The World of Leverage – From Good to (Very) Bad

News

|

Posted 12/12/2023

|

2227

Leverage was definitely the IT word of the 2010 – 2020 decade, with companies, governments and individuals taking advantage of low rates and high asset appreciation to drive wealth. But as the corporate world and individuals are drawn to a rapid halt with interest payments, it seems governments around the world do not understand these boundaries, with ever increasing and underestimated interest costs. This is a growing problem, debt, and debt servicing, which in the U.S. has just eclipsed defense spending for the first time ever. But how big is this problem and is anyone, least of all the governments of the world actually grasping the size of the issue. As we come to the end of the year governments around the world are redoing their budgets, and what is becoming apparent is how far off in estimates many of them have been in estimating the interest burden and deficit spending they have been increasing at a record pace. So how does this end and who will be the winners in the next decade?

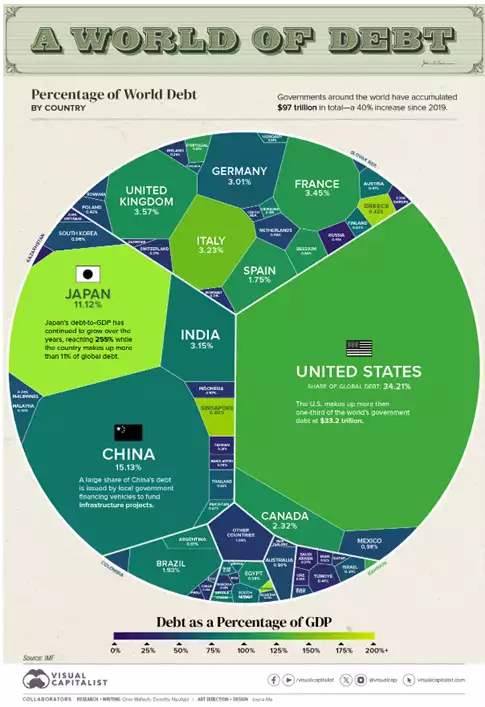

How big is world government debt

The current world government debt is sitting at around $97 trillion, with 3 countries, China, U.S. and Japan making up nearly 50%. This fundamentally means, that by running large deficits the world has been funding the growth (or lack of deflation) in these countries, by buying these bonds. These bonds have proven a terrible investment since the end of covid, as we have previously shown having had the longest losing streak in the period of their existence.

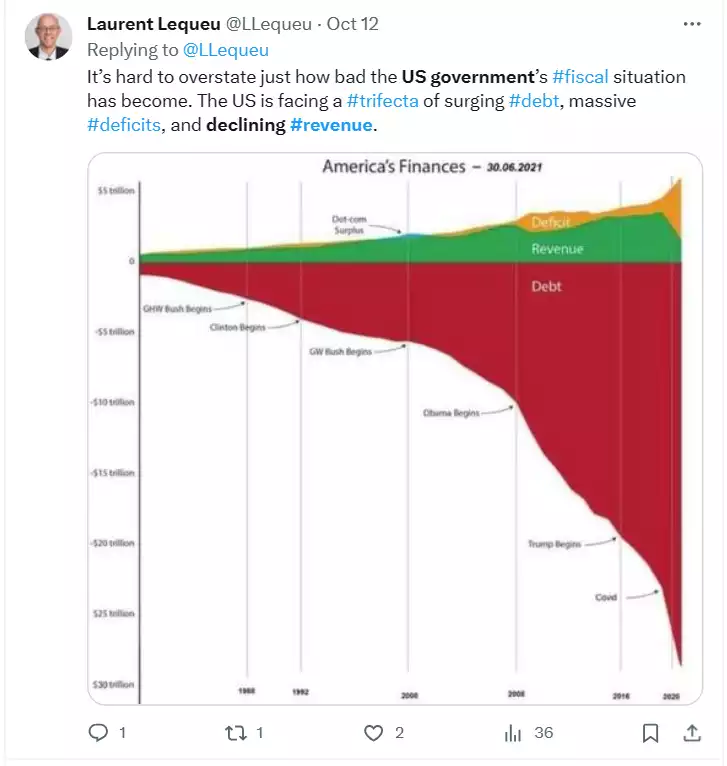

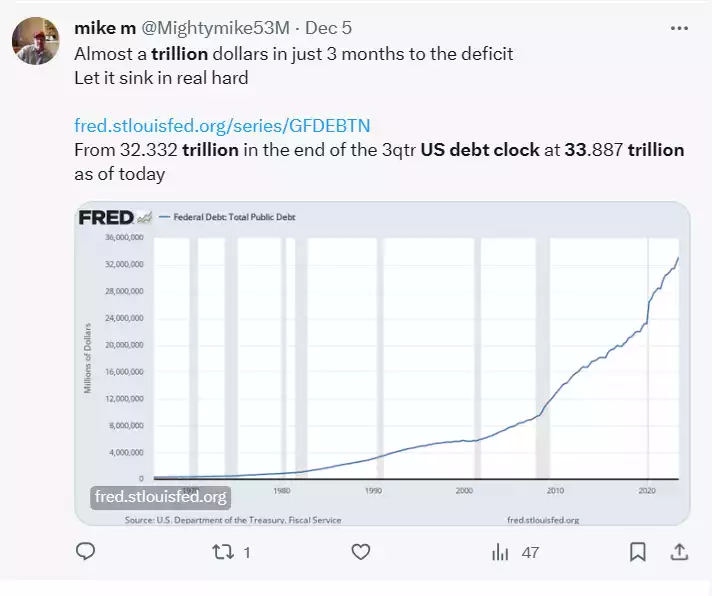

What these high debt countries now all have in common is they cannot afford higher interest rates, and any movement in interest rates is increasing volatility. Similarly there appears to be no tempering of their spending and because of this there is becoming a rapid, more difficult path to budget responsibility. Looking to the U.S., next year they are forecasting a $2-3trillion deficit. With current interest payments at around $1 trillion and $10 trillion rolling off for refinance next year from rates as low as 0% up to 5%, an increase of 3% interest cost increases debt repayments on this $10 trillion by another $300 billion, meanwhile tax revenue in the US is also declining.

2024, budget estimates for the U.S. deficit is running at $2-3 trillion, but with declining revenues, increased interest cost it’s hard to see this as a possibility, with close $1 trillion added in the past 3 months, indicating next year’s deficit is more likely to be in the $4-5 trillion range far surpassing the current forecast.

Leverage is bad this time

As we come into an era where debt is a burden not a benefit, we’ll draw your attention back to the Zombie article we wrote at Ainslie recently… Zombie companies/countries and banks will become a financial burden in finance markets and in fact the world over the next 10 years, with interest rates unlikely to be reduced to pandemic and pre pandemic levels. But these Zombies were in fact the financial drivers of these markets over the last 10 years.

A strategy what was employed by some of these companies was the ‘role up strategy’ where a company, usually listed for greater access to capital markets, would purchase another company by issuing debt, again usually variable and rolling, ie only interest would be paid as the banks were comfortable with the level of revenue and profit supporting the debt. Now debt was say 2% and this company bought 10 companies with revenue of $100million each and grew revenue to $1 billion, but their debt is also now $1 billion. They are now a $1 billion company with an interest bill of $20 million. Sounds cheap. Let’s look at the alternative, a company at the same time wanted to increase its productivity and competitiveness. It chose to spend money on new investments to grow revenue, the banks did not see this as less risky and probably lent at a higher interest rate, say 3%, but fixed as you need to pay the investment down in 5 years . In order to grow their market, they might borrow $100 million for this investment, which may see their revenue grow by $200 million, but they are paying it down at $20 million per year to satisfy the banks ignorance to this longer term more sustainable model. Their productivity and EBITDA increase, but that doesn’t matter until now.

The first example now has $1 billion in debt, an interest rate of 6% so now paying $60 million in interest, but everyone seemed to forget that companies require investment and replacement of assets often to maintain revenue and quality profit. But for the last decade this did not matter to the markets as debt was so cheap, especially in Australia (apparently) and investment in ‘productivity enhancing’ investments were not made as they were not rewarded by the market, hence our hugely lagging productivity numbers. This company unless it can replace its assets with newer more productive assets is going to fall behind the second example and may even end up in bankruptcy. But look at the second example, they’ve got new equipment, new revenue and low debt in a market where their competitors can barely pay their interest. It doesn’t take much to see who comes out on top in the next decade.

Low Leverage countries

In the past, the only reason a country would take out debt was for some sort of exogenous event like a war or a pandemic, but governments were quick to reduce this spending to a manageable level soon after to pay down or at least maintain the debt level. As Europe, Japan China and U.S. all sit on 80% plus debt to GDP, there are several great examples in the world who have achieved economic growth while maintaining low debt. Look no further than Europe with several countries with low debt including Switzerland (42% Debt/GDP), Sweden (37% Debt/GDP)and Denmark (42% Debt/GDP). Norway with 41% Debt/GDP has also created a sovereign fund with revenues from extraction of fossil fuels. This sovereign fund is in fact so large it is bigger than its current deficit, therefore arguing Norway has no debt. These countries have some of the highest levels of GDP per capita. But its not just developed countries that have achieved these feats, in Asia, both Singapore (0 debt), Taiwan (33% Debt/GDP) and South Korea (48% Debt/GDP) have come from being 3rd World countries 50 years ago to Asian powerhouses.

These countries, like the company comparison are poised to be able to reinvest and grow at hugely advantaged rates to their world peers. The overleveraged decline of the other countries will allow for market and competitive advantages that these countries will be able to achieve, while the rest of the world battles with ever increasing interest expenses limiting productive investments.

Low Leverage assets

Applying leverage to assets may give you some indication of the risks currently being exposed in the world. Low leveraged and low counterparty risk assets look to be some of the best investments in the next decade - gold, bitcoin and commodities some of the stand outs. Other assets such as government bonds and high debt stocks will continues to see huge volatility as the smallest in interest rate tweaks will move huge and growing debt repayments.

So if the 2010 decade leverage was a good word – this next decade beware.