China’s Massive Economic Pivot That Will Shape Its (our) Future

News

|

Posted 25/10/2023

|

2694

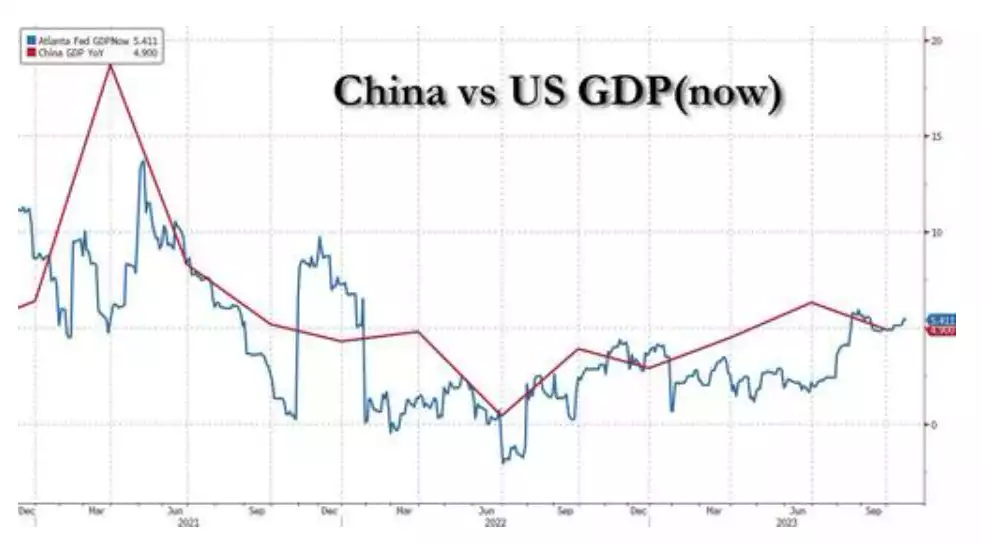

In a fiscal year when the United States have accumulated $2 trillion in debt despite apparently 'growing' GDP by a 5.4% pace, China has decided to shift their economic strategy. The nation has cast aside the guise of fiscal modesty and austerity, in a move motivated by the ongoing global superpower competition.

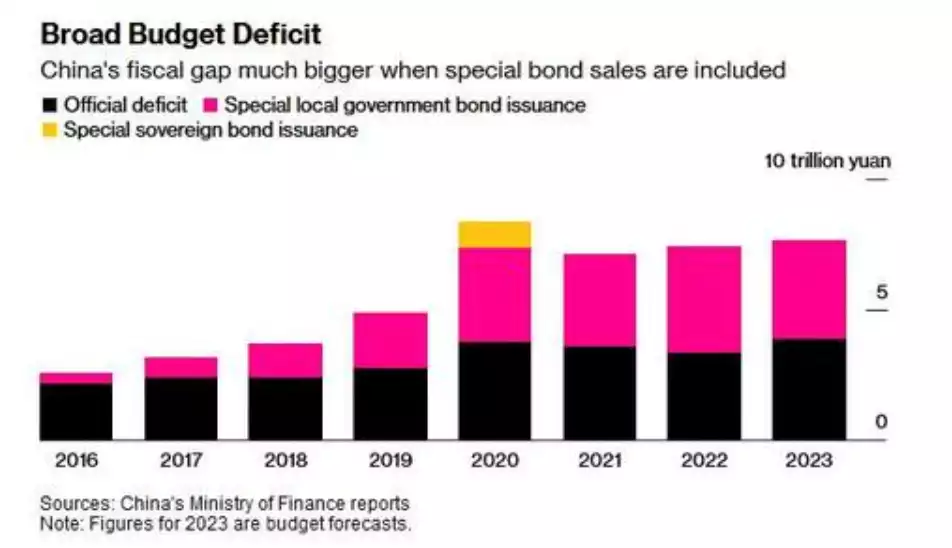

Today, China has taken a momentous step towards a robust fiscal stimulus. The country's legislative body announced plans to issue 1 trillion yuan, equivalent to $137 billion, in special treasury bonds during the fourth quarter. This initiative pushes the budgeted fiscal deficit rate for the year up to approximately 3.8%, a substantial departure from the 3% "limit" set by the government back in March.

"Relevant authorities should make preparations for the sovereign bond issuance and projects in an active and orderly manner to ensure every penny is managed and used appropriately,” said Zhao Leji, chairman of the Standing Committee.

Historically, China has rarely adjusted its budget mid-year, which makes this announcement so significant. The only exceptions were during major events like the 2008 Sichuan earthquake and the Asian financial crisis of the late 1990s.

While around 500 billion yuan is planned to be utilized within the year, and the remaining half trillion yuan will be used next year, this is just the start because once you start the fiscal stimulus route, you don't go back... especially when your youth unemployment is a record high 21%... and so high it is no longer being reported by Beijing.

“The additional fiscal support approved today is the intervention we had been expecting and that was needed to prevent an abrupt fiscal tightening in China in the closing weeks of the year,” said Mark Williams, chief Asia economist at Capital Economics Ltd..

Chinese policymakers had earlier considered raising this year's budget deficit and issuing additional sovereign debt as part of a push to meet the government's official growth target of approximately 5% for 2023. Despite stronger-than-expected data in the third quarter, the recent developments suggest some reservations. Challenges are expected to persist into 2024, stemming from ongoing issues in the property market and deflationary pressures. Economists anticipate a slowdown in growth to 4.5% next year.

Underlining the significance of these recent developments, President Xi Jinping of China, alongside other government officials, made visits to crucial financial institutions in Beijing, including the People's Bank of China and the State Administration of Foreign Exchange. Xi's visit underscores China's determination to revitalize the economy and stabilize markets.

Investors are closely monitoring Xi's actions for potential policy signals, especially as his visit to the foreign exchange regulator demonstrates a focus on understanding China's extensive currency reserves. These moves not only reflect the government's commitment to boosting economic growth and market stability, but also simultaneously weakening the stability of that of the US.

Critically too, this adds an enormous injection of liquidity into the all-important Global Liquidity Index we discussed last week that so clearly signals a bull market ahead for gold and bitcoin. Follow the money….