Central Banks Repatriating AND Buying Gold at Record Pace

News

|

Posted 04/06/2024

|

5069

The moves by central banks in positioning away from U.S. Treasuries and into gold and even repatriating their gold from foreign depositories simply cannot be ignored and indeed should be instructive on what the very architects of this global economic malaise think is coming.

Firstly India, who’s Reserve Bank of India purchased 24 tonnes of gold in just four months this year (1.5X more than its gold purchases for all of 2023) have also quietly moved over 100 tonne of its gold reserves from London back home for the first time since 1991. That move now sees India hold most of its gold reserves in its own vaults. Long time readers will recall Germany did the same from its holdings in New York some years ago.

Last year a survey of 85 sovereign wealth funds and 57 central banks by Invesco Global Sovereign Asset Management revealed that more and more were looking at increasing gold holdings and repatriation in the wake of the U.S. weaponising the USD and seizing assets to do with the Ukraine invasion. This was only the latest in a long list of such actions by the U.S. over the years, but the penny seems to have dropped this time. From Reuters at the time:

“The survey showed a "substantial share" of central banks were concerned by the precedent that had been set. Almost 60% of respondents said it had made gold more attractive, while 68% were keeping reserves at home compared to 50% in 2020.

One central bank, quoted anonymously, said: "We did have it (gold) held in London... but now we've transferred it back to own country to hold as a safe haven asset and to keep it safe."

Rod Ringrow, Invesco's head of official institutions, who oversaw the report, said that is a broadly held view.

"'If it's my gold then I want it in my country' (has) been the mantra we have seen in the last year or so" he said.

We reported more broadly on the huge central bank buy up of gold recently here and the latest In Gold We Trust report leans heavily into this too as a major support for higher gold prices.

“Amid one of the most challenging geopolitical tensions in decades, there is a return to gold as a neutral reserve asset. This is particularly evident in the record gold purchases by central banks. In the In Gold We Trust report 2022, “Stagflation 2.0”, we pointed out that the sanctioning of Russian currency reserves by the U.S. and the EU would “go down in monetary history”. And furthermore that “gold, as a neutral monetary reserve, will emerge as one of the beneficiaries of the troubling conflict between East and West”. As expected, one of the consequences of the momentous sanctions decision of February 26, 2022, is that international central banks have massively accelerated their gold purchases.”

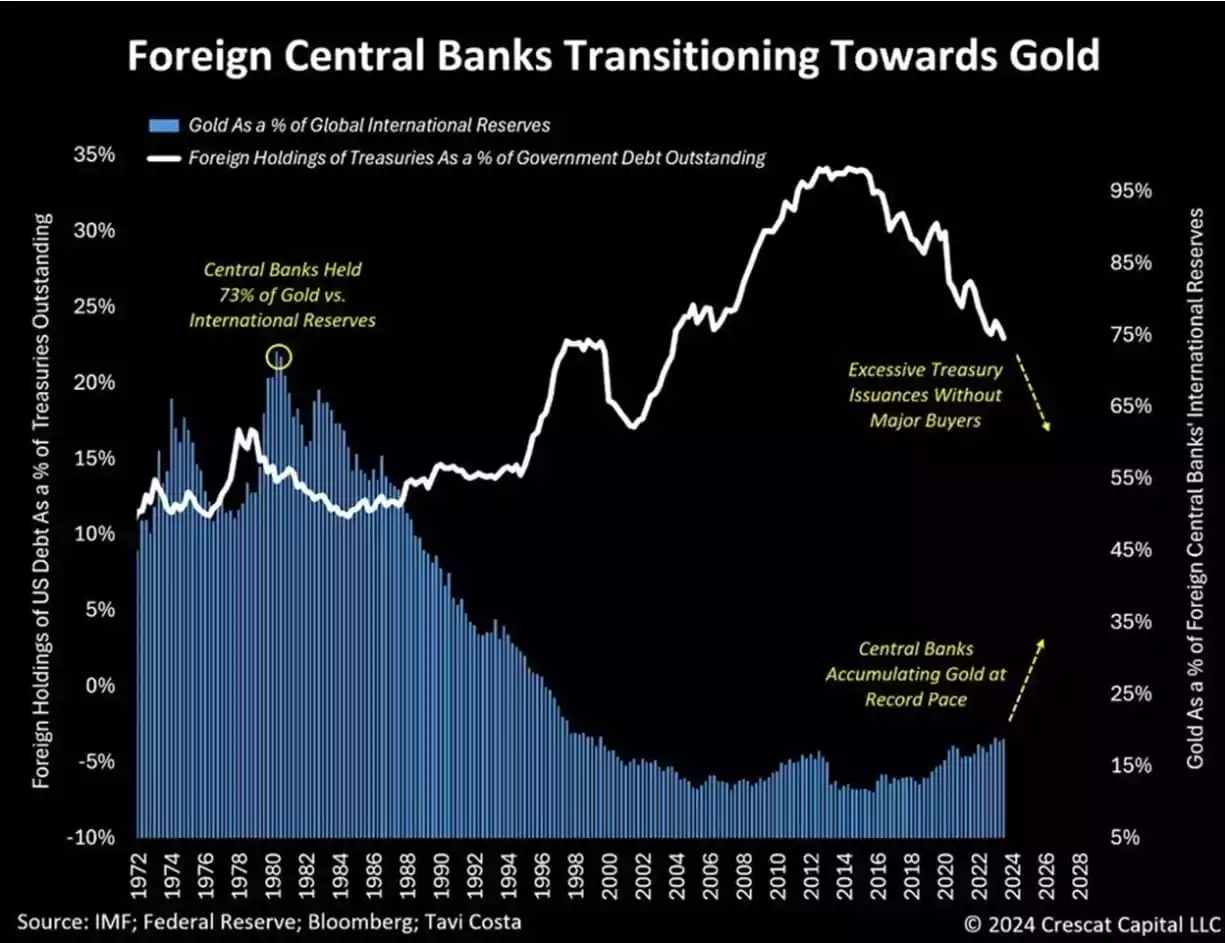

The chart below illustrates very clearly both the trend but also how it has the historical potential to go:

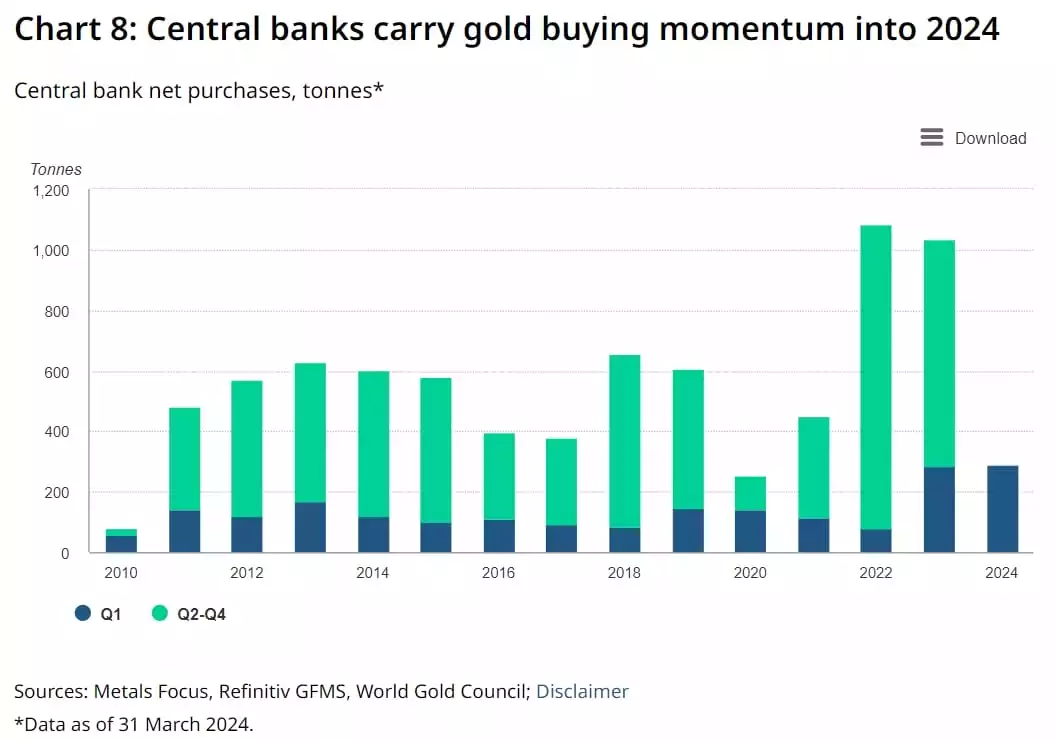

You may recall in the last World Gold Council Demand Trends report for Q1 2024, 2022 was a record year of gold purchases by central banks. Whilst 2023 purchases seemed to ease off slightly from that record high (see below), what we know now is the global figure was impacted by the massive sales from Türkiye around the time of the election, as Erdogan tried to prop-up the lira. If that hadn't have happened, 2023 would have been an all-time record. Metals Focus who prepare the WGC data are clearly saying in terms of gross purchases, last year almost certainly was an all time record.

The following chart critically brings it together where you can see the runoff of U.S. Treasuries and ramping up of gold holdings.

As we wrote back in March – Don’t Do as they Say, Do as They Do!