“Unsustainable” From the mouth of the Fed Chair

News

|

Posted 13/02/2024

|

1988

The word ‘unsustainable’ is thrown around with the same lack of critical thought as the word ‘unprecedented’. Both are applicable to the current economic setup but neither given the gravity they deserve when deciding how to protect one’s wealth.

Arguably one of the key contributors to the current debt based Ponzi scheme of an economy is the U.S. Federal Reserve. The ‘Fed’ are the hapless central bank for the USA whose job it is to print money to pay for the U.S. Government’s constant deficits and use interest rates to somehow not allow both to not fuel out of control inflation. Good luck with that. So when the very Chair of arguably the single most powerful economic machine lever in the world says that word, you should probably listen… Fed Chair Jerome Powel ladies and gentlemen:

“I would say this. In the long run, the U.S. federal government is on an unsustainable fiscal path…. And that just means that the debt is growing faster than the economy. So, it is unsustainable. I don’t think that’s at all controversial. And I think we know that we have to get back on a sustainable fiscal path.”

Ummm, yes we KNOW that but how’s that working out exactly?

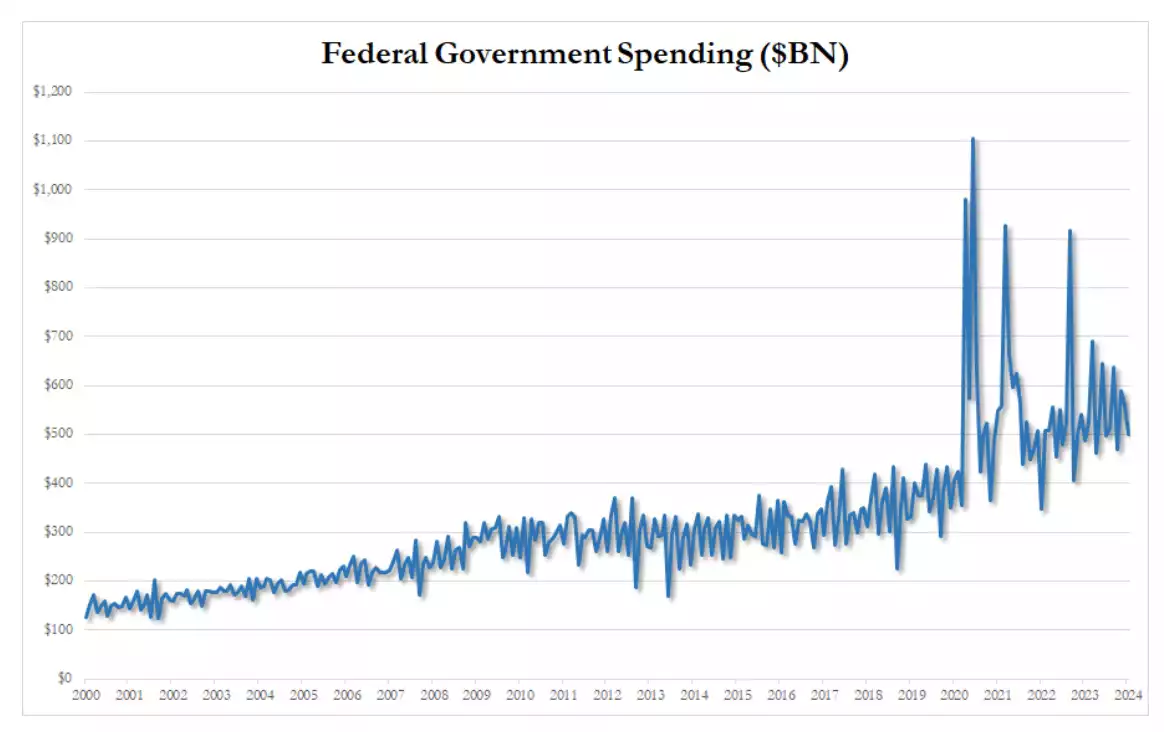

For some contemporary granularity we just saw the U.S. Government spending $499.25 billion in January alone making the average under Biden an eye watering $550 billion per month. That might be fine if paid for through income/receipts but we all know its well in excess and hence the constant deficits requiring the Fed to print more money which sits as debts to the Government to pay.

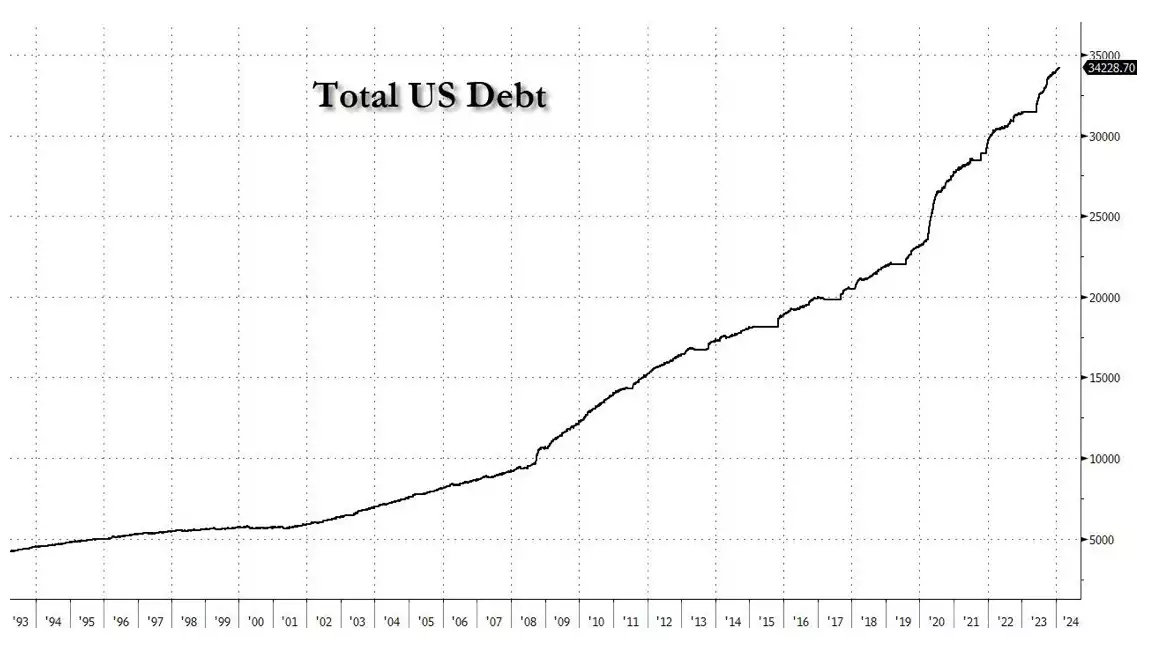

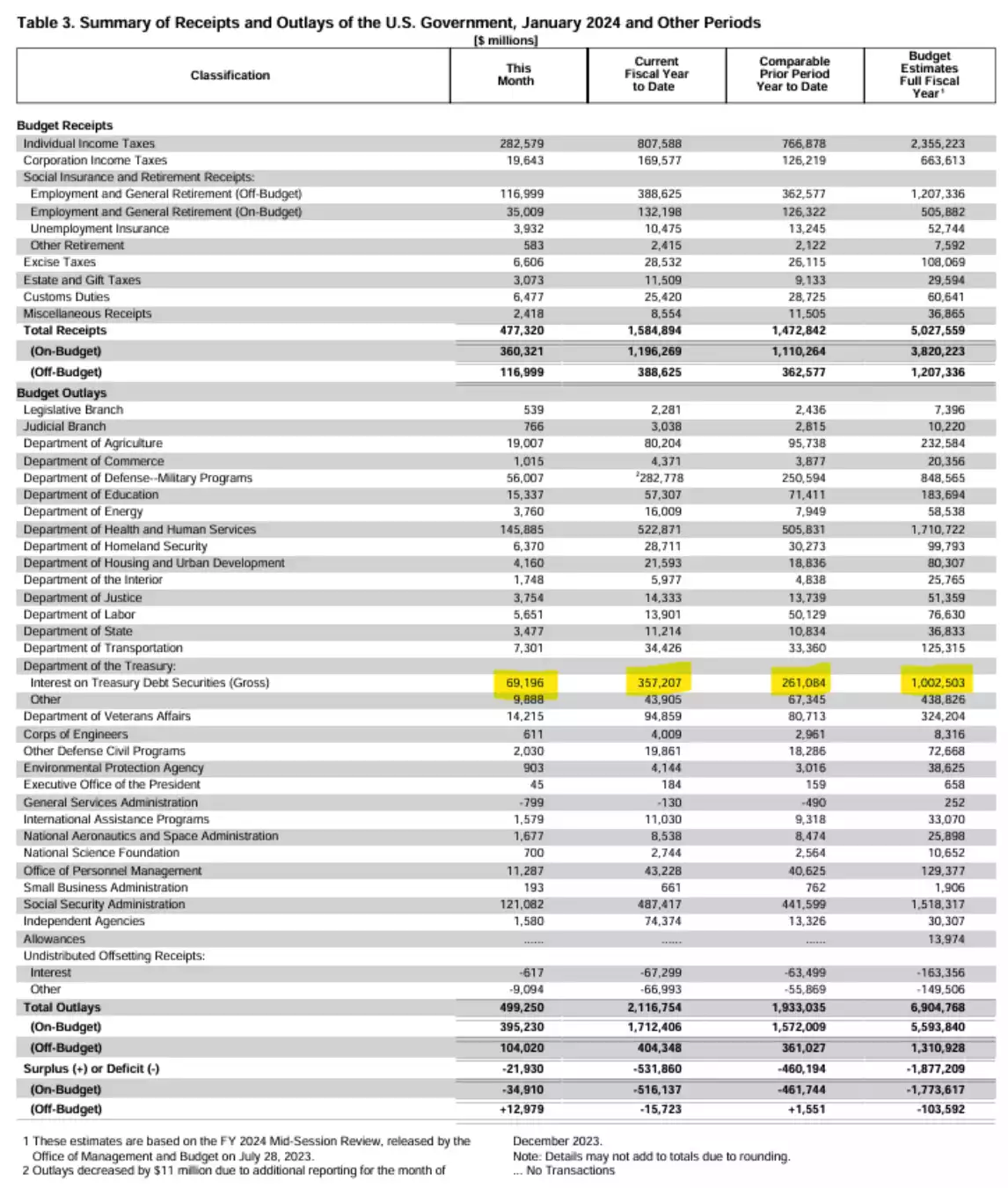

The table below is fascinating and scary at the same time. You will see in the bottom right hand corner they are forecasting a $1.877 trillion deficit this fiscal year (on top of the already $34 trillion debt pile) and that will come with an interest bill now officially exceeding $1 trillion. Only health and social security exceed that. Just year to date, interest costs exceed the previous year by a whopping 37%.

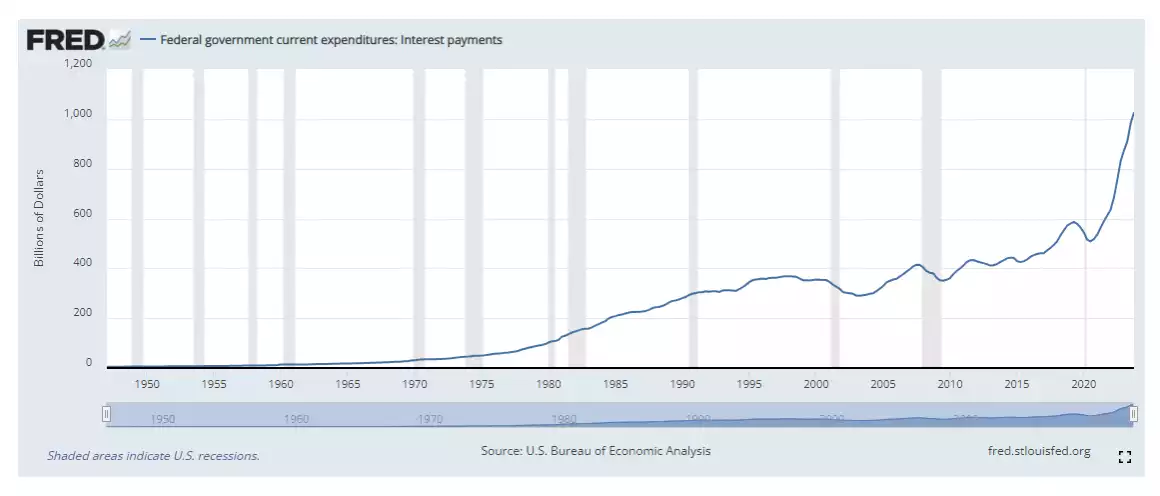

That interest cost is also on an exponential rise… Take a look at the interest cost historically, all the way back to WWII and including the famous 1970’s inflationary high interest rate period…

Again, we remind you of those 2 words ‘unsustainable’ and ‘unprecedented’…

Now that is at the public or Government level, but what about the private or household level? Well, Americans are now the proud owners of an unprecedented and unsustainable $17.5 trillion of debt. The latest data from the Fed shows U.S. household debt rising another $212b last quarter and now $3.4 trillion since COVID started, led by credit cards now sitting at $1.13 trillion. That is $1.13 trillion with the current average credit card interest rate sitting at 20.75%!

Americans have spent ALL the money handed out by the U.S. Government during COVID, then heavy credit card debt and also (GFC redux) drawing down equity from their home loans. Q4 last year saw another $11b of redraws making that the 7th consecutive quarter increase since Q1 of 2022. Indeed, every debt category has increased. And there are growing numbers unable to service that debt already. Delinquency rates are up 3.5% across the board but credit cards are at 8.5% (remember at 20.75%!) and auto loans at 7.7%. Serious delinquencies (90+ days) are at their highest level since 2011.

The elephant in the room is when or if the Fed can lower rates, orchestrate the mythical ‘soft landing’, and somehow ease the pain without flaming more inflation and exacerbating this situation. They are tackling a U.S. election year where (incredibly) Government expenditure always balloons trying to buy votes. And let’s not forget the Fed don’t necessarily ‘control’ rates. The bond market too dictates rates. This is by no means a straight forward market. We will leave you with Simon White, macro strategist from Bloomberg:

“Inflation may have fallen from its peak around the world, but in the inflationary regime in which we remain, upside surprises are more likely.

That would worsen already weak liquidity in global bonds and heighten the risk of rising yields.

Global bond yields have fallen almost everywhere in recent months, but that shouldn’t distract from the fact that underlying conditions remain combustible, and a seemingly (relatively) benign environment for yields could be abruptly upended.”

Don’t be fooled going ‘all in’ on the goldilocks narrative. Its not that simple nor sustainable. Balance your wealth in an (unprecedently) unbalanced world.