‘Do as they do, not as they say’ – Why Central Banks Are Buying Gold

News

|

Posted 07/03/2024

|

9786

Central banks, particularly in a post GFC hyper financialised world have become the masters of the financial universe. Never before have markets hung off every word, every poignant pause, every action of the US Fed, BoJ, ECB, etc. Why? Simply because the debt pile is so egregious, so perverse and, in the words of the very head of the US Fed, so “unsustainable”, that we have become reliant on central banks to maintain an ample enough supply of new liquidity to service that debt and stop the whole Fiat house of cards imploding.

They are now in an untenable situation, caught between an inflation/hot market rock and a debt servicing hard place. Keep rates high and quantitative tightening and the debt servicing becomes impossible with all liquidity sucked out of the market. Drop rates and turn to some form of QE (money printing) now and risk inflation spiralling again and even more money into a very toppy looking tech sector.

Their mantra is ‘all good, nothing to see here, move along’…. ‘we’ve got this’…..

On no traditional assessment should gold be at all time highs right now. Rates are high, and more importantly real rates are high, and yet these traditional headwinds have seemingly done nothing to hold gold back. So why are we at all time highs and strong conviction to this being just the START of a gold bull market?

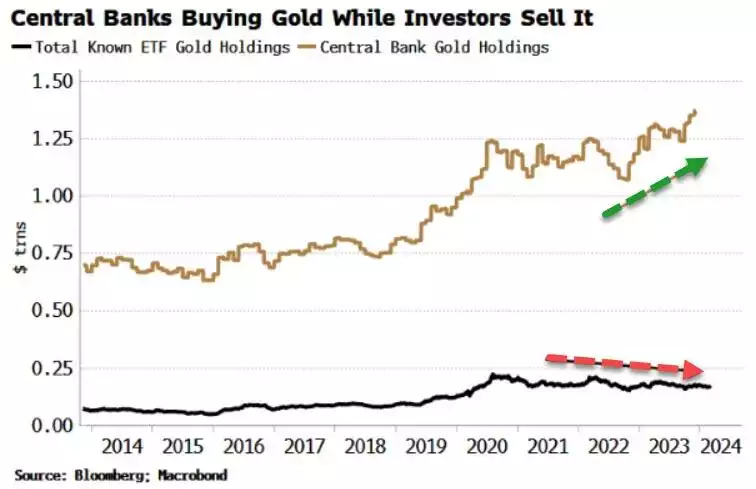

Prices are high now because the very same central banks have been MASSIVE buyers of gold in recent years and still going strong. They, quite simply, are looking through this setup and preparing. Bloomberg macro strategist Simon White explains:

“Powell might not be overly worried about inflation - with his recent comments reiterating the Federal Reserve is on track to cut rates this year - but other central banks are not so relaxed. Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation.

Gold’s move in recent days has been broad as well as pronounced (as well as hinted at by low gold vol), with the precious metal making 50-year highs versus three-quarters of major DM [developed market] and EM [emerging market] currencies. The biggest holdings of gold after jewellery are for private investment - ETFs, bars and coins - followed by central banks’ official reserve holdings.

In recent years the swing buyers have been ETFs, which hold about 2,500 tonnes of gold. But ETF holdings have been falling even as the dollar price of gold has been rising.”

“The dollar has been stable and real yields (which anyway have a non-linear relationship with gold) are higher over the last three months. The bulk of seasonal buying, for instance Diwali in India, is likely behind us. Further, silver has not participated in the rise. It’s therefore a reasonable supposition the official sector, i.e. central banks, has been a significant driver of gold’s recent ascent to new highs.

In the runup to the pandemic, and again in the aftermath of Russia’s invasion of Ukraine, global central banks have continued to add to their gold holdings even as ETF investors (perhaps dazzled by the bright lights of crypto) have reduced theirs.”

“Over the last six months, China, Germany and Turkey have increased their gold holdings by the most (these are official holdings - when it comes to China, its true holdings are likely much higher than stated).

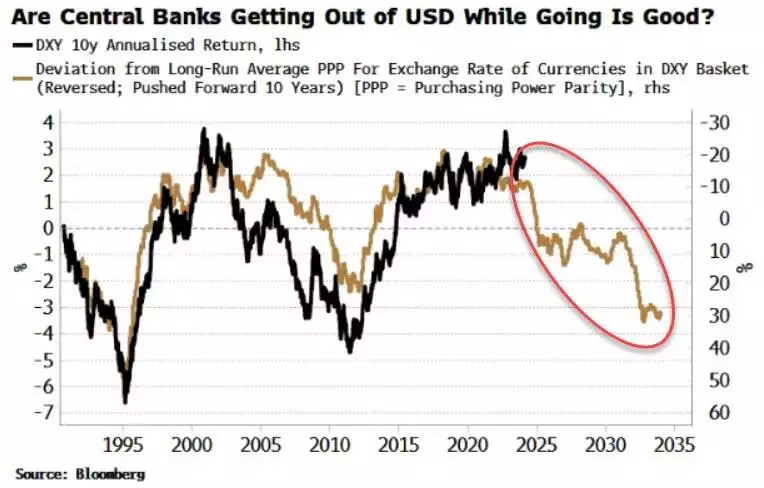

Central banks want gold as it is a hard asset, not part of the financialized system when owned outright. But the dominant reason is a desire to diversify away from the dollar. If you’re not on friendly terms with the US, then it is a way to avoid your reserve assets being seized, as happened to Russia.

But central banks everywhere are quite possibly uneasy about owning too many dollars when the US is running large, inflation-causing fiscal deficits. The dollar is structurally overvalued on a purchasing-power-parity basis versus the main DM currencies. As the chart below shows, this points to dollar underperformance in the coming years.”

“Investors in gold ETFs may not see much risk from inflation and to the dollar, but central bankers are signaling very much the opposite.”

As we discussed this week and in our last Ainslie Research: Macro & Global Liquidity Analysis update, gold is an each way bet on how the current disconnect between the Fed Funds Rate (FFR) and US Treasuries yield plays out. The current FFR minus US CPI equation, being real rates, is completely incongruous with gold at this price. The smart money and the very controllers of this globally, are looking through this narrative and buying up big.

Don’t do as they say, so as they do. The writing is so clearly on the wall.