The Most Perverse Financial Setup Unfolding

News

|

Posted 19/12/2023

|

2424

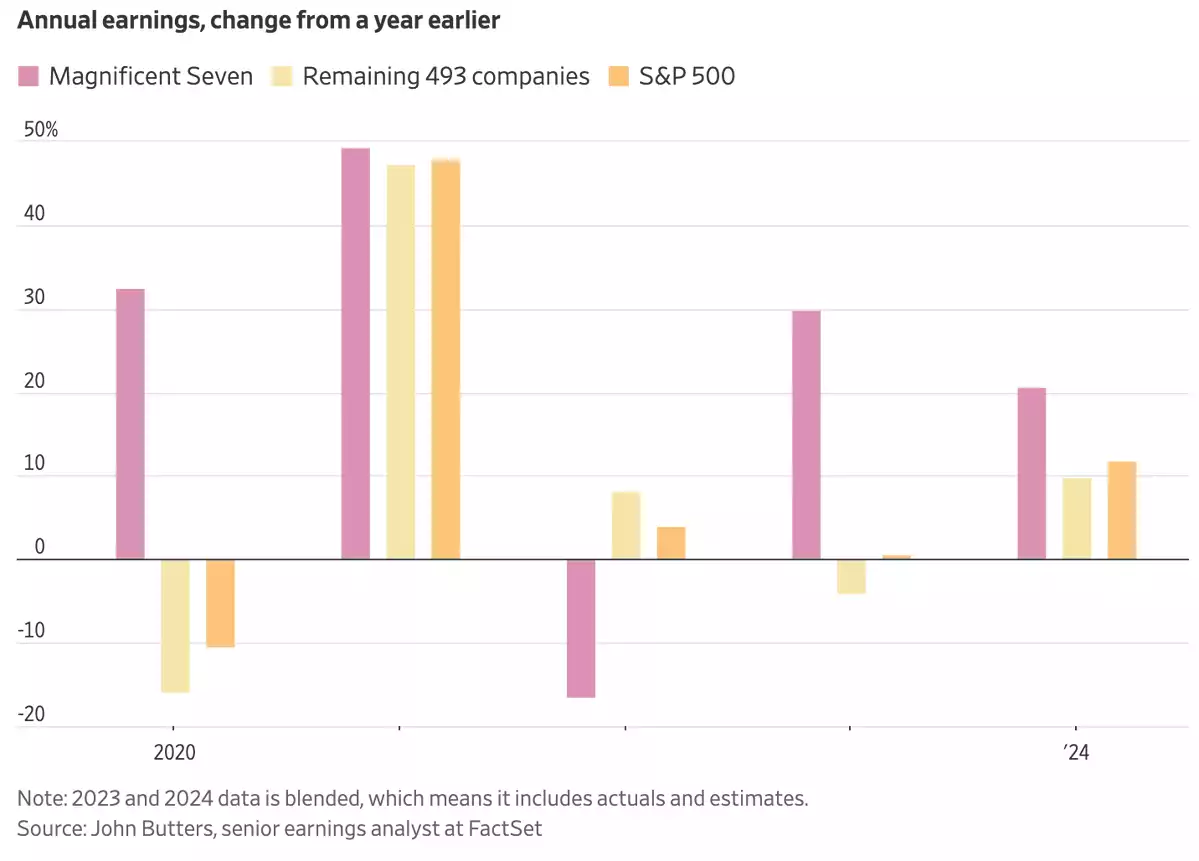

One of the defining themes of the financial assets space in 2023 has been the bifurcation of the equities markets into a hand full of tech shares and everything else amid constant fears of a recession, amid high rates and inflation. The “Magnificent 7” (as we discussed back here - Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet) have defied all fundamentals to trade at eye watering valuations. We dig beneath that and uncover just how perverse this setup is.

The Most Perverse Financial Setup Unfolding

One of the defining themes of the financial assets space in 2023 has been the bifurcation of the equities markets into a hand full of tech shares and everything else amid constant fears of a recession, amid high rates and inflation. The “Magnificent 7” (as we discussed back here - Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet) have defied all fundamentals to trade at eye watering valuations.

Indeed, whilst equities investors may be celebrating the S&P500 being up over 11% for the year amid such headwinds as some kind of validation, if you take out the Magnificent 7 the index would be down 4%... (whilst gold is up 13%)

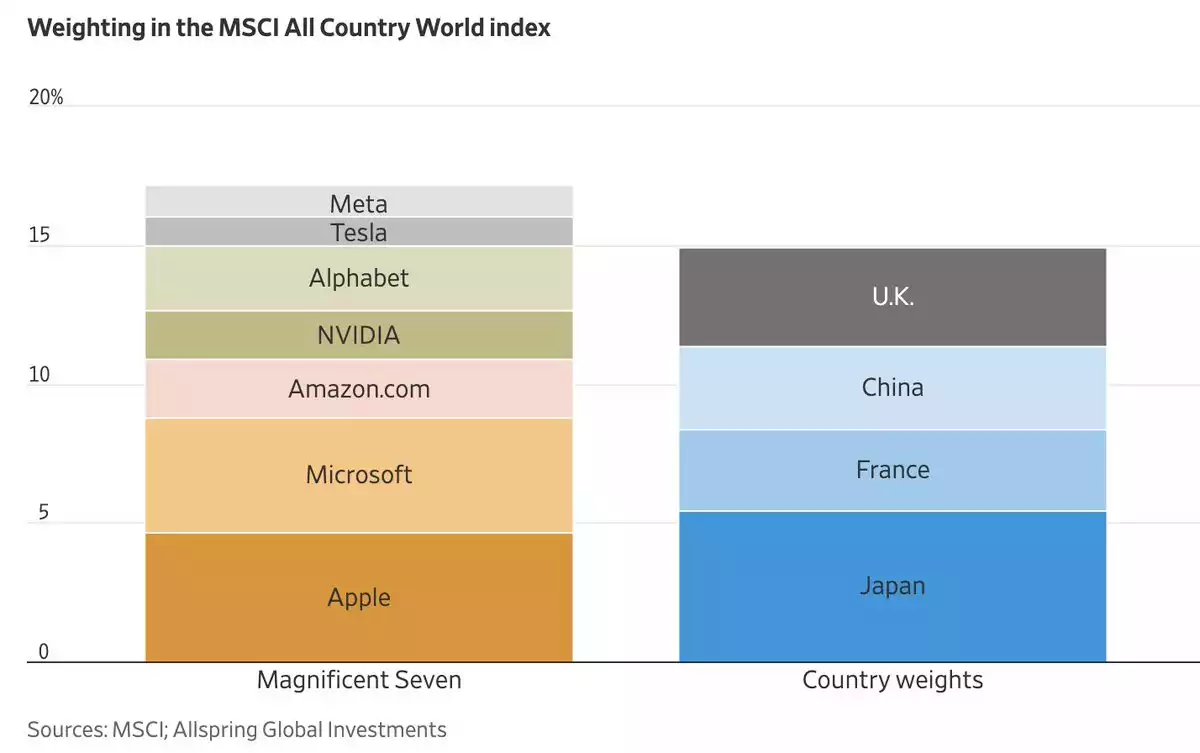

So that’s America, and whilst the S&P500 is the single largest index in the world, what about the rest of the world? The author of the following chart (Hardika Singh) puts this into further perspective…

"Within the MSCI All Country World Index—a benchmark that claims to cover about 85% of the global investible equity market—the combined weighting of the Magnificent Seven is larger than that of all of the stocks from Japan, France, China and the U.K."

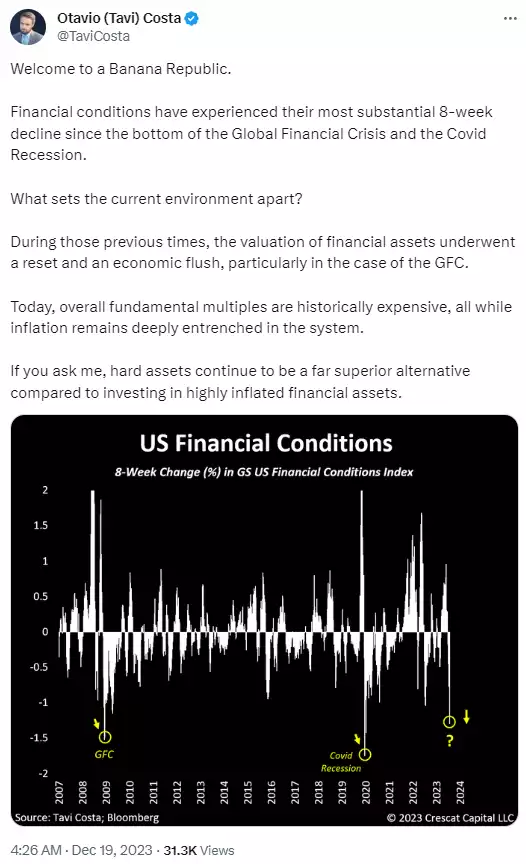

Last week we got a slew of bad economic data out of the U.S. which even the most ardent ‘soft landing’ advocates are starting to concede looks like recession dead ahead. Whilst escalating, the news is not new and we have been seeing it increasingly over a couple of months. For historical context, Crescat’s Tavi Costa puts it nicely thus…

There is no ‘harder’ asset than precious metals. Gold, silver and platinum bullion stand almost alone in a world of financialised, promissory, and derivative assets where they are all someone’s liability. Precious metals bullion are no-one’s liability and have zero counterparty risk… zero. This is why they shine when the sorts of distortions we are seeing in this global economy inevitably correct. And now in our ‘new paradigm’ of central banks ‘printing’ their way out of (but in reality only extending and further perverting) economic corrections or crashes, precious metals shine again as real ‘un-inflatable’ money whilst all the fake money is being printed or given away hand over fist, debasing it at an unprecedented rate. How unprecedented? Below very starkly reminds you…

Footnote – such is the pace that even the above chart is out of date. The U.S. added another $2.6 trillion of debt between June 2023 and December 2023. $31.4 trillion to $34 trillion now.

Are you prepared for the fallout?