US Bond Yields Soar - Reverse Repo Drains – What Next? (Brace!)

News

|

Posted 04/09/2023

|

1850

Poor old US Bonds took yet another hit Friday night with yields climbing ever higher and despite the US NFP employment figures coming in better than expected on Friday night, unemployment increased and previous employment numbers were downgraded. The market clearly seems to be buying the higher for longer narrative. Amid a record nearly $33trillion of government debt and continued massive deficits, the sell off of US bonds is just adding to the US’s interest cost woes. The Reverse Repo market is front and centre of this dynamic but generally gets little attention, nor the inevitable outcome.

Heresy Financial University’s Joseph Brown posted an excellent tweet over the weekend stepping you through this US Treasury / Reverse Repo dynamic in clear and insightful terms as well as where this all inevitably ends.

“The Reverse Repo facility at the Fed dropped to $1.57 trillion

What does this mean for markets?

1. The government is getting deeper into debt by spending more while taxes are dropping, and they have to borrow the difference. Normally they borrow from China, Japan, and the Fed at low rates

2. China, Japan, and the Fed are all not lending right now. They are actually unwinding their debt, allowing it to get paid back instead of rolling it over. The US is forced to find other lenders to borrow from

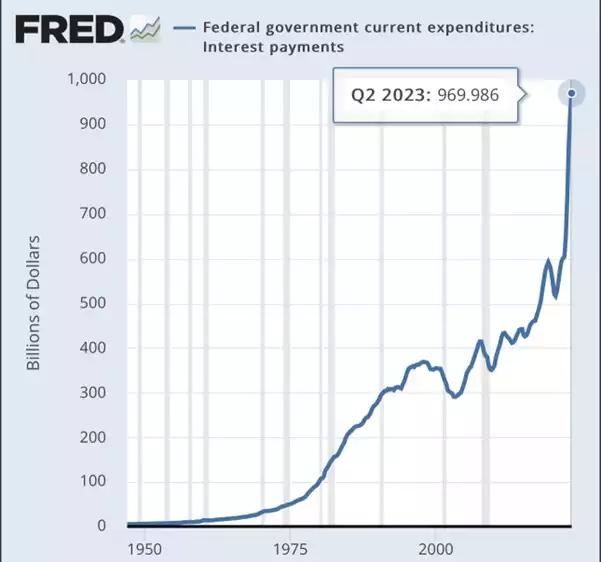

3. Because there is not as much available to borrow, the government must offer higher and higher rates to entice new lenders. This is making their debt more expensive to them as time goes on.

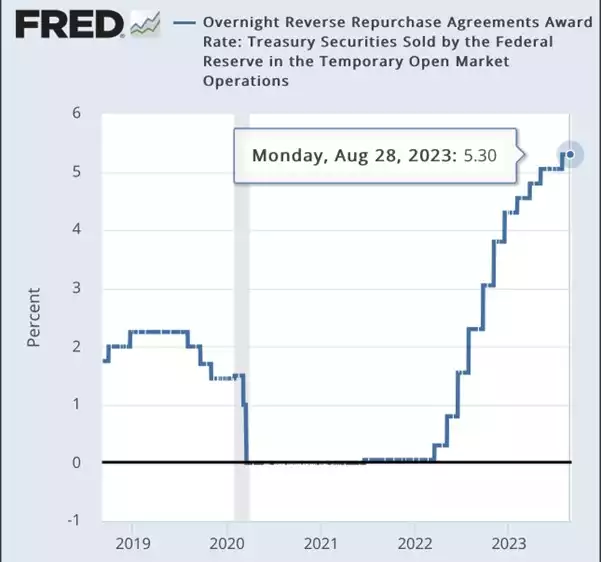

4. The reverse repo facility is where many individuals and institutions have their cash parked. It earns a high rate of interest (5.3%) and is risk free because it comes from the Fed’s money printer. No risk of default or government gridlock

5. As the government needs to borrow more, rates go higher. To lend to the US government for 6 months, the yield is 5.49% right now - this is better than the reverse repo. The more the gov borrows, the higher rates go, the more attractive this looks to lenders

6. As a result of the above, the reverse repo is acting as somewhat of a buffer - a cushion of excess reserves - that the US government can access for borrowing. Rates push a little higher, and pull some cash out of the reverse repo. The risk of government default becomes worth the higher yield.

7. At the short end of the yield curve (under 2 years) rates will likely only move slightly higher until all the money from the reverse repo facility has been drained. Rates will need to move high enough to attract the cash, but that cash acts as a cap on short term rates

8. Once the reverse repo facility is drained, there is very little left over in the system to lend to the government. They have borrowed $1.35 Trillion in the last 90 days. At this rate, the reverse repo facility could theoretically be drained by the end of the year

9. Once the reverse repo is drained, rates across the curve will surge higher. Unbelievably higher. The government appetite for borrowing can only increase as they borrow at higher rates - because the interest cost alone is growing exponentially fast

10. Bottom line: watch the reverse repo. Bond prices are set to collapse shortly after this facility is emptied. Before that, rates will continue to move moderately higher. After, a major liquidity event that requires Fed intervention (QE, YCC) is almost guaranteed.”

So what does this mean for investors? There is a micro and macro answer to this. In the micro, this is all adding weight to a lot of volatility in financial markets dead ahead, in particular the massive disconnect between sky high equities and a recessionary environment foretelling a big market crash.

In the macro, we are relatively just moments away from the inevitable intervention of the Fed cranking up the printers taking us from their current QT (quantitative tightening) to QE (easing > money printing) and maybe even dropping rates sooner than anyone anticipates to make those mispriced bonds look more attractive.

Gold loves volatility and is the perfectly (and nearly only) uncorrelated asset to shares. Gold also loves global liquidity, and when the Fed inevitably comes to the rescue and pumps a heap of liquidity into the system, it will add further wind to its sales. Beyond the Fed’s monetary policy there is a less understood dynamic that sees all that interest paid on all those bonds flowing into the economy, albeit the wealthy end of town, that further sees global liquidity climb.

If you missed Friday’s article, we spoke directly to how this Ponzi scheme plays out.