The Technical Not Recession

News

|

Posted 28/11/2023

|

2533

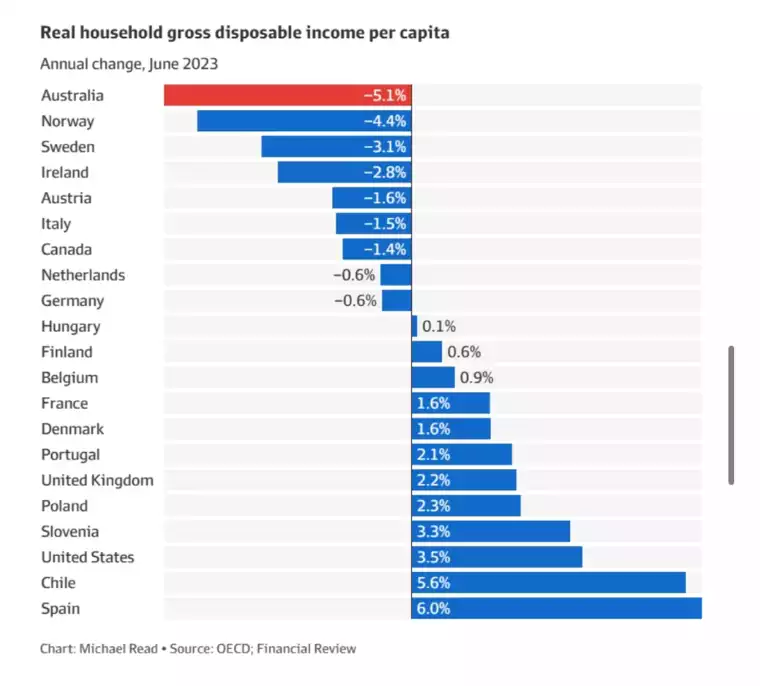

Multiple articles have come out this week about the Australian GDP recession, and the ‘three economic records that were broken in November this year; Real Household disposable income plunged the fastest ever recorded at 5.1% Year on Year; Bloomberg ranking Australia with the lowest rental availability amongst developed countries; Finally the Economist ranked us number 1 for ‘entrenched inflation’. Telling an Australian right now the economy is on track to grow and we are not in a recession and they will not believe you. Because Australia is not in a recession but an Australian is in a recession. With sky high migration holding wage growth down, while also creating inflation due to a scarcity.

Number Manipulation – What’s a recession?

Australian governments have shown a penchant, like their developed counterparts, to manipulate the numbers in order to avoid at all costs the ‘recession or depression’ economic milestone. A recession is ‘a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters’ the key here is GDP, not GDP per capita. By adding migrants, GDP per capita can and is going backwards in Australia, without entering a recession.

But as everyone in Australia right now knows – the economy by no means feels like its booming, high energy costs, high rent and housing costs and low wage growth. In fact the one thing holding inflation down is the dropping prices of fresh food, which impact our farmers incomes, but as we enter another ‘El Nina’ event, the reason Australian food, and especially meat prices are down is because farmers are selling as they enter a drought. Over the next year or two with a scarcity of feedstock and livestock this trend is likely to reverse and food inflation will rise.

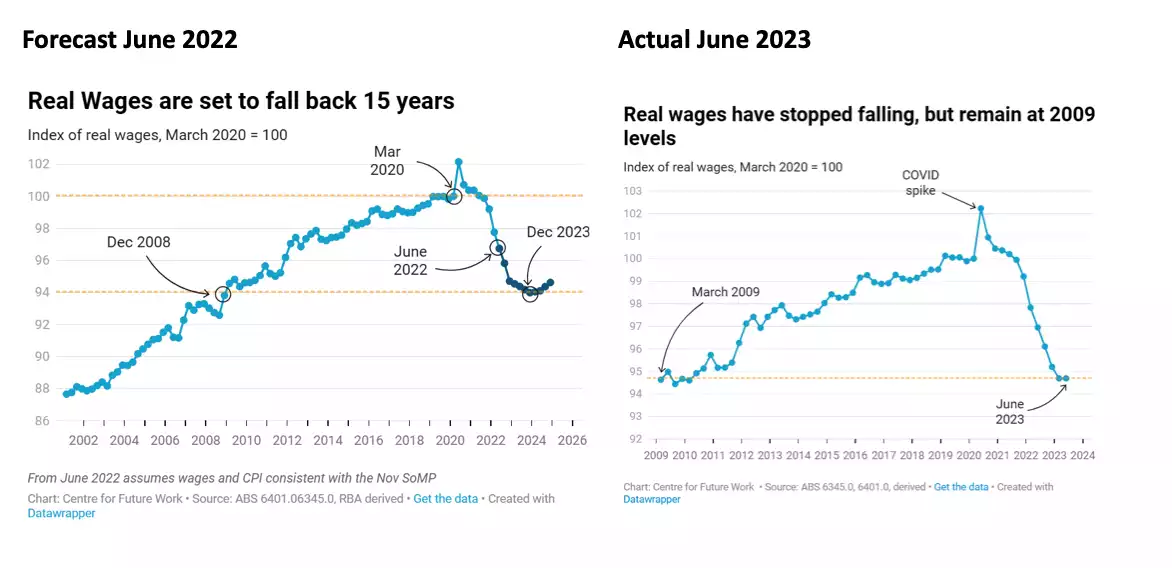

The GDP per capita recession, can be seen in real wages (wage rise less inflation) which have been dropping since April 2020 and now look to revert to 2008 levels wiping out 15 years of growth in 2 years. In June 2022, the RBA rather accurately forewarned the Australian government real wages were declining and looking at actual compared to their forecast this one they got right. And yet despite this forecasting or rather cry for help the Australian government continued with record 2022/2023 migration levels.

Interestingly and in line with some worldwide trends, where data is not reported or revised when it adversely effects public opinion of government (look no further than China’s youth unemployment and America’s consistent downwardly revised job numbers), it appears the last migration report was published in 2019-2020, and has seemingly ceased!?

Migration that has wrecked the Australian economy

Economist Gerard Minack last week came out with a scathing analysis of the Australian economy, and how 20 years of migration has wrecked productivity growth and reduced Australian living standards. He stated the following;

‘Australia’s economic performance in the decade before the pandemic was, on many measures, the worst in 60 years’

The main reason he claims was the ‘giant capital-to-labour switch’ meaning rather than investing in businesses for efficiency and growth, companies just threw labour at the problems and in doing so reduced its innovation. The policy of high migration has led to Australia recording the worst decline in real per capita household disposable income, – 5.1%, in the world.

The problem with high migration is, the smarter countries with lower migration needed to invest and innovate to keep up, have already made these investments in a low-rate environment. The problem Australia now has is we have higher rates and therefore higher costs of capital making it harder to compete going forward. Hence the flood of immigrants, you may view it as the last hoorah of a ponzi scheme, throwing more and more resources at something as the gig becomes harder and harder to keep up with. Look no further than the US deficit as a similar collapsing ponzi scheme.

We’d also add to the argument that the ponzi migration scheme took capital and investment way from businesses and those entrepreneurs who may have wanted to make something instead went into property and development, taking more capital out of the productive economy and more importantly entrepreneurs away from business as property was a faster way to make money.

Entrenched Inflation – Property to blame?

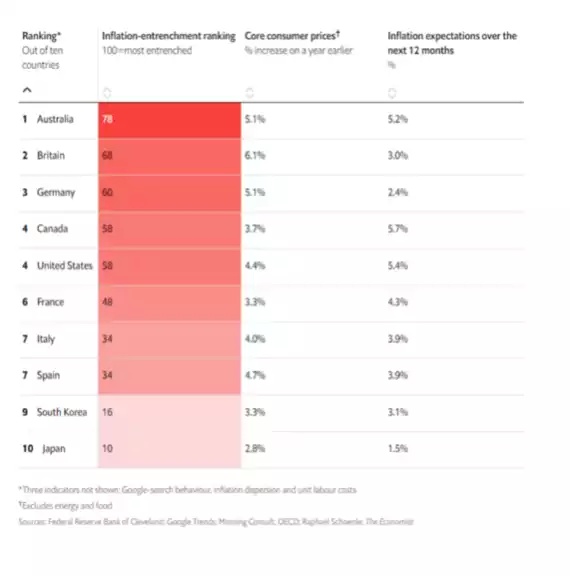

This property ponzi scheme maybe one of the main reasons that ‘The Economists’ magazine this month ranked Australia as number 1 for entrenched inflation.

With record inflation particularly in household rents and costs, entrenched inflation is setting in. Bloomberg recently published an article on rental availability among western countries, and Australia once again wins for the lowest rental vacancy at 0.9%. With the Australian migration ponzi scheme coming to its crescendo of 600,000 migrants last year, as previously discussed there is just not enough housing stock currently or in the pipeline which will further heat housing inflation. The Albanese government has grand ambition for thousands of houses to house these migrants, however there is no buy in from state governments who need to produce as there simply is not enough ability to produce. With entrenched inflation our one-hand-tied-behind-the-bank Central Bank will have no choice but to continue to raise interest rates again increasing housing costs whilst the migration scheme increases housing prices.

The Decline will Continue

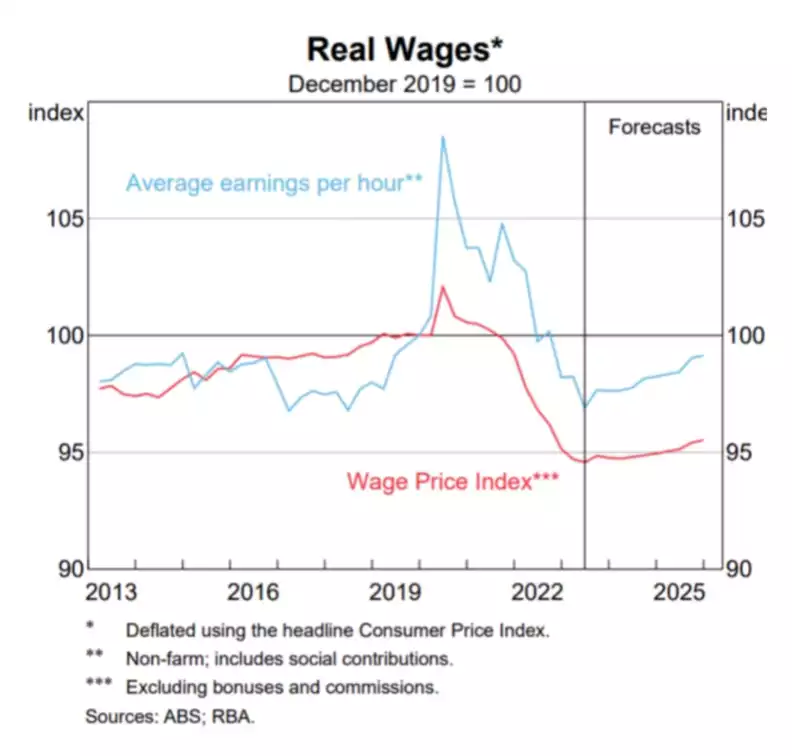

The RBA has recently come out with a new Real Wage forecast and one the government should probably pay attention to, with the forecast showing a prolonged decline in real wages and therefore standard of living.

If the government was serious about strengthening the Australian economy, it should be looking to strengthen and support businesses to create productive jobs, whilst tempering migration to allow infrastructure and housing to catch up. But that would mean a Real Recession and no government in the last 20 years has allowed that to happen.

So as real wages decrease, look to inflation hedges like gold to help maintain some standard of living because all ponzi schemes unravel in the end…