U.S. Inflation Hotter – Rate Cuts Pushed – Dimon says “most predictable crisis”

News

|

Posted 14/02/2024

|

2065

Last night was a big night on Wall Street (with global contagion) as U.S. inflation figures came in considerably hotter than expected and the Goldilocks soft landing and interest rate cuts narrative took a big hit.

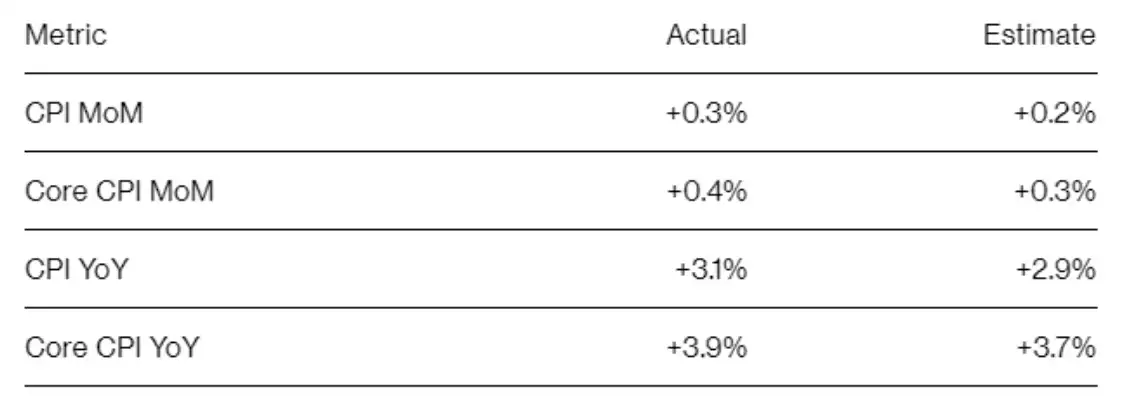

U.S. CPI figures released early last night were higher across the board than expectations. From Bloomberg:

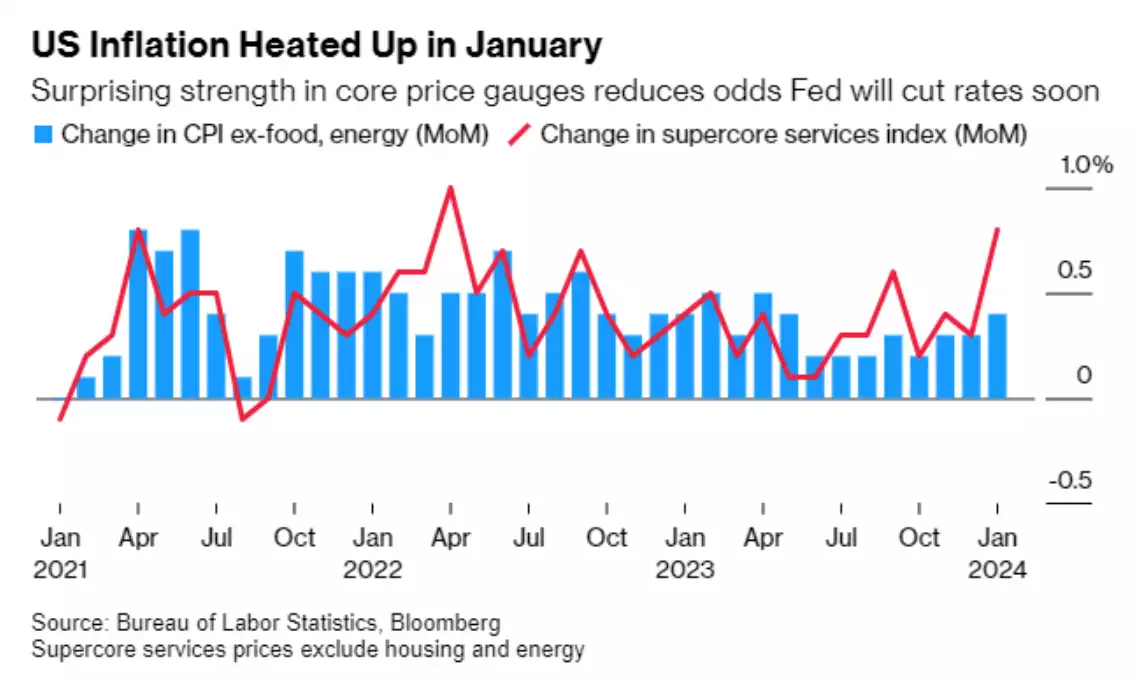

With historical context the market’s reaction make more sense:

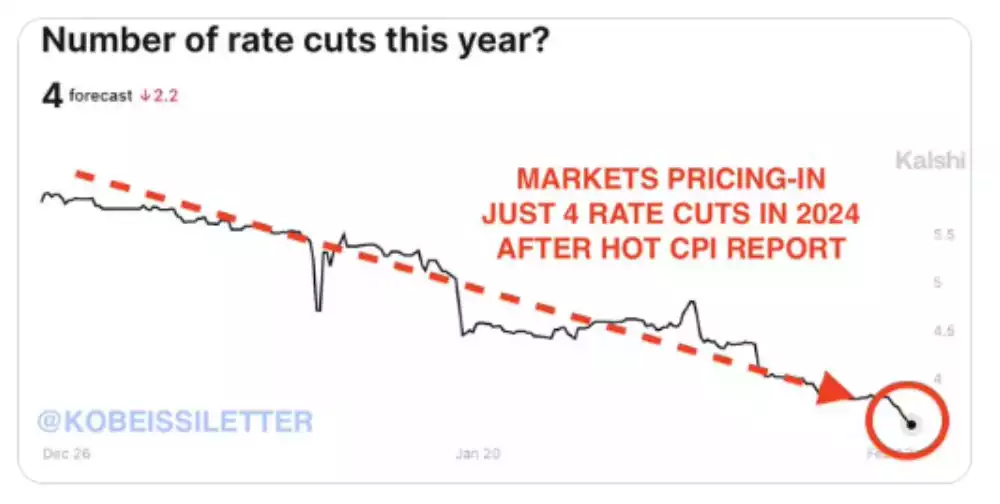

FFor a market largely convinced the Fed were on tracking to cut rates by a total of 175bps this year, and a May first cut fully priced in, it was a major blow. Expectations dropped by literally half and the first rate cut pushed right out. That then of course saw a sharp reaction on sharemarkets across the board with the S&P500 down 1.4% after recovering somewhat, NASDAQ down 1.8% and Dow down 1.4%. Small caps were particularly hit with the Russell 2000 down 4%. Predictably bonds also tanked (taking 10yr Treasury yields up to 4.3%!) and the USD strengthened 0.6% pushing gold back down 1.3% and below 2000 albeit the lockstep fall in AUD saw little change in AUD gold. The VIX volatility index surged to 18. Globally the MSCI was down 1.2% too.

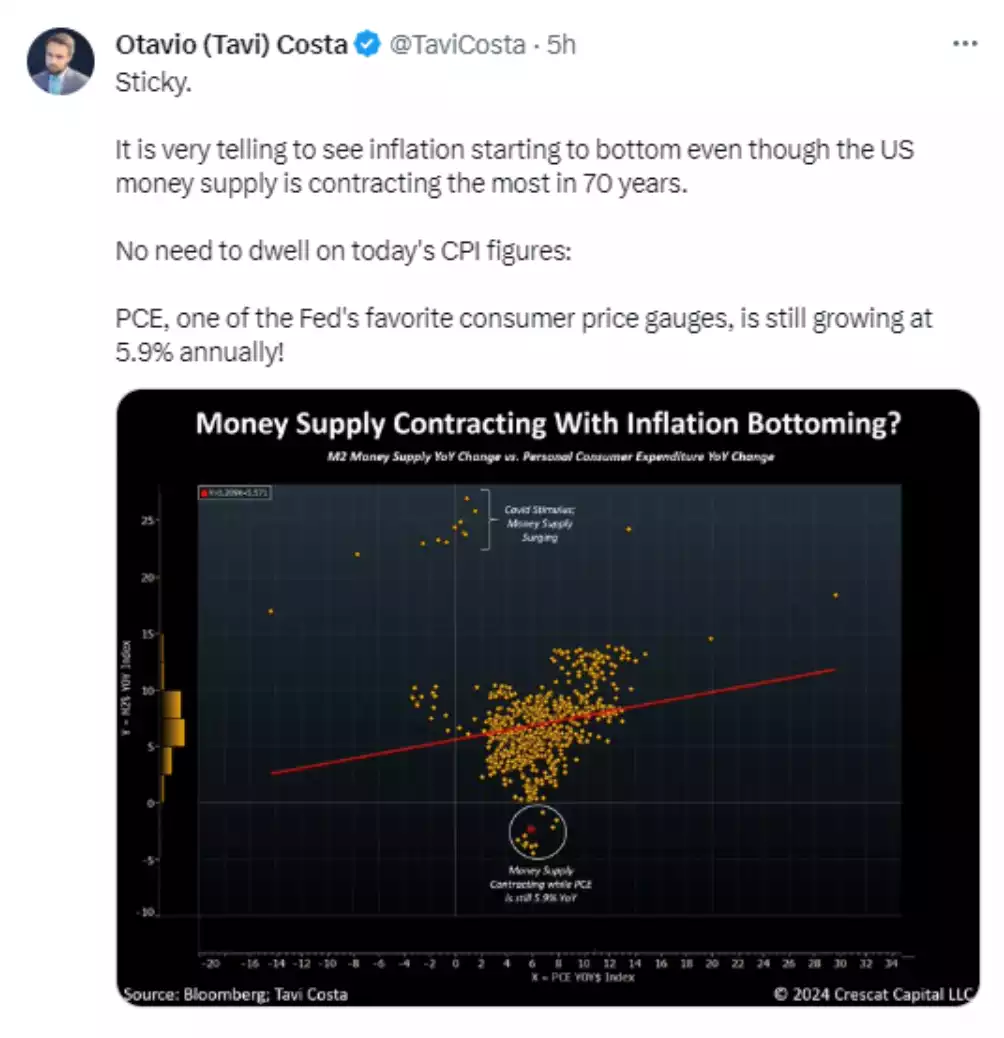

Despite the market’s sharp reaction, many still believe this is a ‘blip’ in the road to lower inflation and so ALL eyes will be on next month’s print. There is considerable difference in opinion in the market still. Many believe the sheer amount of ‘money’ injected into the system means inflation will remain sticker than others predict. Crescat’s Tavi Costa is one of the former and posted this after the print last night:

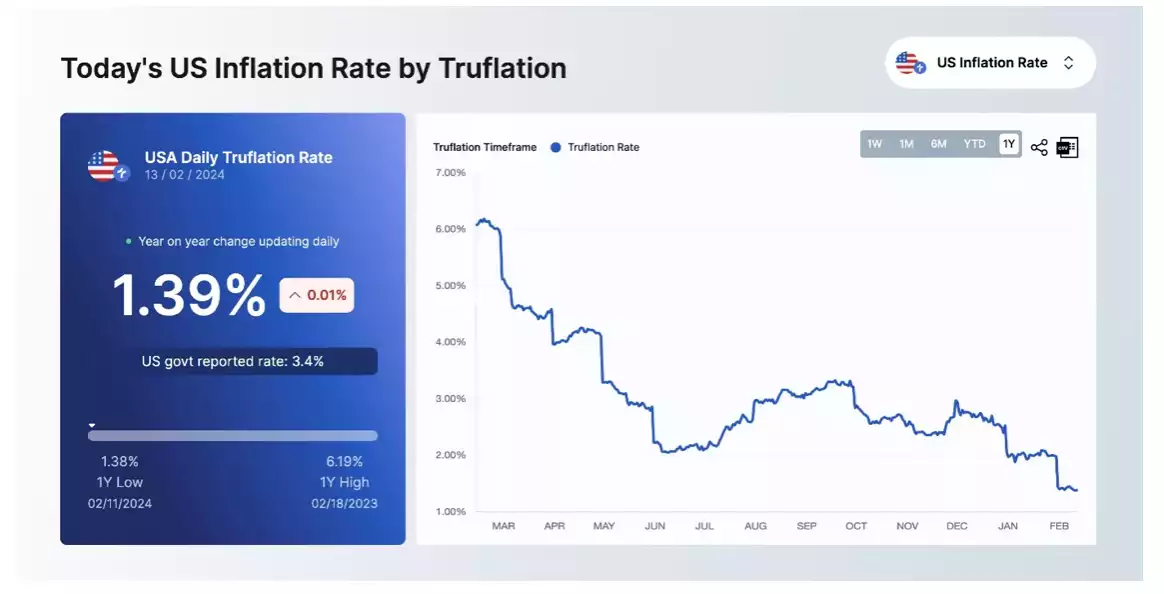

It is worth considering too that there is a growing distrust of the Government CPI figures and more people looking at the Truflation print which, whilst showing early signs of bottoming, is sitting at only 1.39%.

So how does this fit with our monthly Global Liquidity Index analysis you ask? There is a big difference between global liquidity and U.S. Fed fund rates. At the time that the Fed are (very understandably) holding out as long as possible on cutting rates (so, topically, not to fuel inflation before ‘finishing the job’), they are injecting cash into the system via other less transparent means, and you have China (massively), Japan and others stimulating their markets with new liquidity. Looking at the U.S. Fed funds rate and M2 (simple money supply, like Mr Costa) is not global liquidity as you can see in the above link.

Simply saying too that “high inflation should be good for gold so why did gold go down?” misses the point too. Gold is principally a monetary inflation hedge, not a Main Street inflation hedge. So whilst the market can gyrate on CPI prints, they are missing the bigger point of what’s to come. As we spoke to yesterday and many times before, this is merely short term noise to a much much bigger issue, and that is the debt burden. The Fed simply cannot afford higher rates for much longer and that is as much about bond yields as it is about their FFR. They must ease and ease soon as they simply cannot service their debt. That easing, that inflation of money supply or debasement of currency, is the inflation that gold loves and is highly correlated to. Yesterday we reported the very Chair of the Fed admitting this was “unsustainable” and just 3 days ago on Fortune:

“Jamie Dimon believes U.S. debt is the 'most predictable crisis' in history—and experts say it could cost Americans their homes, spending power, and national security. Dimon is sounding the alarm over national debt and the issues it could cause for markets down the line.”

That, dear reader, is the head of the biggest U.S. bank. Be prepared and don’t get caught up in the short term noise. It is THAT predictable.