World Gold Council - Gold Demand Trends Q1 2024

News

|

Posted 07/05/2024

|

3465

As usual we present to you a summarised version of WGC’s quarterly demand trends report. The quarter saw gold demand increase by 3% y/y to 1,238t – the strongest first quarter since 2016 and another record buy up by the Central Banks. However, excluding the very strong OTC demand this quarter, demand slipped 5% y/y to 1,102t, due to continued ETF outflows. Let’s look a little deeper.

Investment

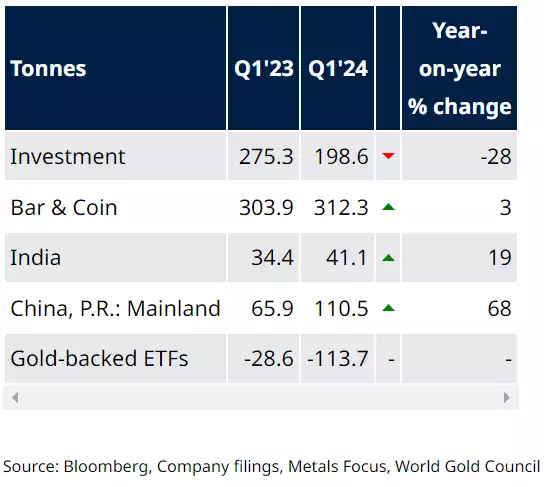

Q1 gold investment (excluding OTC – over the counter) was notably lower at 199t as ETF outflows eclipsed modest growth in bar and coin demand.

- Holdings of global gold ETFs declined by 114t in the first quarter (-US$6bn).

- Q1 bar and coin investment generated a 3% y/y increase to 312t.

- OTC investment of 136t was a key contributor to total demand and to the gold price reaching record highs in March.

Q1 gold investment (excluding OTC) was down by 28% y/y. Strength in total bar and coin investment was purely due to buoyant demand for small gold bars, which was offset by a slump in demand for gold coins. This partly reflects a divergence in West/East investment behaviour that was evident across all areas of gold investment during the quarter: profit-taking by Western investors contrasted with largely one-way investment buy up demand in Asia – weak to strong hands. At home, Australia saw bar and coin demand halve y/y to 2t and a big inflow of buybacks as people took profit on the higher price and selling due to cost of living pressures.

OTC buying by investors, while opaque, is reflected in the pace and scale of the price rise. CME net managed money positions, which can be used as a proxy, rose by 91t in Q1.

Central Banks

Central banks doubled down on gold demand by setting a new first quarter record.

- Central bank net demand totalled 290t in Q1 – the strongest start to any year on record.

- Reported purchases remained broad-based, with China, Turkey and India leading the way.

- The strong start reinforces WGC’s view that central bank demand will remain robust in 2024. The U.S.’s recent further weaponisation of U.S. Treasuries will only add impetus to sovereign states taking direct control of their reserves.

Jewellery

Jewellery consumption held up well in the face of surging gold prices.

- First quarter gold jewellery consumption of 479t was 2% softer y/y.

- Initially aided by the mild correction in the gold price during January and February, demand pulled back as the March rally took off.

- Jewellery demand remains under pressure so far in Q2, due to unprecedented price levels. Although buying will likely be encouraged by any price pullbacks, WGC expect a subdued y/y comparison.

Technology

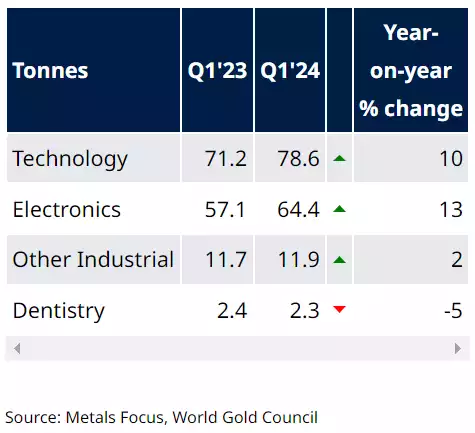

Supply chain restocking in the electronics sector bolstered gold demand during Q1.

- Industrial demand for gold in Q1 rose by 10% y/y to 79t.

- This growth was driven by a recovering electronics sector, which saw a 13% y/y rise to 64t.

- Other industrial applications recorded a small rise of 2% y/y to 12t, while dental demand continued its long-term decline with a fall of 5% y/y to 2t.

Supply

Total supply rose 3% in Q1 due to record mine production and higher recycling.

- Q1 mine production increased 4% y/y to a record level for the first quarter.

- Gold recycling volumes rose by 12% y/y as the gold price increased.

- Mine production looks set to record a new record in 2024, while higher prices may encourage more – but limited – recycling.

In summary, there are no real surprises here. Q1 saw the gold price rising strongly despite the continued huge outflows from ETF’s as ‘mainstream’ investors applied the simple ‘high rates/low gold rule’ that is arguably no longer valid in our post GFC and COVID-19 world. Where once high rates were an opportunity cost drag, now they threaten untenable interest costs on all that debt and must trigger central bank easing and fiscal intervention to tame. Gold’s correlation with the resulting global liquidity is undeniable. Last night the gold price rose 1.2% and silver price surged 3.3% in the session largely off the market’s view that the Fed will (have to) cut rates sooner given the awful NFP U.S. employment figures Friday night, again reinforcing all is not great in the world’s biggest economy.