Remember Capital is King – Implications after the #*not a recession*

News

|

Posted 14/11/2023

|

2181

Let’s start with the definition we have chosen for *not a recession*. For the purposes of this article *not a recession* is defined as ‘higher for longer, everything is fine over there, but in a GDP per capita recession, but definitely isn’t in a recession’ economy. This is the world we are in and entering into a new phase that will structurally shift the global economy in 2024, today we investigate the structural shift and its implications for inflation and the global economy.

As M2 money contracts and the cost of capital continues to increase, the phrase ‘Capital is King’ will be a defining one in 2024. With huge government deficits, trade disruptions and mergers occurring in 2023, what will this mean for 2024 and inflation?

M2 Money Collapse

As the M2 Money Collapse to the deepest level since it has been measured, as per recent @GameofTrades_ tweet, the world is reminded of a phrase that had seemingly disappeared from financial markets… ‘Capital is King’. No more so is this true with the proliferation of zombie companies, increasing mortgage payments and increasing debt.

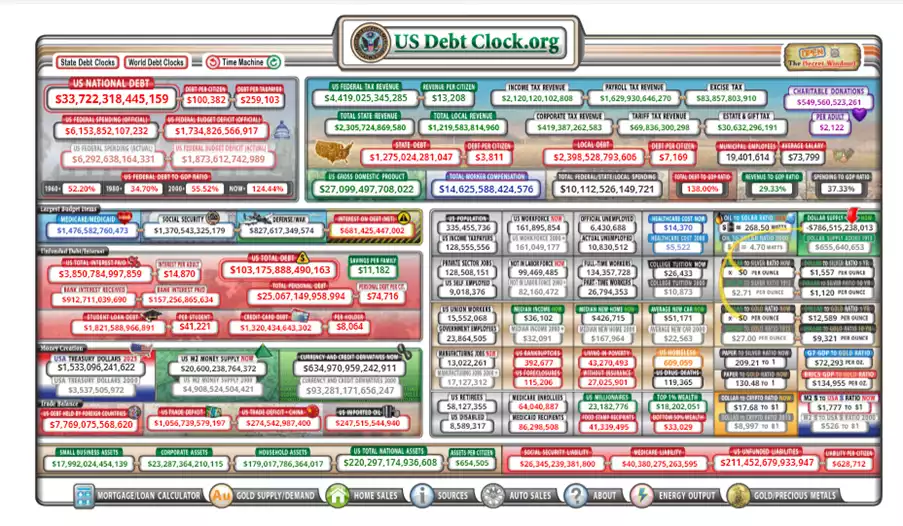

No more is this apparent than in the US with its spiraling debt according to this morning’s debt clock topping a whopping 33.73 trillion.

After the shocking 30 year bond auction last week, lets now investigate how Capital is Really King. Next year the US needs to raise $7 trillion in replacement bonds, these are bonds that are reaching maturity, AND on current deficit estimates they need to raise an additional $2 trillion to keep the lights on, but based on this years deficit this is likely to be closer to $3 trillion.

The total M2 money supply in the US is $21 trillion, and next year the US needs to sell $10 trillion in bonds, half of M2 money supply, or $830 billion per month. Last week’s failed bond auction was $112billion (now this was just 30year bonds, but still). You can see where we’re going here. Unless the US Government cuts its spending into surplus (near impossible, particularly in an election year) the Federal Reserve is going to have to step in and increase money supply, just to support the government, forget the economy…

Now as all Central Banks have learnt recently, increasing money supply at a rapid rate, which according to the deficit and bond market numbers seems unavoidable, will stoke inflation. What will make this worse, we discuss below, is the structural damage to the global economy will also put pressure on inflation. We discuss one such industry, transport, below.

Transport Recession and increased time to trade

There’ve been quite a few articles lately on the current wars in Israel and Ukraine and droughts in the Panama canal increasing the time to ship, their disruption to trade and the cost to shipping. Shipowners are facing huge queues, being forced to sail around South America or pay extra fees for early Panama crossings. Choosing the Suez Canal, adds up to 10 days (if the Suez canal is used as an alternate route). The Panama canal had a recent auction to jump the queue, with Japans Eneos Group paying a whopping $3.98million USD for a quick pass through the Panama Canal.

But lets now go back to the ‘Capital is King’ view of this. All these ships taking weeks more to ship goods around the world in itself is tying up capital by increasing shipping times and therefore supply chains. Now in a 0% interest environment this is not an issue but in a 6% environment, on $1million over 2 weeks, is an increase of $1200, not to add the increased shipping and fuel costs.

Zombie companies being acquired, reducing competition

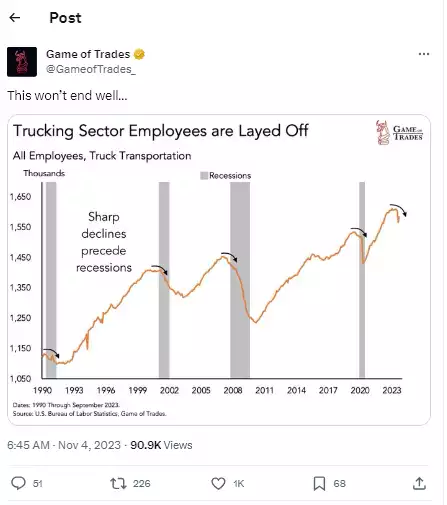

Appropriately at Halloween we issued an article on the Zombie companies plaguing the world Halloween and the Zombie Central Banks | Ainslie Bullion. Keeping on the transport industry, which with increased costs and dropping freight there have been huge redundancies and mergers as the high debt companies, who saw fast growth and high capital return over the last 15 years, suddenly become worthless with increased cost of capital eroding these profits, and increased debt cost eroding their equity. With huge layoffs, most recently Maersk laying off 10,000 staff and as per Game of Trades_ recent tweet, a sharp decline is becoming apparent.

With these contractions in volumes and layoffs, mergers and acquisitions have begun to accelerate, Mergers and Acquisitions Market Begins to Accelerate | Transport Topics (ttnews.com), in the article it identifies the M&A activity accelerating within the industry, with industry buyers

‘The investment banking and advisory firm Republic Partners found M&A deal volumes are down 25% to 35% year-over-year. But that has picked up as the sector heads toward the end of the year, with much of that activity coming from strategic buyers. These companies operate in the same industry as their acquisitions, as opposed to a financial buyer.’

But what you can see in the transport industry is contraction and merging of this capital intensive companies to fewer, stronger, well capitalised companies which after the *not a recession* will control more market share and become more monopolistic, which will fuel inflation as price gouging becomes easier with less competition.

Long Term Inflation

Transport is a sector of the Global Economy that we’ve chosen today to illustrate what the long term impact of a global recession may have on inflation. As industries collapse, contract and merge due to the high cost of capital, meaning previous zombie companies are taken over by their more capitalized peers, a more monopolistic global economy will emerge after the *not a recession*. What this means for the world economy is something Australians are well versed in that monopolies and duopolies cost more due to the rent seeking abilities and as the world economy emerges from *not a recession* inflation will increase rapidly unless governments are able to control the corporate beasts they create and control their own spending. Additionally with increasing global disruptions from droughts to wars, cost of capital will also keep fueling inflation as interest rates continue to rise to control inflation. So as we move from ‘higher for longer’ as a recent Morgan Stanley report touting a rapid drop in interest rates starting in June 24, the world should all be wary of what will emerge – inflation from increased global conflict, inflation from transport, inflation from industry consolidation and monopolies and of course.. inflation from government spending.