RBA Missing the Race

News

|

Posted 06/11/2024

|

1200

With all the U.S. election noise in the past few days, many people may have sidelined two key Australian events. The Melbourne Cup, won by Knight’s Choice paying 80:1 odds, and the Reserve Bank of Australia’s (RBA) rate announcement – its 8th in a row of holding rates steady at 4.35%. Last Melbourne Cup without the Shadow of the U.S. election, the RBA made the bold decision to raise interest rates to 4.35%, looking back at the news commentary at the time this would have been a tough decision but one that appears to have proven right so far, but with the rest of the world now truly in a race to the bottom, how long will the RBA hold, and have we missed the start of the race?

RBA Commentary Yesterday

Yesterday the RBA left its key interest rate unchanged for its 8th meeting, holding onto 12 months unchanged. After their two-day meeting, the board only considered the option of leaving interest rates on hold, looking for more evidence of reducing inflation. Michelle Bullock, Governer of the RBA, continues to refuse to speculate on when a rate hike or drop will occur, stating underlying inflation ‘was still too high’, and saying ‘We’ve made good progress. But as we’ve seen throughout the year, this last part of the job of getting inflation down is not easy or straightforward. We’re watching the data closely, and we’re not ruling anything in or out.’

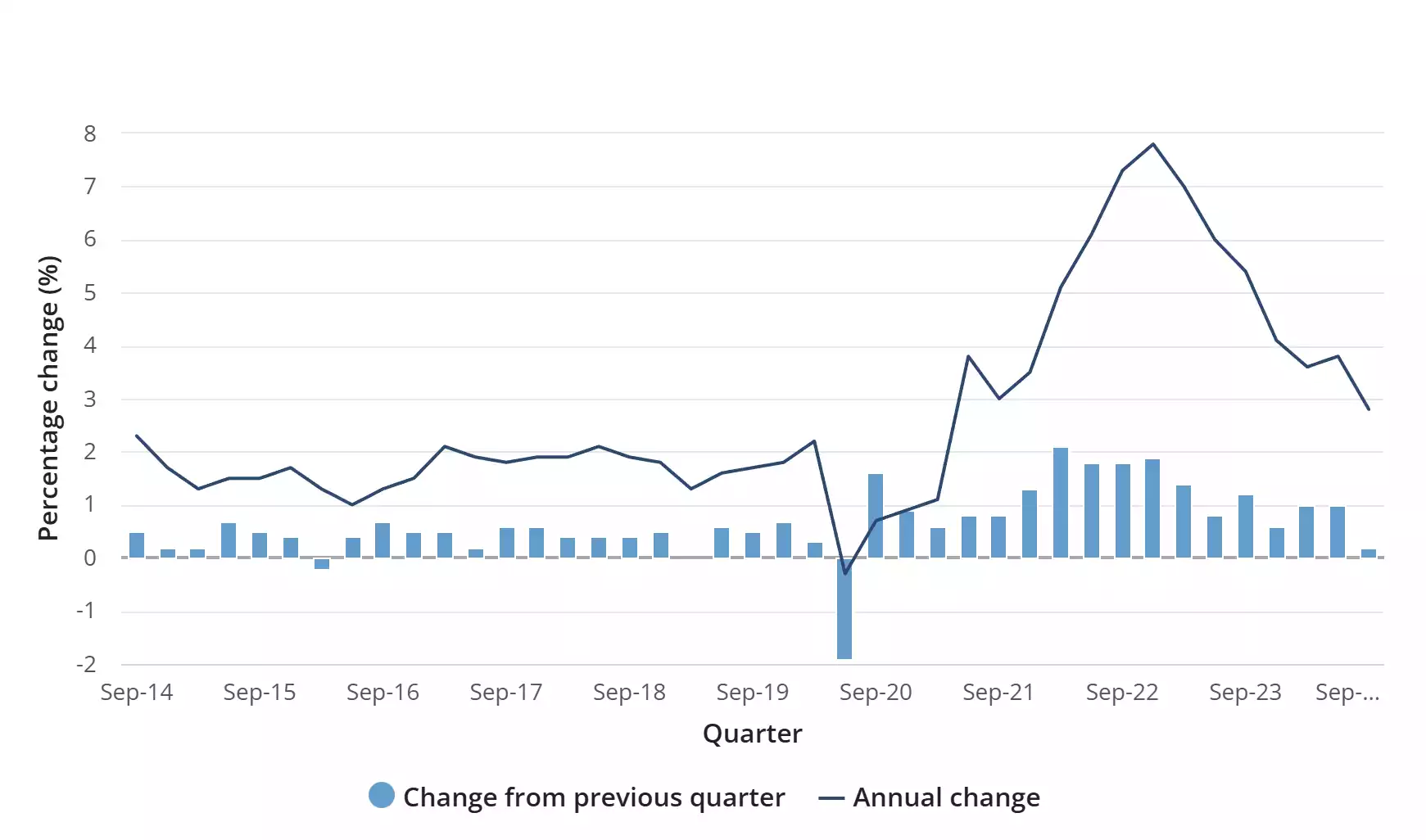

Underlying inflation remained at 3.5%, with the September quarter inflation dropping to 2.8%, coming off a peak in December 2022 to 7.8%.

The RBA statement suggests it will be some time before inflation is within their target range, with markets not pricing in a quarter-point drop until mid-next year. Since the announcement, the Australian dollar initially had a muted response, but has climbed nearly 0.5c since, climbing to 0.6638 this morning at the time of writing. If the U.S. dollar drops again this week, the Aussie dollar could continue to rise, which helps to dampen inflation as the cost of imported goods continues to reduce.

Is Australia missing the point?

The RBA has touted that the Stage 3 tax cuts that occurred earlier this year may help ignite inflation, however, it appears to have been an underestimation of the dire financial predicament of households. This prediction of ignited inflation may have meant they missed what other banks seemed to have acknowledged. Oil prices are falling and are likely to continue falling even with wars in Ukraine and the Middle East Ranging.

The World Bank has recently come out saying that there is a major shift in China, with oil flatlining due to the drive of the ‘Green Economy’ lowering demand. On the supply side, it is also recognised that with the U.S. now being the major oil producer, OPEC is likely to respond by increasing output, as they have stated;

‘Next year, the global oil supply is expected to exceed demand by an average of 1.2 million barrels per day,’

With the massive glut in oil production, it doesn’t take a great economist to predict these prices will feed into food and commodites, the World Bank now estimates that the oversupply may push down the price of commodities by 10% by the end of 2026.

Missing the start of the race

You don’t have to drive far anymore to see the effect it is already having on the bowser, with fuel sitting below AU$2/L at most petrol stations (something we have not seen in over a year). Similarly, electricity and gas prices appear to be moderating (at still high levels) for new contracts. This has started feeding through to the Australian Economy, and the World economy.

Charlie Billelo does a great job tracking who is hiking and cutting rates, and Australia appears to be one of the last holdouts… and we are still not talking about cuts!

Let’s see if Australia misses the interest rate race to the bottom. Hopefully by the next Melbourne Cup we will have joined the race.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=6Y_5JWM29Ng