Is Anybody Bullish Enough? A Case for the Fundamental Repricing of Gold

News

|

Posted 13/02/2025

|

3693

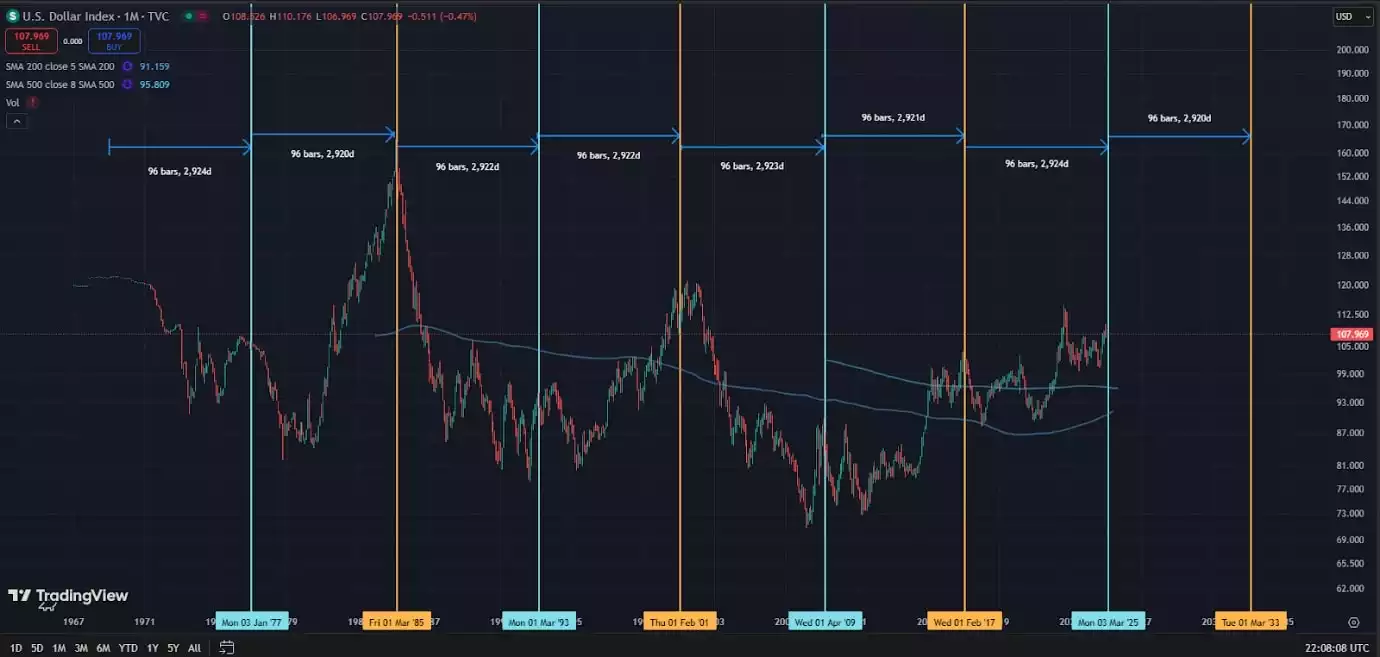

Much like the DXY, the gold price has moved in 8-year cycles since the end of the Bretton Woods system – during which the US dollar was fixed to gold - at $35 per ounce.

Having experienced an 80x multiple price increase in the last 50 years is a reflection of the dilution of currency and soaring government debt. However, a case can be made that the last 50 years have simply been building up to what comes next. Let’s dig into why we are likely early to a perfect storm - of the most significant revaluation of gold this century.

The 8-year gold cycle

With a midpoint of 2026 - we expect a right-translated 8-year cycle. While some wait for minor pullbacks in light of recent upward price movements, on a macro scale we can see that we are in an excellent long-term buy zone. It appears that central banks wholeheartedly agree.

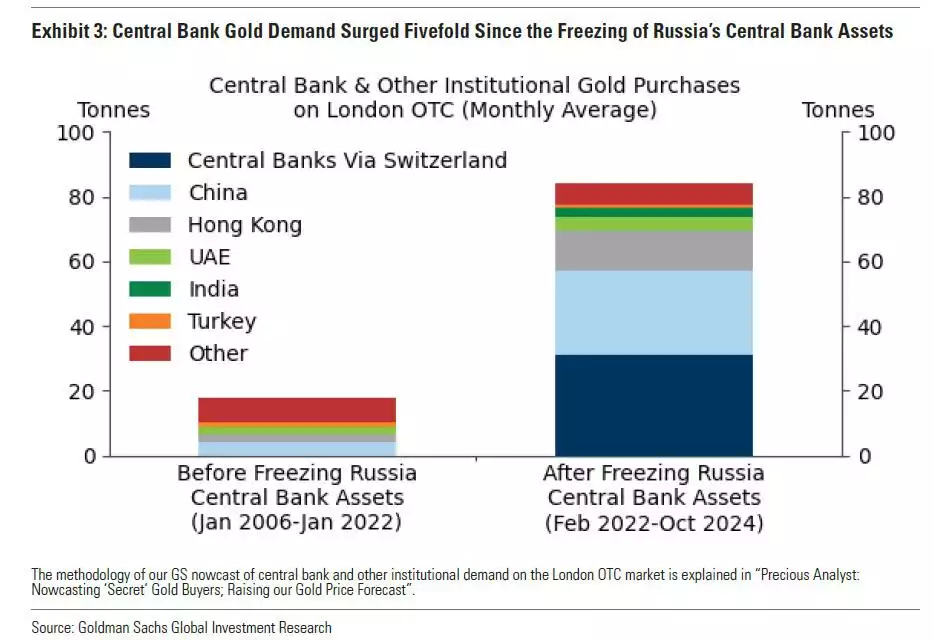

Central banks are stockpiling gold at a record pace - 5x their usual speed - what do they know?

A significant portion of demand for physical gold has been led by central banks, as they continue to stockpile at 5x the usual speed ever since the US weaponised the dollar against Russia in 2022. Gold provides much-needed geopolitical sovereignty and a hedge against financial instability.

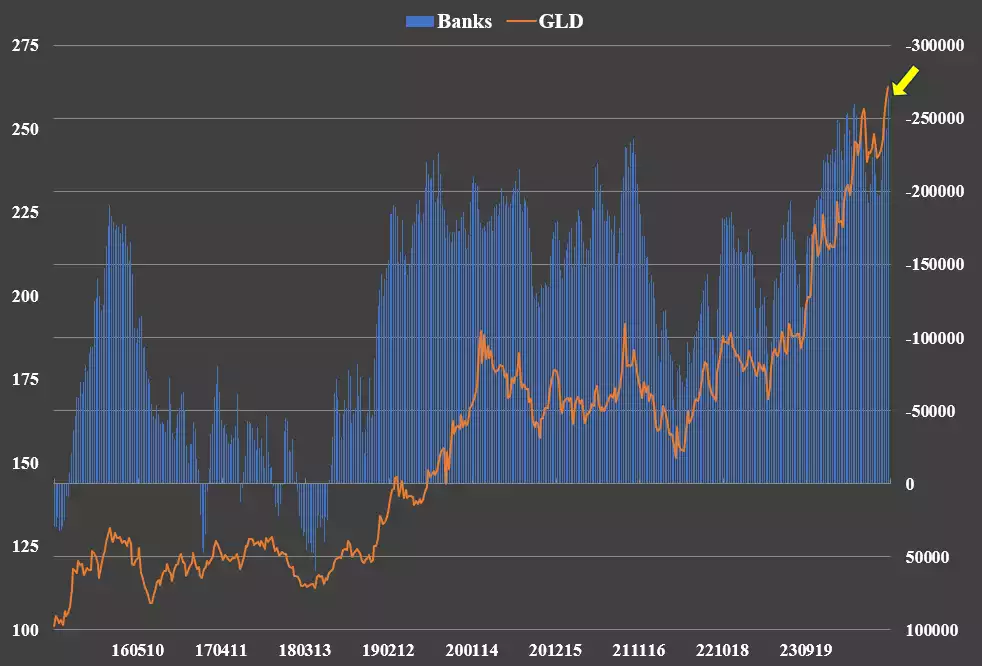

Price suppression tactics are failing – the physical gold markets overpower paper markets

While central banks stockpile physical gold, private banks have a record-high net short position on the gold derivatives markets. While the manipulation strategies to suppress the spot price of gold are no secret - it appears that despite their best efforts - the gold price continues to soar.

Furthermore, this creates an environment of a potential short squeeze – with a blow-off in spot price led by short covering on the table. While manipulation tactics have seen minor slaps on the writs in the past, leading to no change in behaviour – paying a penalty to the market in the form of short covering would be the ultimate justice to private investors who would experience significant capital gains on their physical gold holdings as a result.

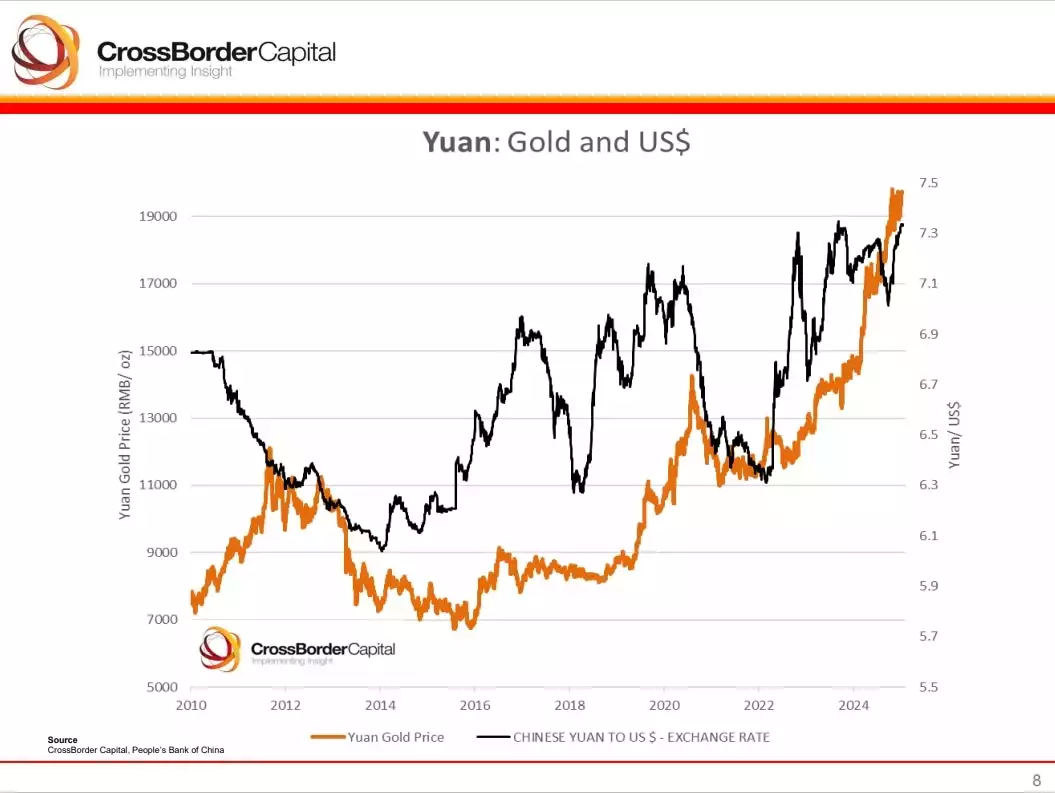

Governments continue actively devaluing their currencies – and hence their debt – against gold

Major governments drowning in debt, have clearly adopted a strategy of actively devaluing their currencies (and therefore their debt) - against gold. This has been and will continue to result in the revaluation of gold – both, against individual currencies - and globally - with arbitrage trade opportunities between currencies.

Let us take the example of the Chinese Yuan. Rather than devaluing the Yuan against the US dollar which has led to huge outflows in the past, they are maintaining their FX pairs and devaluing against gold.

Chinese private residents are allowed to hold as much gold as they would like, but cannot export it (unlike the FX laws which have restrictions on allowable holdings).

Meanwhile, the DXY is scheduled to fall off a cliff, cyclically speaking

As mentioned, the DXY experiences 16-year cycles, broken into 8-year sub-cycles. It would not be unexpected to see the DXY lose strength for a few years from here.

While China’s devaluing of the Yuan against gold will increase the US dollar price of gold, due to arbitrage opportunities - a loss of dollar strength will further throw gasoline on the fire of the gold price – resulting in significant upward pressure.

18.6-year and 80-year cycles converge

Zooming out to the 18.6-year land cycle, we are currently on the lookout for the final phase of the uptrend, where we expect an increase of liquidity, leverage and complacency, followed by a broad-based financial collapse. While gold greatly benefits from increased liquidity, it is also the asset of choice for central banks, hedge funds, and individuals seeking shelter from the storm during the collapse and recovery phase. This leads to sustained capital growth after the collapse - while most other markets struggle.

Zooming out further, to the 80-year socioeconomic cycle called the “Four Turnings” we are currently approaching the end of our current cycle - which began after WWII in 1946 - approximately 80 years ago. As we move from one 80-year cycle to the next, we experience major collapses and resets of institutions of all kinds. Amid this “once in a century” uncertainty and volatility - central banks, institutions and individuals seek a safe haven asset with thousands of years of reliability.

With the 18.6-year and 80-year cycles converging, the upcoming decade will be nothing short of historic.

As we transition from one human-made system to another, we seek a form of money that is eternal, reliable and consistent – we rely on God’s money.

With central banks stockpiling at 5x their usual speed, the Yuan actively being devalued against gold and the DXY scheduled to fall off cyclically – with an imminent boost in global liquidity, followed by a broad-based financial collapse and a centennial systemic reset – it is clear that there hasn’t been a more significant time for gold to shine in the last century.

Given the current landscape - gold has justifiably established itself as the vehicle of choice for investors and central banks alike to navigate the upcoming decade of turbulence.

While many wonder if they have missed the boat with the recent upward price movements – zooming out to the bigger picture we can see that we haven’t seen anything yet for the gold price – and that the biggest moves are yet to come.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=2OWgwGQrSDU