RBA to Deliver

News

|

Posted 03/07/2025

|

1055

4 Banks Tip RBA to Cut Next Week

Next week marks the fourth Reserve Bank of Australia (RBA) meeting of the year, and for the first time, all four major banks are aligned and expecting a rate cut. With households already struggling under the weight of a GDP per capita recession that’s effectively pushed living standards back to 2011 levels, many are hoping for some much-needed relief. But as other central banks move more aggressively in this new global easing cycle, the question becomes: how many cuts will the RBA deliver, and what could hold them back?

What Are the Banks Predicting?

All four major banks now expect a rate cut at next week’s meeting, with some even suggesting the possibility of a larger-than-usual move, as economic data continues to highlight fragility. Retail sales rose just 0.2% in April after remaining flat in March. The unemployment rate held at 4.1%, though 3,000 jobs were lost, and the participation rate continued to decline. Annual inflation is now sitting at 2.4%—well within the RBA’s 2–3% target band.

Looking further ahead, Commonwealth Bank and ANZ expect two more cuts this year after this month’s. NAB forecasts three, while Westpac—typically the most bearish—predicts four cuts by May 2026. With the average mortgage size around $600,000, each 25-basis point cut equates to roughly $90 per month in savings. If Westpac’s view plays out, factoring in two cuts already delivered, this could mean an additional $630 per month in relief for mortgage holders.

Housing Market May Complicate RBA Path

The challenge for the RBA is that rate cuts often fuel further growth in house prices. With the government already falling short of its housing targets—currently 214,000 homes behind its 2029 goal of 2.5 million dwellings—supply constraints and high immigration are pushing property prices deeper into bubble territory.

In recent years, housing completions have averaged around 170,000 per year, down from a previous average of 190,000, despite a significant increase in migration. To meet the 2029 target, the pace must lift to nearly 300,000 per year—well above the all-time record of 210,000. Unless housing supply can be significantly scaled up, or immigration policies are revised, property market pressures could limit the RBA’s ability to ease rates as much as the banks are hoping.

Global Rate Cuts Already Underway

Globally, inflation appears to be under control in most major economies, following a period of overtightening that triggered GDP per capita recessions in 13 developed nations during 2024—including Canada, Germany, the UK, and Australia.

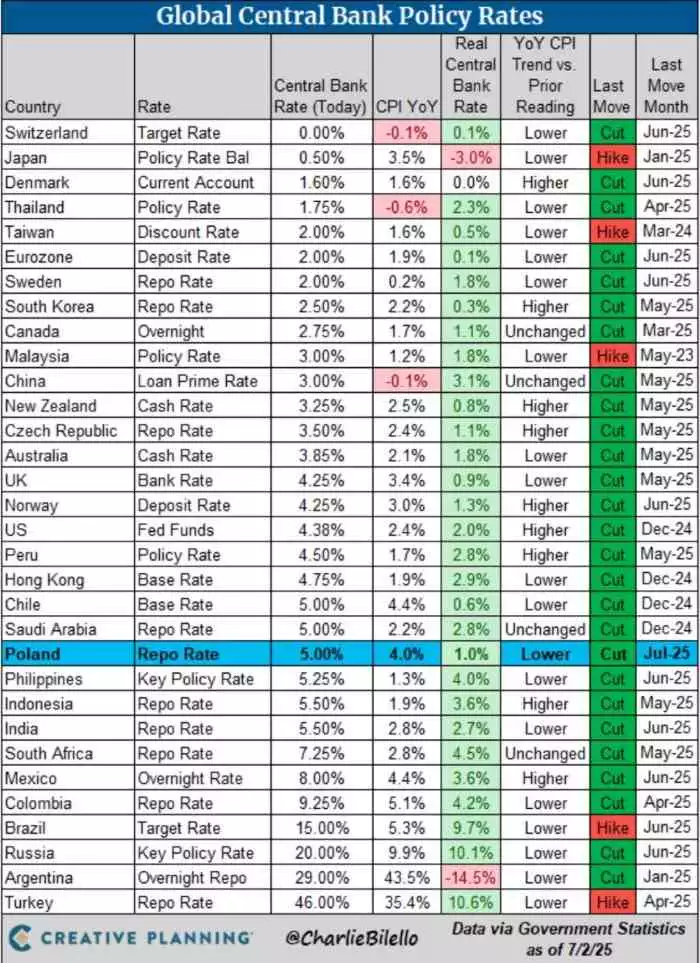

Even with tariffs in the US placing upward pressure on import prices (while delivering US$76 billion in extra tax revenue), inflation has cooled to 1.4%, opening the door to rate cuts. Of the 32 central banks tracked by Charlie Bilello, only three raised rates in their most recent moves.

Some countries, like Switzerland, have moved well ahead of the curve. With inflation at just 0.3%, the Swiss National Bank has cut rates to 0%, thanks in part to decades of fiscal discipline and a strong Swiss franc.

So, are we once again in a race to the bottom? With governments like Australia and the US continuing to spend heavily—Australia’s housing shortfall and the US Big Beautiful Bill now expected to add another US$5 trillion to its debt ceiling—the broader question is whether this wave of rate cuts will simply inflate asset prices while quietly eroding the purchasing power of your money.