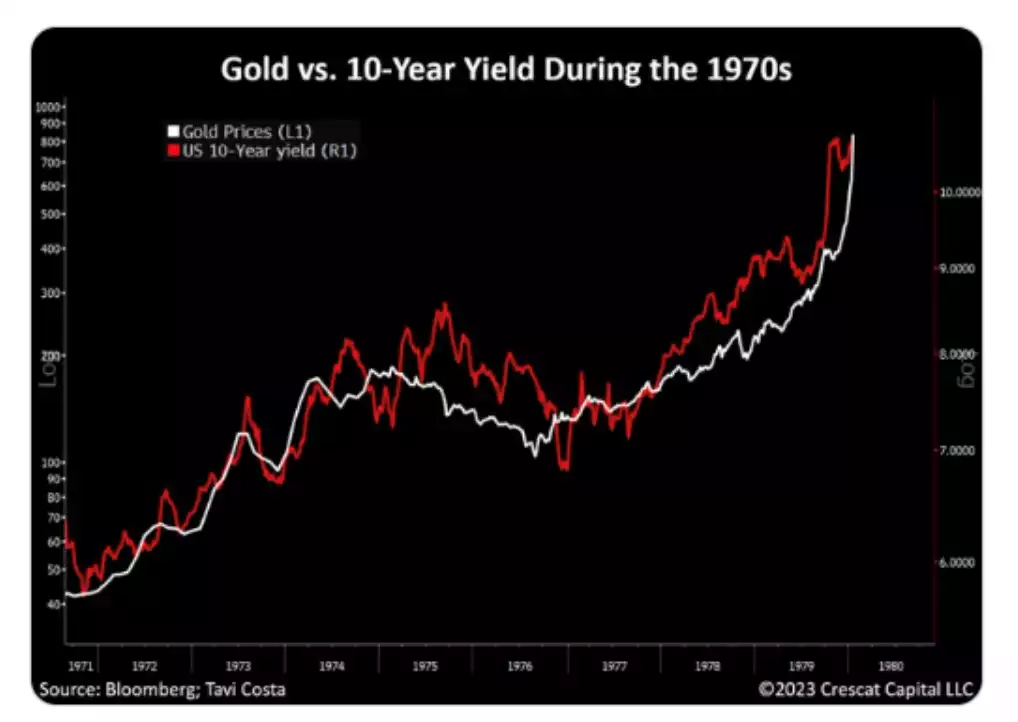

Part of what has been driving gold is that US Treasury bond market that has everyone scared. Gold normally doesn’t like high yields but when those high yields risk exploding the entire monetary system then gold grabs the bid. Just like in the 70’s below….

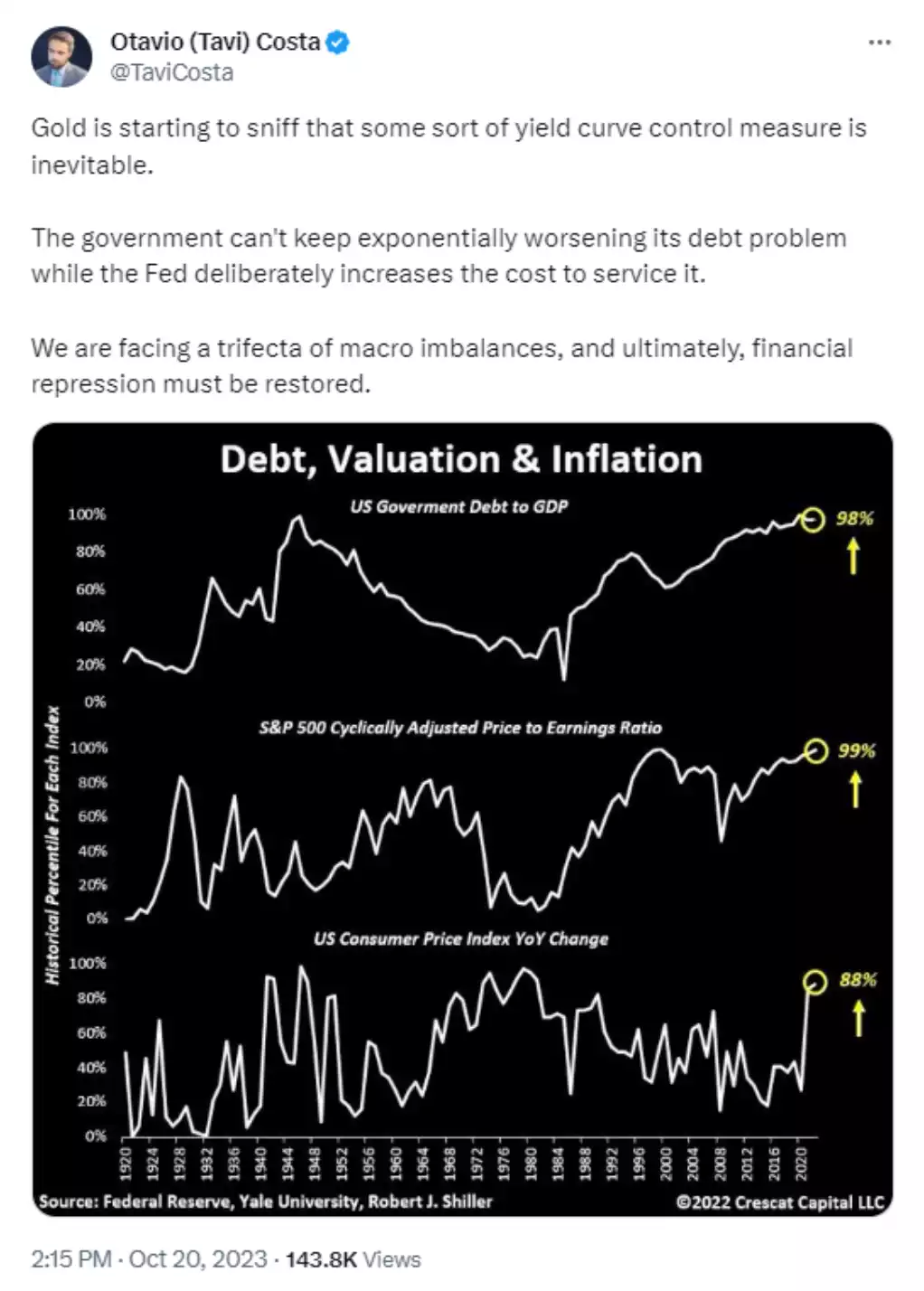

Gold KNOWS this is unsustainable and the Fed must intervene with Yield Curve Control and/or lowering rates and printing money, probably with a new name other than Quantitative Easing like Quantitative Support. Blah blah blah, its printers go brrrrr by any other name….

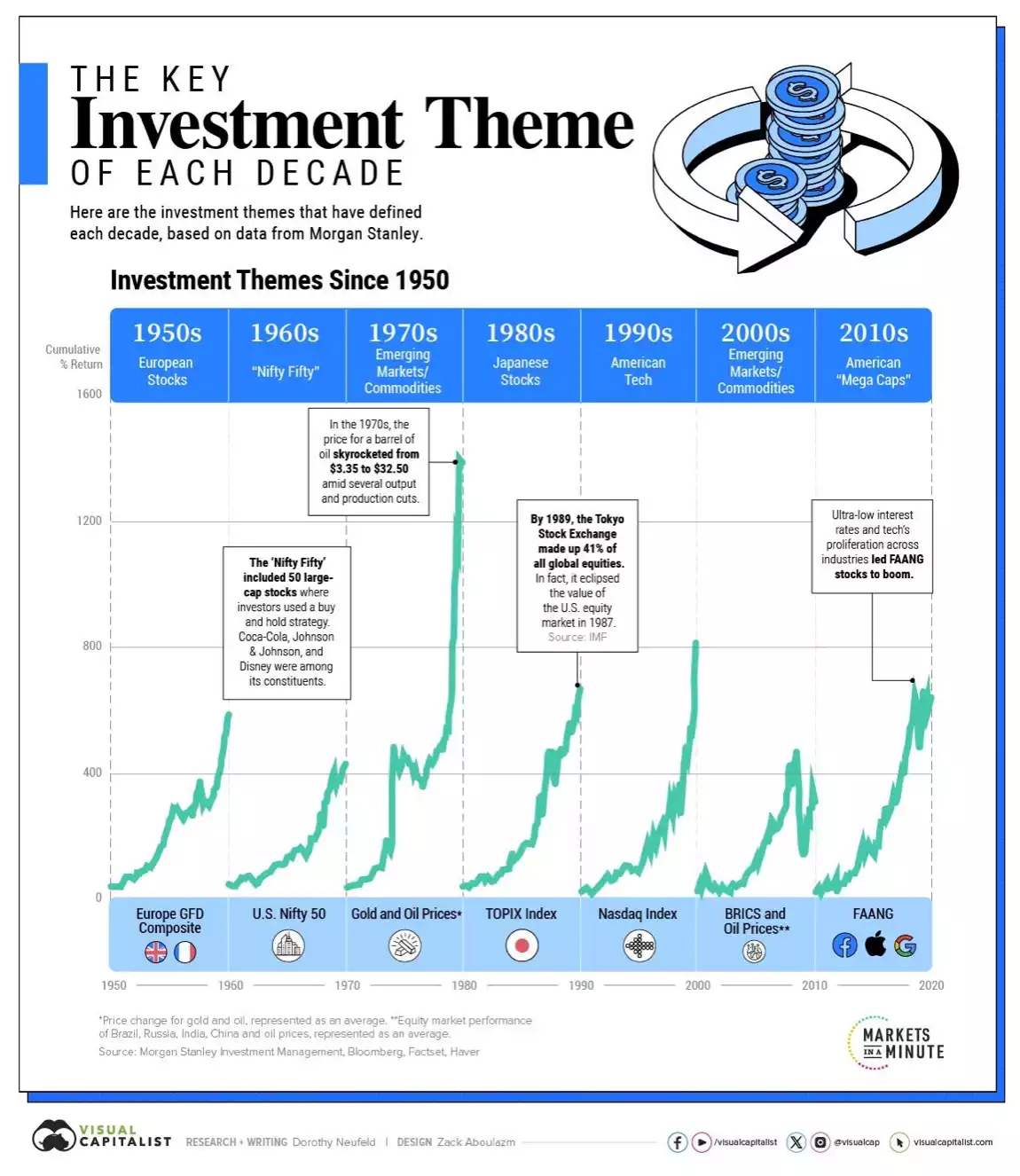

So what happens next? The infographic below shows the key investment themes for each of the last 7 decades. The 2020’s may well be the decade of reckoning; the decade where the 5 before it, since we left the gold standard in 1973, were fuelled by an unprecedented accumulation of debt, a debasement of the reserve (USD) currency at a staggering hubristic pace (mostly in just the last few years but en-masse since the GFC), and a temporary ‘debt jubilee’ by virtue of interest rates suppressed near zero since the GFC. That has all changed and all that debt is still there and is now facing stickier ‘higher for longer’ interest rates and bond yields. Something must give and give in a big, big way. The 2020’s may well be the decade (much like that biggest peak you can see below in the 1970’s) where real, hard assets prevail as the credit cycle fuelled synthetic assets of Fiat currencies and their sovereign bond debt instruments fail.