Saudi Arabia Appears to be Secretly Buying Gold

News

|

Posted 24/09/2024

|

6944

Saudi Arabia, historically a linchpin of the petrodollar system, may be amassing gold reserves in secret, while other central banks worldwide buy up the precious metal.

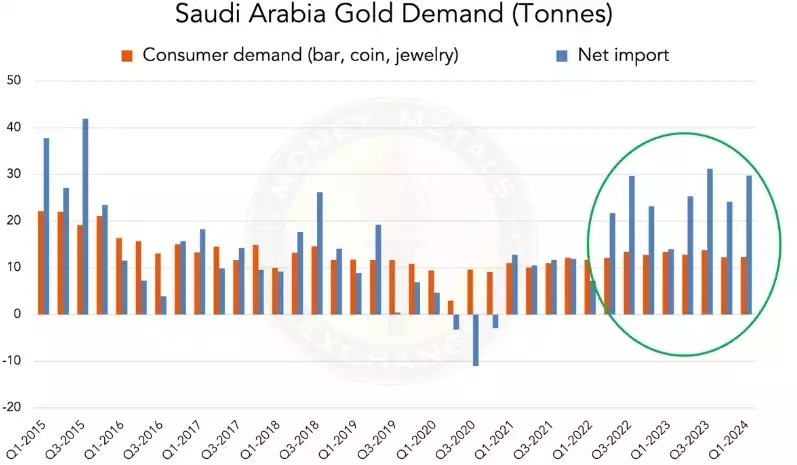

While official Saudi gold reserves remain unchanged, an analyst from MoneyMetals has investigated undeclared purchases, uncovering a surge in buying which equates to a massive 160 tonnes purchased since 2022 in Switzerland. The analyst found this discrepancy by comparing World Gold Council estimates with IMF reports, and the buying suggests a strategic move away from the U.S. dollar, potentially mirroring the actions of Russia and China, who have been major gold accumulators for years.

The Saudi actions align with the broader BRICS (Brazil, Russia, India, China and South Africa) agenda, of which Saudi Arabia is a member. These nations appear to be preparing for a potential return to a gold standard currency and directly challenge the extensive privilege the U.S. enjoys through the dominance of the dollar in international trade – a privilege established by forcing OPEC (The Organization of the Petroleum Exporting Countries) to trade oil exclusively in dollars since 1975.

The apparent secrecy behind this buying is an interesting piece of this puzzle. After all, Saudi Arabia’s former neighbour, Saddam Hussain, decided to defy the USD for oil trade by switching to euros and also converting Iraq’s USD reserves to Euros in the early 2000s. We saw how that turned out for him. Perhaps Saudi Arabia is worried that their weapons of mass destruction will be discovered?

The potential perils of going against the USD is an example of the BRICS nations having decided to band together and develop an alternative currency for trade. With growing strength in numbers of the BRICS group, and their intention to use gold to back their trade, we expect continued tailwinds for the price of gold.