“Silver is Ready to Surge” – Historic Indicators Turn Green!

News

|

Posted 25/09/2023

|

3231

There aren’t many ‘sure bets’ in investing. Indeed on Friday we spoke to some of the traps in investing psychology. And whilst history doesn’t necessarily repeat, it often rhymes. So… when Michael McDonald, ex Senior VP of Investments / Morgan Stanley wrote to the undeniably bullish patterns for silver recently, its worth sharing.

McDonald is calling for a heady 50% increase in the silver price within 12 months based on 2 reliable indicators. First, he speaks to the painful last few years in the metal:

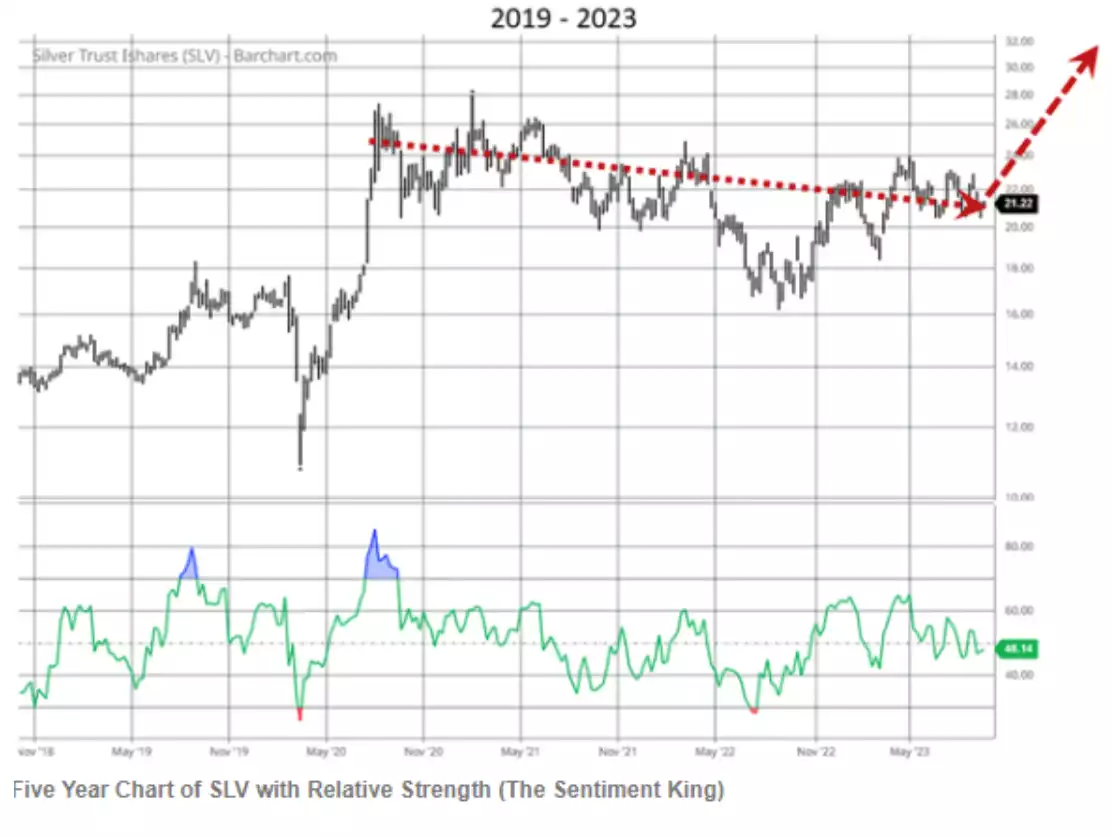

“The price of [USD silver] has been slowly eroding over three years. It closed at $24.93 on September 18th, 2020 and now, three years later, it's at $21.23, down 15%. However, we believe this period of erosion is ending and that investor metrics point to a price surge of at least 50% over the next twelve months.”

The chart above maps out that erosion and the expected red arrow movement ending at US$32 (AUD50). The green line is the relative strength of silver over the last 5 years reflecting the ‘no mans land’ of neither overbought nor oversold leading McDonald to say they “believe it presents a solid base for a move higher. We’ll explain why.” So why?

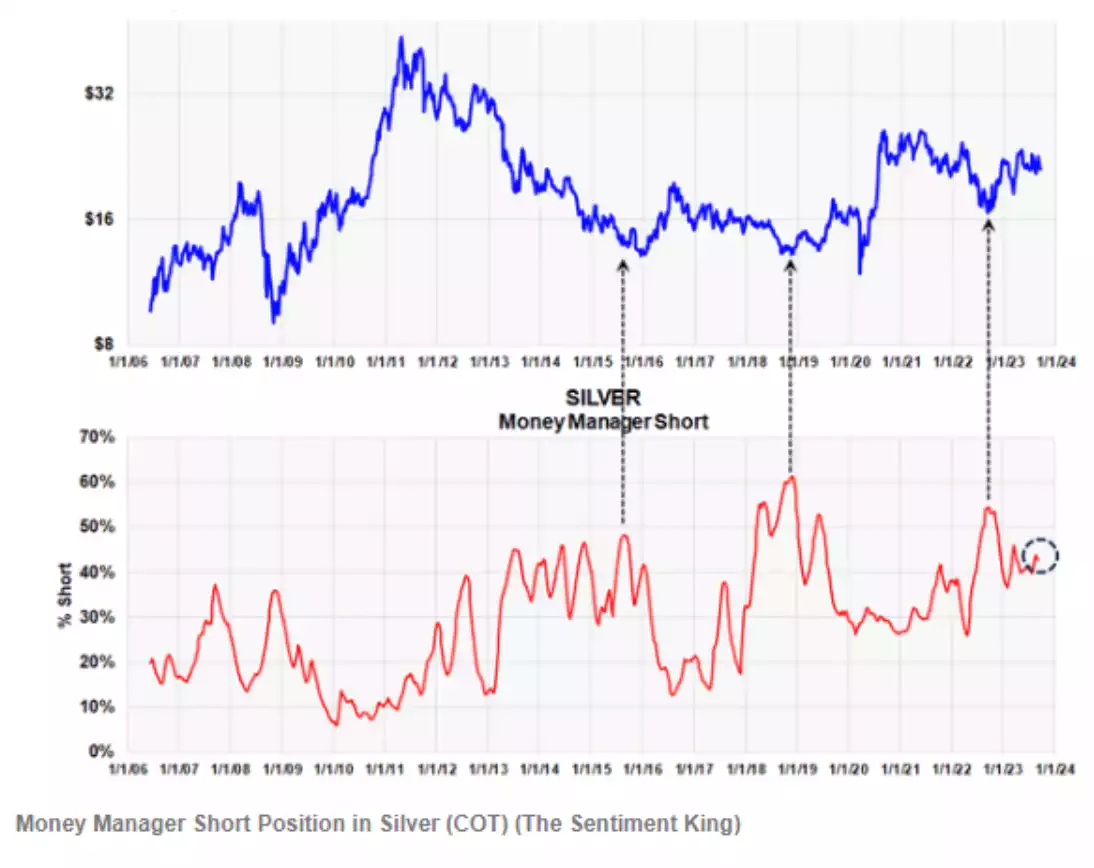

Money Managers Short Silver

On the futures market there are 2 main participants, the Commercials (ala bullion banks etc) and the Managed Money (ala hedge funds etc). The following chart shows the percentage of money managers who are short (selling/ betting on lower) silver. Ironically a high in this ratio historically aligns with a turning point for subsequently higher silver. The Commercials have a good track record of winning these junctures.

McDonald maintains: “last October’s buy signal is still in play and there has been with no sign of a reversal from this indicator. In fact, we believe the next indicator supports our thesis that the price of silver is ready to surge.”

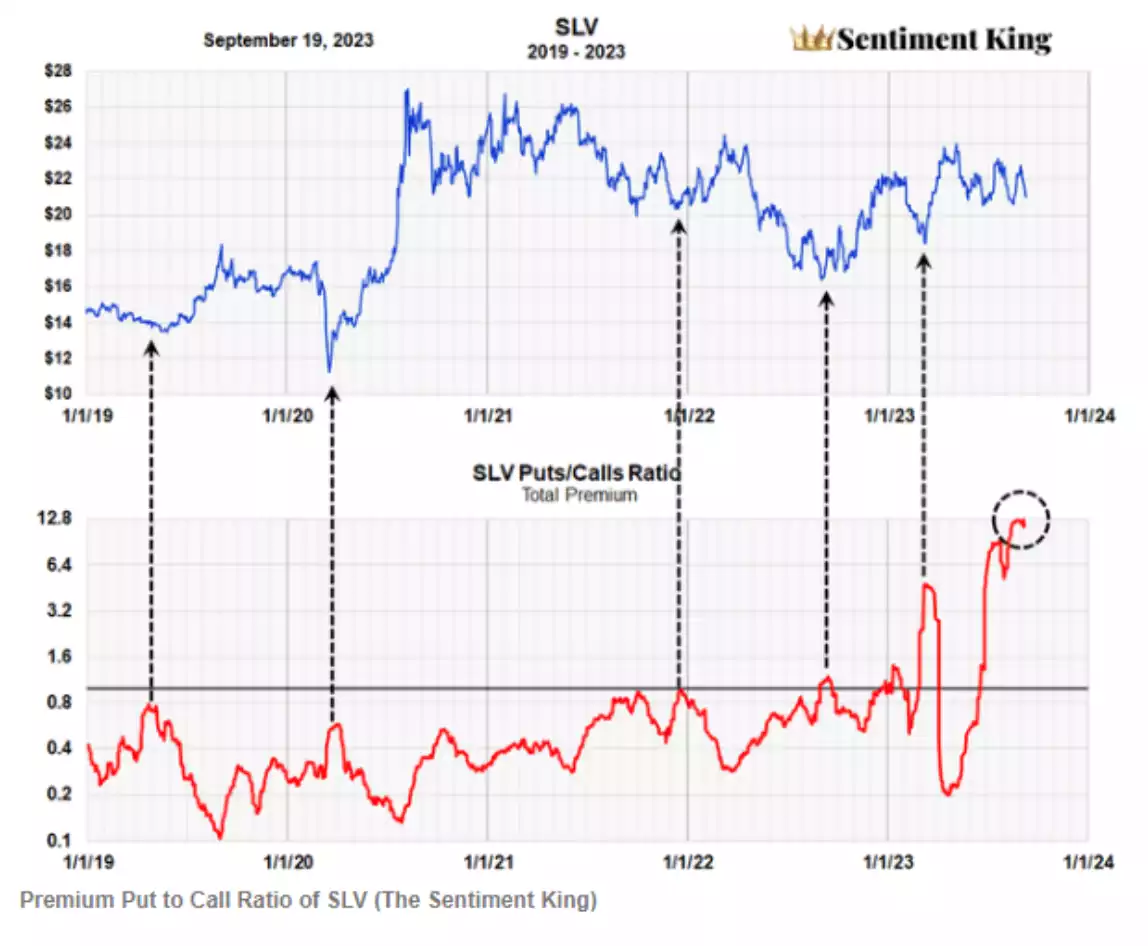

Put Option Purchases in SLV are Surging

SLV is the world’s largest silver ETF and its synthetic nature allows options to be traded. Remember a put option is a ‘short’ position (bet its going down) and a call option is a ‘long’ position (bet its going up). From McDonald:

“The "puts to calls" ratio is a classic indicator of what investors expect a market to do. It was invented by Mary's Zweig in 1972 and it's been used by market analysts for over 50 years.

A high ratio means high levels of put buying, which means investors generally expect prices to go down. It works as a contrary opinion indicator. Heavy put buying is a positive indication for higher prices.”

They then chart the ratio of money going into each as follows:

“It's easy to see that relative peaks in the ratio, which represent increased put buying compared to call buying, usually occur before the price of SLV increases. We've indicated a few past moments with black arrows.

We've also circled the current ratio, which is the highest ratio in four years. It's been in this high range for two months now. To us this is an important indicator that prices are ready to move much higher.”

You will agree that is an indicator with a remarkable track record.

Leaving McDonald and turning to Crescat’s Tavi Costa, he then also looks at that first chart again, zoomed out to the GFC and put to a log scale to illustrate the technical resistance line in play right now:

“Silver: Poised for an Explosive Move

The chart below is possibly the most important technical chart for precious metals investors today. Silver is incredibly close to a major breakout from a 12-year resistance. Following an extended period of consolidation, the metal is poised for a vigorous rally to revisit its highs from 2011. At its current price, silver appears to be exceptionally attractive and is likely to take the lead in this long-term cycle.”

The ’irony’ on McDonald’s indicators is the contrarian play at large. “Fortune favours the brave”, “buy when there’s blood on the streets”, “buy low, sell high” – pick your tune. But the tune playing for silver right now is the same played before. It just comes down to who’s listening.