Central Banks Buying Up Gold While Destroying Their Own Money

News

|

Posted 23/07/2024

|

3037

Inflation Has Eased…

Inflation is slowly decreasing but far from being under control. The latest Consumer Price Index (CPI) data shows annualized inflation at 3% in the U.S. and 2.6% in the Eurozone, with eight countries, including Spain, reporting inflation above 3%. Consequently, central banks need to maintain a hawkish stance, keeping or cautiously lowering interest rates. However, monetary policy remains highly accommodative. Money supply growth is picking up, the European Central Bank (ECB) continues its "anti-fragmentation mechanism," and the Federal Reserve is injecting money through its liquidity window.

…But Gold Remains an Attractive Option for Investors

On July 19, 2024, gold prices surged to above US$2,400 per ounce, marking a 16.5% increase since January. This rise outpaces major indices like the S&P 500 and over the past five years, gold has consistently outperformed major indices, with only the Nasdaq surpassing its performance. Investors anticipate continued monetary expansion to cover rising deficits and public spending, making gold an attractive safe haven and hedge against currency debasement and inflation.

On the U.S. politics front, uncertainty remains about who the Democratic Party’s candidate will be, investors may seek a safe haven until they can assess whether or not the replacement for Biden will continue or break from the high tax, more regulation, and more government intervention policies of the current administration. And that’s not even to mention the biggest show on Earth, Donald Trump, and what a second term from him could bring. Recent moves in the markets signal that either option is making investors nervous.

Follow The Money Big Money

As discussed in a recent article, central banks play a significant role in this demand for gold.

Central banks are major buyers of gold, which they view as a means to diversify reserves and reduce reliance on fiat currencies. JP Morgan’s iconic phrase, “gold is money and everything else is credit,” underscores this strategy. Central banks worldwide hold treasury bonds from countries with global reserve currencies to stabilize their own currencies. However, with government bond prices falling by 7% between 2019 and 2024, many central banks are experiencing latent losses. The solution? Strengthen their balance sheets by purchasing gold.

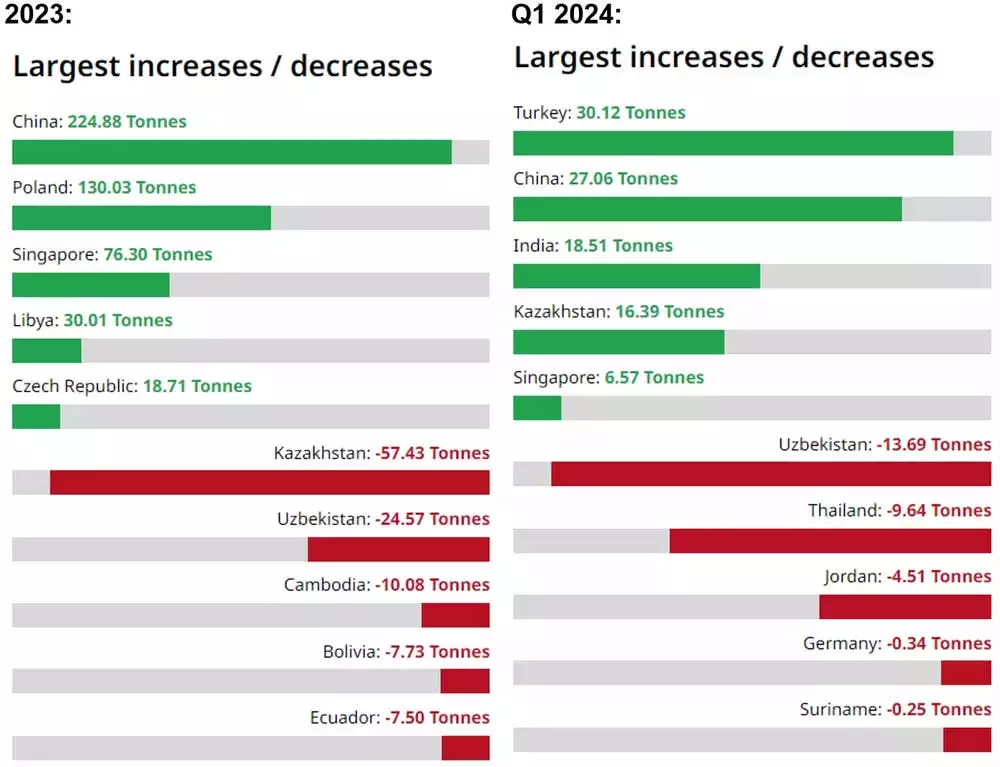

The World Gold Council reports that central banks accelerated their gold purchases to over 1,000 tonnes per year in 2022 and 2023. In the first quarter of 2024 alone, global official gold reserves increased by 290 net tonnes, the highest since 2000. This trend is led by the People's Bank of China and the Central Bank of India, which aim to reduce their dependence on the dollar and euro. While this does not indicate full de-dollarization, it reflects a strategic effort to balance their reserves.

China has increased its gold reserves by 16% since 2022, and local media reports that the People’s Bank of China aims to raise its gold reserves to at least 14% of total reserves, up from the current 4.6%. India’s central bank added 19 metric tonnes to its gold reserves in the first quarter of 2024. Other central banks, such as those in Kazakhstan, Singapore, Qatar, Turkey, Oman, the Czech Republic, and Poland, are also increasing their gold holdings. These actions reflect a desire to balance exposure to volatile government bonds and diversify their asset bases.

The goal of these central bank strategies is to add an asset that does not fluctuate with government bond prices. This move is not about abandoning the dollar but about stabilising their balance sheets against the volatility created by expansionary policies. Central banks are correcting years of misguided strategies by increasing their gold holdings, anticipating future inflationary pressures, and protecting themselves against the erosion of purchasing power.

In a world where asset correlations are high and monetary policies are perpetually accommodative, gold offers a low volatility, low correlation, and high long-term return. It remains a prudent addition to any investment portfolio, providing stability and protection in uncertain economic times.