Oil Driven Deflation

News

|

Posted 02/10/2024

|

1658

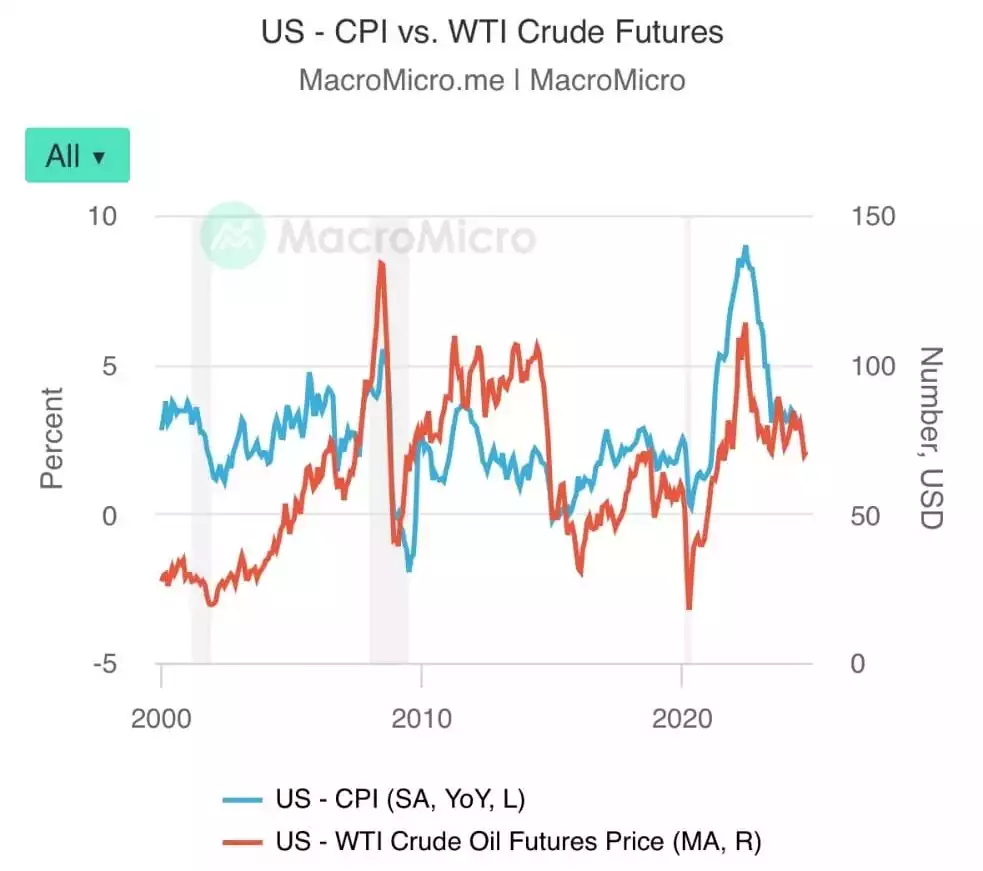

Oil prices have been steadily dropping since June 2022, when the price of crude hit $120/barrel, now in October 2024, oil is sitting at just $70/barrel. With oil feeding into so many prices – transport, food, packaging, building materials, and more, it is no wonder that inflation is starting to ease worldwide.

Last night in a shock reading, the Eurozone’s inflation dipped below its 2% target. Last week we saw the questionable decision by the Federal Reserve to drop interest rates with a super-sized cut of 0.5%, a figure we’ve seen only during the 2000 dot-com bubble burst, and 2008 Great Financial Crisis. And the massive stimulus announced by China last week of $1 trillion yuan with huge support for the stock market. Leaving the question to be asked – what do they know that the markets don’t?

Another sign of oil prices struggling, similar to how they would during a global recession, emerged last night when Iran sent 180 Ballistic missiles Israel’s way, which in previous wars would have sent oil barrelling higher – but the escalation of war in the middle east appears to not have excited the oil market this time, with a modest increase of only 2%.

What’s driving oil

The Organization of the Petroleum Exporting Countries (OPEC) has been reducing output over the past two years to counter the decline in oil prices, yesterday announcing a 5.86 million barrel per day cut, or the equivalent of 5.7% of global demand. But with the increased output in the U.S., making it the world’s largest oil producer in 2018, OPEC cuts have had less impact on the price of oil.

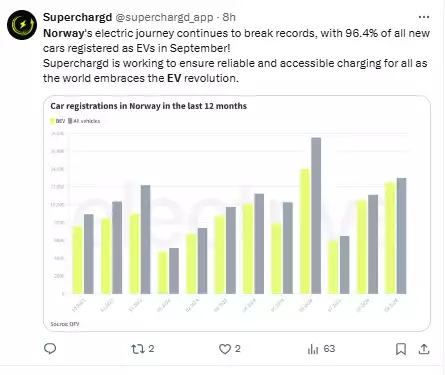

The movement of cars from combustion to electric vehicles (EV) has seen a decreasing need for oil. In September, Norway saw a record-breaking 96.4% of cars registered to be EVs.

In China, oil demand has slowed so much that the government last week announced a massive stimulus, driving the AUD higher and putting more downward pressure on the USD. It’s believed that oil demand in China has experienced a decreased demand of 3% YoY, with 2025 estimates looking similar.

With the growth engine of the world economy in an apparent contraction, it is no wonder there is fear of world deflation driven by oil.

Oil Driving a lower inflation (maybe deflation)

Several countries around the world have started to see inflation ease, while some, including Indonesia and China, have been fighting deflation throughout 2024. Yesterday the Eurozone saw inflation dip below the 2% target threshold, reporting inflation of 1.8% across its 18 members, paving the way for even further interest rate cuts.

Ultimately, inflation has a close relationship with oil, with nothing including a war in the Middle East, emergency interest rate drops in the U.S., and cuts through OPEC seemingly impacting it, deflation may be the next battle to be fought. When the reserve banks of the world hiked too low to create rampant worldwide inflation, it seems this time they’ve hiked too high, and deflation may now be inevitable (unless global conflicts manage to sustain higher prices).

RBA will be too slow to the party

With the U.S. and Eurozone cutting rates and only two more Reserve Bank meetings this year, will the RBA (once again) be too late to the party? With CPI cooling rapidly in Australia, and the rest of the world enacting emergency stimulus measures, the RBA may already be too late to the cutting party, driving the Australian dollar higher, and opening the window for rapid inflation cooling. Whatever the outcome – the rest of the world is reacting like it's 2008 – so what do they know that the RBA doesn’t?