The Momentum Isn’t Stopping: Another Massive Day for Gold

News

|

Posted 04/04/2024

|

2030

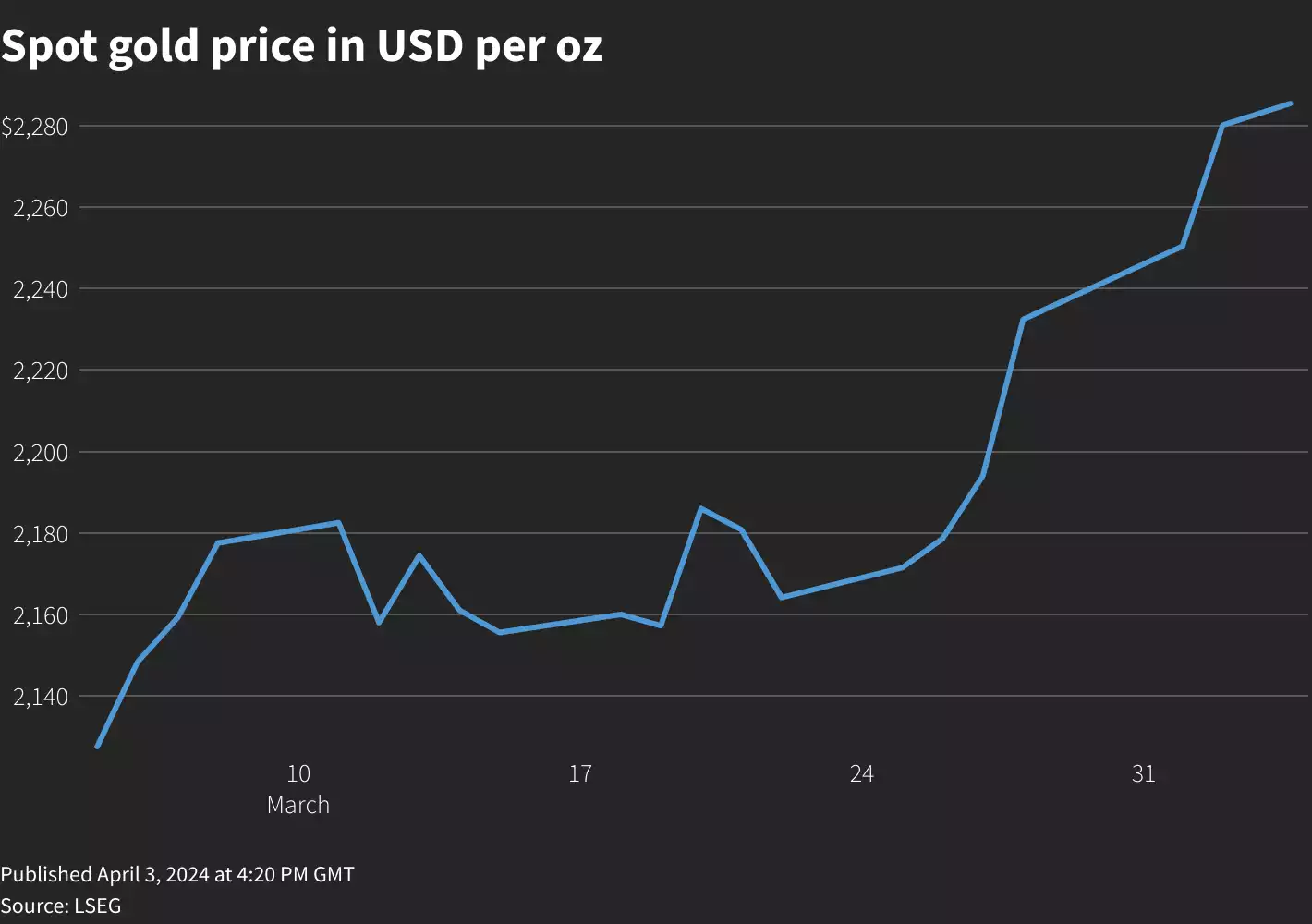

Gold prices soared to new record highs again on Wednesday following comments from Federal Reserve Chair Jerome Powell, who maintained that recent economic indicators such as job gains and inflation spikes do not significantly alter the overall economic policy outlook for the year.

The price of spot gold increased by over 0.5% to reach an all-time high of US$2,294.99 (AU$3,510) this morning. Meanwhile, U.S. gold futures settled 1.5% higher at US$2,315, further displaying Wall Street’s general bullishness on the commodity.

In addition to gold, other precious metals also experienced gains, with silver rising 3.1% to US$26.92 per ounce (we discussed silver’s rise above $26 yesterday here) and platinum up 1.7% at US$931.13.

Tai Wong, an independent metals trader based in New York, noted the surge in gold prices amid elevated trading volume following Powell's remarks.

"Gold surged to yet another historic high on elevated trading volume after Powell stresses that 'bumps' in the road don't change the overall rosy picture."

"Powell's customary cautious approach doesn't worry gold bulls... I think bulls want to see $2,300 and I think more 'tourists' are getting involved in the trade."

Powell's statements regarding future policy interest rate adjustments based on economic developments have fuelled expectations of a rate cut at the Federal Reserve's upcoming June 11-12 policy meeting. However, recent robust economic data has raised uncertainties among investors about the timing of such cuts.

This uncertainty about the timing of rate cuts has only seemed to benefit Gold, as its value has climbed over 11% since the beginning of the year which has been dominated by the FED rate storyline. Price has been further supported by significant central bank purchases and an increased demand for safe-haven assets during the continued turbulent political climate.

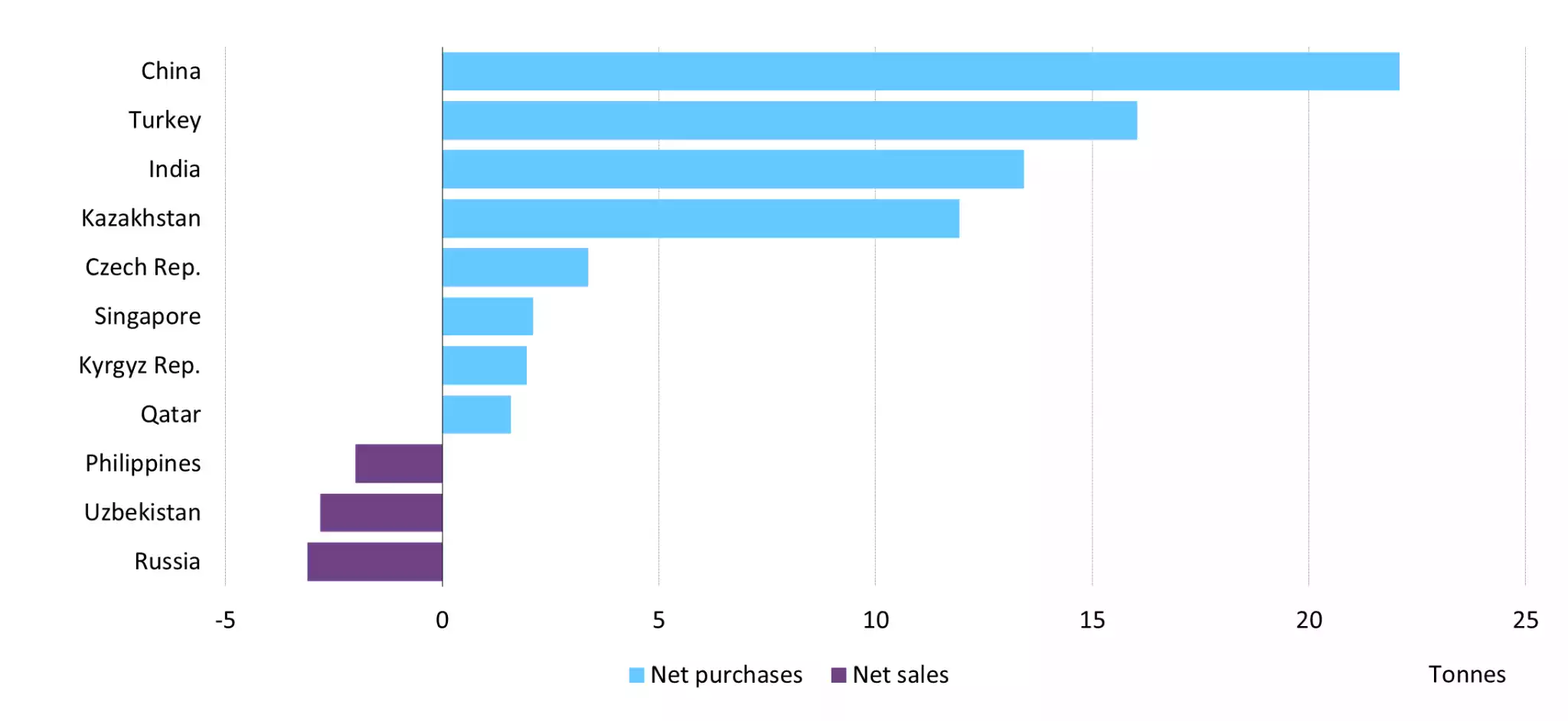

On the note of central bank purchases, the latest World Gold Council report showed that February saw a 19-tonne rise in global central bank gold reserves, marking the ninth consecutive month of growth.

This ongoing demand is primarily driven by emerging market banks, notably those in China and India. More specifically, the People’s Bank of China emerged as the largest buyer again this past month, increasing its gold reserves by 12 tonnes to reach a total of 2,257 tonnes. Despite this growth, gold constitutes about 4% of the PBoC's total reserves, maintaining a relatively stable proportion over time.

Though there was a slower rate of gold accumulation in February, it hasn't significantly altered the continuous trend of central banks increasing their gold holdings.

Overall, this consistent institutional buying pressure, combined with the current economic/political climate, means that there is a strong case for this gold momentum continuing to last given its strong fundamental base, the current sentiment, and the almost perfect technical setup.