Why “But gold doesn’t yield!” Doesn’t Matter

News

|

Posted 09/04/2024

|

2669

Too often people who do the research and conclude it is time to buy gold or silver bullion are turned around by financial advisors who kill the idea on the basis that gold and silver ‘do not pay a yield or dividend’ and therefore aren’t ‘an investment’. Alternatively, gold and silver bullion are not on their AFSL ‘approved list’ and if you really want to buy it then how about an ETF?…. ASIC don’t necessarily like bullion as it sits outside their ‘system’ and hence rarely on an AFSL list (which ASIC must approve)… Lets look into this further….

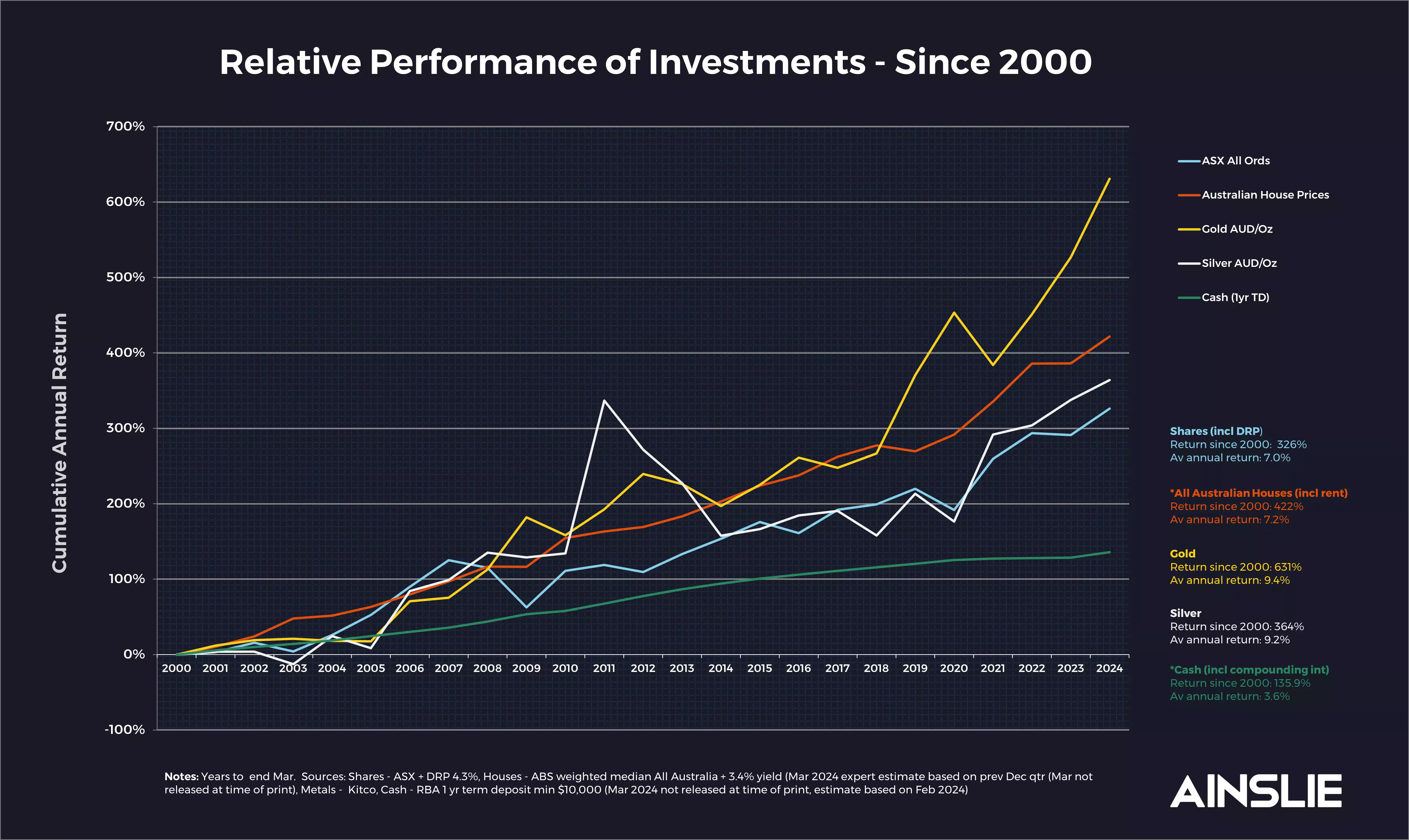

Firstly, absolutely correct, gold, silver and platinum for that matter do not pay a yield or dividend. You are relying solely on the capital gain for each. So let’s consider the chart below that shows the relative performance of gold, silver, Aussie houses, ASX200 (Aussie shares) and cash deposited into a 1 year term deposit since the turn of this century. HOWEVER, unlike other more disingenuous comparisons we are removing the ‘it doesn’t yield’ argument by including the yield / dividend / interest payments from those other assets in the returns. In other words, we are comparing apples with apples.

As you can see, gold is demonstrably outperforming every other major asset class in Australia. Unsurprisingly, given what we all know about Aussie property this century, it comes in 2nd (but remember that is not the case for your own home as you are not getting the rent this chart included). Silver has had a more volatile ride and is currently lagging gold with the Gold:Silver Ratio still up high in the mid 80’s. Read here and here for our recent looks at silver. Already in April silver is starting to outperform gold. Have a look at 2011 to see what happens when silver inevitably takes off. Next on the chart comes Aussies shares and then, predictably, cash on term deposit down the bottom.

The trap then is to think gold is now overpriced however as we discussed yesterday, it appears to just being in its early stages of the next secular bull market.

In short, gold and silver’s lack of yield is more than overcome by their capital gains and that of course also means no pesky tax on yields (with the above being pre tax) along the way!

The next hurdle of course is bullion not being on an ASIC approved list with your advisor. Ironically this is also one of its key benefits or appeal as it reinforces the nature of this asset as being outside ‘the system’, a system replete in counterparty and contagion risk. Gold and silver bullion are no-one’s liability. Period. Buying gold and silver through opaque, dubiously backed ETF’s introduces counterparty risk when none is needed to simply and securely trade and hold the asset. You also have around 0.4% loss of asset each year in fees taken from your holdings in ETFs.

You can secure your bullion in your own safe inside one of our sister vaults (Reserve Vault and The Melbourne Vault) for around that cost and YOU HOLD THE KEY. We even deliver to the vaults and buy back from them directly to make it even easier and more secure. There is nothing stopping you doing all of this directly and very easily if your advisor (who can) doesn’t allow it. We have many advisors with their client’s best interests at heart simply have their clients sign an agreement to allow them to do it still through them. It’s that easy.

Gold and silver bullion are unparalleled for divisibly liquid, uncorrelated, stores of value with no counterparty risk in a world of unprecedented currency debasement and highly correlated, interconnected financial assets.

The chart is the ultimate ‘look at the scoreboard’ test and the game is just in the first quarter…