“152 Rate Cuts in 2024” - Brace

News

|

Posted 18/12/2023

|

3802

Last week we wrote to the Fed Chair’s comments that rate cuts were coming next year and the exuberance this caused in the markets. This ‘slip up’ was very quickly doused on Friday night with other Fed members talking down (jawboning) the likelihood of cuts whilst inflation is still at large and employment so tight.

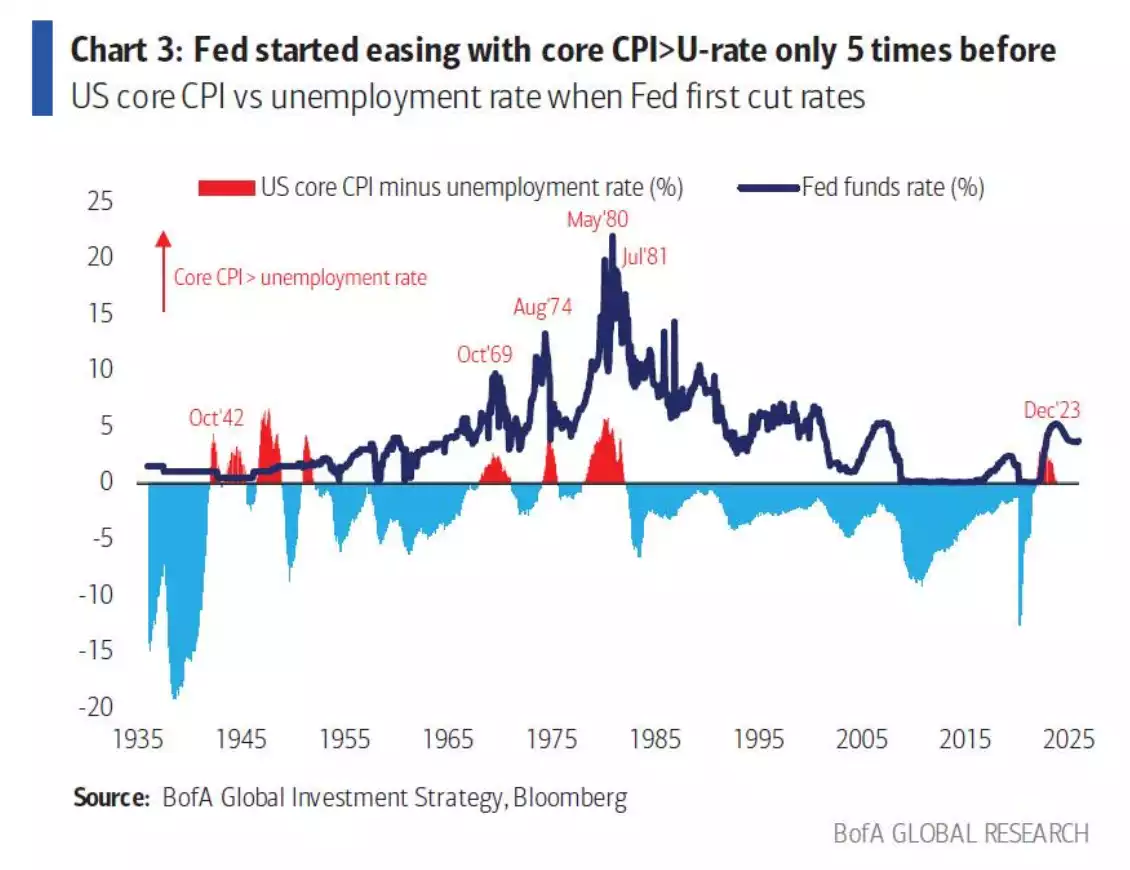

This current mix of inflation and employment in the U.S. has only seen 5 rate cuts in 90 years, once (1942) during the war and every other time due to recessions.

Therefore for the Fed to cut in such an environment would be historically supported by either a war breaking out (and unfortunately that is not out of the question but lets assume not), a recession early next year is achieved as so much of the current data supports, or the Fed, an institution supposedly apolitical, is trying its hardest to prevent a recession in an election year where it prefers the incumbent. The latter is not, mind you, without precedent. In 2019 senior Fed member Bill Dudley openly admitted they ensured the opposite outcome to actively prevent Trump from re-election.

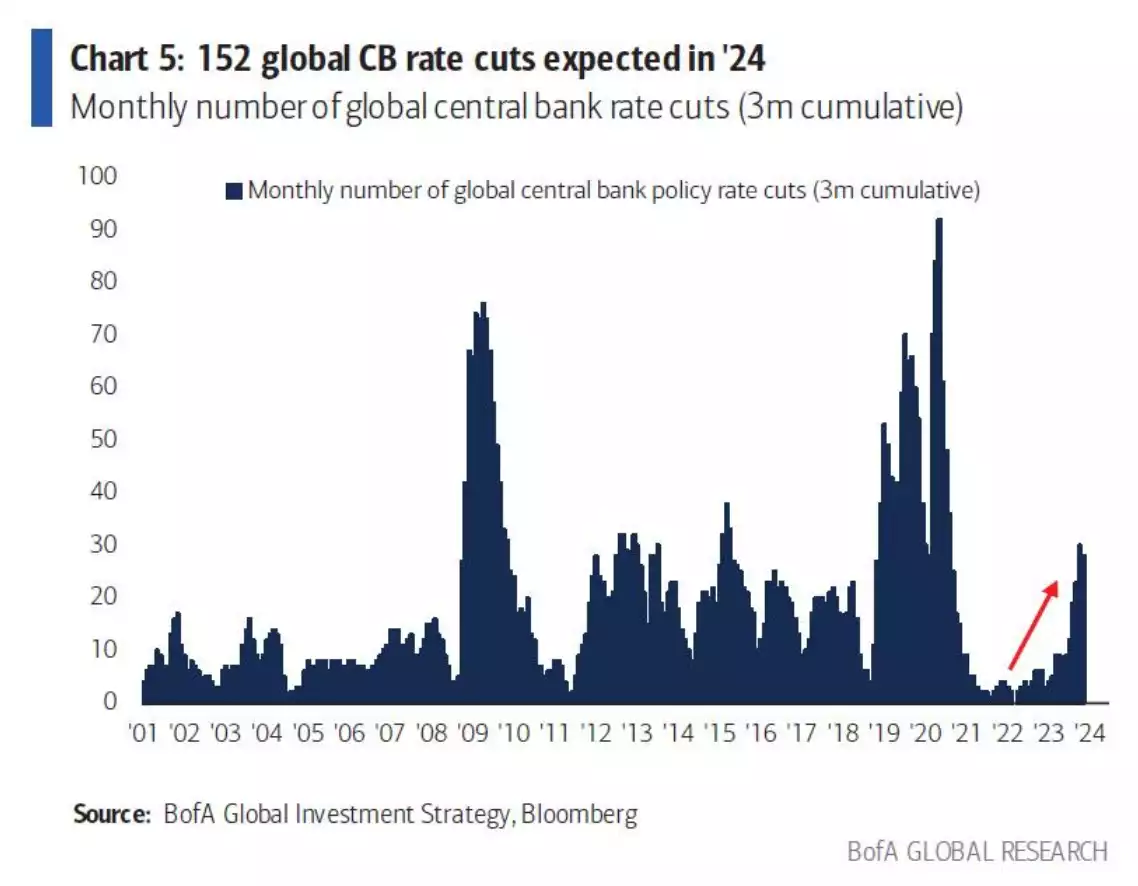

Bank of America’s lead strategist Michael Hartnett is predicting a wave of money coming despite the jawboning of Friday night. Indeed looking beyond the U.S., he is predicting no less than 152 rate cuts by the world’s central banks in 2024!

Cutting of rates can still achieve the so called “soft landing” (no or mild recession, move along nothing to see here…) that now seems heavily priced in by markets, but can also cause the “hard landing” (recession, market crisis as cuts too little too late and inflation unresolved). Hartnett is in the hard landing camp and is bullish on gold bullion and bonds as the investment play in it.

This of course if completely consistent with our last monthly Global Liquidity - Gold & Bitcoin update.

And so they may well be forced to make it the 6th time in a century where rates are cut despite a tight employment market. The implications for gold are clear, and hence the strategist for one of the world’s biggest banks being so bullish. Lower rates, stickier inflation, and recession put gold in its sweet spot of low real rates (headline less inflation) and safe haven in a recession. The prediction of 152 cuts world wide and both Europe and Asia in even worse economic health than the U.S. mean this is very much a global phenomenon too. That this could happen in a U.S. election year with the deeply divisive setup that promises to be, means 2024 could be one for the record books. As we repeatedly impress:

Balance your wealth in an unbalanced world.