Halloween and the Zombie Central Banks

News

|

Posted 31/10/2023

|

2172

Seeing as though its October 31st – a very auspicious scary holiday – Happy Halloween!!!! It’s time to introduce the Zombie Central Bank. We are all warned about Zombie companies and institutions. Wikipedia defines one as ‘a zombie company is a company that needs bailouts to operate, or an indebted company that is able to repay interest on its debts but not repay principal’. As you can understand the higher rates go the more and more zombie companies that appear – right in time for Halloween 2023. But the scariest zombies are the ones created by Central Bankers – the ones that no matter how indebted they become – they cannot die and will continue their brainless destruction of anyone that gets in their way.

ASX Zombie Companies

As rates rapidly increase, the Central Banks around the world are creating Zombie companies. A recent KPMG paper identified 127 companies on the ASX on the brink of collapse as their debt burden erodes their operating margins and equity. With 2400 companies listed on the ASX, this equates to 5.3% of companies in Zombie Land. In the past 6 months they estimate an increase of 51% alone.

By Central Banks holding rates lower since the 2008 GFC, this has allowed capital to flow to inefficient companies, robbing from innovation and growth companies, and creating an even greater number of Zombies and therefore lower productivity. And this is the thing with Zombies – with one bite they create each other. So as more and more Central Banks become Zombies – with poor policy choices have they created a Zombie apocalypse?

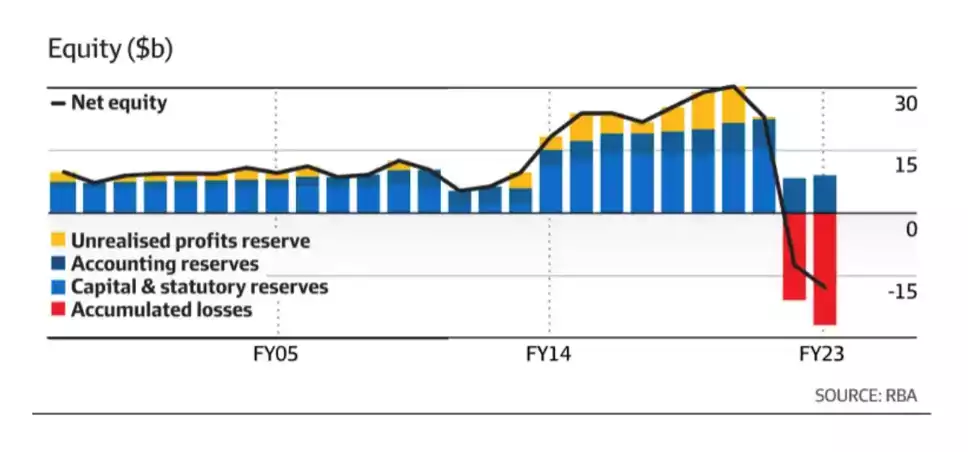

Australia’s Zombie Central Bank

In September 2022 the RBA saw a Mark to Market loss of $44.9 billion on its $300 billion emergency bond issuance from the covid era. These bonds, due to rising interest rates, depreciated $44.9 billion. This wiped out the RBA’s equity, and left it with negative equity of $12.4 billion. Fast forward to 2023, with interest rates having lifted from 2.35% in September 2022 to 4.1%, these mark to market losses are growing, another $5 billion being added to the banks negative equity this year. Worsening this is that with negative equity of $18 billion, the forecasts are for this to in fact worsen to $27 billion by 2025 and not to return to positive equity until 2030 (based on lots of positive assumptions).

The losses have led to calls from economists including former Treasury official Peter Downes, for the Australian government to inject equity into the RBA.

The World’s Zombie banks

When there’s one Zombie there’s many –Sweden most recently reporting negative equity of $5 billion. The UK bailing their bank out in 2009 and again in 2022. The UK government in 2009 promising to continually make the BoE whole, covering any losses. There also Switzerland, Chile and Slovakia. With Japan trying desperately to yield curve control at 1%, a falling Yen, increasing inflation and debt at 168.1% of GDP – around $11 trillion US – the Zombie Central banks are multiplying.

The Master Zombie – coming next Halloween

As we all know a zombie bite creates another Zombie – and what we can see currently is the Zombie Central Banks with the ultra loose monetary policy since 2008 having created 1000s of Zombie companies. So who is the ‘Ground Zero’ Zombie? In a recent talk, Jerome Powell hinted at this indicating Fiscal government spending. “The path we're on is unsustainable, and we'll have to get off that path sooner rather than later,” Powell said. We continue to point out that fighting fiscal stimulus with monetary tightening is not an effective tool; especially considering the sheer amount of fiscal stimulus unleashed during Covid.

So who created these Zombie Central Banks? Governments and their ultra loose fiscal spending – so are they the Ground Zero of the zombie sickness in the economy? With US Treasury borrowing another $776 billion in the Oct-Dec quarter, on top of the $1.01 trillion in the July-September quarter and an expected $816 billion in the Jan – March quarter – are these not what by definition a Zombie company is? A reminder;

‘a zombie company is a company that needs bailouts to operate, or an indebted company that is able to repay interest on its debts but not repay principal’.

The US Federal Reserve is by no means the only Zombie Government – there seems to be an inability of any modern Western Government to Balance their books and this is the Ground Zero of the Zombie Apocalypse taking over the West – Central Banks will continue to follow the Federal Reserve, the RBA, the BOJ and the Swedish Central Bank to Zombie status – unless someone cuts off the fiscal head of this Zombie.

There is only one asset that can thrive in the Zombie Apocalypse – Precious Metals Bullion.