Ugly Chart. U.S. Dollar's Worst Month?

News

|

Posted 01/12/2023

|

2207

The U.S. Dollar index has suffered an almost 3% slide this month, recovering only in the last day on the back of potential profit taking and recent comments by central bankers. A look at the chart reveals an ugly, more than one month fall and no major support level nearby.

Investors last month continued to disregard inflation and jobless claims while anticipating an interest rate cut in the first half of next year. This means that they expect the dollar to weaken, as it has, and stocks and gold to rise. It is clear on the Gold/USD chart that gold has come very close to retesting its major ceiling for the fourth time.

Contrasting this, we have just had an army of bankers come out with surprisingly hawkish comments. Williams, President of the New York Fed, made some repeat statements about being data-dependent and the future being uncertain. Then, he dropped an aggressive comment by stating "if price pressures and imbalances persist more than I expect, additional policy firming may be needed." This bats back the narrative that Fed Governor Chris Waller created just a day earlier.

Mary Daly, San Francisco Fed President, has maintained her tough stance and stated that she is not thinking about rate cuts at all right now. She also mentioned that fears of a recession have faded away, which seems like an attempt to invalidate a need for a pivot.

The US central bankers are not alone. The Bank of England's Megan Greene has come out stating that there is inflation persistence in the labour market and that she is more worried about inflation persistence in general. This creates a very mixed message in the UK, as the economy shows signs of weakness.

The ECB's Nagel was the harshest and said that he may favour higher rates. He stated that the ECB is not satisfied yet in terms of inflation goals and that they are still significantly above the 2% target.

In terms of central bankers, there is still more to come. Saturday at 3:00AM, Powell will be speaking. Though potentially outdoing Powell, the Fed's Lisa Cook will be the final speaker at 6:00AM.

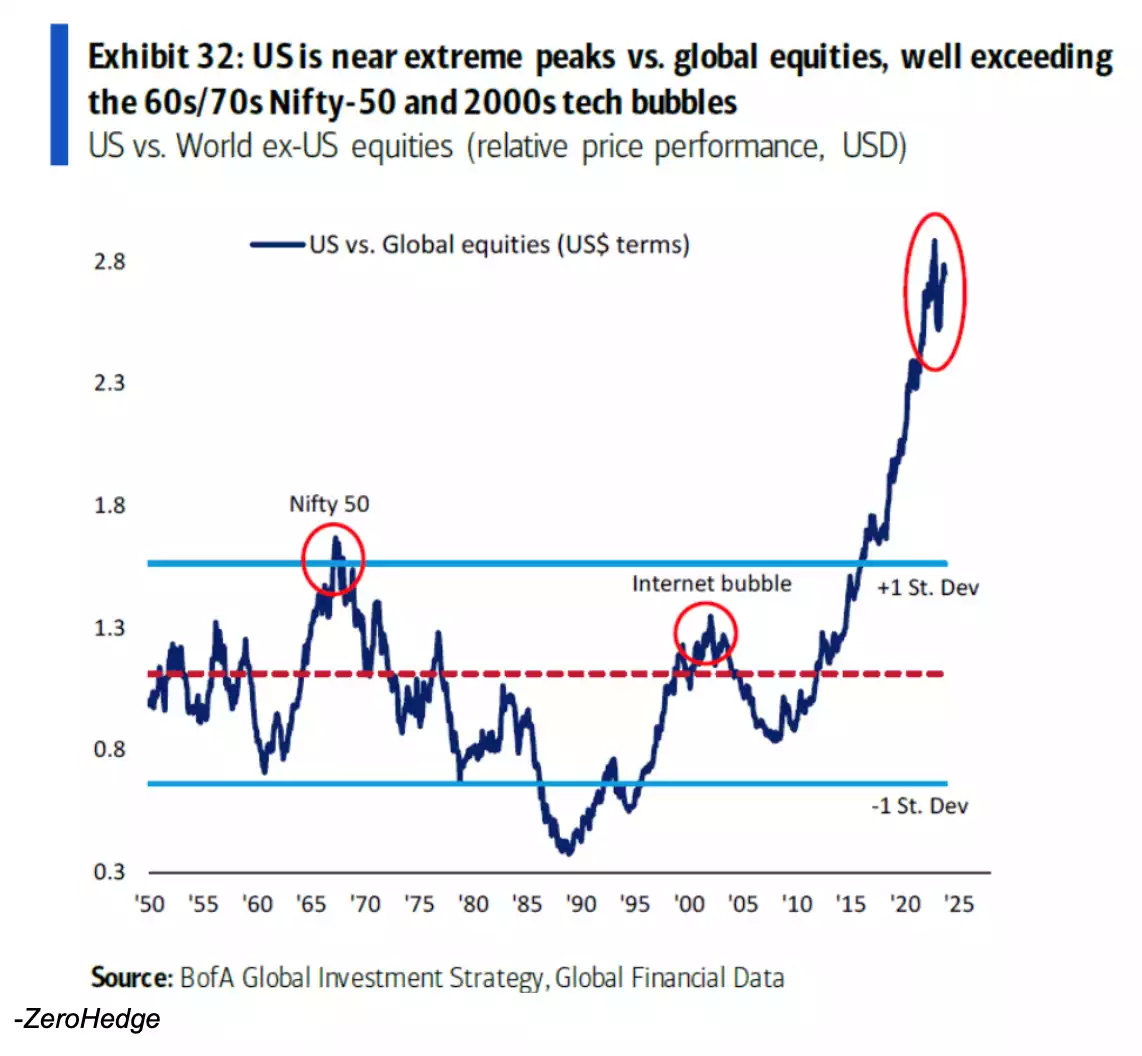

Are these speakers misguided by trying to hold rates higher? Perhaps investors are correct and they are simply bluffing. They will pivot on a dime and keep the indices rising, avoiding any recession. Or, are the central bankers seeing a big bubble that needs to be popped?

If the chart above is anything to go by, we could be in for a very interesting "landing" in the near future. This aligns with a note written last week from Bank of America’s chief strategist to his high-profile clients, that BOA’s Bull and Bear indicator has left the “buy” area and now appears as “neutral”. He backed this up with an array of problems:

- Tighter credit

- A rise in delinquencies

- Increased defaults

- Rising unemployment

- And, a higher risk of a hard-landing

The central bankers are stuck between a rock and a hard landing. The Global Liquidity Index (again if you missed last Friday’s monthly update it is a must read/watch) and the bond market this week are very clearly telling a story of coming easing. That, for the custodians of inflation and employment control, is too soon. All they have left is jaw boning the market with scary words. The Aussie dollar has taken some shine off the AUD gains in gold and silver this week as it has risen off the falling USD hitting a 66c handle as we write. However as we reported Tuesday, the ‘lucky country’ is looking very ordinary indeed and such relative strength may be short lived…