The Great Depression 2.0 – Why China Won’t Help Australia’s Next Recession

News

|

Posted 05/12/2024

|

3855

In both the 2008 and the early 2000s recessions, China’s strength as a major trading partner played a significant role in keeping the Australian economy resilient. Will Australia get by relatively unscathed once again, during the anticipated upcoming secular recession?

It appears that while China has become an increasingly prominent player in the global financial landscape - with their central bank, The People's Bank of China (PBOC), currently being the world’s second-largest (after the US Federal Reserve) - their economic landscape is simultaneously becoming increasingly precarious.

With China’s ongoing financial stimulus measures at historically high levels, a deeply unwell property sector, an ageing population, and conflicting geopolitical aims with the West—pivoted on their occupation of Taiwan, which is expected to fracture their international trade agreements—China is unlikely to be the centre of economic prosperity it once was as we approach the end of this decade. While wartime economics can help temporarily prop up financial landscapes, the laws of nature ultimately win, and the longer a market is artificially held up the harder it tends to collapse.

While China’s upcoming economic struggles will directly impact us here in Australia, what’s additionally concerning for the Australian economy is the low probability of trade agreements between Australia and China remaining intact amid China’s occupation of Taiwan. With the Australian economy being largely supported by resource exports, and China being our most prominent trade partner; the cessation of iron ore and natural gas purchases by China from Australia alone would have catastrophic consequences on the Australian economy and banking sector at large.

While China is focusing on becoming self-sufficient in preparation for this situation by building alternate trade alliances and stockpiling essential resources. Australia, unfortunately, isn’t quite ready for this economically mutually beneficial relationship to end.

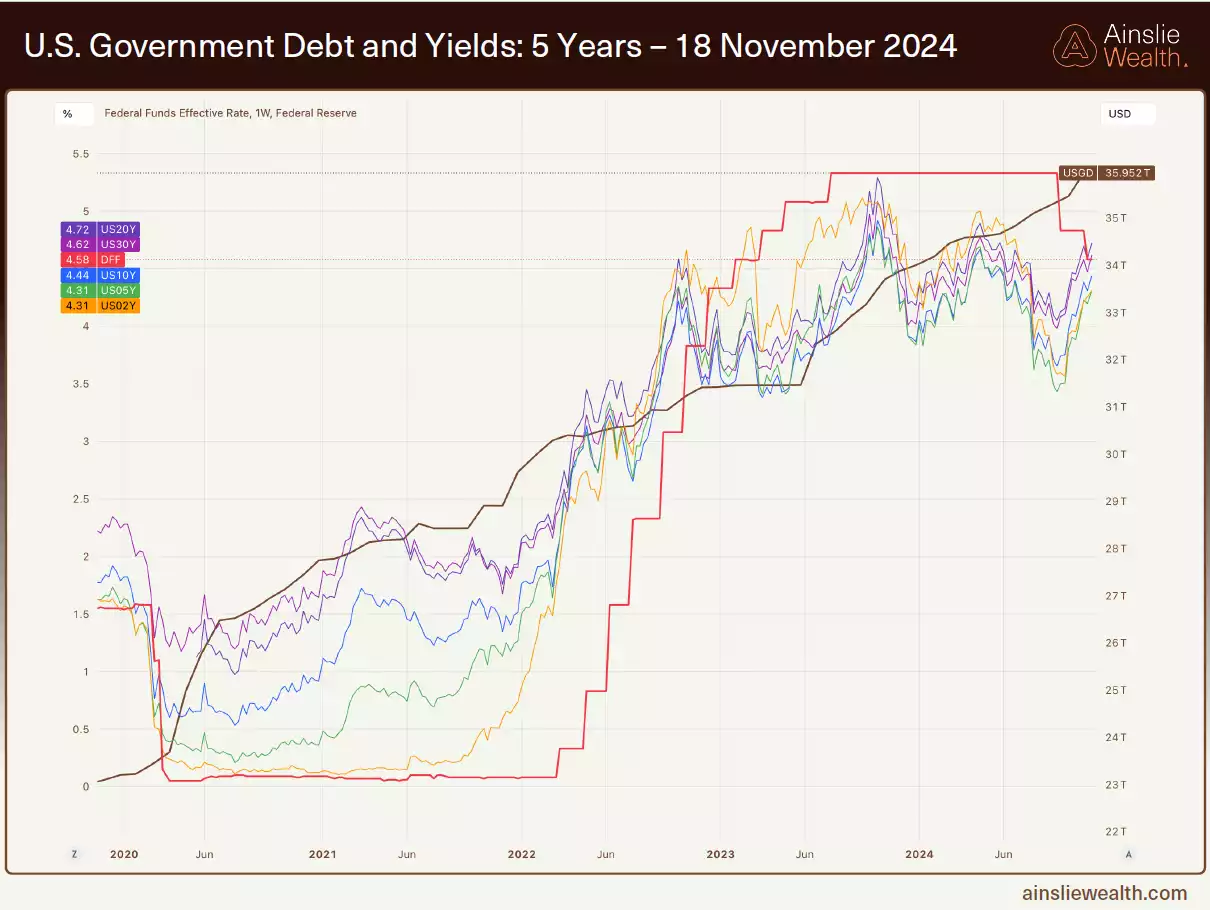

Briefly looking west - the US government debt is reaching eye-watering levels - while the U.S. Federal Reserve dances between managing inflation - and the pressure of high interest rates on their financial landscape. As a result of rate cuts by the U.S. Fed, into a strong economy and low unemployment - the US bond market priced in the expectation for inflationary pressures to return – and we witnessed U.S. bond yields moving up. This results in reduced bond collateral values, which are the blue-chip collateral held by all banks in the private banking sector (by law).

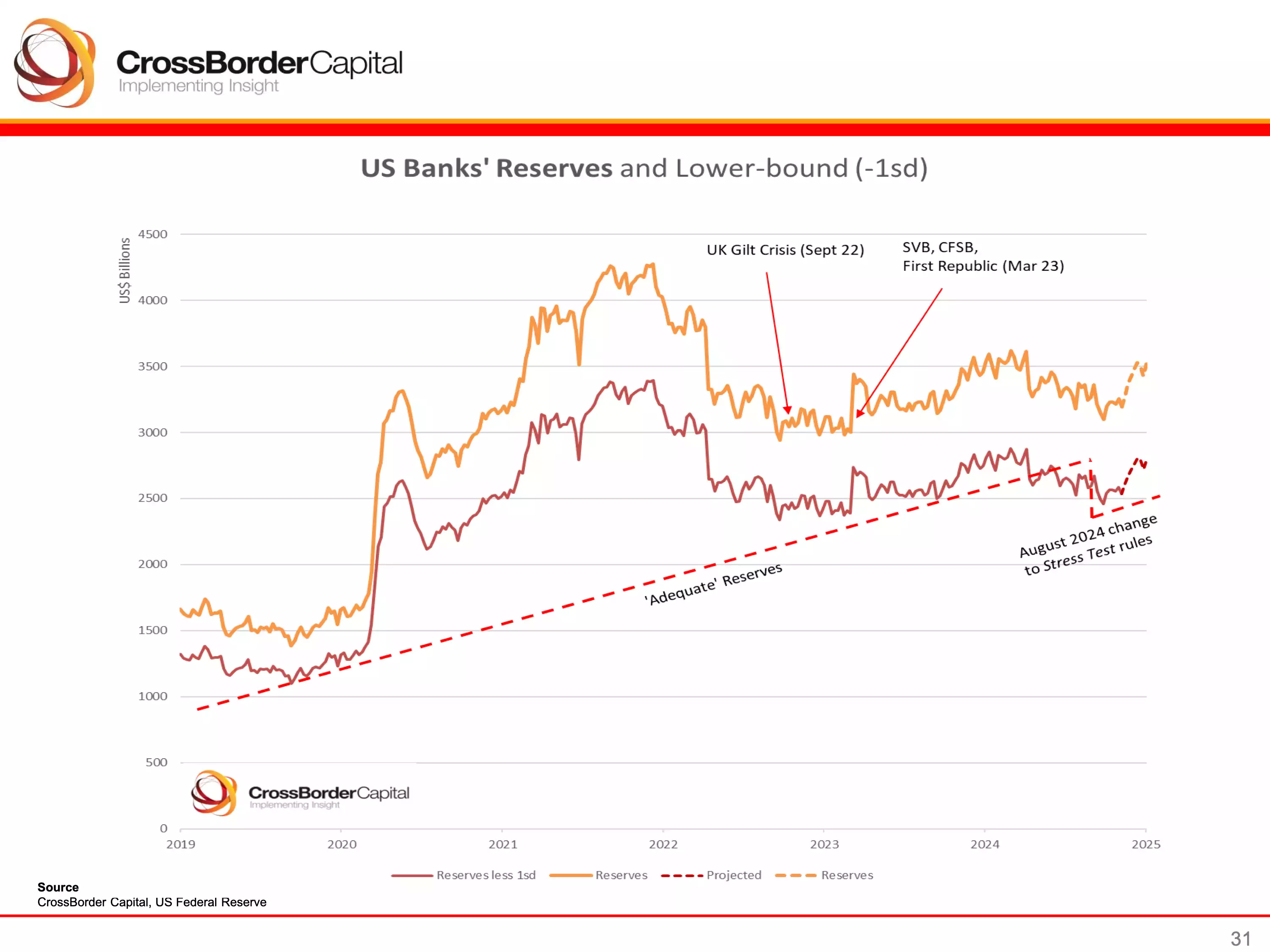

While bank collateral reserves also dropped to concerning levels around this time, the threshold for adequate reserve requirements for stability in the banking sector was simply reduced.

This shows pressure on the US private banking sector, that the U.S. Federal Reserve is unable to tackle using monetary policy in the immediate term. While this doesn’t necessarily imply definitive and immediate trouble in the U.S. banking sector – it clearly reflects the rock and hard place that the U.S. Fed is currently in between.

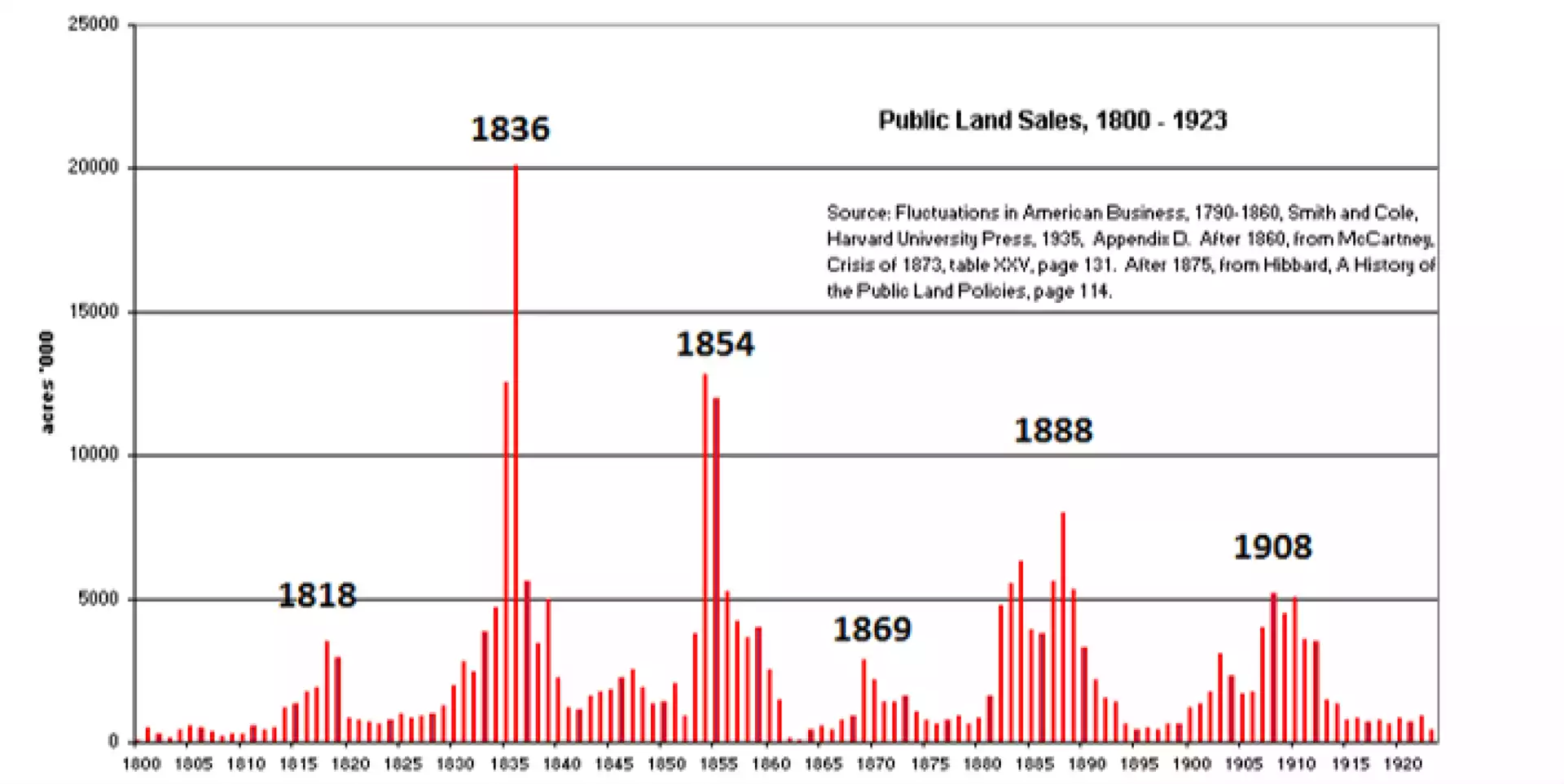

This global economic backdrop is all while (from a timing perspective) we approach the final phase of the 18.6-year land cycle (based on over 350 years of data) - where western economies are expected to record a secular land recession (the most recent one was the 2008 GFC), while also approaching the final phase of an 80-year socio-economic cycle called the fourth turning (based on over 800 years of data) - where broad-based systemic collapses can be expected (the most recent one was the 1930s Great Depression).

Notice the approximate 18 years between land value peaks.

With looming recessionary and war concerns, holding assets attached to any specific government, or organisation, holds significant counterparty risk.

So how can Australians preserve (or grow) their wealth during this turbulent macro phase?

The solution to counterparty risk across 80-year cycles - is to hold wealth in decentralised, hard assets, with proven track records, of acting as stores of value - over multiple centuries (such as gold and silver). These become the assets of choice for investors and organisations during such phases, steadily increasing in value, while most other markets struggle to recover.

We see that during the 2008 GFC, while U.S. stocks and land spent years recovering from the collapse, gold continued putting in new highs during this time.

While gold is the AAA safe haven asset of choice during collapse and recovery times, it also benefits from the increasing liquidity in the financial system in the years leading up to the collapse, which is seen rising with most other markets during this phase as well.

This positions gold, as a straightforward, reliable and profitable vehicle, to navigate the turbulent and (potentially) confusing macroeconomic phase of the simultaneous culmination of the 18.6-year, and 80-year cycles – a once-in-a-century occurrence!

As we navigate this phase, we rely on stores of value such as gold and silver often called “God’s money” – being consistent, reliable and eternal - unphased by the systemic changes and chaos - of transitioning from one world to another.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=5fsvYI7TNcM