Rising Inflation with Rising Unemployment

News

|

Posted 11/10/2024

|

1449

U.S. CPI came in last night higher than expected but is still following a trajectory back to normalisation and the fabled soft landing. Last week we looked at oil and its current deflationary impact, today we look at artificial intelligence (AI) and its current investment leading to a future deflationary outcome.

Is AI partly to blame for current inflation and will it become deflationary?

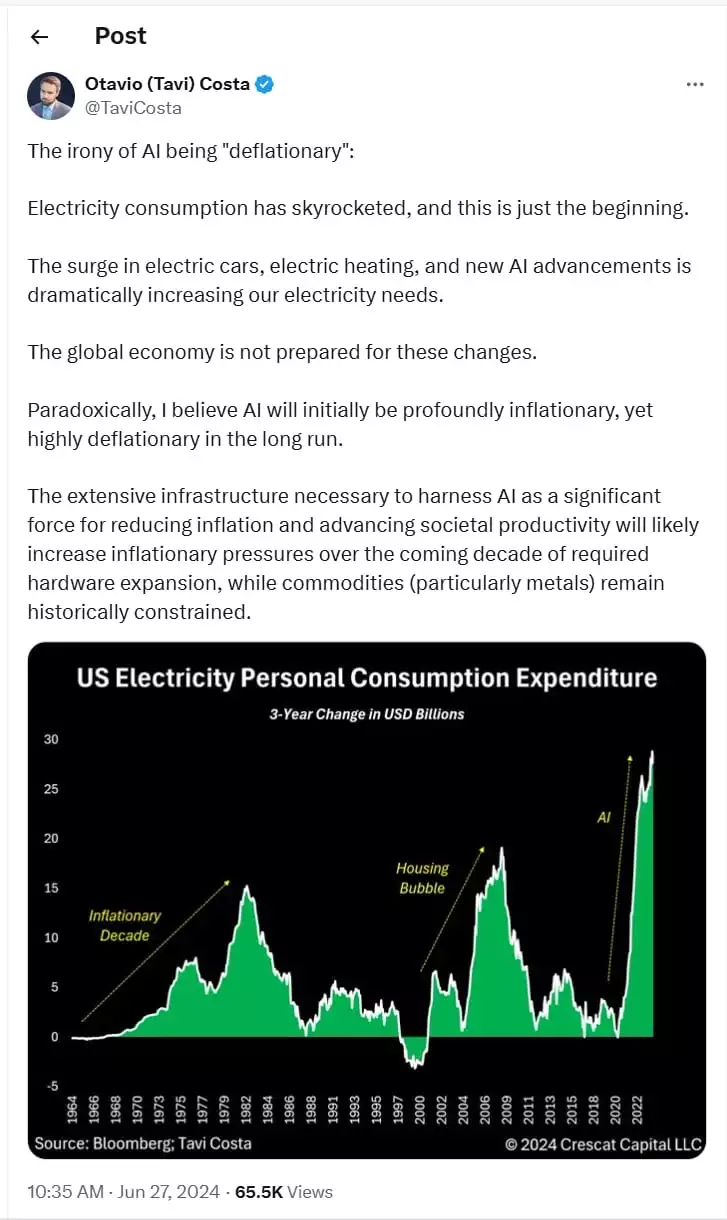

As Octavia (Tavi) Costa rightly pointed out, AI will initially be inflationary before it becomes deflationary. The spike in electricity use including electric cars, new data centres, and personal devices has spiked electricity consumption (and expenditure) similar to previous cycles including robotics used in manufacturing – which started around 1962 in General Motors, increased housing automation, and electrification which started around the 2000s with garage doors and security cameras becoming household items.

Comparatively, robotics started to be used in 1962 – it took around 20 years to peak, home automation and the housing bubble took around 10 years to peak, so if the AI capex started in 2021 – will the next deflationary cycle follow the 10-year cycle, or a cycle halving like previous of 5 years?

The Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) have been spending around 40% of their free cash flow on AI investment. This large capex expenditure helps stoke inflation, with cash that has previously been held by these companies being returned via investment. But, AI technology is still in its infancy, so this expenditure is likely to have added to the current inflationary environment. This year AI investment by large tech companies has led to increasing operating margins, however, as economic models suggest, these gains will eventually be compressed, with operating margins declining as deflation affects the pricing of delivered products.

Does Capital Expenditure show this?

Current ‘future estimated capital expenditure’ is starting to pick up again – as technology becomes cheaper and more efficient gains that may have only been available to first adopters and those companies with sufficient capital to invest in research and development will start filtering through to the greater market which should start to see AI goods delivered cheaper, and more quickly (with 5-10 years from 2021).

Feds worst nightmare

The latest U.S. CPI report shows a drop in inflation, accompanied by an unexpected rise in unemployment benefit filings, which contrasts with last week's strong non-farm payroll report. If AI, like oil, is about to become a deflationary force, and the speed at which AI is adopted doesn’t allow the market sufficient time for individuals to train and learn new skills and jobs, rapid deflation could lead to a sharp rise in unemployment. Meanwhile, human services such as aged care, healthcare, and education may experience high inflation until AI adoption catches on in these sectors.

The Kobeissi Letter summarises the Fed’s worst nightmare below.

So, buckle up for a bumpy ride as rapid changes in the work environment with faster investment in AI lead to cheaper and more efficient delivery of goods. The good news for gold and silver holders is these commodities are going to be necessary for the delivery of this next boom.