Gold Surges Beyond US$2,500: What It Signals for the Global Economy

News

|

Posted 10/09/2024

|

3023

What is the sharp and sustained rise in the gold price past US$2,500 telling us about the state of the global economy and finances, and why have central banks in Asia and elsewhere been adding to their gold reserves? The answer seems to be concerns that there could be severe turbulence ahead.

This year’s rally has seen the gold’s relationship with other assets such as the U.S. dollar and interest rates break down. This is significant to how the price will likely move from here on. The fact that the gold price has come untethered from traditional anchors or benchmarks points not just to uncertainty from central banks and investors about the state of the world but also to growing concerns over the condition of the global monetary system.

Rarely has there been such a combination of threats to global physical, economic, and financial security as what is facing us now, including significate geopolitical risks, with Russia’s invasion of Ukraine, Israel’s war in Gaza, potential conflict over Taiwan, political divisions, stock market instability, massive government debt, and so on. As the global economy becomes increasingly fragmented into rival economic and ideological tribes, the monetary system is under increasing stress and gold is reassuming its role as a safe haven asset.

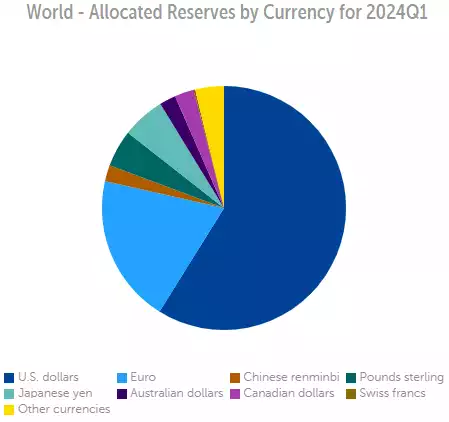

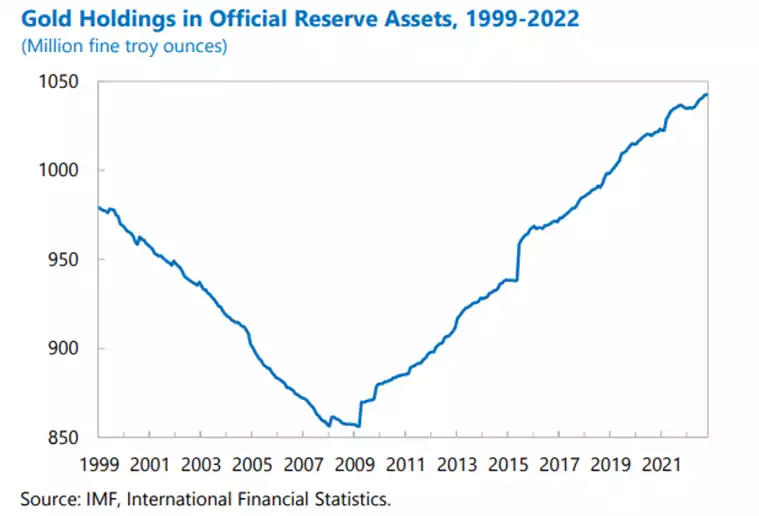

The weaponisation of the U.S. dollar by the freezing of Russia’s foreign currency assets and exclusion from the SWIFT payment system for its war against Ukraine tempted fate as the privilege of having the world’s reserve currency isn’t guaranteed. These actions can set in motion processes that can ultimately lead to the erosion of the dominant position of the U.S. dollar. Mind you, this erosion has been underway for some time in terms of U.S. dollars in international reserves. The U.S. dollar’s share of global foreign exchange reserves has declined to less than 60 per cent today from around 70 per cent 25 years ago, while by contrast gold’s share has risen dramatically, according to figures from the International Monetary Fund.

Source: IMF

Recent gold buying by central banks has been intense. In 2022 and 2023, central banks bought more than 1,000 tonnes of gold per year, more than doubling the annual volume in the previous 10 years. The People’s Bank of China has been among the biggest buyers, followed by emerging market countries such as Turkey, India, Kazakhstan, Uzbekistan, and Thailand.

There has been a surge in Chinese interest in bullion during the past year and a half. The People’s Bank of China has raised the share of gold in its official reserves from 1.8 per cent in 2015 to a record 4.9 per cent while cutting its holding of U.S. Treasuries from US$1.1 trillion in 2021 to US$775 billion.

There is every reason to think that central banks and investors will continue adding to their gold stocks in the short to medium term. The U.S. Federal Reserve is about to embark upon what will almost certainly be a series of interest rate cuts beginning this month while stock markets appear to be entering another period of volatility.

“Gold is money. Everything else is credit.” – J.P. Morgan, 1912

“In truth, the gold standard is already a barbarous relic” – John Maynard Keynes, 1924

The idea of a gold standard might be a “barbarous relic”, but faith in the metal as a store of value in troubled times remains strong.