The $26 Silver Hurdle

News

|

Posted 03/04/2024

|

4393

What’s $26? Well it’s a big hurdle that silver bugs have been waiting for! This overhead level has only been breached briefly (twice) during 2022. It previously sat above this level through the COVID-19 pandemic precious metals boom, otherwise it has not been seen since 2013, when the price of silver briefly scaled $49/oz, just shy of the elusive $50 target…

#silversqueeze

A quick search of the internet reveals that traders are talking about a 40 year cup and handle break out, and an upside down head and shoulder pattern. The excitement around the metal as it lags gold in its all time high is starting to take hold. Possibly more important, however, is the hype currently surrounding that long forgotten #silversqueeze, trending today both in Australia, the U.S. and the UK.

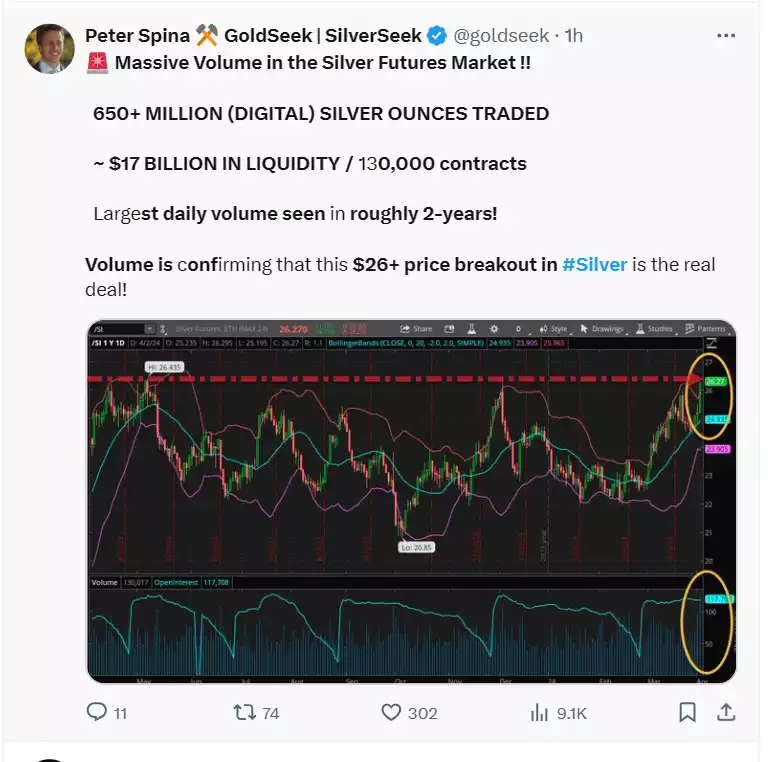

Record Trading

If there’s any doubt of this break out – last night saw 130,000 contracts traded, the largest daily volume in 2 years. This added $17 billion in liquidity into the market…

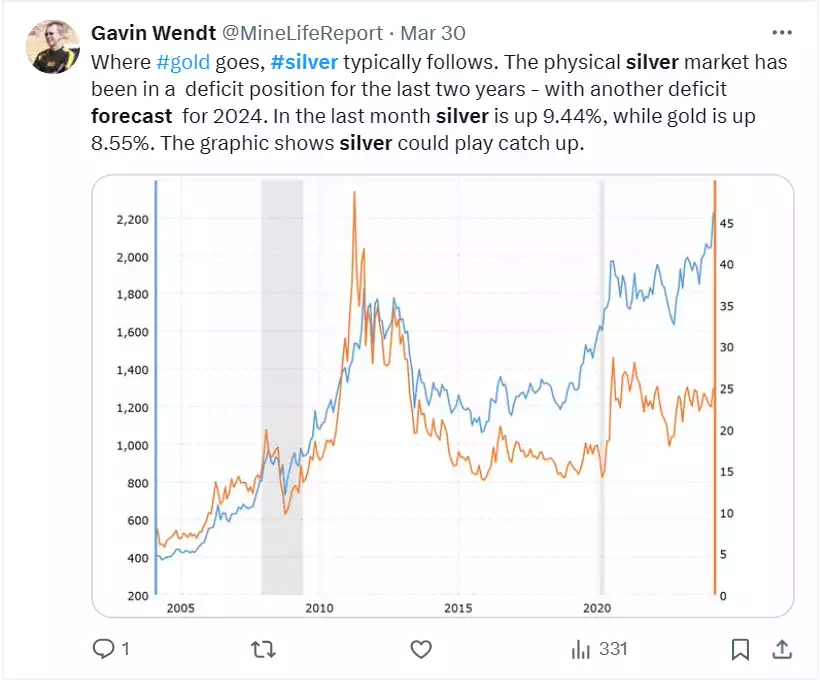

Gold All Time High Catch-up

Silver serves a dual purpose as both a precious metal and an industrial metal. Traditionally silver is perceived more as a precious metal during economic turmoil, where it becomes a hedge against uncertainty, like its big brother gold. During these periods silver often outperforms gold, like in 2011, where silver reached $49/oz. During this time gold was relatively underperforming, reaching around $1800/oz. Fast-forward to 2024 – gold scaled another new all time high yesterday at $2288/oz and silver finally returned to the $26/oz price point.

So then the question becomes “are we or aren’t we in a period of economic turmoil?” All of the latest data coming out of the U.S. suggests we are not, while the rest of the world suggests we are…

So what could happen if the world wakes up to the recession/depression we are in, or at least facing? Based on the 2011 gold/silver ratio, silver’s potential price would be at $63/oz right now.

4 Years of Deficits

Silver output continues to undersupply the market. 2024 is expected to see a demand of around 1.2 billion ounces compared to mining and recycling supplying only 1 billion ounces. The Silver Institute put out their demand and price forecast in January 2024 Global Silver Demand Forecasted to Rise to 1.2 Billion Ounces in 2024 | (silverinstitute.org), outlining subdued investor demand in early 2024. If #silversqueeze takes hold investor demand is likely to outperform this forecast, leading to further shortages.

So with the US$26 hurdle breached, how long will it be until silver reaches $30, $40 and the elusive $50 all time high? Our thoughts as always: stack at least some silver!