Wall Street v Gold & Silver – the game is up

News

|

Posted 20/02/2024

|

2748

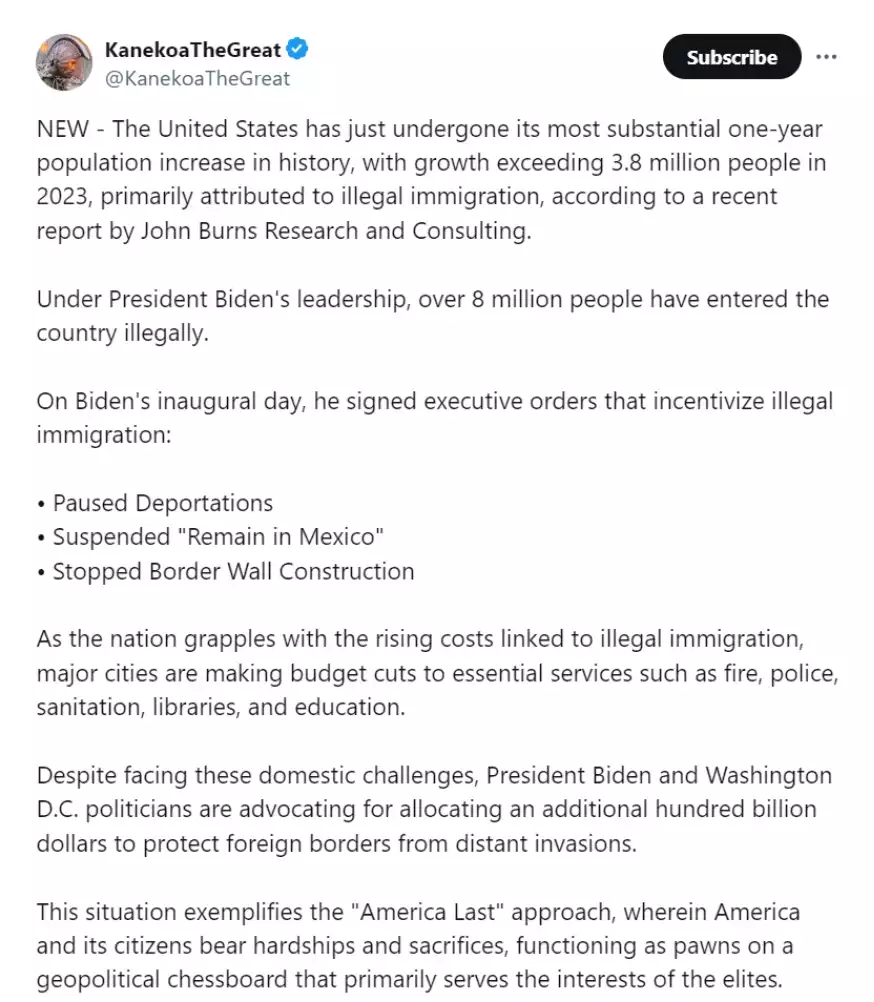

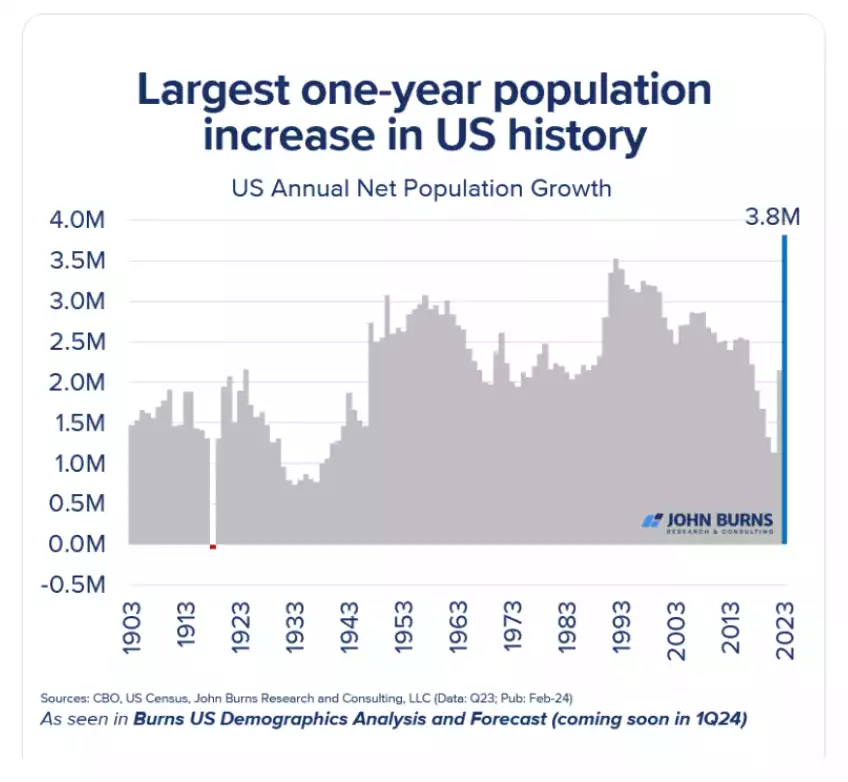

We have written extensively on Australia’s record 600,000 new immigrants last year propping up our GDP through importing new consumers masking the reality we are in a per capita recession right now. We also wrote to this being a global phenomenon and the Malthusian Trap Theory here. Its something governments don’t really want you to know as it lays bare the Ponzi scheme we are in where they need new participants to maintain the perception of growth and economic prosperity. Last week we then learned that like Australia and Canada, the USA saw its single biggest year in history of immigration, some 3.8 million people! Today we step through the implications of this and land on a powerful chart around what’s next…

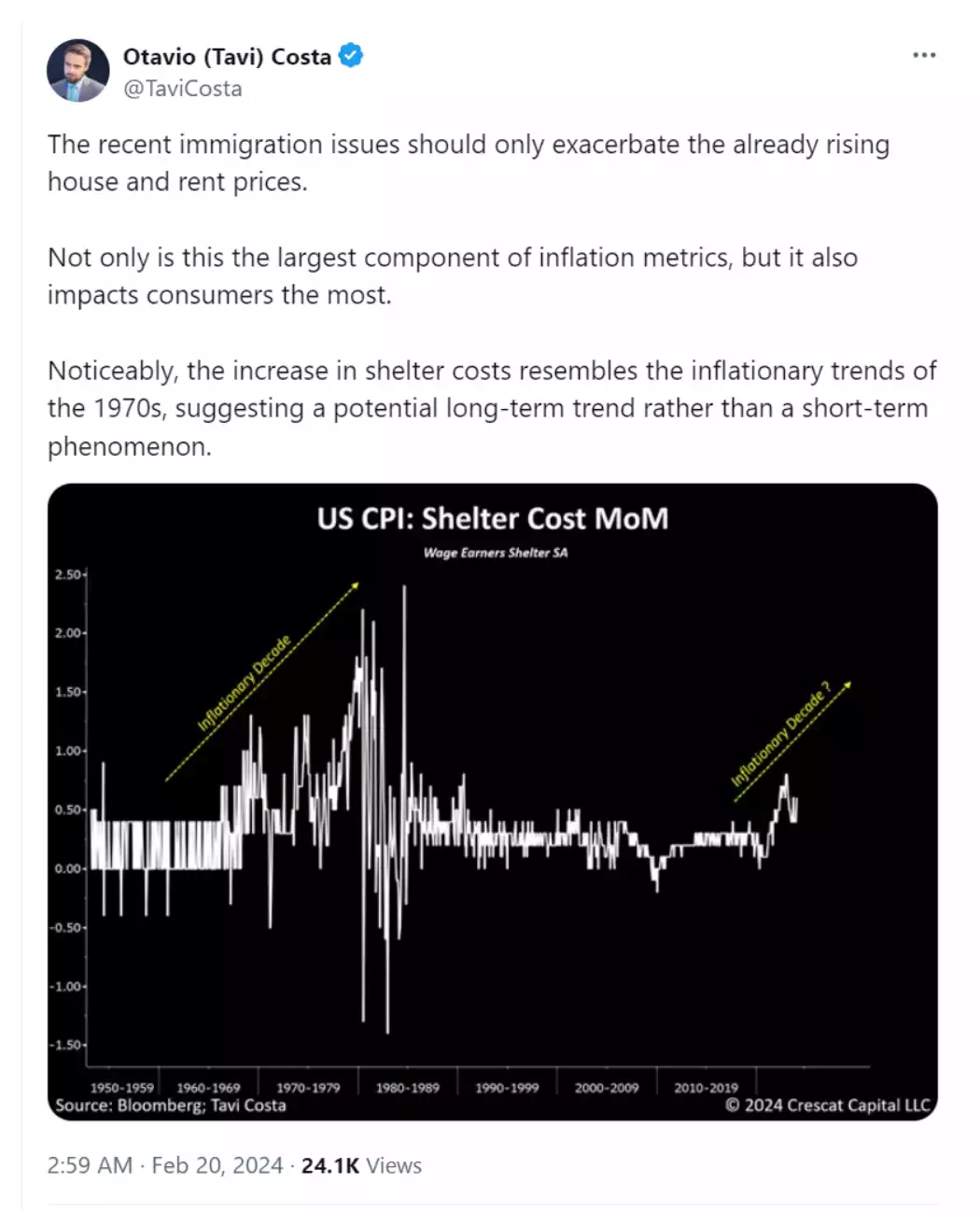

Like Australia, that puts more pressure on housing supply and inflation in general:

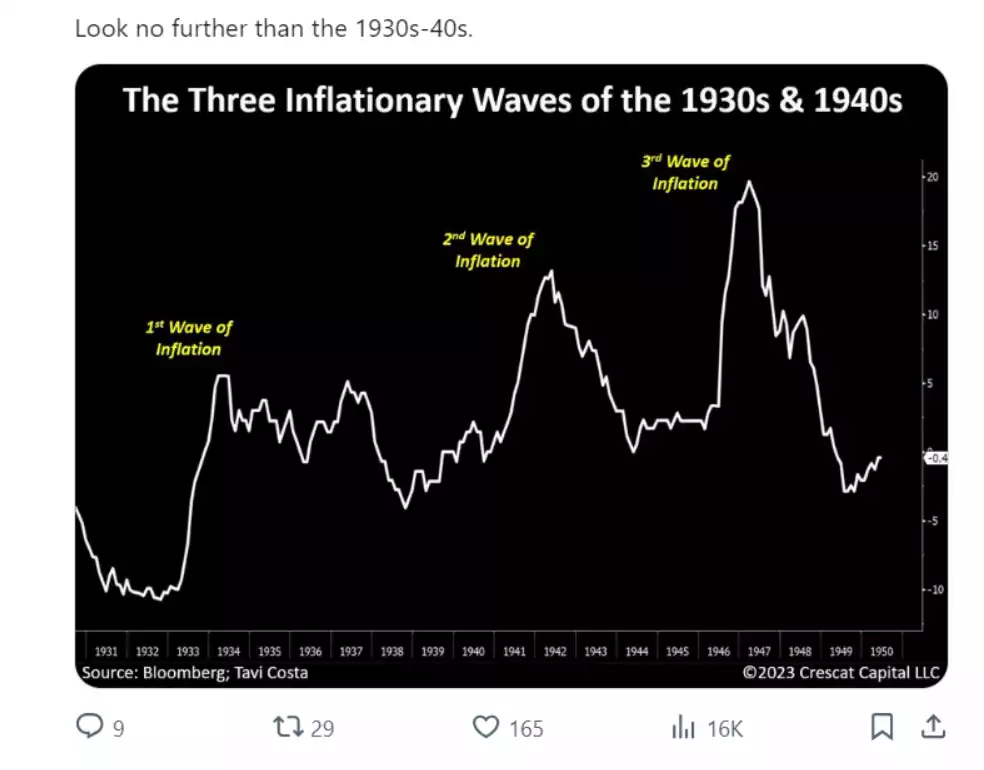

Author of the above, Crescat Capital’s Tavi Costa has long been vocal on the inflationary period we have just experienced being only the first of 3 waves, just as we saw in the 70’s and also the 30’s & 40’s:

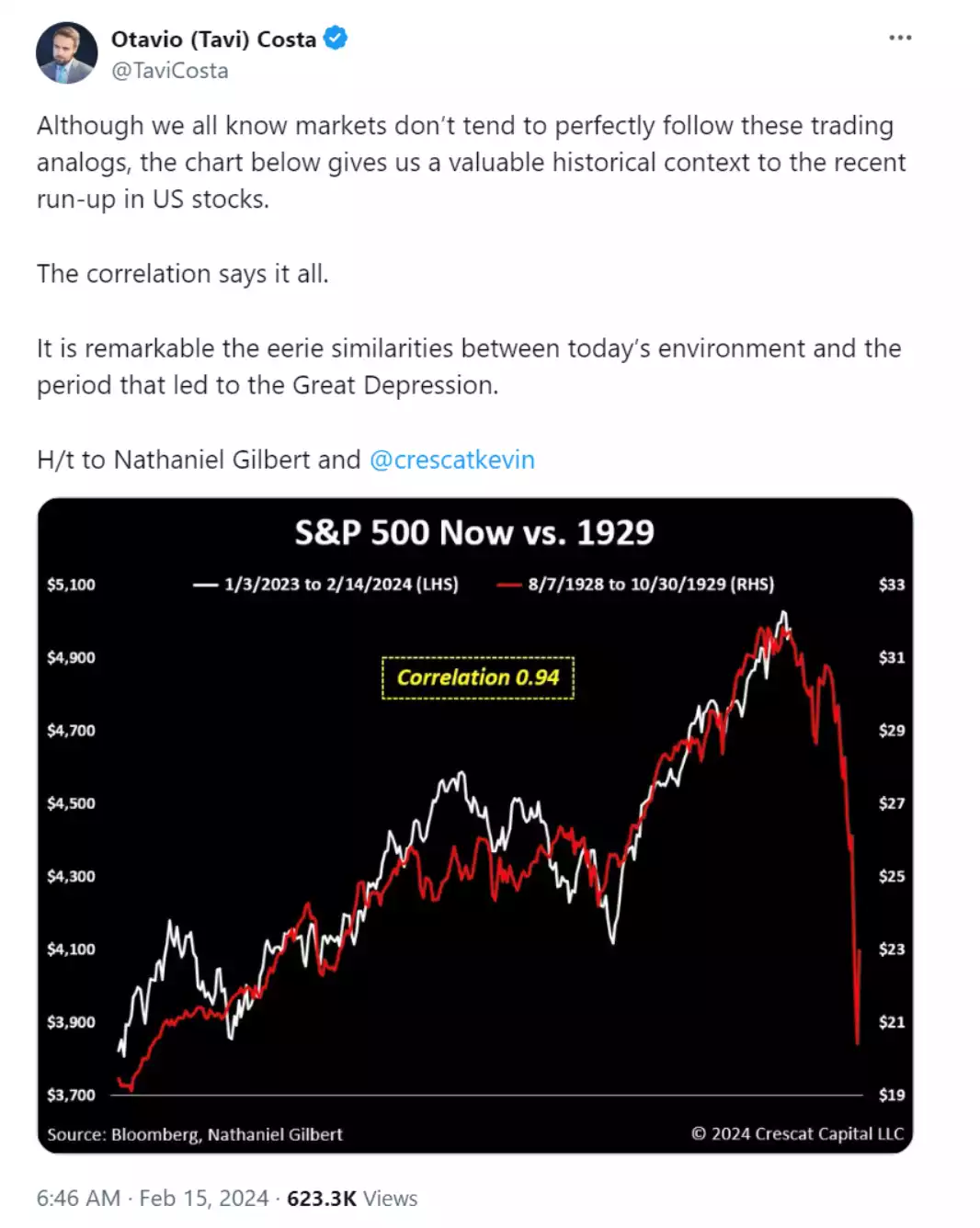

Speaking of the 30’s…

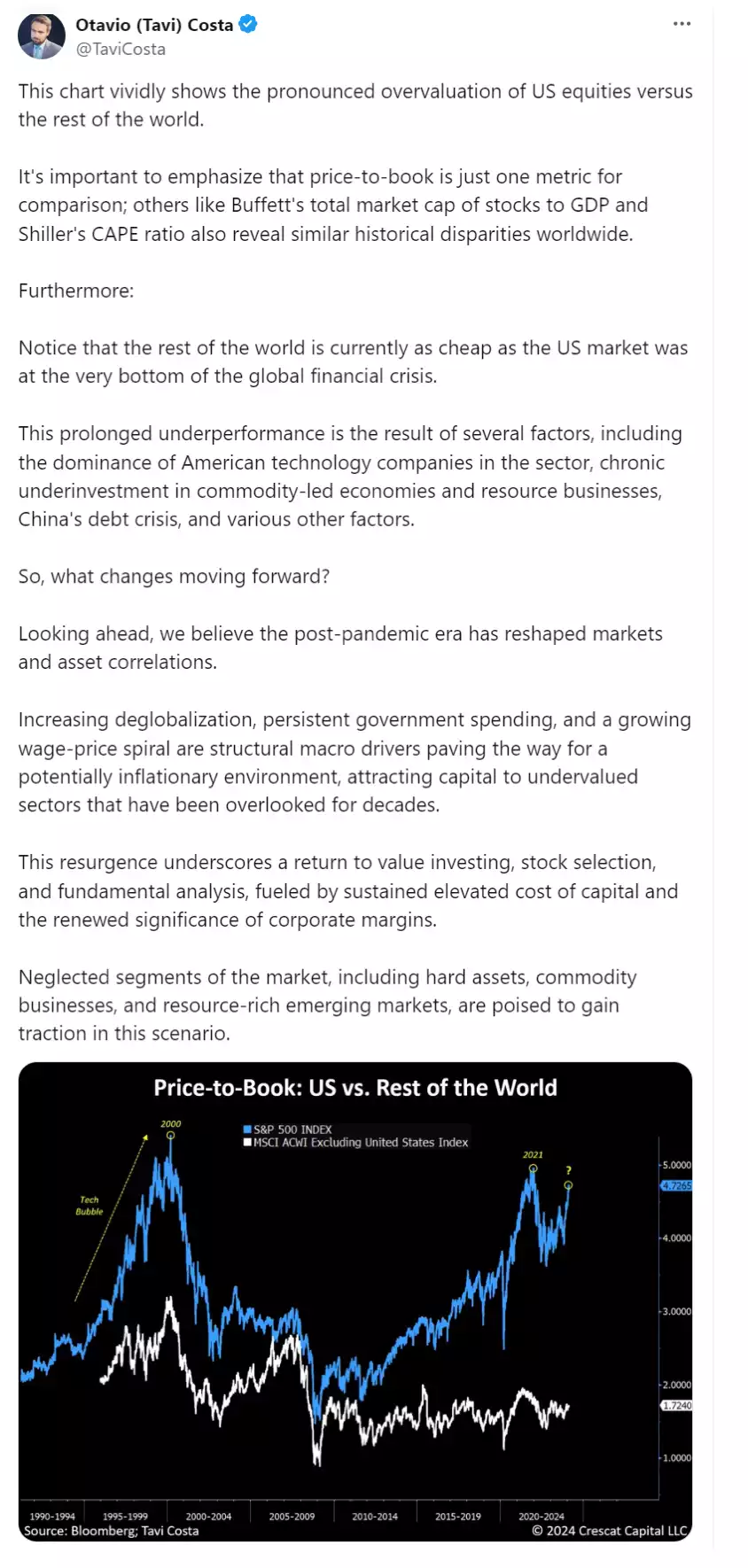

So where to from here? Hard assets such as gold, silver and platinum according to Costa:

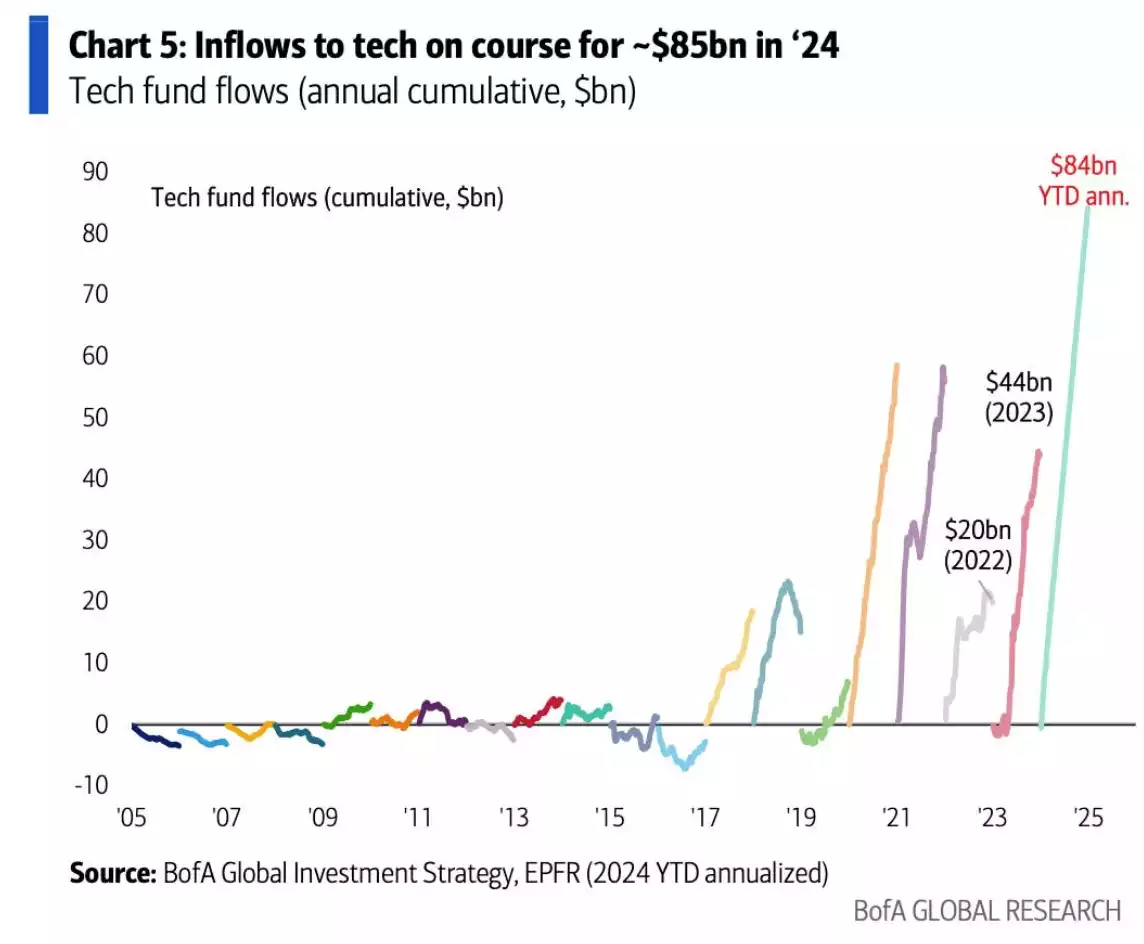

Our monthly Global Liquidity Index report tells us the liquidity is piling in and as much as it is correlated with gold and bitcoin, it also sees tech shares climb too. However, you cannot visit a news outlet now without seeing warnings of a tech bubble ready to burst. Check out the staggering inflows:

So let’s recap. The US is blowing the bubble through record immigration, record deficit spending, fueling inflationary pressures. US shares, the Magnificent 7 in particular (and sole driver of S&P500), have been on a tear but on any measure are looking extremely toppy. So where does all that liquidity go if that pops? Gold and bitcoin. Money is made buying low and selling high. The chart below, S&P500 v Gold & Silver, could not paint a clearer picture. A rotation into gold and silver seems inevitable and we are at extremes of this right now. You can beat the crowd or follow the crowd over the cliff.

One Wall Street legend is doing exactly that…