Latest Gold Move Has Analysts Baffled

News

|

Posted 14/03/2024

|

3213

As we all know, the price of gold has recently been surging, up 7% reaching record highs within just over a week. This unexpected rally has left many market observers puzzled, as it doesn't seem to align with the typical factors that have historically influenced gold prices.

While some attribute this surge to growing expectations of U.S. interest rate cuts, which would make gold more appealing as a non-yielding asset, several analysts argue that none of the usual drivers of gold's upward trajectory seem to be responsible this time.

More specifically, the drivers include significant central bank buying, demand from Chinese investors seeking safe havens, and geopolitical tensions in regions like Ukraine and the Middle East, all of which have been a key force in Gold's bull run the past year.

“It has been the quietest, most confusing rally,” said Nicky Shiels, precious metals analyst at MKS PAMP, a Swiss gold refinery and trading house. “What took it from U.S. $2000 [last month] to above US$2150 is the head-scratching part.”

The recent rally started when U.S. manufacturing data indicated a larger-than-expected contraction at the beginning of the month, leading investors to believe that the Federal Reserve might consider cutting rates by June. However, analysts have noted that the magnitude of movements in Treasury yields and the dollar doesn't entirely justify the gold rally.

“Previously when we have had a rally of US$70 to US$80, it is usually accompanied by a new catalyst or risk event,” said Suki Cooper, analyst at Standard Chartered. “But this time there has been no significant shift in current events.”

According to Bloomberg, gold-backed exchange traded funds (ETFs) have seen outflows of 21 million ounces the past year, making the rally appear even more unique in its nature, though this could be partially explained by the recent Bitcoin ETF inflow.

The lack of clear data on market flows has led to speculation that purchases by stealth buyers of gold, which are difficult to trace, might be driving prices up. However, it's challenging to attribute the rally to changing expectations of Fed rate cuts or renewed demand from Chinese retail investors.

“It’s the first time I’ve sat down discounting stuff rather than just saying what it is” that is moving the price, Dahdah said. “The ones who would be doing this would be a big hedge fund or asset manager using derivatives.”

In a sign of higher investor activity, the number of outstanding gold futures contracts on Comex has jumped 30 per cent since February 28, while net long positions rose about 64,000 to 208,000 contracts last Tuesday, according to Commodity Futures Trading Commission data.

While some believe the rally indicates investors are getting ahead of themselves in betting on rate cuts, others such as StanChart’s Cooper argues that there's still room for gold prices to rise further, as prices remain below their inflation-adjusted record from 1980, and strong demand from retail and central banks outside of the West could provide support.

“There are too many unknown events that investors want to hedge for,” she said, citing elections, risks of conflict escalation or the return of a banking crisis. “It does look like we have a new appetite in the gold market.

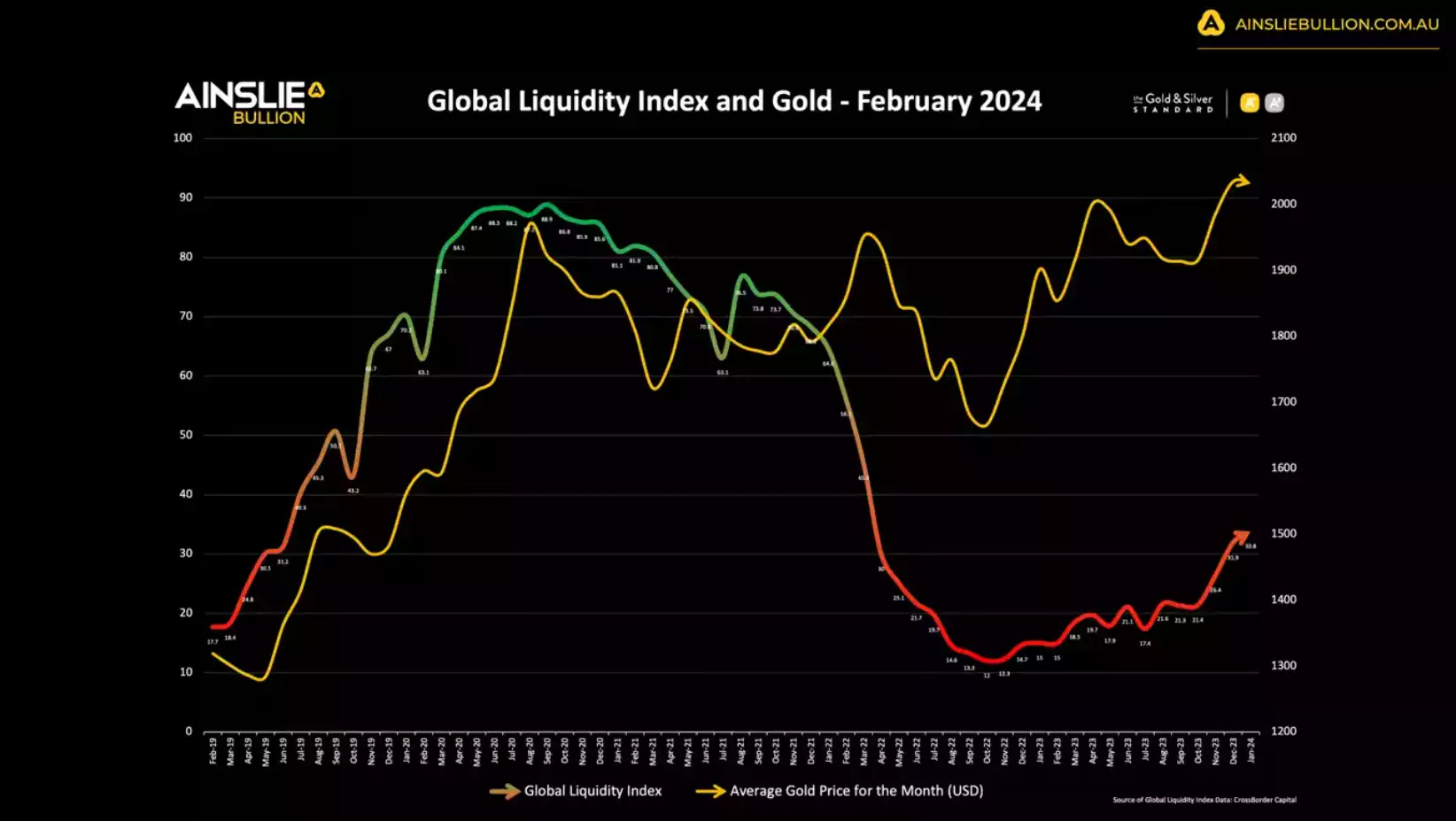

Followers of Ainslie Research on the other hand know that this is all about global liquidity, a broader metric than the usual fixation with the Fed and what they may do or not do. Below is an excerpt from last month’s update, which you can see in full here.

As you can see, we are only very early in the start of the next expansion cycle. In answer to the above too, you can see gold never retraced fully in the lows due to Ukraine and the central banks backing up the truck, but it certainly bottomed right on cue at the bottom of the cycle in late 2022.

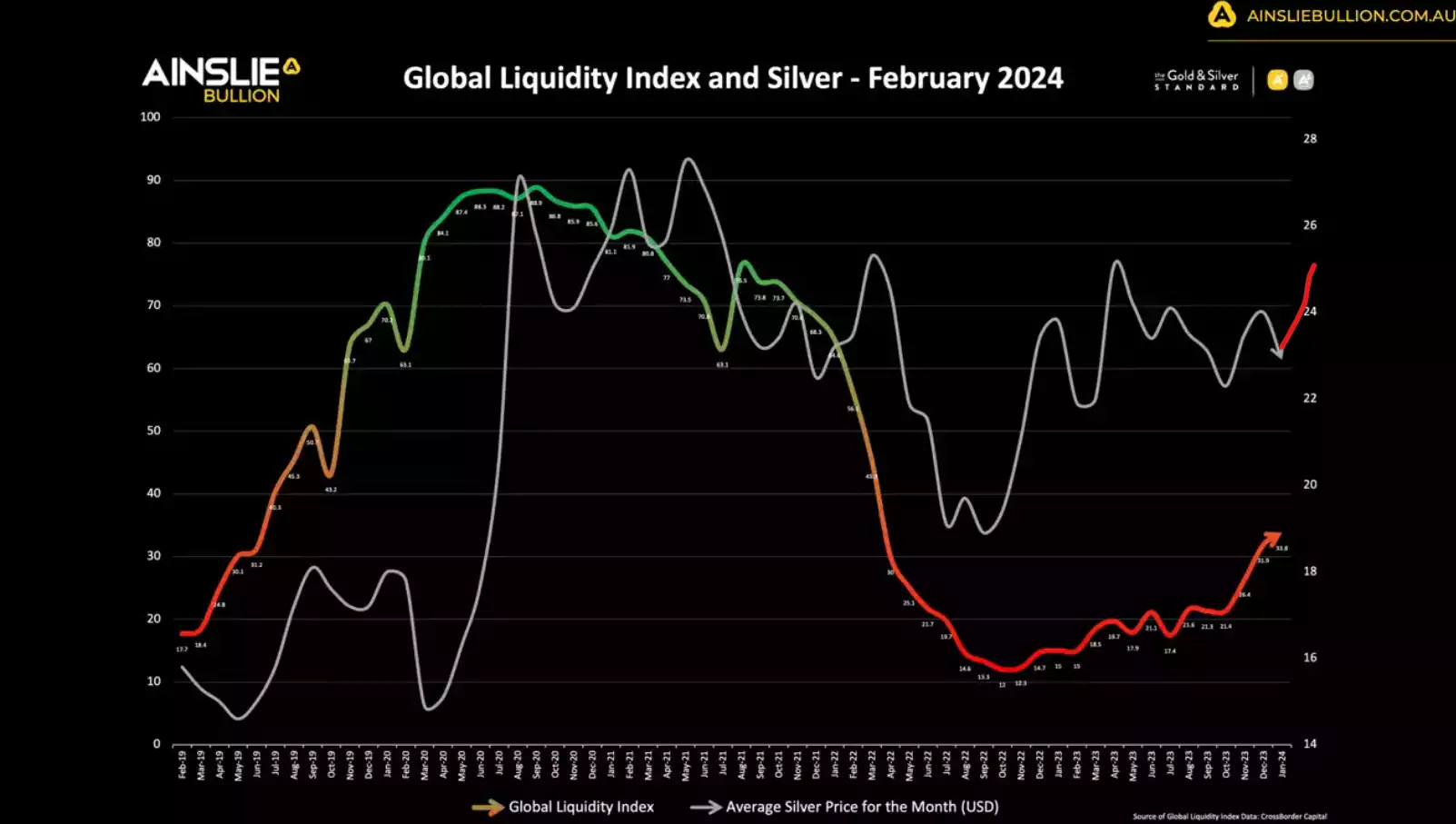

Last night saw another solid rally from gold but a huge jump by silver, up over 3% in the session. Silver is always late to the party but then normally slingshots past gold, dramatically outperforming gold. With a Gold:Silver Ratio still at heady highs of 87:1, that mean reversion play looks set to go. You can see below silver has been dancing around $24 to 25 USD/oz for a while now while gold reached all time highs. Last night saw it back up to $25, testing that upper resistance.

Whilst ETF’s have been unloading like they have, and with the drivers behind gold and silver as they are, the “quietest, most confusing” opportunity to buy at these prices may not last long before ‘mainstream’ Wall Street starts to pile back into ETF’s when the “confusion” clears.