USD vs Gold - Shocking Chart

News

|

Posted 12/04/2024

|

4077

Gold just reached a new all-time-high and U.S. stocks bounced back as worries about inflation eased slightly following a report showing only a slight increase in producer prices for March. This helped offset concerns caused by higher-than-expected consumer price gains earlier in the week.

Earlier this week, we discussed if a $7,700 USD gold price could be plausible in the next two years. Gold has continued to reach new all-time-highs every day this week in Australia, despite "looking high".

In the last trading day, both the Nasdaq Composite and the S&P 500 closed higher, held up by the data indicating less pressure on prices from the producer side – so relief looking forward on CPI. Investors also found relief in the outcome of a $22 billion sale of 30-year Treasuries. This is nothing groundbreaking, but it didn't signal a significant decline in demand for U.S. government bonds. This contrasted with late 2023 when weak auctions contributed to a sharp rise in yields, which scared investors out of the stock market.

Market sentiment now depends on the Federal Reserve's response to persistent inflation alongside solid economic growth. Prior to Wednesday's consumer price data, expectations were for three 25 basis point rate cuts this year. However, now traders are factoring in only two cuts, reflecting a more cautious outlook.

The Nasdaq outperformed other major indices, climbing by 1.7%, driven largely by gains in the technology sector, while financials lagged. Attention now turns to the upcoming earnings season, with three major U.S. banks - JPMorgan Chase & Co, Citigroup Inc, and Wells Fargo & Co - set to report their first quarter results on Friday.

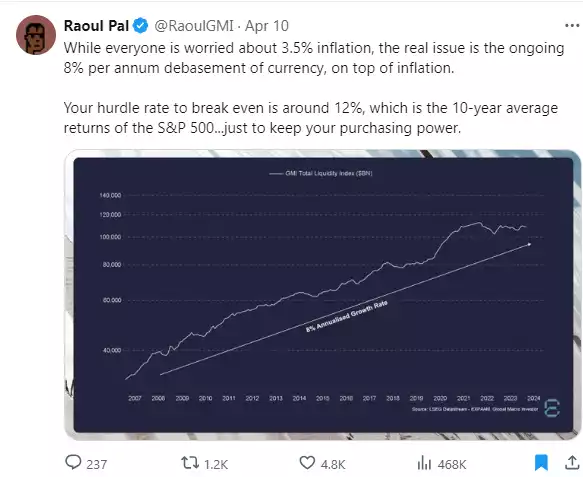

Take a look at the shocking chart below of how the U.S. Dollar has been performing against gold.

Which answer do you think is most correct?

A) Holding interest rates higher for an extra month or two will fix everything.

B) One less cut this year should fix everything.

C) The micro-detail of one rate cut happening this month or that month will do almost nothing in stopping the exponential devaluation of the currency.

USD VS Gold – 1960s to now

Global Macro Investor and Real Vision chief Raoul Pal puts it another way (tweet below) but either way this screams a huge problem ahead and one gold and silver are the perfect, historically proven assets to hold right now at this point and for some considerable time ahead…