Will this be another “Downtember” for Gold?

News

|

Posted 03/09/2024

|

2055

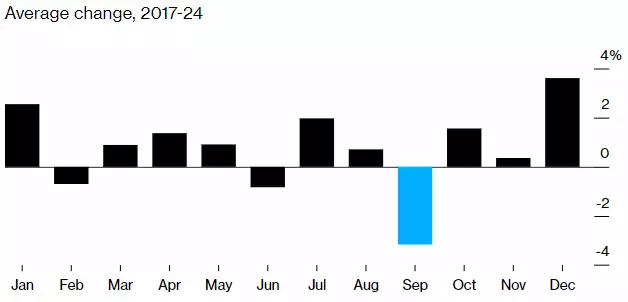

Or, ”Septumble”? September might provide a golden buying opportunity if recent history is anything to go by. Since 2017, gold has taken a tumble every September in what has proven to be its worst-performing month of the year.

September is Gold's Worst Month Since 2017

Source: Bloomberg

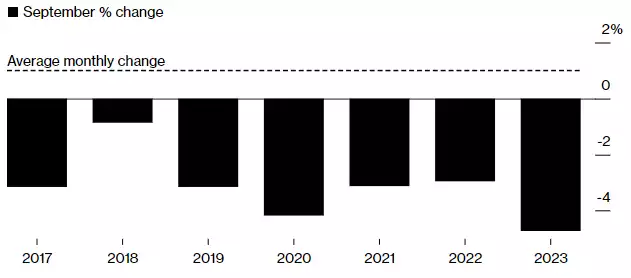

Gold has dropped every September since 2017. Over that period, the average decline has been 3.2% in September – easily the worst month of the year, and far below the monthly average gain of 1%.

It’s a phenomenon that befuddles economists who believe markets should behave more efficiently, and it isn’t limited to gold. September is also commonly the worst month for U.S. stocks, with average declines of more than 1.5% in the S&P 500 over the past decade.

Although there is no consensus on the reason for this dynamic over the last seven years, one explanation for the weakness is that traders buy gold to hedge the risk they have in markets while taking time off for the northern hemisphere summer. The bullion provides a defensive position to de-risk over the increasingly turbulent northern summer months. This means there’s an inbuilt headwind for gold in September when traders return to work and sell their defensive position.

Gold’s Performance Each September Since 2017

Source: Bloomberg

Gold has rallied 21.5% this year against the Aussie dollar thanks to robust purchases by central banks, increased safe-haven demand amid geopolitical tensions, and healthy buying of physical bars in the over-the-counter market. Gold’s gains have also been driven by expectations the Federal Reserve will start to ease monetary policy next month. Fed Chair Jerome Powell said last week that the time has come to lower interest rates, but the speed and magnitude of cuts may be key to determining whether bullion maintains its momentum.

Whatever the reason for this seasonal fall in gold’s price in previous years, knowing this past price action can help us to position ourselves to take advantage of the situation, like ensuring some powder is kept dry if you are looking to increase your gold allocation. As always, the price of gold does not exist in a vacuum, so we must keep our heads on a swivel and see how the month plays out.