The 18.6-Year Economic Cycle - What it Means for Land, Stocks and Gold Prices

News

|

Posted 20/08/2024

|

16881

Over the past 200 years, western economies have recorded an economic cycle that averages 18.6 years (The shortest on record is 17 years, with the longest being 21 years). Today we explore this cycle and its impact on land, stocks and gold prices – looking at where we currently sit – to help forecast what comes next.

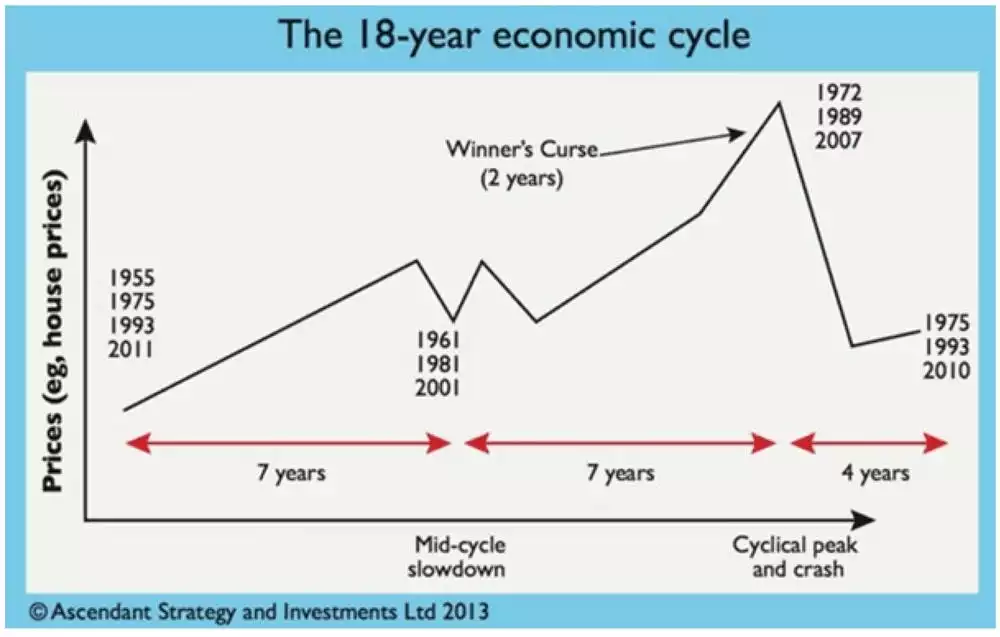

The 18.6-year cycle plays out as roughly 14 years of the economy rising - and 4 years declining. The 14 years up are divided by a mid-cycle slowdown - which creates enough recession fears for most market participants to avoid most of the second leg altogether - usually only returning to the markets later in the cycle (when assets are overvalued and over leveraged). These final few years of the up-phase - when most participants have returned to the markets and are fully invested - is coined the “winner’s curse” phase – it marks the final 2 years of the economy rising on average - following which, a secular bear market takes hold for approximately 4 years, wiping out the excess leverage from the system, along with most market participants - before starting all over again for the next 18.6 approximate years.

Source: Ascendant Strategy and Money Week magazine 2014

Source: The Secret Life of Real Estate and Banking

Notice the approximate 18 years between each land cycle boom – uncanny.

Understanding history helps us form an informed view of where we currently sit in this cycle, and more importantly, where we are headed.

For the purpose of this article, we will divide the 18.6-year cycle into 3 phases. Phase 1 is the first 7 years of the uptrend. Phase 2 is the next 7 years of the uptrend. Phase 3 is the 4 years of the downtrend. As this is a macrocycle, all the periods are approximations and will vary slightly from cycle to cycle.

So, what is the dynamic between land, stocks, the U.S. dollar and Gold across the 3 phases?

In Phase 1 we find the U.S. dollar gains strength against other currencies with the U.S. economy leading the charge, in the recovery phase. We therefore see the DXY move up, in conjunction with U.S. stocks and land prices. Gold moves into a healthy accumulation phase after experiencing a sustained run-up during Phase 2 and Phase 3 of the previous cycle.

In Phase 2 we find increased liquidity in the system, globally - we see stocks and land continuing to move up while becoming increasingly over-leveraged, with higher price-to-earnings ratios on stocks and increased debt on land. With liquidity flooding into the system, increasing the supply of currency - we find the dollar losing value, with the DXY settling into a downtrend - and hard assets like Gold gaining value, settling into a new secular uptrend. As we move into the final years of Phase 2, the winner’s curse phase - we see the U.S. dollar index (DXY) fall off a cliff; we see stocks and land get over-leveraged and overpriced - unsustainably so; and we see hard assets like Gold and Silver perform incredibly well, in a sustained uptrend.

In the winner’s curse phase, we see investor sentiment becoming overconfident and complacent as all assets move up together - investors can do no wrong, everyone is a “winner”, and their unstoppable winning streak ends up becoming their curse, as risk management goes out the window, they get over leveraged - just in time for everything to come crashing down.

This leads to the final phase of the cycle - the collapse.

In Phase 3 we see systemic failures, banking collapses and resets. Land and stock prices crash - going from being overpriced to underpriced. The U.S. dollar starts to recover, after getting hammered in the previous phase. Hard assets like Gold and Silver continue to gain value as investors and central banks flood into precious metals to seek shelter from the storm. While some will avoid the sin of greed to avoid getting caught up in the collapse that follows - most will make decisions based on emotions and fall victim to a cycle that has been in play for centuries.

While stocks and land prices rise in Phase 2 and crash in Phase 3 - precious metals steadily increase in both Phase 2 and Phase 3 – gaining value through both the euphoria and the crash.

Phase 2 of the cycle (marked in red) and Phase 3 (marked in orange) - show the DXY getting hammered down in Phase 2 and moving sideways in Phase 3.

So where are we now? And what comes next?

Let’s go back to our most recent global financial crisis in 2009. Most assets reached their peak value around 2007 and by the time it was coined a “crisis” in 2009, most assets had already found a bottom price.

As the cycle has a minimum of 17 years and a maximum of 21 years (with an average of 18.6 years) and is measured from peak to peak - we can expect this cycle to peak (or Phase 2 to conclude) between 2024 and 2028 (with an average expectation of roughly mid-2025).

This means we are currently in Phase 2 of the cycle - on the lookout for the final phase of the uptrend, or the “Winner’s curse” phase - the final few years where markets become over-leveraged, and investors become overconfident - before it all comes crashing down.

Looking at the current market sentiment, we can see that most investors are barely confident, let alone overconfident – with recession fears still held by the mainstream consciousness. So, while we are in Phase 2 of this cycle, we are not in the winner’s curse phase yet – however, we can expect it to be around the corner.

So, what exactly comes next? If history is any indication - a flood of liquidity and leverage – leading to a collapse.

The Gold price (in pink) illustrates how gold moves during both Phase 2 and 3 of the macrocycle.

Looking at the DXY today - the 50% of the move up which started in 2018 is at around the 101 level. This means that any consecutive long-term closes below this level show objective weakness in the U.S. dollar. Currently sitting quite heavy on the 101 level, signals the DXY could be on the verge of recording macro weakness - pushing us further along Phase 2 of this cycle, as expected.

While navigating stocks, land, and the U.S. dollar will be chaotic leading into the euphoria and greed of the winner’s curse phase - and the collapse that follows – hard assets such as Gold and Silver will play a key role in providing steady, sustained growth - and shelter from the chaos - for individuals, organisations and governments, in the many years to come.