"Just Close The F*#kin Door" - Powell – Worst US Bond Auction

News

|

Posted 10/11/2023

|

2519

Public, foul language from the Chair of the Federal Reserve…Of course, he was just talking to climate protestors who shouted over his speech. But, Powell did also close the door on recent gains in the stock market and was clearly frazzled by what happened in the bond market. The extraordinary moves in the world’s biggest (and world reserve) sovereign bond market may have closed the door on the ‘soft landing’ goldilocks scenario markets are desperate for.

A selloff in equity indices was bolstered by Powells comments that central bank officials "are not confident" that interest rates are yet high enough to finish the battle with inflation. He also used more aggressive language in regard to timing, stating that "we will not hesitate" to tighten further if appropriate.

Since his speech earlier in the week headlines have been openly calling Powell "Dovish". For those unfamiliar with economist jargon, this typically refers to a Fed chair that is not looking to raise rates and fight inflation, but rather cut and let easy money fix the problems (what has to be done later anyway, right?). The more recent comments by Powell re-establish him as a hawk and may have put an end to the tech-led surges in major indices.

But Wait, There's More

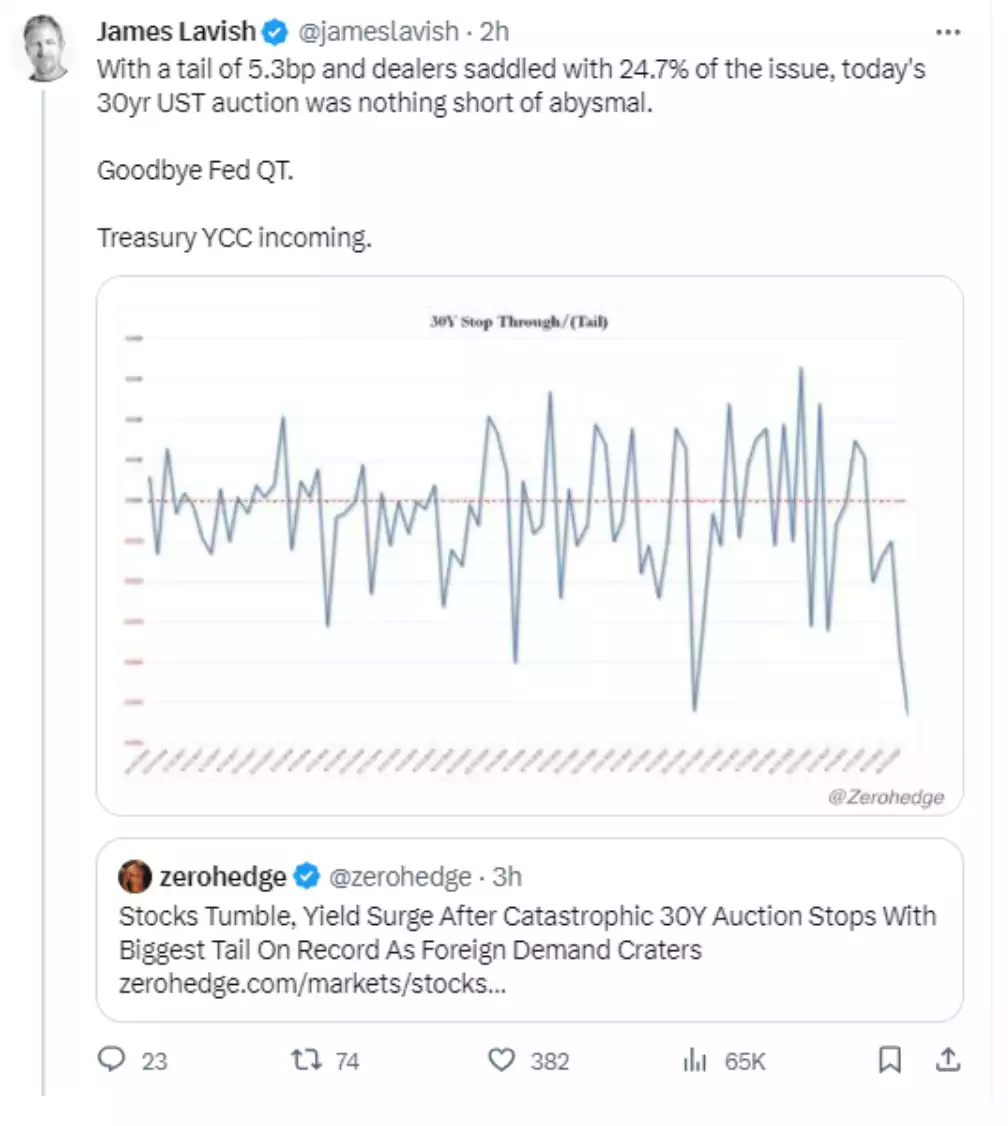

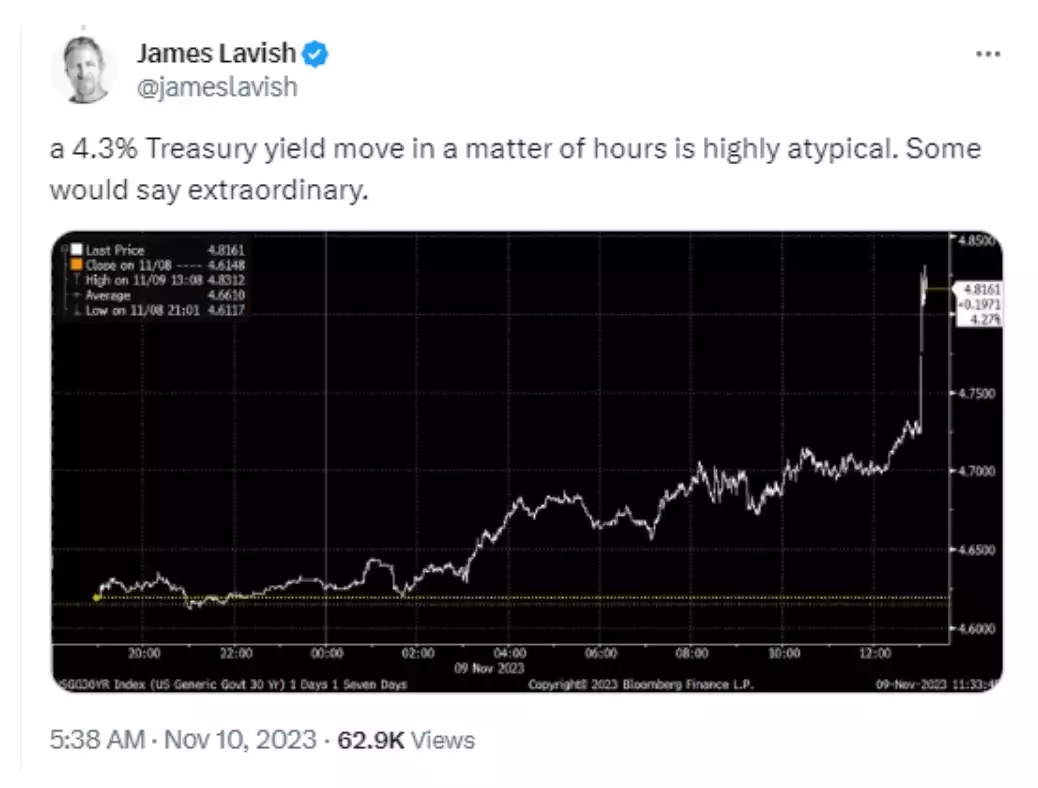

About an hour before Powell's speech, the major indices moved sharply lower after Treasury yields jumped due to the auction of 30-year US bonds. That auction was one of the worst in history. As the Fed needs to issue more and more bonds to fund more and more deficits with fewer and fewer buyers… well, you can do the math. And the math was terrible. One of the biggest auction tails on record:

And a distinct feeling of something ‘breaking’…

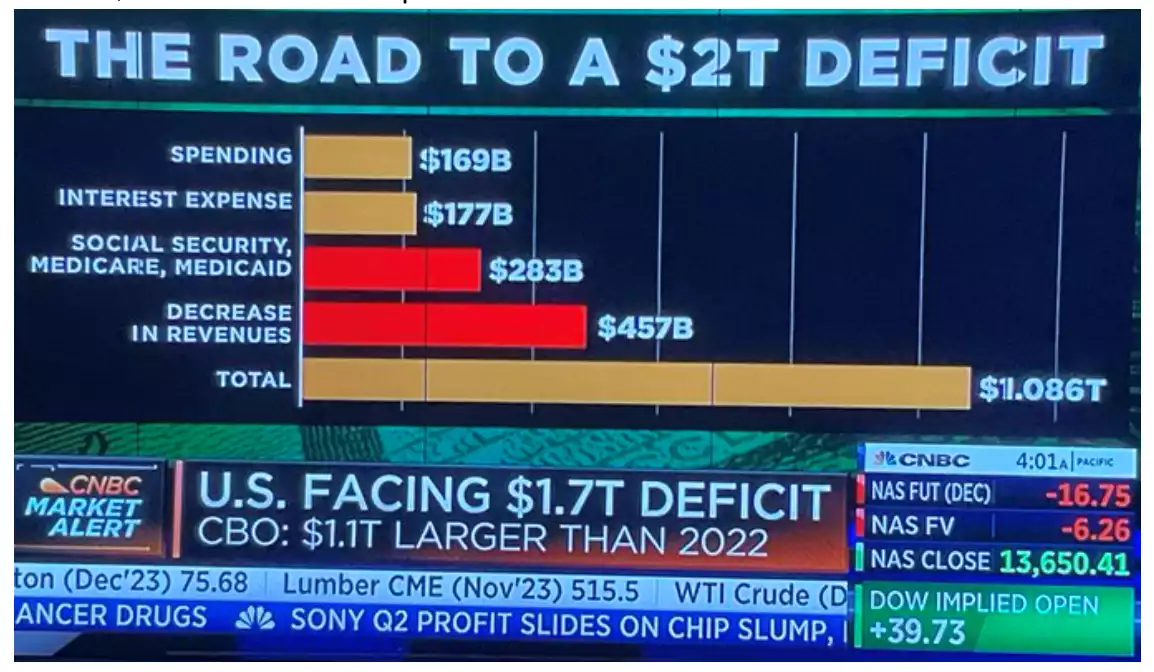

And when we talk about growing deficits, we aren’t talking incremental, just ‘mental’…an EXTRA $1.1 trillion in 2023 compared to 2033….

The 10-year Treasury yield US10Y has popped back up to 4.64%. Powell's comments acted as a second blow to the indices but did not damage all markets.

The US Dollar, gold, and oil all benefitted from these events. Below we can see Gold, priced in Australian Dollars, which had an aggressive rise.

Gold has received a resurgence in safe-haven appeal due to the most recent war, but we have just seen another rise up in its price for purely economic worries - no extra kinetic bombs or bullets needed…just the financial bomb that is the world economic set up. It even rose in the face of a strong USD. This should not be a surprise as investors are always looking for a place to park their money to achieve the best returns, as well as safety. If the Fed is coming after the stock market with hawkish rhetoric, buoyed by surging US bond yields, this makes gold a potential option as one can see in the chart above.