Psychological Investing Traps

News

|

Posted 22/09/2023

|

2246

Having extra money and a clear strategy can be rendered obsolete if one falls into a common psychological investing trap. These traps can appear in a variety of asset classes, and we are covering some of these traps now as global stock markets have begun to experience pullback in the last week. These are not limited to individual investors. Large companies and institutional investors have been wiped out by these mistakes. Today, we will cover what some may view as the top 3.

Sunk Cost

Some words that can describe the Sunk Cost psychological trap are denial and avoidance. If allocating money to the stock market over the span of a decade has made steady gains, but is beginning to look risky, it can be very easy to avoid addressing the issue and leave the investment as it is. Many will even attempt to get revenge on their falling investment by aggressively adding to it as it falls from its high.

What is temporarily a successful investment can easily form a strong habit and feeling of comfort that are difficult to stop. The habit can eventually become challenged when a market cycle flips and the easiest way to continue and keep feeling comfort is to deny that the investment has started to go the wrong way. As it gets worse, the loss becomes too difficult to bear and the investor feels forced to hold on for another full cycle until the price rises again (if the company still exists).

In the 1980s, hedge funds in London shocked the world with their tremendous gains happening during a recession. So, what were they doing? The answer is very easy: Hedging. They were shorting overheated markets and investing in safe havens, such as gold. The Sunk Cost mentality was such a pervasive trap that it plagued most of the finance sector and resulted in hapless investors bleeding themselves into failing markets. They didn't know what else to do and had such strong habits formed during the bull market that they could not quit cold-turkey.

Irrational Exuberance

Markets have cycles: They rise and fall, boom and bust, and individual companies can be taken out of the game in a very short time due to unforeseen competition and challenges. When investors' greed and excitement reach a high level, a specific stock or sector can be so aggressively pumped that a pullback or crash becomes certain. This is especially painful for investors joining in the herd mentality near the end of a bull cycle or fake-out and are buying into overvalued stocks at their highest prices.

This exuberance is used as a weapon against consumers by the most professional marketing firms. Consumers shown a large crowd of people lining up for the first release of a new mobile phone are easily pulled into the line so that they too can purchase the device that will be over a thousand dollars cheaper in several days.

In terms of investing in the stock market, consumers are not typically overly excited at the prospect of a new product, but rather the prospect of more money. The main emotions backing up the decision to enter the overheated market are greed and overconfidence, which are created by the rise in price and the crowd of others doing the same thing.

Anchoring

Anchoring is a state of mental inflexibility, in which the investor stands by their original thesis for the investment and refuses to gain a holistic view or update their strategy based on new information. One recent example of this is the stock prices of short-term loan companies. From its low in March 2020, Zip Co rose over 1200% in just under a year. A brutal crash of 50% happened in a matter of weeks after it reached its highest point and investors who piled in to the seemingly endless run were wiped out.

What were investors thinking? One thing they were linearly aligned to was that the economic slowdown combined with easy money made buy now, pay later companies the perfect investments. A major flaw here is that this easy money would not last forever, and the high-interest charges from these companies cannot be received if consumers stop spending money or cannot pay down their debts.

Anchoring is a great term for describing people who decide to "marry" their stocks and never abandon their original theses. This typically discards market cycles altogether and assumes that changes in things, such as interest rates and competitors, will never occur.

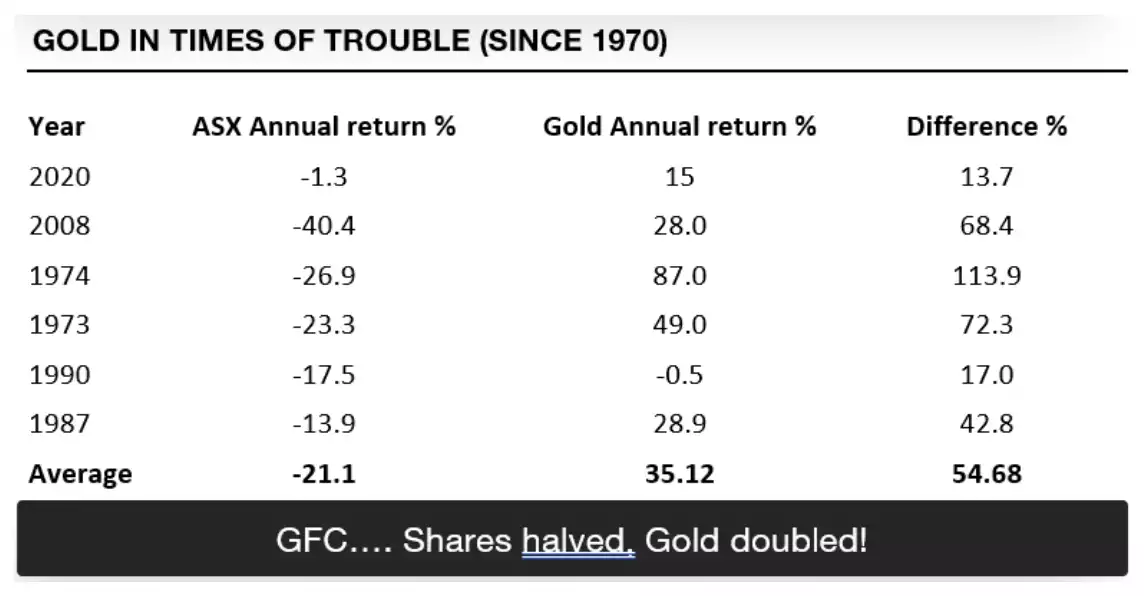

A too often forgotten mathematical reality is that if your investment drops by 50% you have to make 100% on what’s left just get back to even. Financial markets overnight were hit heavily again. The NASDAQ is now down 3% since the Fed Wednesday, the Dow Jones down 2% and S&P500 now down to a 3 month low. ALL are below their 100 day moving average and looking precarious. With the demise of US Treasuries, the classic ‘set and forget’ 60/40 portfolio has been awful. Gold & Silver remain one of the few truly uncorrelated assets to own. As a reminder….