Macro and Global Liquidity Analysis: Gold, Silver, and Bitcoin - November 2024

News

|

Posted 29/11/2024

|

5871

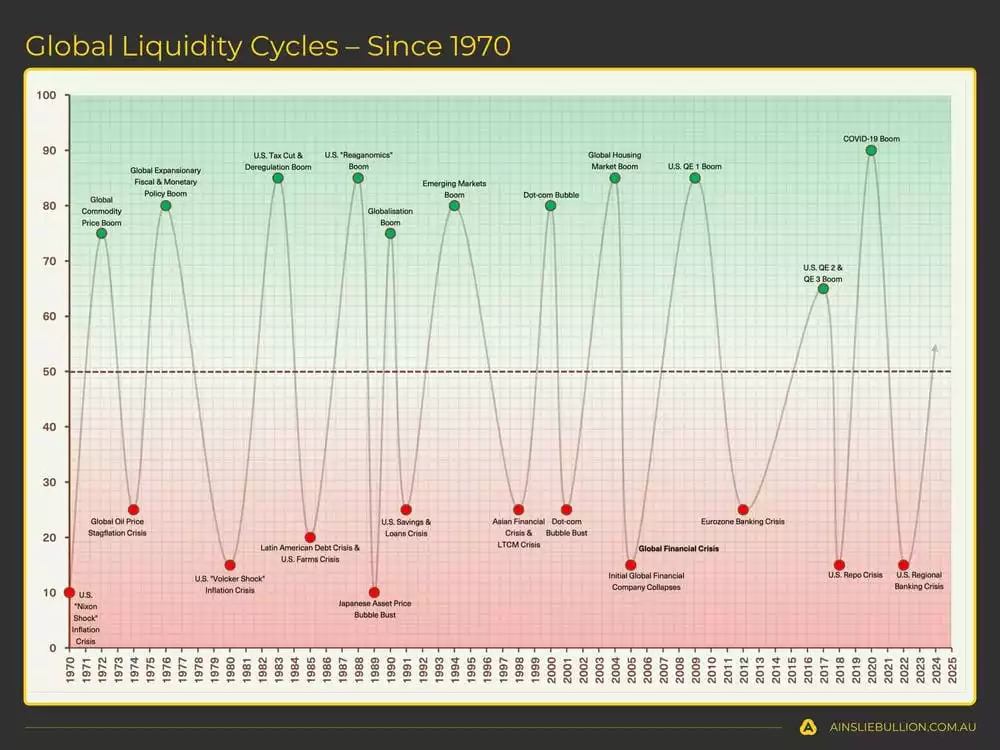

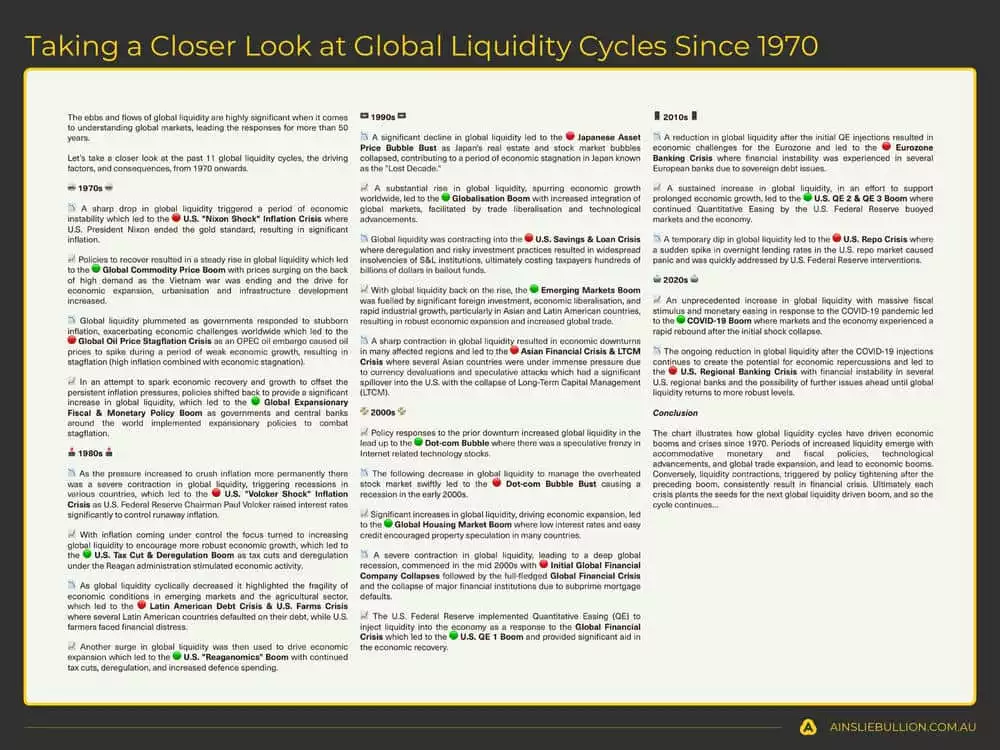

Today the Ainslie Research team brings you the latest monthly update on where we are in the Global Macro Cycle, driven by the Global Liquidity Cycle, and the implications for Gold, Silver, and Bitcoin. This summary highlights the key charts discussed with our expert panel on Tuesday. We encourage you to watch the recorded video of the presentation in full for the detailed explanations.

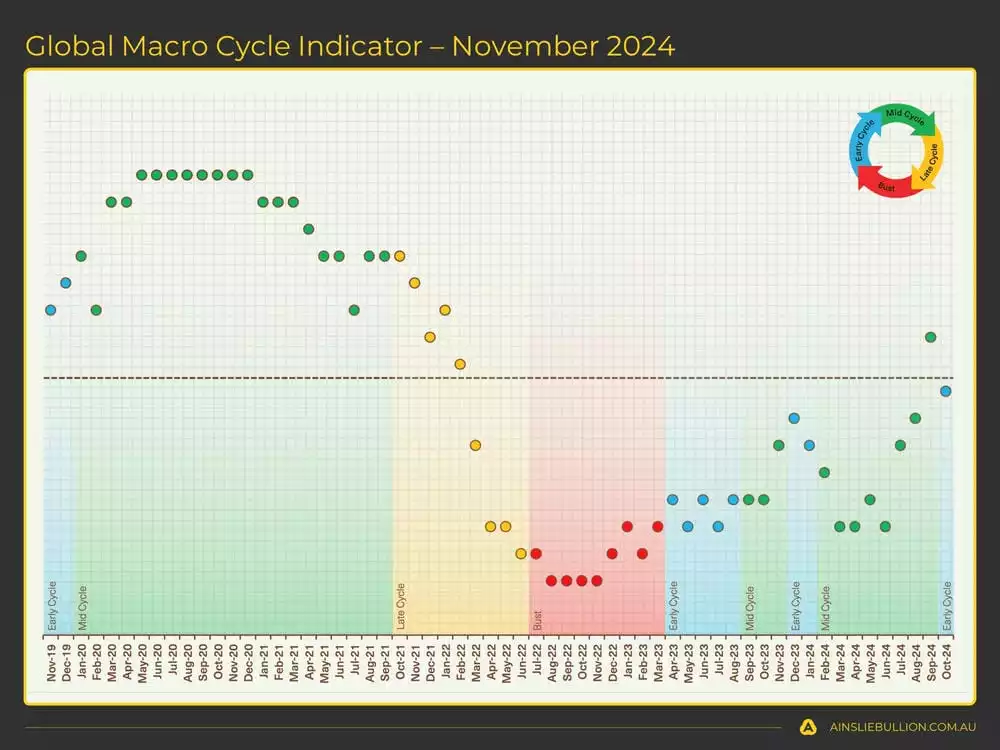

Where are we currently in the Global Macro Cycle?

This month a data revision had us back above the halfway line for the first time since the very start of 2022, before a drop back into early cycle, just below. We expect to return to mid cycle after the brief detour and resume the move higher to start 2025 in a strong position.

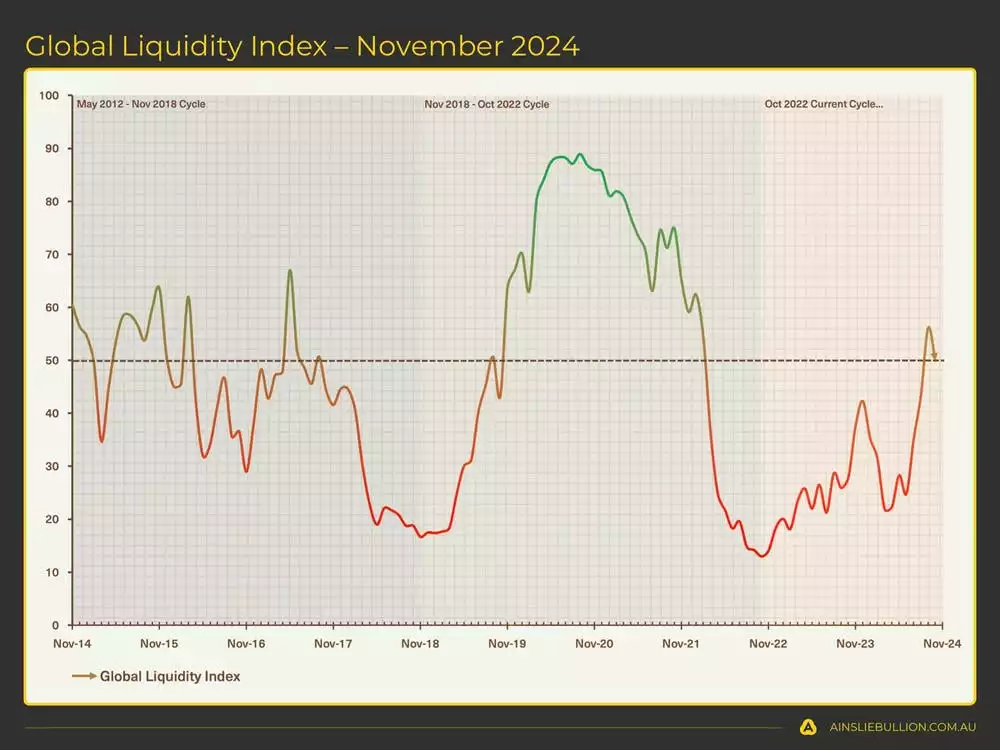

Where are we currently in the Global Liquidity Cycle?

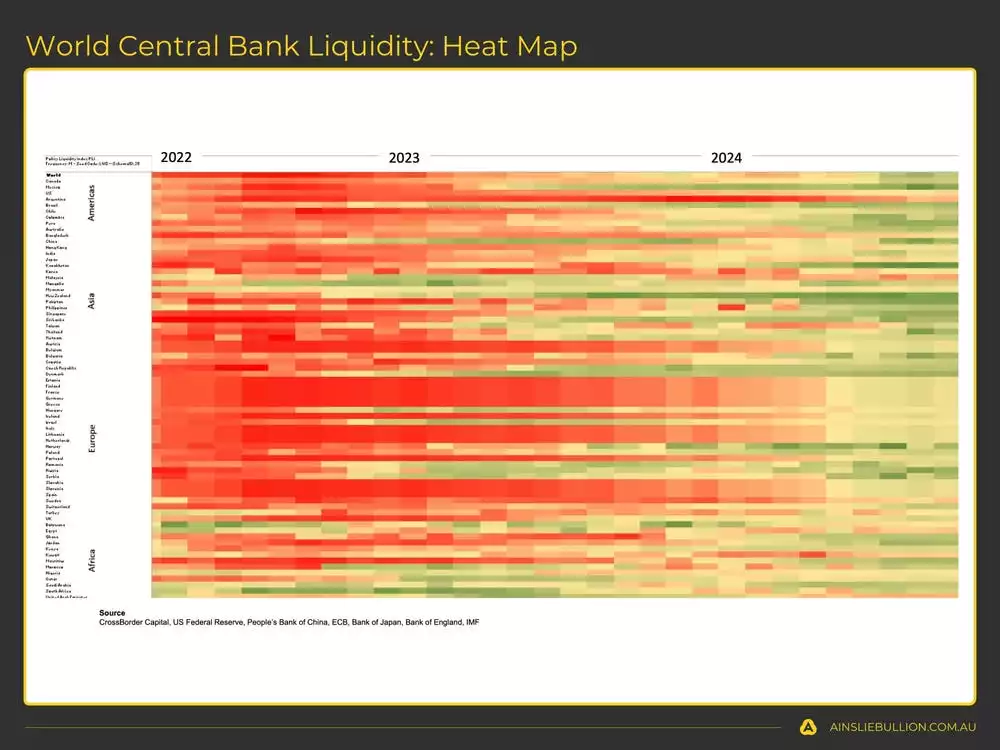

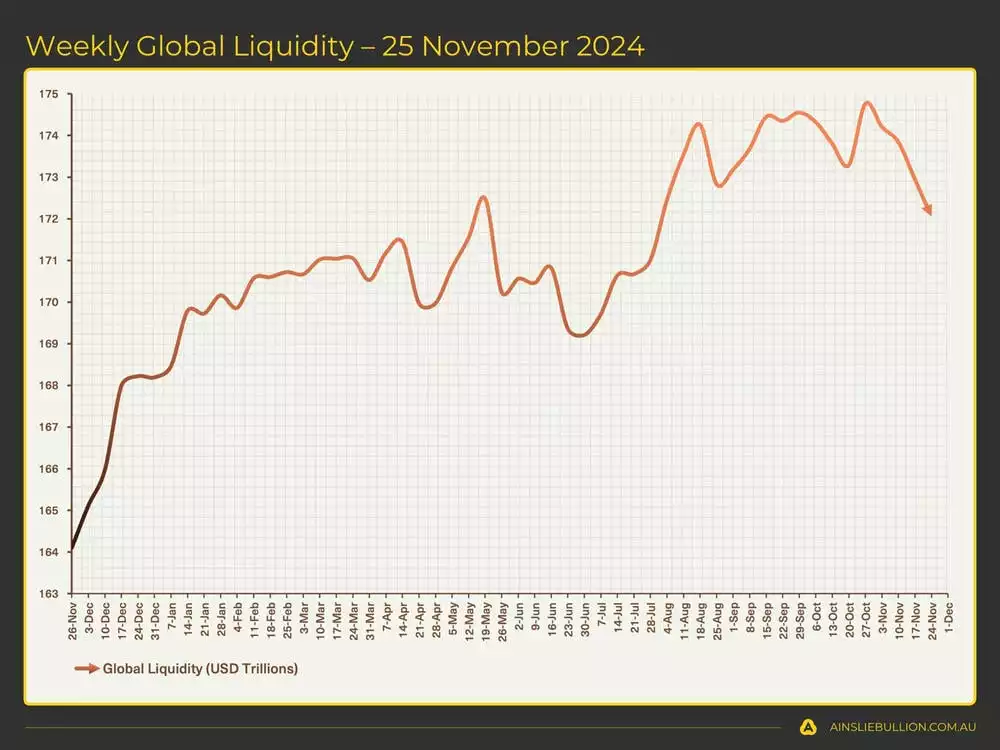

Global Liquidity leads the movement of World financial assets, so this is the indicator we look most closely at to determine where the opportunities are to take advantage of. It is currently showing solid signs of recovery from the cycle lows.

The greens are now clearly starting to dominate the heatmap, showing improving liquidity conditions across an increasing number of global central banks. Only a few holdouts remain, however they include important participants such as the U.S.

Do U.S. Growth and Inflation support where we think we are in the Global Macro Cycle?

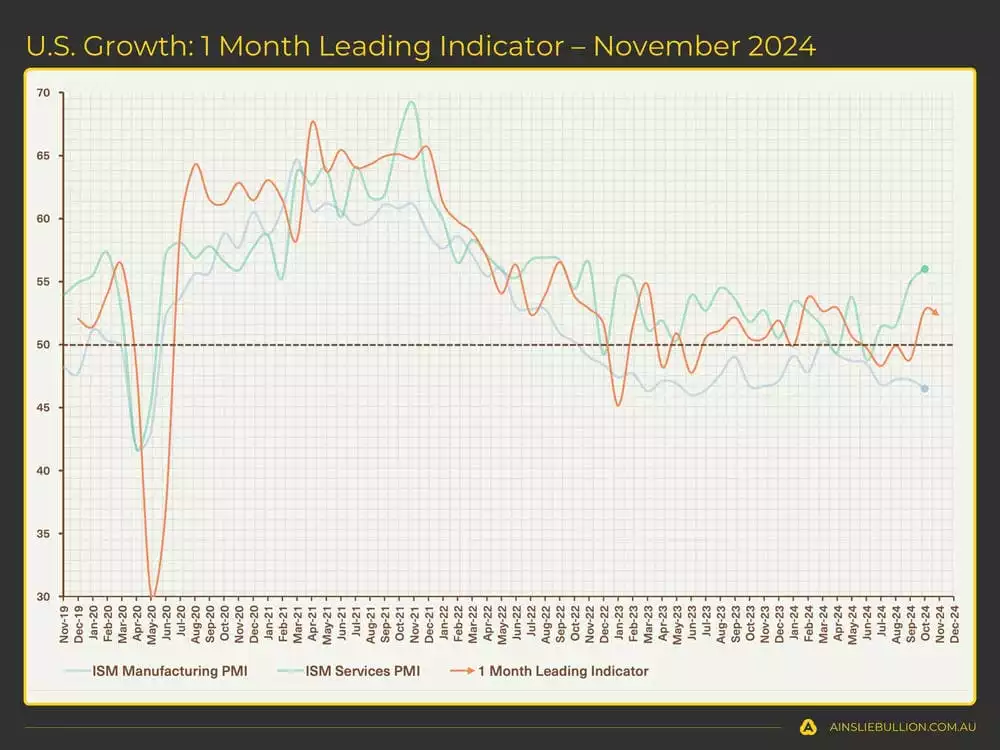

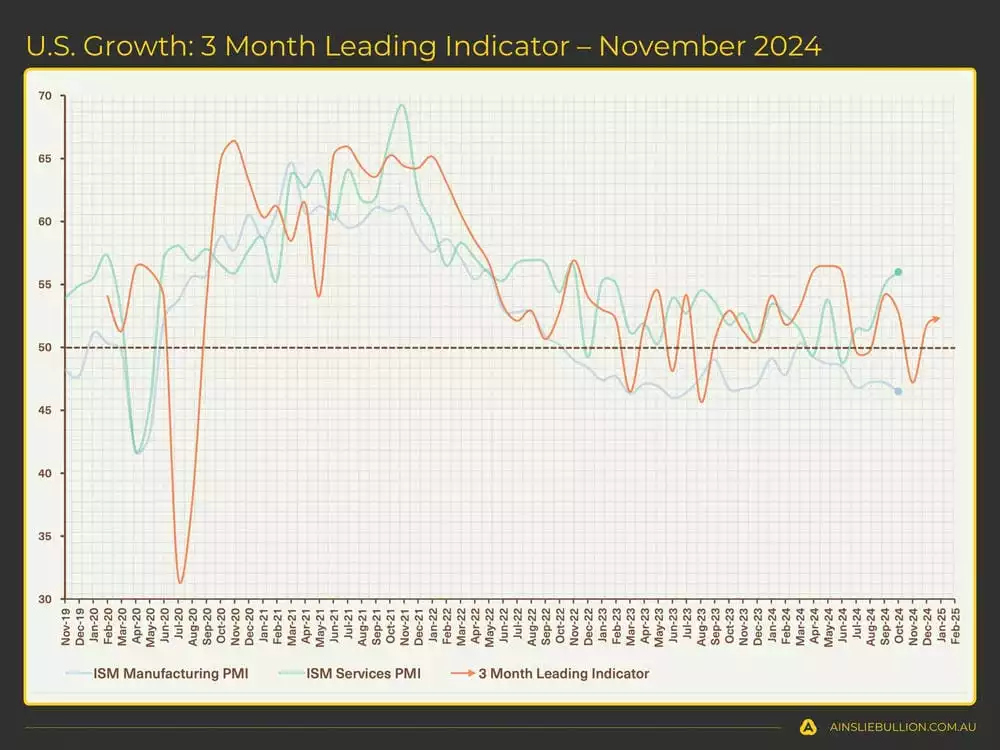

In terms of economic growth in the U.S., as evidenced by the ISM data, services are taking a strong lead that we expect to extend to manufacturing into the new year…

And the forward-looking indicator over the next 3 months supports the idea of the lows for growth overall being in place.

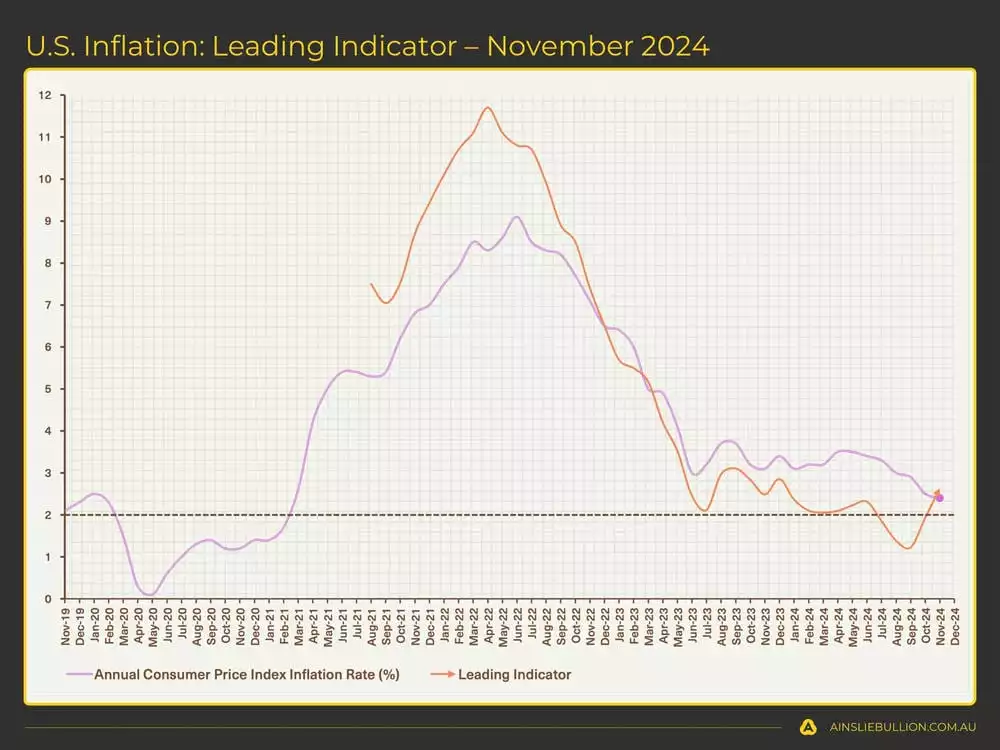

In terms of U.S. inflation, our leading indicator has moved above the lagging government reported rate for the first time in almost 2 years. Although both lines remain above the stated Federal Reserve target of 2%, inflation remains relatively low for now, but concern will increase over time alongside the leading indicator if the lows are in and higher costs are on the horizon.

Does the behaviour of U.S. Government Debt, Yields and the Dollar support where we think we are in the Global Macro Cycle?

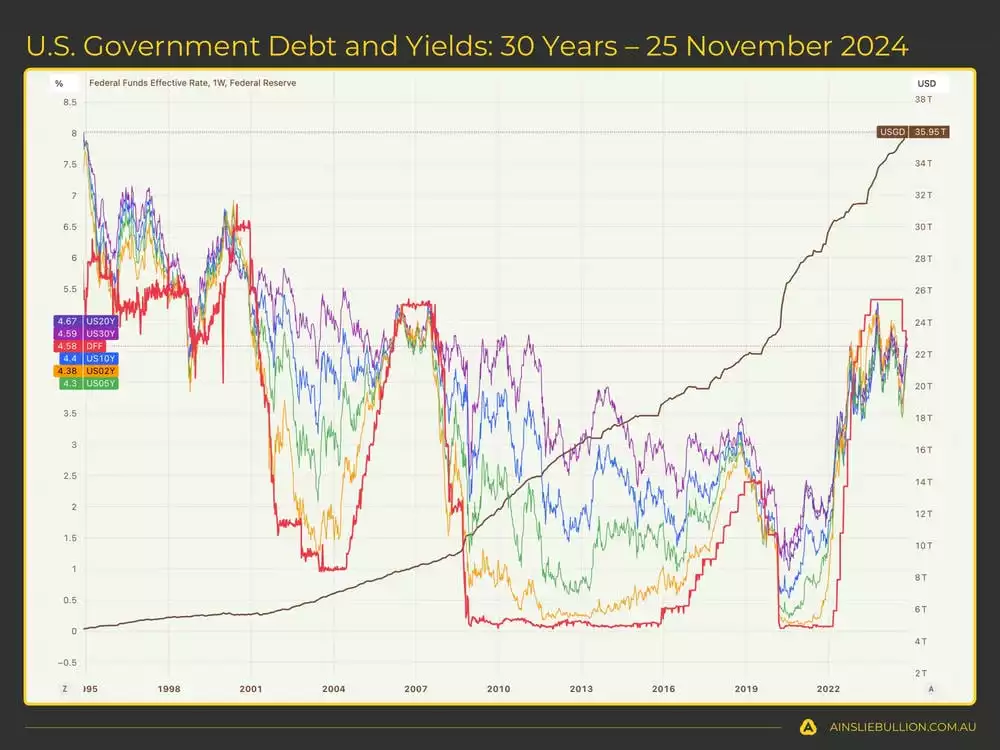

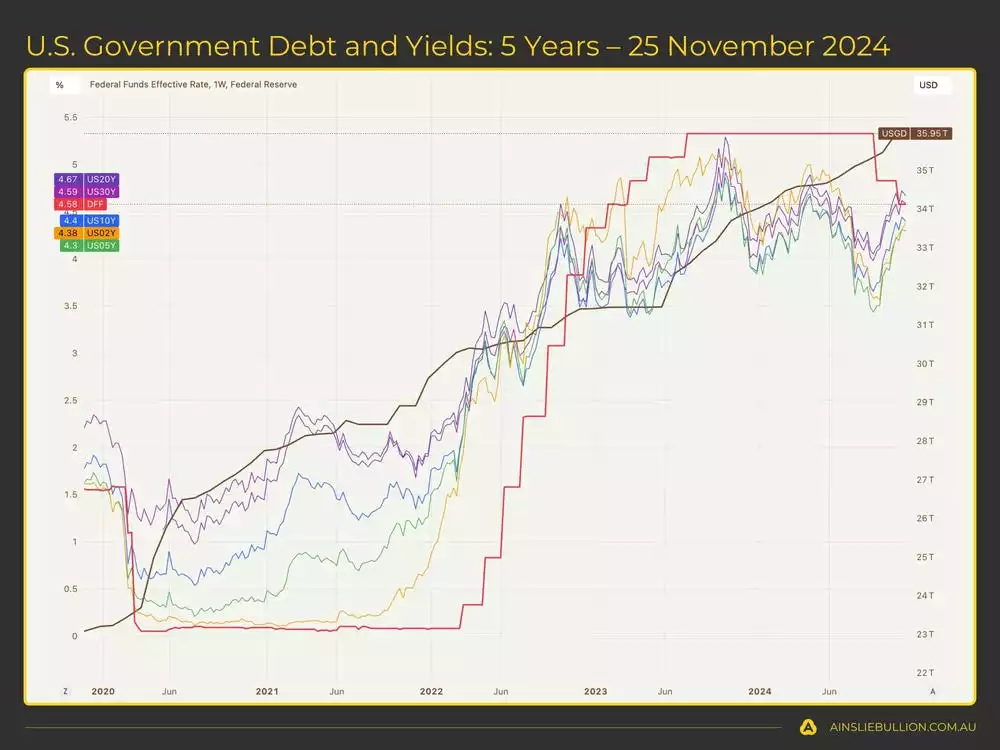

U.S. government debt continues its relentless, and increasingly exponential, march higher with no meaningful attempts to bring it under control.

Bond yields have persistently remained elevated, increasing volatility in the markets generally. They will need to start moving lower soon to give the Fed room to continue cutting rates.

The U.S. Dollar has bounced quite considerably over the past few weeks. This is inconsistent with the expectations for a falling Fed Funds Rate, but consistent with the currently rising bond yields. We expect the USD to peak and roll over, and we may have seen the first indications that this is happening, but a more substantial pullback will be required to provide much needed relief and increase overall Global Liquidity generally.

Looking more closely at Weekly Global Liquidity, does it support our expectations for the direction of the next move in the Global Liquidity Cycle?

At a weekly level, Global Liquidity has stalled in recent weeks, awaiting further tailwinds to offset the most recent lacklustre support from China and the U.S. in particular. The hope is for a weaker USD and falling bond yields to see the chart pushing back higher once more.

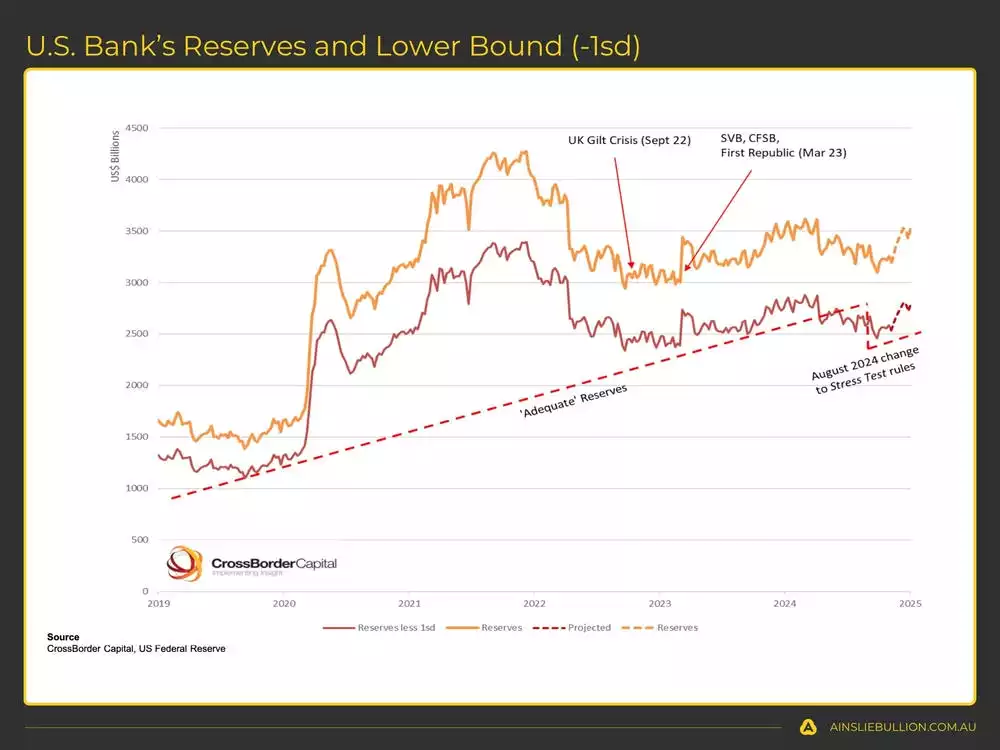

Until more substantial direct stimulus support is provided from the U.S. to increase Global Liquidity, they have been using a number of backdoor measures to keep reserves at the minimum levels at least, including changing the “Stress Test” rules.

Macro Assets for Macro Cycles

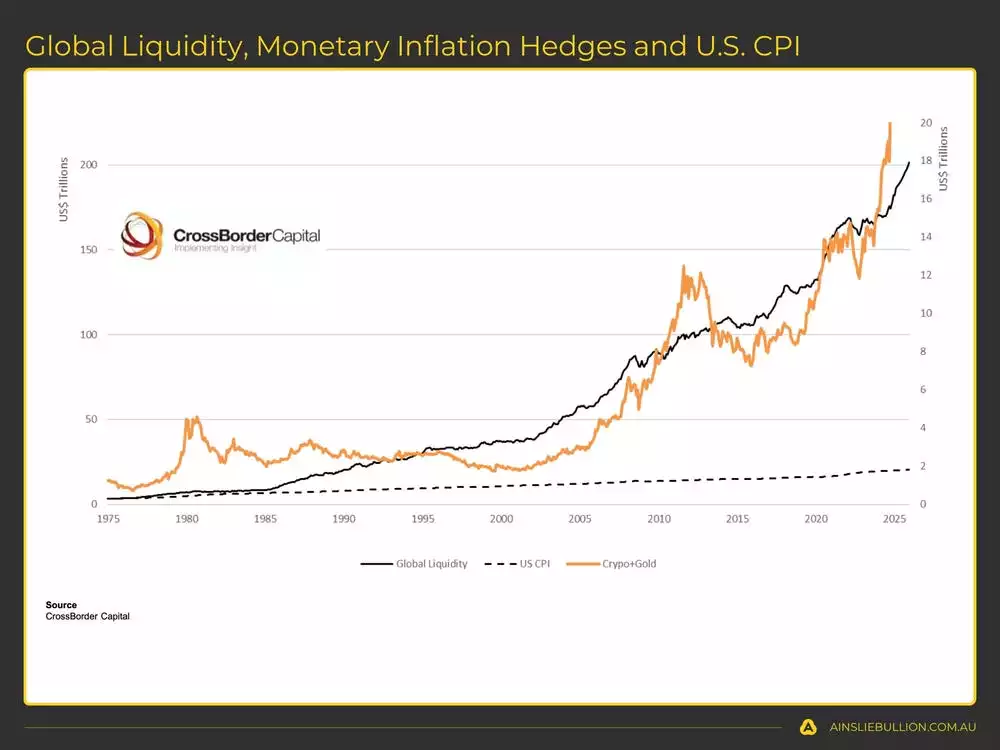

Understanding Consumer Price Inflation (CPI) is far less important than Asset Price Inflation in ensuring wealth isn’t eroded, and can actually grow, over the long term. A combination of Gold, Silver, and Bitcoin keep up with the growth in Global Liquidity over time, and the corresponding debasement of fiat currencies. As such we look to trade into each at the appropriate times to take optimum advantage of the cycles. When correctly timing and structuring the rotation, it is possible to significantly outperform ongoing monetary debasement.

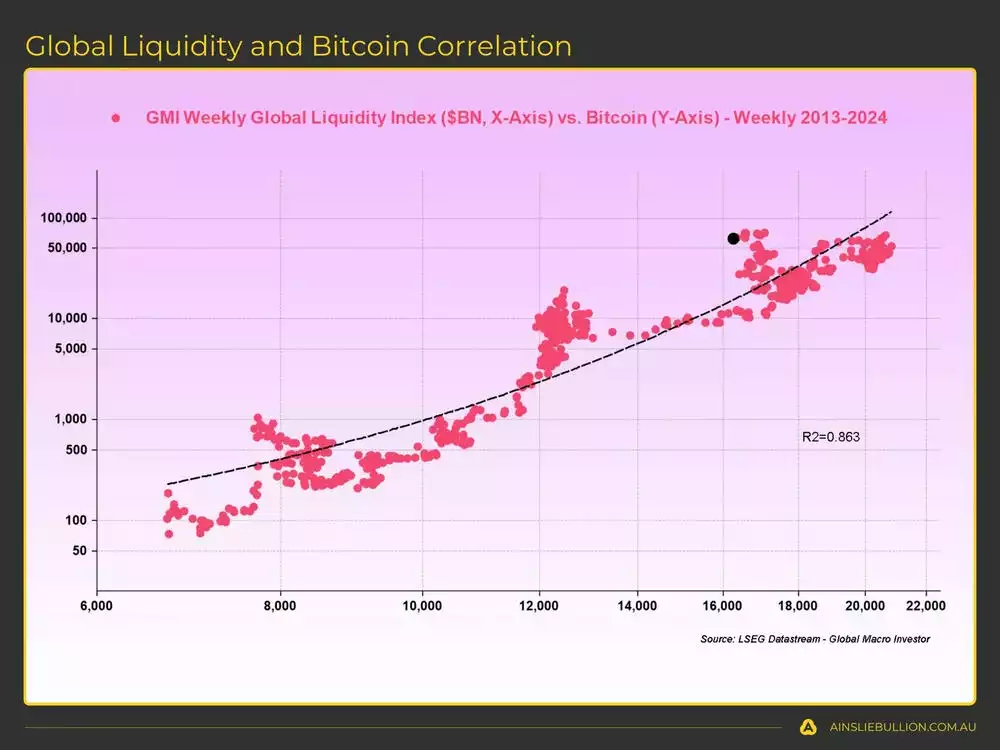

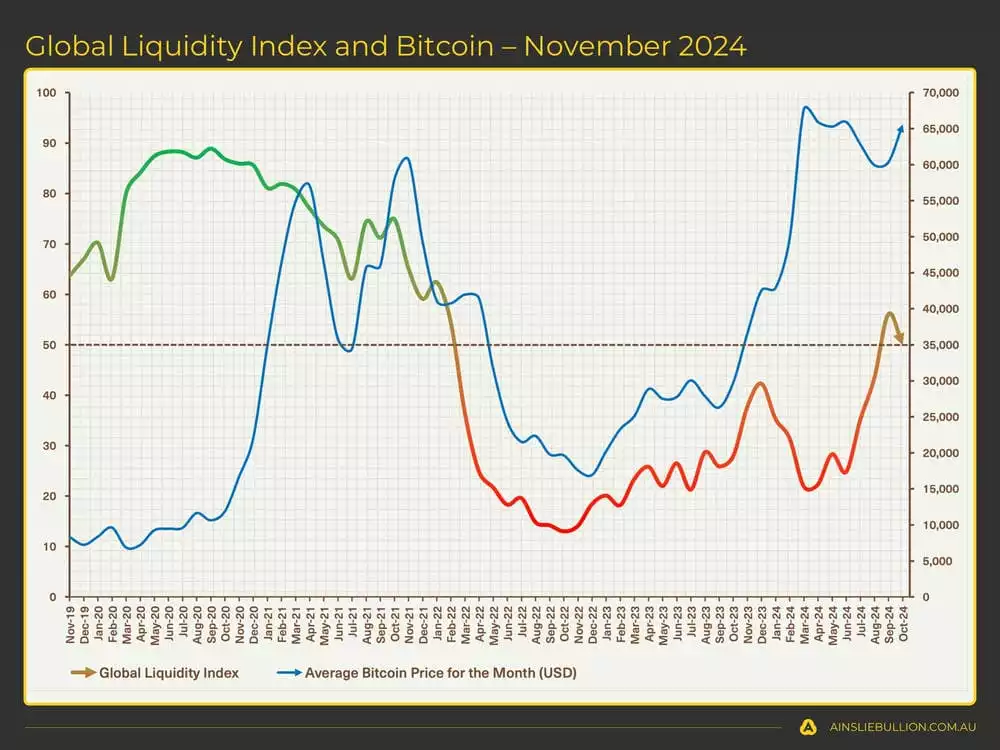

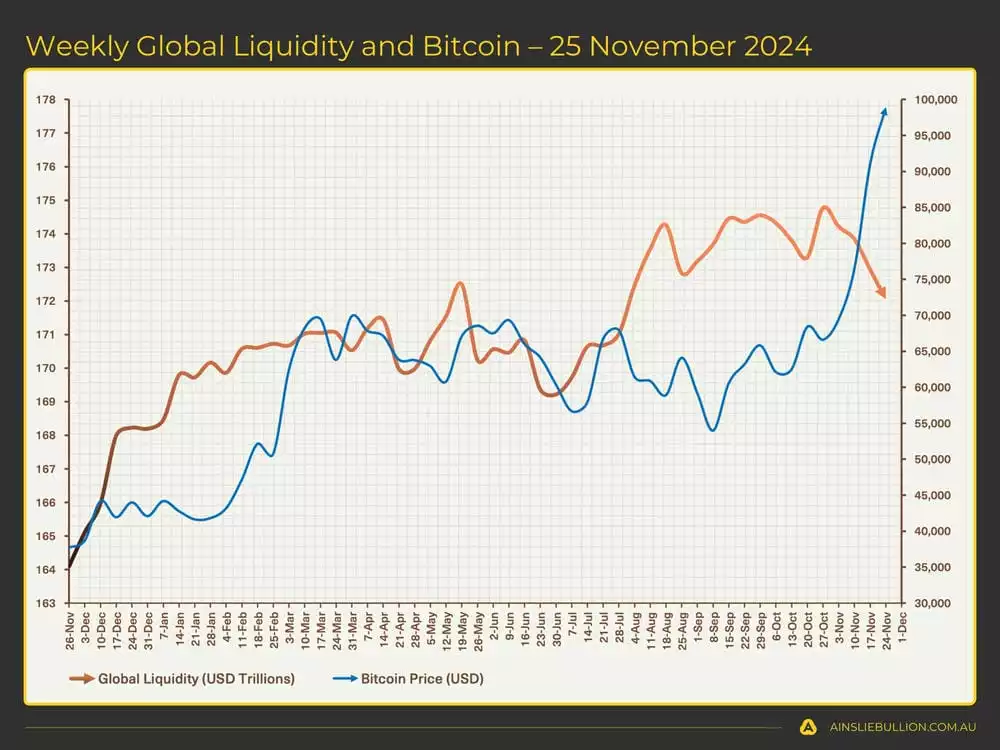

Bitcoin is the most directly correlated asset to Global Liquidity. Trading Bitcoin can be thought of as trading the Global Liquidity Cycle, but with an adoption curve that leads to significantly higher highs and lows each cycle.

The Bitcoin cycle low was in November 2022, and since then the returns have been unmatched by any other major asset. The sideways price action that has dominated for most of 2024 has resolved to the upside as Global Liquidity conditions continue to improve.

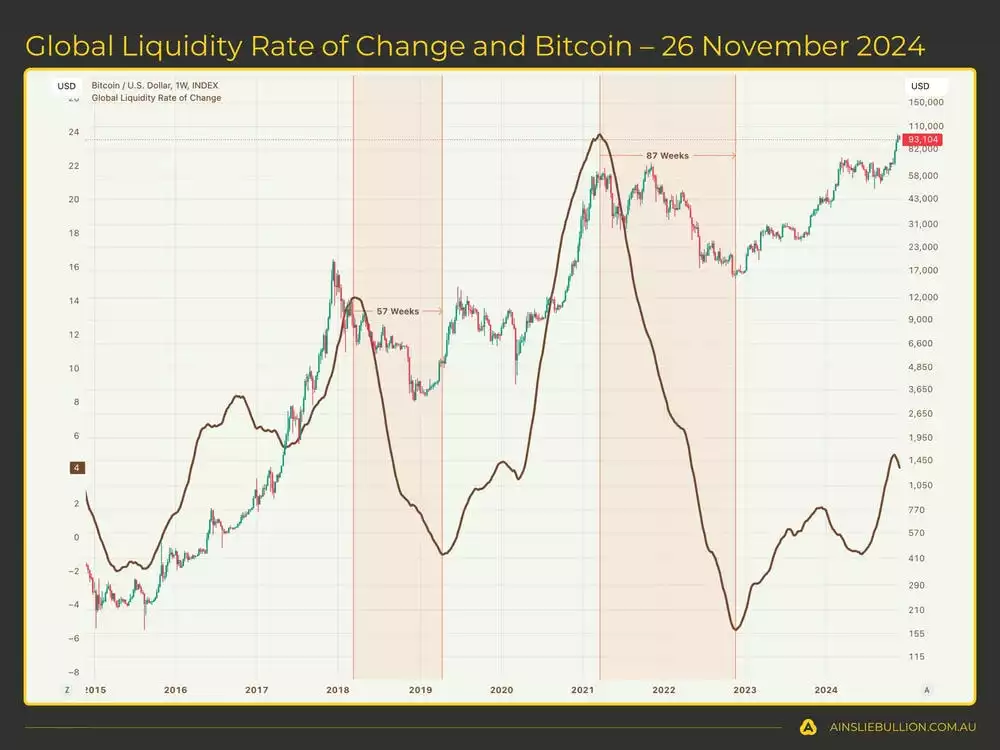

Zooming out, and looking at Bitcoin on a log scale, the picture becomes clearer that the rate of change for Global Liquidity remains supportive, which should continue to flow through to the Bitcoin price for longer in this current cycle.

At the weekly level, Bitcoin and Global Liquidity are showing some divergence, with Bitcoin likely front-running the expected Global Liquidity to come into the end of the year.

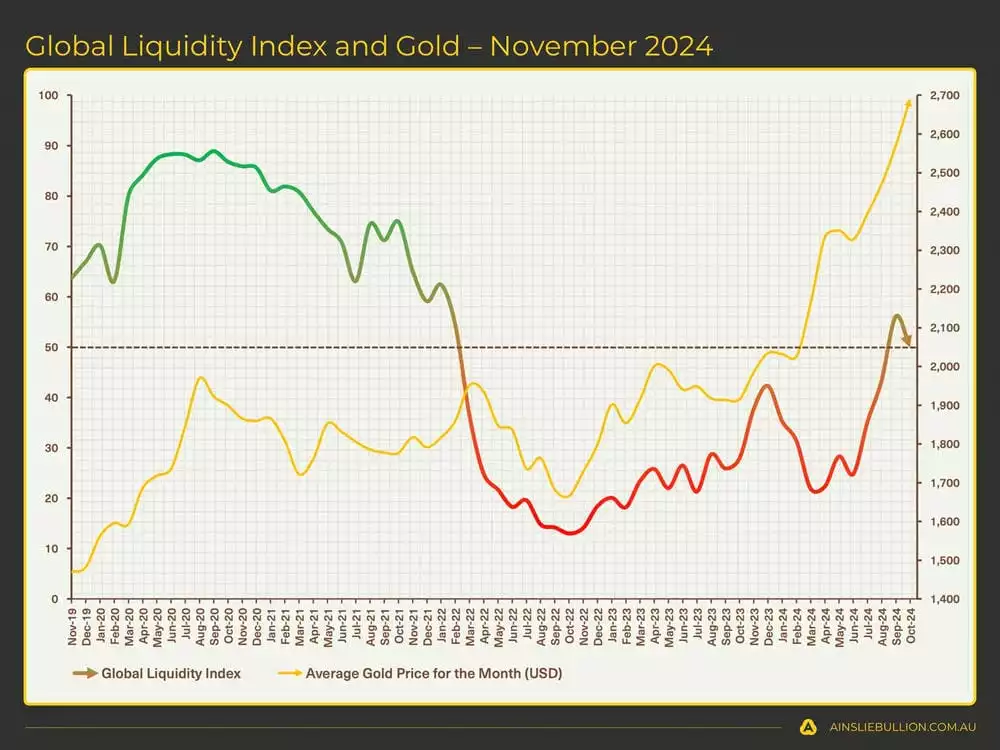

The Gold cycle low was in September 2022 and the price has been rising consistently with an improving Global Liquidity picture ever since. The recent strength has seen a run of new all-time highs which has been especially bullish.

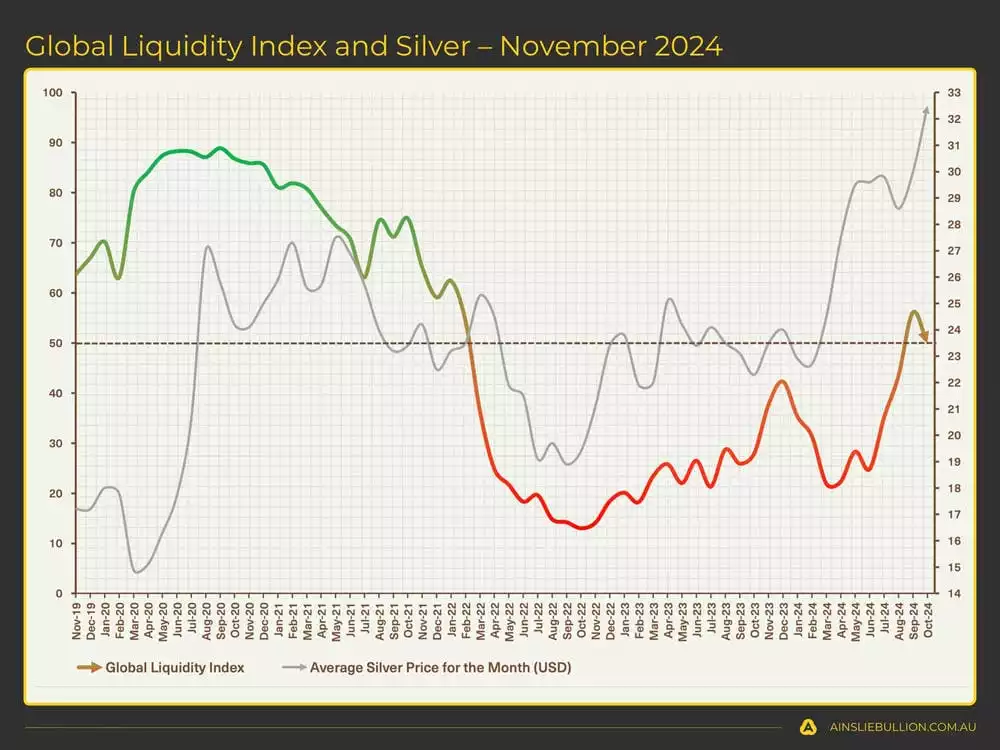

It is a similar story with Silver which also had a cycle low in September 2022 and has exploded higher with recent gains.

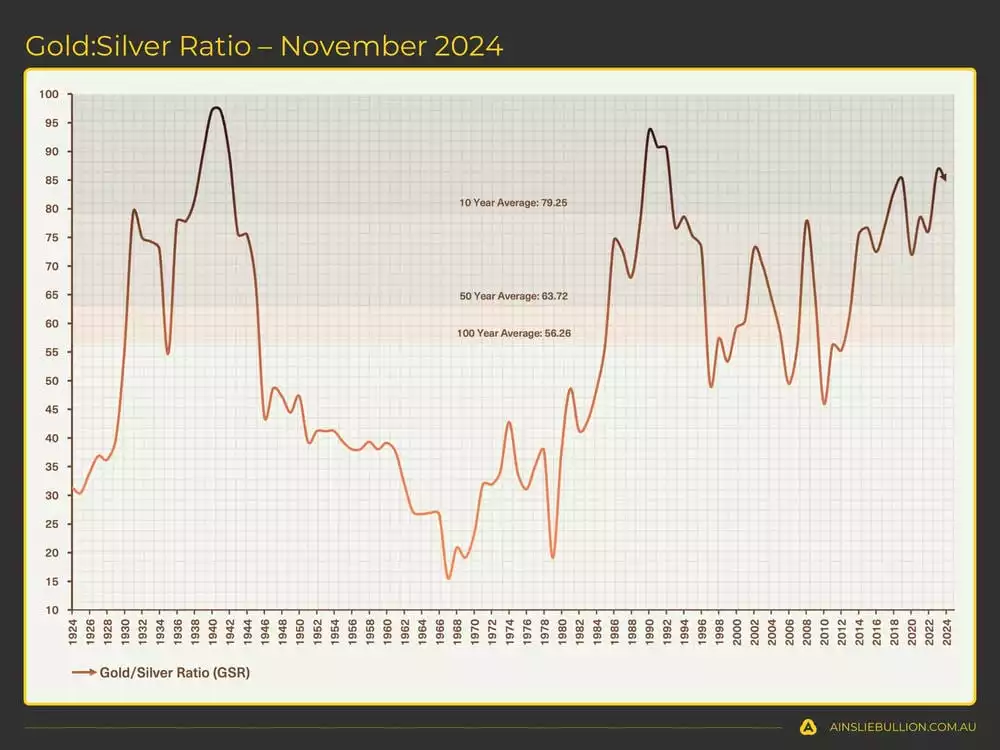

It remains prudent to key an eye on the Gold Silver Ratio (GSR). The current GSR remains at historically high levels, which could indicate a longer term trade opportunity to accumulate Silver now, to be traded into more Gold in the future.

A Simple Trading Plan to take advantage of the cycles

Watch the video presentation to see full details of the specific Trading Plan we provide, that you can follow, which has returned 235.0% p.a. as at Tuesday’s recording.

Watch the full presentation with detailed explanations and discussion on our YouTube Channel here: https://www.youtube.com/watch?v=BWUC4AQpktE

This was our last full Macro and Global Liquidity Analysis report for 2024, but we will return in January 2025. We wish you a happy and safe holidays before a prosperous new year ahead in the market!

Chris Tipper

Chief Economist and Strategist

The Ainslie Group

x.com/TipperAnalytics

Note: The monthly video presentation is recorded live with our expert panel. Our objective is to make the updates as useful and specific to what you want to understand as possible, so as always feel free to reach out with any questions or feedback that we can incorporate into next month’s video to make it something that provides you with the highest possible value for your time!