The Rate that stops the nation

News

|

Posted 07/11/2023

|

2016

Today on the day with the Race that stops a nation –

The Melbourne Cup, and event that dominates the news on the first Tuesday of November. However, there is another headline that shares this date and that is the RBA rate decision. Much like the Race that Stops the Nation, the RBA holds a powerful decision on whether their Rate will stop the nation. This week the odds have been shortening to around 50/50 for an interest rate rise, with all Big 4 banks predicting it, and the IMF cheer squad supporting one. There have been four consecutive months of interest rate pauses, however, with increasing inflation and a resilient labor market this could be the month RBA breaks their short-term trend and lifts rates. With the nation under pressure, could this be the rise that finally pushes Australia over the interest rate cliff? One that many other nations have already experienced?

IMF Greenlight

With the IMF report into Australia last week encouraging further monetary tightening, a green light was given to the newly appointed RBA Governor, Michelle Bullock, who much like her predecessor, is damned if she does (with public and government backlash) and damned if she doesn’t (with month on month inflation starting to creep higher). Finally, some sense appears to be creeping into the government with Jim Chalmers finally conceding that the government needs to tighten fiscal policy. On Sunday ABC TV, Chalmers recently commented ‘I do think we’re going to need to make some difficult decisions about the infrastructure pipeline’. Lifting interest rates into a fiscal tightening change may therefore be the ‘Rate hike that stops the nation’.

The Race to the top is over

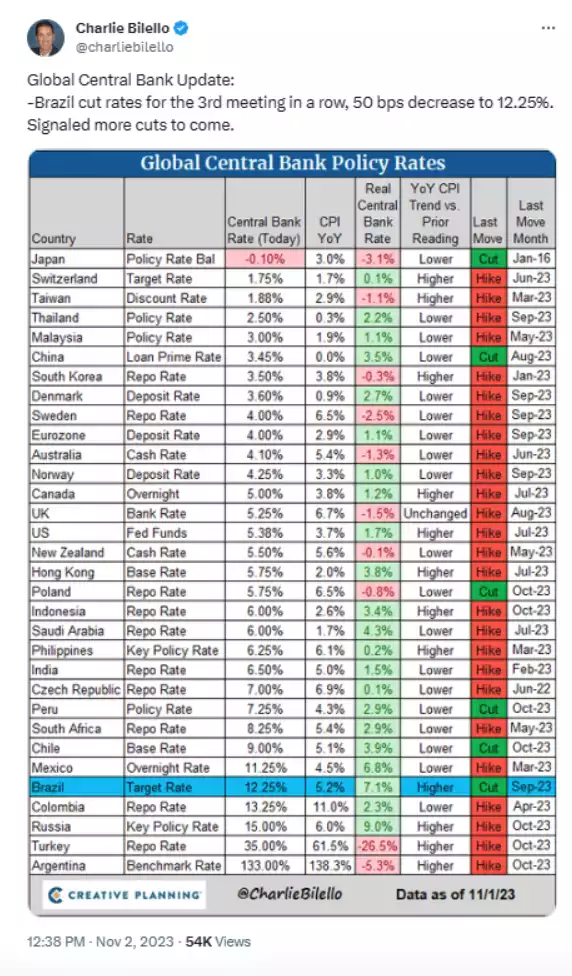

With inflation still above interest rates, monetary theory indicates we are still not high enough. With the September quarter CPI hitting an uncomfortable 5.4%, Bullock stated the RBA ‘would not hesitate to lift rates again if there was a ‘material’ change in the inflation forecasts’. As the RBA looks prepped to overshoot the race, saving the last run when the winners are already placed, there has been a clear exacerbation on rate hikes worldwide, with several notable countries now in recession including Germany and Canada. Australia is in a GDP per capita recession and others are looking likely to follow down the rabbit hole in the coming months including the Eurozone and the US, the situation is dire. So, have the Central Banks overtightened and is the race well and truly over? A recent tweet from Charlie Bilello, who tracks the Global Central Bank moves whilst deducting CPI, still shows inflation outstripping interest rates. However, the list of overtightened, including New Zealand and the UK, continue to grow, and these interest rate rises are starting to show strong signs of exhaustion.

Higher for longer or The New Race to the Bottom

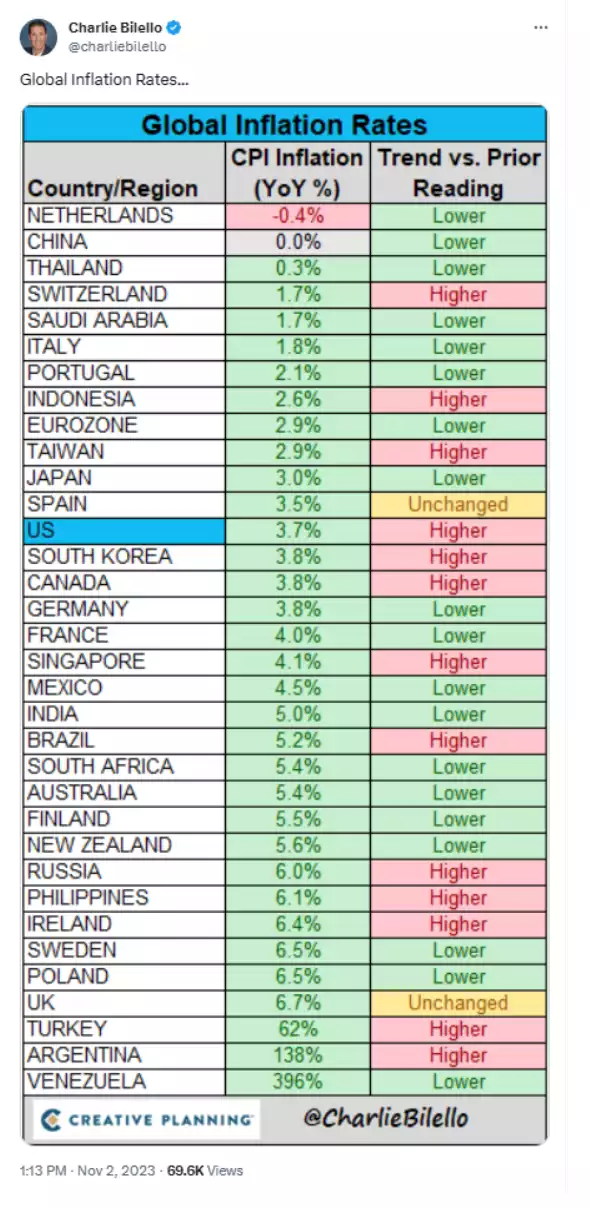

Back in 2017, a race to the bottom of the interest rate levels was seen worldwide, with many countries hitting lows of less than 0%. The longing for these “good ol days” of ultra loose monetary policy should come with a caveat that this is what in fact created todays current inflation nightmare. Furthermore, an additional tweet from Charlie Bilello shows that CPI inflation appears to be moderating, with 15 countries CPIA prints still higher than in the past with 2 unchanged and now 19 lower.

As more and more countries start entering recessions, will next year’s race go against the ‘higher for longer’ rhetoric? And will the next race we see on Melbourne Cup Day 2024 be to the bottom?